The market experienced its first significant downturn in a while,but a single bearish day isn’t cause for alarm.

The Russell 2000 ($IWM) showed a notable bearish engulfing pattern at overbought momentum,with increased volume suggesting distribution,though not enough to trigger a sell signal on the On-Balance-Volume indicator.

Other major indices also confirmed distribution, but the selling pressure was less intense than on the Russell 2000.

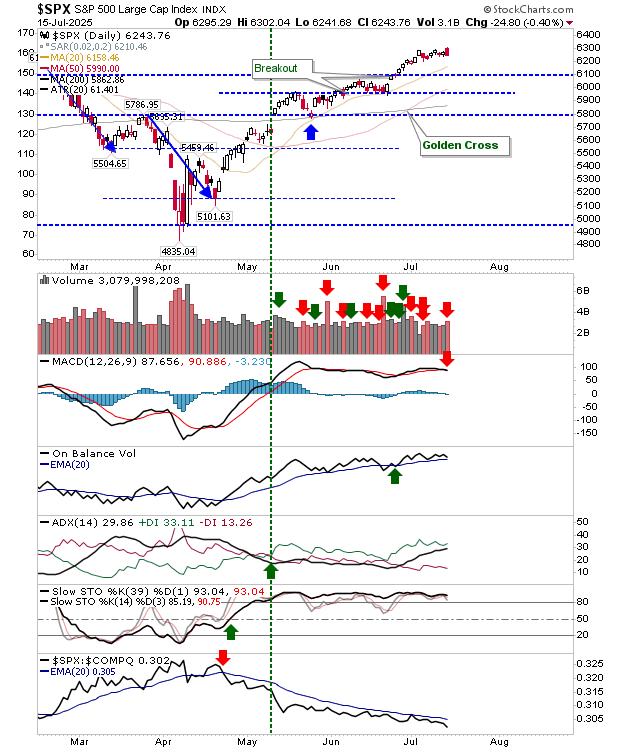

The S&P 500 ($SPX) saw a minor loss, less than half a percent, but a new sell signal did appear on its MACD indicator.

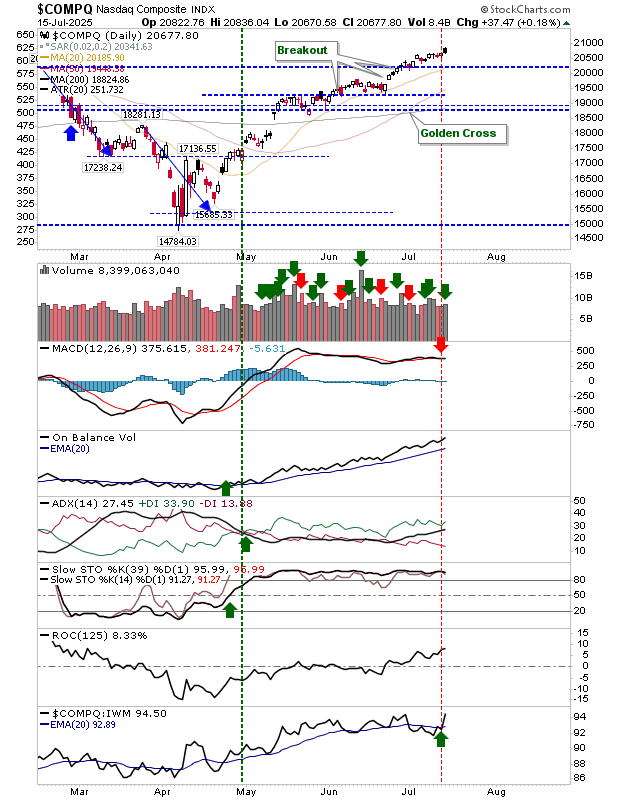

The Nasdaq ($COMPQ) closed with a bearish candlestick while in overbought territory, also accompanied by a sell signal on its MACD.

Despite a slight decline, it performed well relative to its peers, managing a higher closing price.

Bearish reversal patterns at overbought levels, especially when combined with increased volume, often signal an upcoming downtrend.

Given recent breakouts, traders might look for opportunities to buy on retests of support levels.

How can identifying overbought conditions using indicators like RSI and Stochastic Oscillator help manage risk in a portfolio?

Table of Contents

- 1. How can identifying overbought conditions using indicators like RSI and Stochastic Oscillator help manage risk in a portfolio?

