Global Markets Brace for Unforeseen Economic Shifts as Fed Signals Cautious Stance

New York, NY – July 28, 2025 – The global financial landscape is on edge following recent pronouncements from the U.S. Federal Reserve,which have signaled a more measured approach to future monetary policy adjustments.This cautious outlook has sent ripples through international markets,prompting analysts to reassess the trajectory of economic growth and inflation.

In a move that has captured the attention of investors worldwide, Federal Reserve officials have indicated a heightened sensitivity to emerging economic data. While no immediate policy changes were announced, the subtle shift in tone suggests a departure from the more assertive stance observed in previous quarters. This recalibration comes as policymakers grapple with a complex interplay of factors, including persistent supply chain disruptions, geopolitical uncertainties, and evolving labor market dynamics.

The Fed’s deliberate pacing is seen as an attempt to avoid premature tightening that could stifle nascent recovery trends or, conversely, an overly accommodative stance that could exacerbate inflationary pressures. Market participants are now keenly observing the Fed’s next moves, with particular attention paid to upcoming employment figures and consumer price index reports, which will likely serve as key indicators for future interest rate decisions.

This period of economic recalibration underscores a broader theme of uncertainty that has characterized the post-pandemic recovery. Businesses and consumers alike are adapting to an habitat where predictability has become a rare commodity. The central bank’s cautious navigation highlights the delicate balancing act required to foster lasting growth without triggering undue volatility.

Evergreen Insight: The Federal Reserve’s monetary policy decisions serve as a critical barometer for the global economy. Understanding the nuances of their pronouncements, the factors influencing their decisions, and the potential market reactions remains essential for any informed investor or economic observer. Historically, periods of uncertainty surrounding central bank policy have often led to increased market volatility, emphasizing the importance of a diversified investment strategy and a long-term outlook. The Fed’s current measured approach, while causing short-term jitters, could ultimately pave the way for a more stable and sustainable economic environment if managed effectively through the data-driven adjustments it promises.

How might Italian brands utilize financial instruments like forward contracts and options to mitigate the risks associated with unfavorable currency movements resulting from the tariffs?

Table of Contents

- 1. How might Italian brands utilize financial instruments like forward contracts and options to mitigate the risks associated with unfavorable currency movements resulting from the tariffs?

- 2. Italian brands Face Uncertainty: Navigating 15% Tariffs on U.S. Exports

- 3. The Impact of New Tariffs on Italian Goods

- 4. Affected Industries: A Sector-by-Sector Breakdown

- 5. Strategies for Mitigation: Adapting to the New Reality

- 6. The Role of Exchange Rates & Currency Hedging

- 7. Case Study: Parmigiano-Reggiano Consortium Response

- 8. Navigating Legal & Compliance issues

- 9. Long-Term Outlook & Future Considerations

The Impact of New Tariffs on Italian Goods

A recently imposed 15% tariff on a range of Italian exports to the United States is sending ripples through the luxury goods, food & beverage, and manufacturing sectors. This progress, stemming from ongoing trade disputes regarding aircraft subsidies, presents significant challenges for Italian brands heavily reliant on the U.S.market. Understanding the specifics of these U.S. tariffs on Italian goods and developing proactive strategies is now crucial for survival and continued growth. the affected products span diverse categories, including but not limited to: olive oil, wine, certain cheeses, apparel, and motorcycle components. This isn’t simply a financial hurdle; it’s a potential disruption to established supply chains and brand positioning.

Affected Industries: A Sector-by-Sector Breakdown

The impact isn’t uniform. Some industries are bracing for more significant consequences than others.Here’s a look at key sectors and their anticipated challenges:

Luxury Fashion: Italy is renowned for its high-end fashion. The 15% tariff adds a significant cost to already premium-priced items like leather goods, apparel, and footwear. This could lead to decreased sales volume, particularly for price-sensitive consumers. Brands are exploring options like absorbing some of the cost, wich impacts profit margins, or passing it on to consumers, risking a loss of market share. Italian fashion exports are particularly vulnerable.

