“`html

openai Accelerates IPO Plans Amidst funding push And Legal Battles

Table of Contents

- 1. openai Accelerates IPO Plans Amidst funding push And Legal Battles

- 2. The Road To Public markets

- 3. Massive Investments And Financial Pressures

- 4. The Competition Heats Up: OpenAI Versus Anthropic

- 5. ‑Profile Debut Ahead of Rival Anthropic

- 6. OpenAI Accelerates push for Q4 IPO, Eyes High‑Profile Debut ahead of Rival Anthropic

- 7. The IPO Timeline: What We Know

- 8. OpenAI’s Competitive Edge: Beyond ChatGPT

- 9. Anthropic’s Challenge: A Formidable Competitor

- 10. Potential IPO Valuation: The $1 Trillion Mark

- 11. Impact on the AI Industry

- 12. Real-World Applications & Case Studies

- 13. Benefits of OpenAI’s IPO for Investors

- 14. Practical tips for Following the IPO

san Francisco,CA – openai,The Creator of ChatGPT,Is Rapidly Advancing Towards A Potential Initial Public Offering (Ipo) As Early As The Fourth Quarter Of This Year. This Move Comes As The Artificial Intelligence (Ai) Pioneer Seeks To Solidify Its Financial Footing And navigate A Competitive Landscape Dominated By Rivals Like Anthropic And Tech Giants Such As Google. The Push For An Ipo Signals A Significant Shift For The company, Which Has Relied Heavily On External Funding To Fuel Its Enterprising Growth.

The Road To Public markets

According To Sources Familiar With The Matter, OpenAI Has Initiated Preliminary Discussions With Investment Banks To Explore The Feasibility Of A Public Listing. The Company Is Currently Valued Around $500 Billion, A Figure That Reflects The Intense investor Interest In The Ai Sector. OpenAI Has Been Strengthening Its Financial Team, Recently Appointing Ajmere Dale As Chief Accounting Officer And Cynthia Gaylor To Oversee Investor Relations.

The Timing Of The Ipo Is Influenced By A Recovering Market For Public Offerings. Analysts Predict 2026 Could See A Surge In Listings After A Period Of Reduced Activity.Though, A Year-End Launch Presents Challenges For OpenAI, Given The Company’s Rapid Growth And The Fierce Competition It Faces, Especially From Established Technology Companies.

Massive Investments And Financial Pressures

OpenAI’s Plans are Underpinned By Substantial Investment Requirements.The Company Is Currently Pursuing A funding Round Exceeding $100 Billion To Support Its infrastructure Growth. These investments include a $500 Billion “Stargate” Initiative, In Partnership With SoftBank And Oracle, A $300 Billion Agreement With Oracle Cloud, And A Recent $38 Billion Collaboration With Amazon Web Services (Aws). These large-scale commitments highlight the enormous capital expenditure required to maintain OpenAI’s position at the forefront of Ai innovation.

Currently, OpenAI is not self-funding and relies on external sources to maintain its operations. This is a common strategy for companies developing cutting-edge technology, but it necessitates a successful fundraising strategy or an eventual path to profitability. Similar to other major AI developers, OpenAI and Anthropic are both operating at a loss, investing heavily in research, development and computing power.

The Competition Heats Up: OpenAI Versus Anthropic

OpenAI Is Conscious Of The Threat Posed By Anthropic, Another Leading Ai company. Anthropic Has Indicated Its willingness To Pursue An Ipo By Year-End, Benefiting From The Popularity Of Its Claude Code Product. While Both companies Face Significant Financial Losses As They Scale Their AI Models, Anthropic Projects To Achieve Break-Even Status In 2028, Two Years Ahead Of OpenAI’s Projected Timeline.

