gold Futures Plunge: Is This a Buying Opportunity or the Start of a Deeper Correction?

Table of Contents

- 1. gold Futures Plunge: Is This a Buying Opportunity or the Start of a Deeper Correction?

- 2. A Week of Volatility: What Triggered the Sell-Off?

- 3. Goldman Sachs Remains Bullish Despite Correction

- 4. Technical Analysis: Key Levels to Watch

- 5. Daily chart Analysis

- 6. Weekly Chart Analysis

- 7. Understanding Gold as a Safe Haven Asset

- 8. Frequently Asked Questions About Gold Investing

- 9. What factors could cause the current gold rally to lose momentum despite ongoing geopolitical risks and inflation?

- 10. gold Rally Faces Sustainability Scrutiny Amid Recent Price Pullback

- 11. Decoding the Recent Gold Price Action

- 12. Key Drivers Behind the Gold Rally – And the Pullback

- 13. Analyzing the Technical Landscape

- 14. The Role of Gold ETFs and Physical Demand

- 15. Historical Precedents: The Vreneli and Long-Term gold Performance

- 16. Risks to Consider: Dollar Strength and Interest Rate Hikes

New York, NY – Gold futures are under intense selling pressure, sparking debate among investors. Following a record peak tested on Monday at $4397.65, the market witnessed a sharp downturn this week, wiping out approximately $1.7 trillion in market capitalization in a single day. Traders are now grappling with whether to view this as a strategic entry point or brace for further declines.

A Week of Volatility: What Triggered the Sell-Off?

The decline began on Tuesday, with gold futures slumping roughly 6.80% from their recent highs. By Wednesday, the price had tested a weekly low of $4021.91, representing an 8.63% drop for the week. Several factors appear to be at play, including a shift in capital flows from gold towards other asset classes, particularly cryptocurrencies, as central bank buying eased. A concurrent weakening in Bitcoin‘s value – down approximately 15% since October 10th – seems to have further fueled the sell-off, possibly triggered by considerable sales from China.

However, many experts believe the primary cause of the crash is profit-taking following a sustained nine-week rally, fueled by expectations of monetary easing and geopolitical uncertainty. Easing tensions between the United States and China also contributed to a shift in market sentiment.

Goldman Sachs Remains Bullish Despite Correction

Despite the recent pullback, Goldman Sachs maintains a structurally bullish outlook on gold. The investment bank cites ongoing demand from central banks and increasing investor interest in gold as a portfolio hedge as key factors. They anticipate a continued “sticky” buying pattern and project a price of $4,900 per ounce by the end of 2026. Goldman Sachs acknowledged that the correction likely exacerbated the sell-off.

Did You Know? central banks have been accumulating gold at an accelerated rate, particularly China, potentially reducing their reliance on the U.S. dollar and bolstering gold’s position as a safe haven asset.

Technical Analysis: Key Levels to Watch

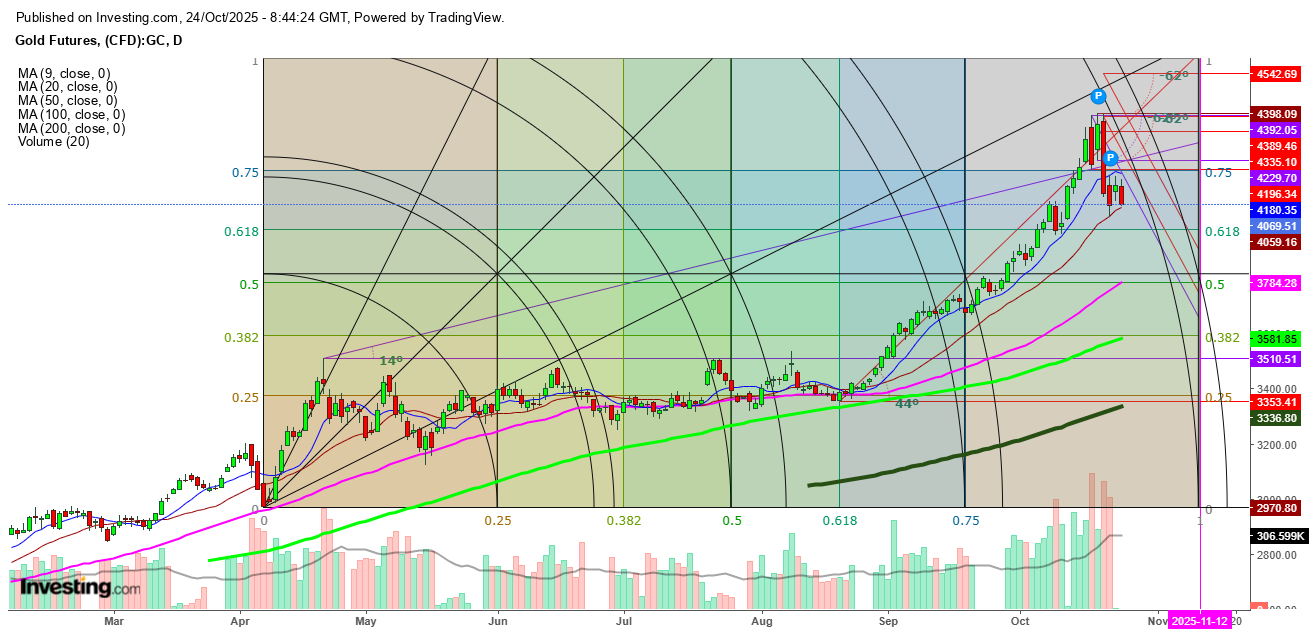

Technical analysts are closely monitoring key support and resistance levels to guide potential trading strategies.

