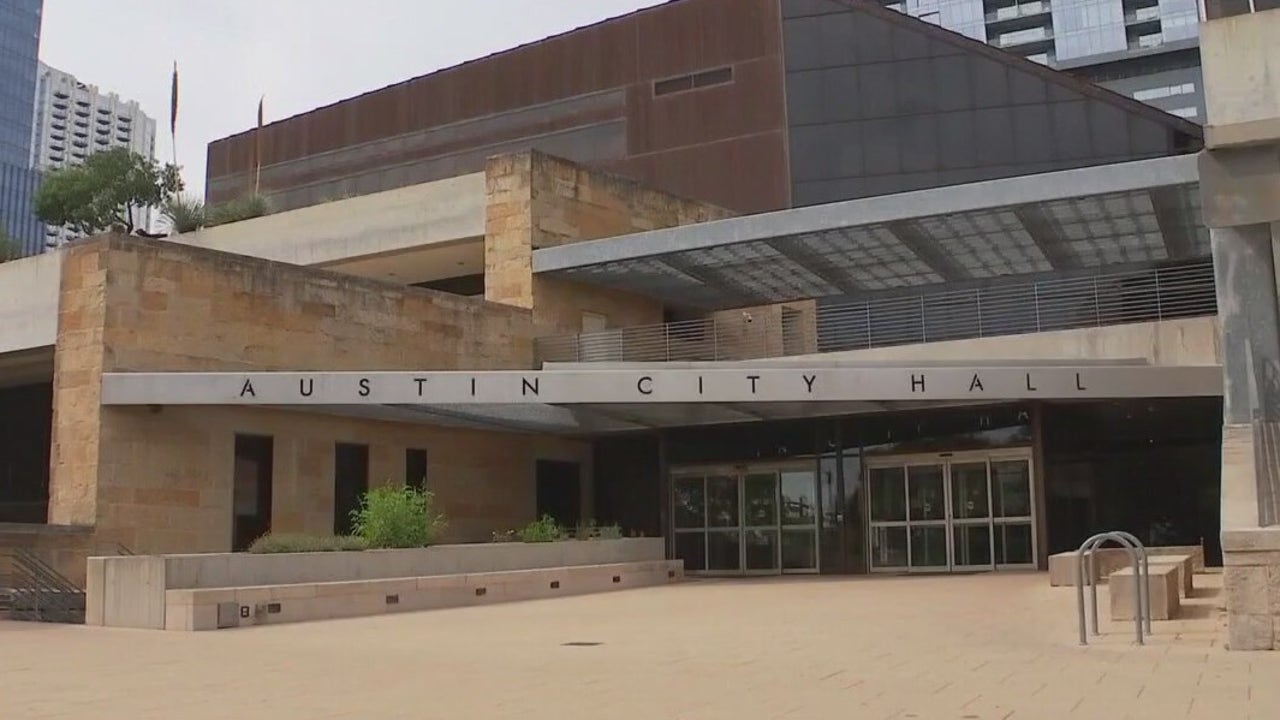

A legal challenge has been filed against the City of Austin regarding the language used on the upcoming November ballot for a proposed property tax increase. Jeff Bowen, a former candidate for Mayor, initiated the lawsuit, claiming the wording is intentionally designed to misdirect voters.

Details of the Proposed Tax Increase

Table of Contents

- 1. Details of the Proposed Tax Increase

- 2. Bowen’s Allegations

- 3. city’s Response

- 4. Understanding Property Tax Elections

- 5. Frequently Asked Questions About the Austin property Tax Election

- 6. What specific claims do plaintiffs make regarding Proposition A’s impact on existing property tax limitations?