Here’s a comparative look at the two companies:

| Company | Projected Break-Even | Key Product |

|---|---|---|

| OpenAI | 2030 | ChatGPT |

Anthropic

‑Profile Debut Ahead of Rival Anthropic

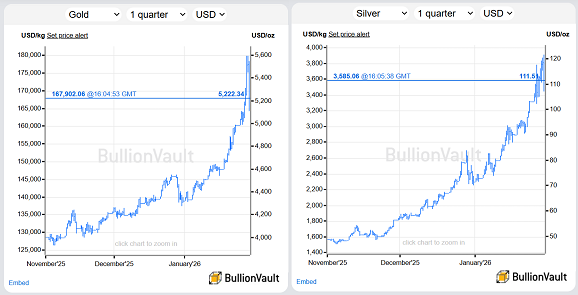

OpenAI Accelerates push for Q4 IPO, Eyes High‑Profile Debut ahead of Rival AnthropicArchyde.com – January 30,2026 The race to dominate the artificial intelligence landscape is heating up,and OpenAI is firmly positioning itself at the forefront. Recent developments indicate a important acceleration in the company’s plans for an Initial Public Offering (IPO), now firmly targeted for the fourth quarter of 2026. This move comes as OpenAI seeks to capitalize on its leading position in generative AI and potentially achieve a valuation of $1 trillion, as reported by Reuters last October. The timing is crucial, as it aims to preempt a potential IPO from rival Anthropic, backed by Amazon and Google. The IPO Timeline: What We KnowWhile an exact date remains unconfirmed,sources close to the company suggest a late-year launch is the current priority. This accelerated timeline represents a shift from earlier speculation of a 2027 debut. several factors are driving this urgency: * Market Conditions: Favorable market conditions and investor appetite for AI-focused companies are key drivers. * Competitive pressure: Anthropic’s growing capabilities and potential for an IPO necessitate a swift move from OpenAI. * Funding needs: An IPO will provide OpenAI with considerable capital to fuel further research, advancement, and infrastructure expansion. * Internal Restructuring: OpenAI has been actively streamlining its operations and strengthening its financial reporting in preparation for public scrutiny. OpenAI’s Competitive Edge: Beyond ChatGPTOpenAI’s success isn’t solely based on the popularity of ChatGPT. The company boasts a diverse portfolio of AI technologies, including: * DALL-E 3: A powerful image generation model, continually evolving with enhanced realism and creative control. * GPT-4o: The latest iteration of its flagship large language model, demonstrating significant improvements in speed, reasoning, and multimodal capabilities. * Whisper: An automatic speech recognition system, used in a variety of applications from transcription to voice control. * Enterprise Solutions: Increasingly, OpenAI is focusing on providing tailored AI solutions for businesses, driving revenue growth and demonstrating real-world applications. This diversified approach positions OpenAI as more than just a chatbot company; it’s a thorough AI platform provider. Anthropic’s Challenge: A Formidable CompetitorAnthropic, founded by former OpenAI researchers, is rapidly gaining ground with its Claude series of language models. Backed by significant investment from tech giants, Anthropic is focusing on: * Constitutional AI: A unique approach to AI safety, aiming to align AI behavior with human values. * Long-Context Understanding: Claude excels at processing and understanding extremely long documents, making it ideal for tasks like legal research and financial analysis. * Enterprise Adoption: Anthropic is actively targeting enterprise clients with its AI solutions, competing directly with OpenAI. The rivalry between OpenAI and Anthropic is expected to intensify as both companies vie for market share and investor attention. Potential IPO Valuation: The $1 Trillion Markthe reported $1 trillion valuation target is ambitious,but potentially achievable given OpenAI’s current trajectory. However, several factors could influence the final IPO price: * Revenue Growth: Demonstrating sustained and significant revenue growth will be crucial. * Profitability: While currently operating at a loss, openai needs to demonstrate a clear path to profitability. * Market Sentiment: Overall market conditions and investor confidence in the AI sector will play a significant role. * Regulatory Landscape: Evolving regulations surrounding AI could impact investor perception and valuation. Impact on the AI IndustryOpenAI’s IPO is expected to have a ripple effect throughout the AI industry: * Increased Investment: A prosperous IPO will likely attract further investment into the AI sector. * Validation of the AI Market: It will serve as a strong validation of the commercial potential of AI technologies. * Talent acquisition: The IPO will enable OpenAI to attract and retain top AI talent. * Competitive Dynamics: It will intensify competition among AI companies, driving innovation and development. Real-World Applications & Case StudiesOpenAI’s technology is already impacting various industries. For example: * Healthcare: AI-powered diagnostic tools are assisting doctors in