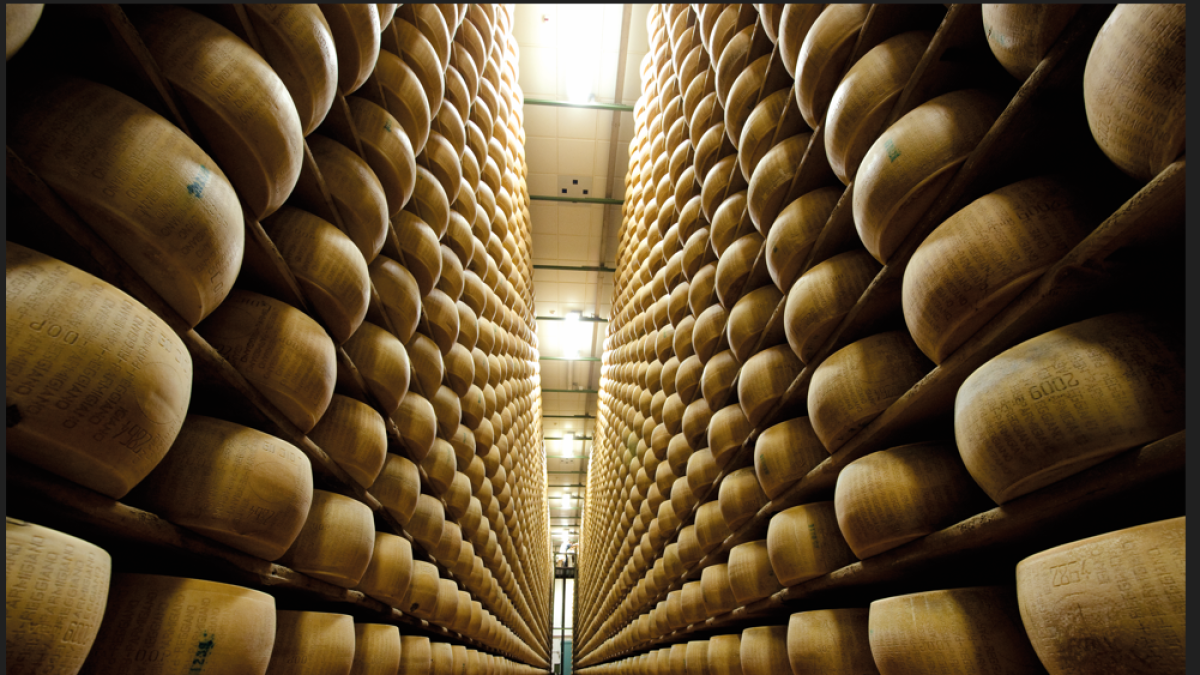

Food & Beverage: Italian culinary products – olive oil, wine (especially Prosecco and Chianti), and certain cheeses (Parmigiano-Reggiano, Grana Padano) – are staples in the U.S. market. The tariff increases prices for consumers and possibly opens the door for competitors from other countries. italian wine tariffs are a major concern for producers.

Motorcycle Industry: Italy’s motorcycle manufacturing sector, including iconic brands like Ducati, faces increased costs for components exported to the U.S. This could affect production costs and potentially lead to higher retail prices for motorcycles sold in the U.S.

Machinery & Equipment: Certain specialized machinery and equipment manufactured in Italy are also subject to the tariff, impacting businesses that rely on these imports for their operations.

Strategies for Mitigation: Adapting to the New Reality

Italian companies are actively exploring several strategies to mitigate the impact of the tariffs. These include:

- Supply Chain Diversification: Reducing reliance on U.S. exports by exploring alternative markets – Asia, the Middle East, and other European countries – is a key long-term strategy. This requires investment in market research and establishing new distribution networks.

- Cost Optimization: identifying areas to reduce production costs without compromising quality is essential. This could involve streamlining operations, negotiating better deals with suppliers, and investing in automation.

- Price adjustments: Carefully evaluating pricing strategies is crucial. options include absorbing some of the tariff cost,passing it on to consumers (with careful consideration of price elasticity),or offering promotional discounts to maintain sales volume.

- Lobbying & Advocacy: Italian trade organizations are actively lobbying the U.S. government to reconsider the tariffs and seeking a resolution to the underlying trade dispute.

- Nearshoring/Reshoring: Some companies are considering moving production closer to the U.S.market – a process known as nearshoring (e.g., establishing facilities in Mexico or Canada) or reshoring (bringing production back to Italy).

The Role of Exchange Rates & Currency Hedging

Fluctuations in exchange rates between the Euro and the U.S. Dollar can exacerbate the impact of the tariffs. A stronger Euro makes Italian exports more expensive for U.S.buyers. currency hedging strategies can definitely help companies mitigate this risk by locking in exchange rates for future transactions. This involves using financial instruments like forward contracts and options to protect against unfavorable currency movements.

Case Study: Parmigiano-Reggiano Consortium Response

The Consorzio del Formaggio Parmigiano-Reggiano, the governing body for authentic Parmigiano-Reggiano cheese, has been particularly proactive. They’ve launched a public awareness campaign in the U.S. highlighting the quality and authenticity of their product, aiming to justify the higher price point resulting from the tariffs. they are also actively working with importers and distributors to minimize the impact on consumers. This demonstrates a focus on brand protection and maintaining market share despite the increased costs.

Understanding the specific details of the tariff regulations is critical. Companies need to ensure they are compliant with all U.S. Customs and Border Protection (CBP) requirements. This includes accurate classification of goods, proper documentation, and timely payment of duties. Consulting with trade lawyers and customs brokers is highly recommended.

Long-Term Outlook & Future Considerations

The long-term outlook remains uncertain. The duration of the tariffs depends on the resolution of the underlying trade dispute.Italian brands need to adopt a flexible and adaptable approach, continuously monitoring the situation and adjusting their strategies accordingly.Investing in innovation, strengthening brand loyalty, and diversifying markets will be key to navigating this challenging period and ensuring long-term success. The focus on lasting trade practices and building resilient supply chains will be paramount.