- 7. Austin Faces Lawsuit Over Controversial Ballot Language in Tax Rate Election

- 8. The Core of the Dispute: Proposition A and its Wording

- 9. Key Concerns Regarding ballot Language

- 10. Legal Challenges and Arguments

- 11. Relevant Texas Election Code Sections

- 12. The Broader Context: Austin’s Property Tax Debate

- 13. Factors Contributing to Rising Property taxes in Austin

- 14. Potential Outcomes and Implications

- 15. Resources for Austin Taxpayers

Last week, the Austin City Council approved a budget that includes a planned election to raise the property tax rate to 57.4 cents per $100 of taxable value. City officials state that if approved by voters, the additional revenue-estimated at $110 million-will be allocated to critical services such as homelessness initiatives, park maintenance, and public safety enhancements.This funding is also intended to address a current $33 million budget gap.

The City Council formally called for the election and later approved the specific ballot language that voters will see on November 4th.

Bowen’s Allegations

In his legal filing, Bowen asserts that the ballot language lacks clarity regarding the permanence of the tax increase. He further contends that it fails to provide a specific accounting of how the $110 million in potential additional funds would be distributed.

“As a Taxpayer and a long-time Resident of Austin, it disappoints me that the city Council would push this major Tax increase in this way,” Bowen stated in a press release. “Along with trying to get voters to approve way more funds than the City Council claims they need, they are doing it in a dishonest, untransparent, and illegal way.”

city’s Response

Mayor Kirk Watson has expressed confidence in the integrity of the ballot language, asserting that it “is appropriate and meets all legal requirements.”

“We also have confidence in the court system and will respond in that venue,” Watson added in an official statement.

| Key Detail | Information |

|---|---|

| Proposed Tax Rate | 57.4 cents per $100 of taxable value |

| Estimated Additional Revenue | $110 million |

| Budget Shortfall | $33 million |

| Election Date | November 4th |

Did You Know? austin’s property tax rate is a key factor in the city’s ability to fund essential services. According to recent data from the City of Austin Finance Department, property taxes contribute approximately 65% of the city’s overall revenue.

Pro Tip: Voters should carefully review the full ballot language and available city budget documents before casting their vote. Understanding the details can definitely help ensure informed decision-making.

What impact do you think this lawsuit will have on the November election? How critically important are clearly worded ballots in ensuring voter participation and informed decisions?

Understanding Property Tax Elections

Property tax elections are a common mechanism for local governments to secure funding for public services. These elections allow residents to directly weigh in on whether they support an increase in property taxes to support initiatives like schools, infrastructure, and public safety. The structure of these elections, including the wording of the ballot language, can significantly influence voter outcomes. Historically, poorly worded or misleading ballot language has been a source of contention and legal challenges in many municipalities across the United States.

In Texas, property taxes are a significant source of revenue for local governments, primarily funding public schools and city services. The state does not have a state income tax, making property taxes especially critically important. Changes to property tax rates can have a significant impact on homeowners and renters alike, making these elections crucial for the economic well-being of the community.

Frequently Asked Questions About the Austin property Tax Election

- What is a property tax election? A property tax election is a vote where residents decide whether to approve an increase in property taxes to fund public services.

- Why is the City of Austin proposing a tax increase? The City cites the need for additional funding for homelessness services, parks, public safety, and to address a budget shortfall.

- what is the current property tax rate in Austin? The proposed rate is 57.4 cents per $100 of taxable value.

- What are the arguments against the tax increase? Opponents, like Jeff Bowen, argue the ballot language is misleading and lacks transparency.

- Where can I find more information about the proposed tax increase? You can find complete information on the City of Austin website.

- How will this tax increase affect my property taxes? The amount of the increase will depend on the assessed value of your property.

- What are the potential consequences if the tax increase is not approved? The city may be forced to reduce funding for essential services or seek alternative revenue sources.

Share this article with your network and join the conversation in the comments below!

What specific claims do plaintiffs make regarding Proposition A’s impact on existing property tax limitations?

Austin Faces Lawsuit Over Controversial Ballot Language in Tax Rate Election

The Core of the Dispute: Proposition A and its Wording

Austin, texas is currently embroiled in a legal battle stemming from the language used in a recent ballot proposition concerning property tax rates. proposition A, presented to voters in the November 2024 election, aimed to restructure how the city calculates and approves property tax revenue.Though,the wording of the proposition has been deemed misleading by a coalition of Austin residents and taxpayer advocacy groups,leading to a lawsuit filed in Travis County District Court. The central argument revolves around accusations that the ballot language was intentionally crafted to obscure the proposition’s true impact – potentially leading to higher tax bills for homeowners.