Daily chart Analysis

On the daily chart, gold futures saw a rebound on Wednesday after finding support at the 20-day moving average (DMA) of $4021.91. Though,resistance remains at the 9-day moving average (DMA) of $4182.50. As of Friday, the 20 DMA stands at $4060. A breach below the 20 DMA could lead to testing of the 50 DMA ($3784), with potential further declines towards the 100 DMA ($3581.84) and the 200 DMA ($3336) next week.

Weekly Chart Analysis

Looking at the weekly chart, failure to hold the immediate support at $4014 this week could push gold futures towards the 9 DMA at $3834.77. A breakdown at this level could trigger a test of the 20 DMA at $3593.

Here’s a quick reference table summarizing key support and resistance levels:

| Timeframe | Support Level | Resistance Level |

|---|---|---|

| Daily | $4021.91 (20 DMA) | $4182.50 (9 DMA) |

| Weekly | $4014 | $3834.77 (9 DMA) |

Pro Tip: Always practice risk management. Consider using stop-loss orders to limit potential losses, especially in volatile markets.

Understanding Gold as a Safe Haven Asset

Gold has historically served as a hedge against economic uncertainty and inflation. Its limited supply and intrinsic value make it a desirable asset during times of geopolitical turmoil or financial instability.However, like all investments, gold is subject to market fluctuations. Factors such as interest rate changes,currency movements,and global economic conditions can all influence its price. Diversification is crucial when investing in gold or any other asset class.

Frequently Asked Questions About Gold Investing

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in gold carries risks, and investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.

What are your thoughts on the recent gold price movements? Do you think this is a temporary correction or the beginning of a larger trend? Share your insights in the comments below!

What factors could cause the current gold rally to lose momentum despite ongoing geopolitical risks and inflation?

gold Rally Faces Sustainability Scrutiny Amid Recent Price Pullback

Decoding the Recent Gold Price Action

The gold market has experienced a significant rally throughout much of 2024 and early 2025, fueled by geopolitical uncertainty, inflation concerns, and anticipated interest rate cuts. Though, the recent price pullback has sparked debate about the sustainability of this upward momentum. Investors are now questioning whether this is a temporary correction within a larger bull market, or a sign that the gold rally is losing steam. understanding the factors driving this scrutiny is crucial for anyone invested in gold, precious metals, or considering adding them to their portfolio.

Key Drivers Behind the Gold Rally – And the Pullback

Several interconnected factors contributed to gold’s ascent. These include:

* Geopolitical Risks: Escalating tensions in Eastern Europe, the Middle East, and increasing global instability have traditionally driven investors towards safe-haven assets like gold investments.

* Inflationary Pressures: While inflation has cooled from its 2022 peak, persistent concerns about future price increases continue to support gold as an inflation hedge.

* Central Bank Policies: expectations of the Federal Reserve and other central banks easing monetary policy – specifically, cutting interest rates – reduce the opportunity cost of holding non-yielding assets like gold. Lower rates typically weaken the US dollar, further boosting gold prices.

* Central Bank Buying: Notably, central banks globally have been net buyers of gold, adding to reserves and signaling confidence in the metal’s long-term value.

The recent pullback, however, can be attributed to:

* stronger-Than-Expected Economic Data: Recent US economic reports have shown resilience, leading to speculation that the Fed may delay interest rate cuts. This has strengthened the US dollar and put downward pressure on gold.

* Profit-Taking: After a significant run-up, some investors are taking profits, contributing to the selling pressure.

* Bond Yield increases: Rising Treasury yields offer investors attractive alternatives to gold, diminishing its relative appeal.

Analyzing the Technical Landscape

From a technical analysis outlook, the recent pullback has tested key support levels. Monitoring these levels is vital for traders and investors.

* Support Levels: Key support currently lies around the $2,300 and $2,250 per ounce levels.A break below these levels could signal further downside.

* Resistance Levels: Conversely, resistance is expected around $2,450 and $2,500. Breaking thru these levels would suggest the rally is regaining momentum.

* Moving Averages: The 50-day and 200-day moving averages are crucial indicators. A golden cross (50-day moving average crossing above the 200-day moving average) would be a bullish signal, while a death cross (the opposite) would be bearish.

The Role of Gold ETFs and Physical Demand

Gold Exchange-Traded funds (ETFs) have played a significant role in the recent rally, experiencing substantial inflows as investors sought exposure to the metal. However, ETF holdings have seen some outflows during the pullback, indicating a shift in sentiment.

Physical gold demand, notably from Asia (India and China), remains a critical factor. Traditionally, increased demand during festive seasons and as a store of value in these regions provides strong support for prices. Monitoring import data and retail demand in these key markets is essential. The Swiss gold exports data, a key indicator of physical gold flow, shoudl be closely watched.

Historical Precedents: The Vreneli and Long-Term gold Performance

Looking back at historical gold performance can offer valuable perspective. The 100-Franken Vreneli,a Swiss gold coin celebrating its 100th anniversary (as discussed on https://forum.gold.de/neues-mitteilungen-f10/100-jahre-100-franken-vreneli-t11978.html), exemplifies gold’s enduring value as a store of wealth across generations. While short-term price fluctuations are unavoidable, gold has historically maintained its purchasing power over the long term.

* 1970s Gold Boom: The 1970s saw a significant gold rally driven by inflation and geopolitical instability. This period demonstrates gold’s ability to perform well during times of economic uncertainty.

* 2008 Financial Crisis: Gold also surged during the 2008 financial crisis, as investors sought safe-haven assets.

* post-2020 Pandemic Rally: The COVID-19 pandemic and subsequent economic stimulus measures fueled another gold rally, highlighting its role as a hedge against currency debasement.

Risks to Consider: Dollar Strength and Interest Rate Hikes

Despite the long-term bullish outlook, several risks could