identifying diseases earlier and more accurately. * Finance: Fraud detection systems are leveraging AI to prevent financial crimes. * Education: personalized learning platforms are using AI to tailor educational content to individual student needs. * Customer Service: AI-powered chatbots are providing instant customer support and resolving issues efficiently. These real-world applications demonstrate the transformative potential of OpenAI’s technology. Benefits of OpenAI’s IPO for InvestorsInvesting in OpenAI’s IPO could offer several potential benefits: * Exposure to a High-Growth Market: The AI market is expected to experience exponential growth in the coming years. * First-Mover Advantage: OpenAI is a leading innovator in the AI space. * Potential for High Returns: A successful IPO could generate significant returns for investors. * Impact Investing: Supporting a company that is pushing the boundaries of AI technology. Practical tips for Following the IPOFor those interested in following OpenAI’s IPO, here are a few practical tips: * Stay Informed: Monitor news sources and financial publications for updates on the IPO timeline and valuation. Gold & Silver Plunge: AI Fears Trigger $3.4 Trillion Wipeout[Image Placeholder: A compelling image depicting a falling gold bar or a chaotic stock market graph] New York, NY – A seismic shift rocked the precious metals market today as gold and silver experienced a stunning collapse, erasing a combined $3.4 trillion in value. The dramatic downturn, unfolding after both metals reached unprecedented highs, is being directly linked to a sharp sell-off in major US AI and technology stocks, particularly the woes of software giant Microsoft. Tech Troubles Spark Precious Metal PanicThe catalyst for this market upheaval appears to be a disappointing quarterly report from Microsoft (Nasdaq: MSFT), revealing a slowdown in its Azure cloud computing and AI data segment. This news sent the tech behemoth plummeting 11.9% at the open, wiping out a quarter of a billion dollars in market capitalization. The ripple effect extended to other key players in the AI space, with Oracle (NYSE: ORCL) falling 5.4% and Nvidia (Nasdaq: NVDA) losing 2.7%. Gold, which had briefly peaked at just $5 below $5,600 an ounce, suffered an 8.7% fall. Silver, after a meteoric 68% rise in January – its largest monthly advance since 1979 – tumbled 11.9% to $107 per troy ounce. This volatility isn’t just about numbers; it’s a stark reminder of the interconnectedness of modern markets. Liquidity Concerns and the Volatility SpiralExperts warn that the speed and severity of the decline are exacerbating the problem. “The problem is that the volatility is self-reinforcing,” explains Ole Hansen, a commodities analyst at Saxo Bank. “As price fluctuations intensify, liquidity decreases. Banks and market makers are struggling to manage the risks, and when their willingness to quote large prices fades, liquidity deteriorates and volatility explodes.” Simon Biddle, head of precious metals at Tullet Prebon, echoes this sentiment, stating, “Banks do not have unlimited balance sheets to trade precious metals. Trading volumes have decreased as they take less risk.” This shrinking liquidity creates a dangerous feedback loop, potentially amplifying future price swings. Beyond Tech: Broader Market SignalsThe turmoil isn’t confined to the tech sector. Base metals also experienced declines following easing financial rules for real estate developers in China. Crude oil prices retreated amid speculation of potential US military action against Iran. Even the US dollar saw a slight gain after a recent dip to a four-year low, suggesting a broader risk-off sentiment gripping the markets. A Historical Perspective on Precious Metal VolatilityWhile today’s drop is significant, it’s crucial to remember that precious metals have always been subject to periods of intense volatility. Historically, gold and silver have served as ‘safe haven’ assets during times of economic uncertainty. However, their recent surge was fueled by speculation surrounding AI and green energy demand, making them vulnerable to corrections when those narratives falter. The 1979 silver peak, referenced in the report, serves as a cautionary tale of speculative bubbles and subsequent crashes. What Does This Mean for Investors?The current situation demands caution. The rapid decline highlights the risks associated with highly speculative investments. Investors should carefully assess their risk tolerance and consider diversifying their portfolios. Monitoring trading volumes in gold and silver ETFs – like GLD and SLV – can provide valuable insights into market sentiment. The surge in GLD volume