Key Concerns Regarding ballot Language

Plaintiffs allege the ballot language failed to clearly articulate several crucial aspects of Proposition A:

Impact on Taxpayer Protections: The language didn’t adequately explain how the proposition would affect existing property tax limitations, such as the homestead exemption.

Revenue Cap Implications: Critics argue the wording downplayed the potential for the city to exceed existing revenue caps, ultimately increasing the tax burden on residents.

Complexity and Clarity: The proposition’s language was described as overly complex and difficult for the average voter to understand, hindering informed decision-making. Specifically, the use of legal jargon and convoluted phrasing is under scrutiny.

Misleading Framing: Opponents claim the ballot language presented a biased view of the proposition,framing it as a measure to “protect” taxpayers when,in reality,it could have the opposite effect.

Legal Challenges and Arguments

The lawsuit seeks a court order to invalidate the results of the November 2024 election on Proposition A. Legal arguments center on violations of the Texas Election Code, specifically provisions requiring ballot language to be clear, concise, and unbiased.

Relevant Texas Election Code Sections

Section 67.002: This section mandates that ballot propositions be presented in a manner that allows voters to understand the measure’s purpose and effect.

Section 67.003: This section prohibits the use of misleading or deceptive language in ballot propositions.

Case Law Precedents: The plaintiffs are citing previous Texas court cases where ballot language was struck down for similar reasons – lack of clarity and potential for voter confusion.

The City of Austin maintains that the ballot language was legally compliant and accurately reflected the intent of Proposition A.City officials argue that the proposition was designed to provide greater openness and accountability in the property tax process. they also contend that the lawsuit is a politically motivated attempt to undermine the will of the voters.

The Broader Context: Austin’s Property Tax Debate

This lawsuit is the latest chapter in a long-running debate over property taxes in Austin. The city has experienced rapid growth in recent years,leading to increased property values and,consequently,higher tax bills. This has fueled a growing backlash from residents concerned about affordability.

Factors Contributing to Rising Property taxes in Austin

Rapid population Growth: Austin has been one of the fastest-growing cities in the United States, putting pressure on infrastructure and services.

Increased Property Values: The influx of new residents has driven up property values, leading to higher tax assessments.

City Budget Needs: The city faces increasing demands for services, such as public safety, transportation, and education, requiring a larger tax base.

Limited State Funding: Texas relies heavily on property taxes to fund local governments, as the state provides relatively limited funding.

Potential Outcomes and Implications

The outcome of this lawsuit could have notable implications for Austin’s future.

Invalidation of Election Results: If the court rules in favor of the plaintiffs, the results of the November 2024 election could be invalidated, potentially requiring the city to hold a new election with revised ballot language.

Changes to Ballot Proposition Process: The case could lead to changes in the way the city drafts and presents ballot propositions in the future, emphasizing clarity and transparency.

Impact on City Budget: A reversal of Proposition A could have a significant impact on the city’s budget, potentially forcing cuts to services or increases in other taxes and fees.

Increased Scrutiny of Local Elections: The lawsuit is likely to increase scrutiny of local elections and ballot propositions across Texas, as voters and advocacy groups become more vigilant about ensuring fair and accurate portrayal of issues.

Resources for Austin Taxpayers

Travis Central Appraisal District (TCAD): https://www.traviscad.org/ – Information on property tax assessments and exemptions.

City of Austin Property Tax Information: https://www.austintexas.gov/department/finance/property-tax – Details on city property tax rates and payment options.

Texas Comptroller of Public Accounts: https://comptroller.texas.gov/ – State-level information on property taxes and other financial matters.

* Austin Board of Realtors: https://www.abor.com/ – Resources for homeowners and potential