- 2. Momentum Shift: Bearish Signals Emerge Amidst Overbought Conditions

- 3. Identifying Overbought Markets

- 4. The Rise of bearish Signals

- 5. Decreasing Volume on Up Swings

- 6. Broadening Price Ranges

- 7. Sector Rotation

- 8. Increasing Put/Call Ratio

- 9. Real-World Example: The Tech Sector in Early 2024

- 10. Benefits of Recognizing a Momentum Shift

- 11. Practical Tips for Navigating a Potential Downturn

- 12. Understanding Fibonacci retracements & Support Levels

- 13. The Role of Economic Data

Momentum Shift: Bearish Signals Emerge Amidst Overbought Conditions

Identifying Overbought Markets

The recent bull run across several asset classes has left many markets in overbought territory. But what does that actually meen? It signifies that an asset’s price has risen too quickly and may not be enduring. Several technical indicators can definitely help pinpoint these conditions:

Relative Strength Index (RSI): An RSI above 70 generally suggests an overbought condition. This is a widely used technical analysis tool for identifying potential reversals.

Stochastic Oscillator: Readings above 80 often indicate overbought levels.

MACD Divergence: When price makes higher highs, but the MACD indicator fails to do so, it’s a bearish divergence – a potential signal of weakening momentum.

Williams %R: Values above -20 typically suggest overbought conditions.

Understanding these market indicators is crucial for investors looking to protect their portfolios. Ignoring these signals can lead to meaningful losses when the unavoidable correction occurs.

The Rise of bearish Signals

While the overall narrative has been bullish, subtle yet persistent bearish signals are starting to surface. These aren’t necessarily harbingers of a crash, but they warrant careful attention.

Decreasing Volume on Up Swings

A healthy uptrend is usually accompanied by increasing trading volume. Currently, we’re seeing instances where price increases are occurring on decreasing volume. This suggests a lack of conviction behind the rally and a potential exhaustion of buying pressure. This is a key indicator for market trend analysis.

Broadening Price Ranges

Look at the daily price ranges. Are they expanding upwards, or are they becoming more erratic and wider in both directions? Broadening ranges often precede a trend reversal.This is a sign of market volatility increasing.

Sector Rotation

Money is begining to rotate out of previously leading sectors (like technology) and into more defensive sectors (like utilities and consumer staples). This is a classic sign that investors are becoming more risk-averse. Sector performance is a leading indicator of overall market sentiment.

Increasing Put/Call Ratio

The put/call ratio measures the volume of put options (bets on a price decrease) versus call options (bets on a price increase). A rising put/call ratio suggests increasing bearish sentiment. This is a valuable metric for investor sentiment analysis.

Real-World Example: The Tech Sector in Early 2024

In early 2024, the tech sector experienced a significant pullback after a prolonged period of outperformance. Leading up to the correction, several of the bearish signals mentioned above were present: decreasing volume on rallies, broadening price ranges in key tech stocks, and a slight rotation into defensive sectors. While many attributed the correction to specific earnings reports, the underlying technical conditions had already signaled a potential shift in momentum. This serves as a reminder that market corrections are a natural part of the economic cycle.

Benefits of Recognizing a Momentum Shift

Identifying a shift from bullish to bearish momentum offers several advantages:

Capital Preservation: Allows you to reduce exposure to risk assets before a significant downturn.

Opportunity for Short Selling: Experienced traders can profit from declining prices.(Note: Short selling carries significant risk.)

Strategic Rebalancing: Provides an opportunity to rebalance your portfolio and allocate capital to undervalued assets.

Reduced Emotional Decision-Making: Having a pre-defined strategy based on technical indicators helps avoid impulsive reactions to market fluctuations.

Here are some actionable steps you can take to prepare for a potential market correction:

- Review Your Risk Tolerance: Ensure your portfolio aligns with your comfort level.

- Diversify Your Holdings: Don’t put all your eggs in one basket. Spread your investments across different asset classes and sectors.

- Consider Stop-Loss Orders: These automatically sell your holdings if they fall below a certain price, limiting your potential losses.

- Raise Cash: Having some cash on hand allows you to take advantage of buying opportunities during a downturn.

- Stay Informed: Continuously monitor market conditions and adjust your strategy accordingly. Utilize resources for financial market news.

Understanding Fibonacci retracements & Support Levels

When analyzing potential downside, understanding Fibonacci retracement levels is key. These levels (23.6%, 38.2%, 50%, 61.8%, and 78.6%) can act as potential support levels where the price might bounce.identifying key support and resistance levels is crucial for setting realistic price targets and managing risk.

The Role of Economic Data

While technical analysis is valuable, it’s essential to consider essential factors.Keep a close eye on key economic data releases, such as:

Inflation Reports (CPI, PPI): Rising inflation can prompt central banks to raise interest rates, wich can negatively impact asset prices.

Employment Data: A weakening labour market can signal an economic slowdown.

* GDP Growth: Decl