yesterday, contrasted with the decline in SLV volume, suggests a flight to the perceived safety of gold, even amidst the overall downturn. The market’s reaction to the Microsoft results and the broader AI concerns underscores the importance of staying informed and understanding the underlying drivers of market movements. This isn’t just about gold and silver; it’s a signal that the AI bubble may be facing a reality check, and investors should prepare for potential further turbulence. Stay tuned to Archyde.com for ongoing coverage and expert analysis as this story develops. Singapore’s Plastic Bag Levy: A Shift in Retail Strategy and What It Means for ConsumersOver S$21,000 collected from plastic bag charges at just one Hao Mart outlet in 2024 – that’s a figure highlighting the impact of Singapore’s push for sustainability. But a recent deregistration from the mandatory charge scheme by Hao Mart and Ang Mo Supermarket signals a potentially evolving landscape, raising questions about the long-term effectiveness of the levy and the strategies retailers will employ as thresholds shift. This isn’t just about a 5-cent charge; it’s about the future of sustainable consumer habits and the financial realities for smaller supermarket chains. The Deregistration Details: Turnover and the S$100 Million ThresholdThe National Environment Agency (NEA) confirmed that Hao Mart and Ang Mo Supermarket are no longer required to charge for disposable carrier bags. This decision stems from their annual turnover falling below the S$100 million (US$79.3 million) threshold stipulated by the Resource Sustainability Act. Introduced in July 2023, the scheme mandated a minimum 5-cent charge for bags at larger retailers to encourage reusable bag usage and reduce plastic waste. While both supermarkets are still charging customers currently, they are no longer legally obligated to do so, nor are they required to report bag usage data to the NEA from 2026. Why This Matters for Smaller RetailersThis deregistration highlights a crucial point: the scheme’s impact is disproportionately felt by smaller operators. Maintaining compliance – tracking bag numbers, collecting proceeds, and reporting to the NEA – represents an administrative burden. For businesses operating on tighter margins, these costs, even if relatively small, can be significant. The S$100 million threshold effectively creates a two-tiered system, potentially incentivizing growth to avoid the levy or, conversely, maintaining a smaller scale to sidestep the requirements. This dynamic could reshape the competitive landscape within Singapore’s supermarket sector. Hao Mart’s Approach: Retaining the Charge Despite DeregistrationDespite no longer being required to, Hao Mart continues to charge 5 cents per plastic bag. According to Jupri Suep, Senior Vice President of Operations, the cost of providing bags remains a factor. Hao Mart’s 2024 report reveals they collected S$21,143.50 from 422,870 bags, retaining the majority after paying GST to the government. This suggests the charge isn’t necessarily about environmental commitment, but rather a revenue stream offsetting operational expenses. The lack of publicly available data from Ang Mo Supermarket makes it difficult to assess their internal calculations, but the current practice of charging suggests a similar cost-benefit analysis is likely underway. The Broader Implications: Consumer Behavior and Future TrendsThe initial success of the plastic bag levy in reducing disposable bag usage is undeniable. However, the deregistration of these two operators raises concerns about a potential reversal of those gains. Will consumers revert to using more plastic bags if the charge disappears at certain stores? The answer likely depends on a combination of factors, including ingrained habits, the availability of reusable bags, and continued public awareness campaigns. Looking ahead, we can anticipate several key trends:

Beyond the 5-Cent Charge: A Holistic Approach to SustainabilityThe plastic bag levy was a crucial first step, but true sustainability requires a more holistic approach. This includes reducing overall consumption, promoting circular economy principles, and investing in innovative materials. The deregistration of Hao Mart and Ang Mo Supermarket serves as a reminder that policy effectiveness isn’t solely determined by mandates, but also by economic realities and consumer choices. The future of sustainable retail in Singapore will depend on finding a balance between environmental responsibility, business viability, and consumer convenience. What strategies do you think will be most effective in maintaining Singapore’s progress towards reducing plastic waste? Share your thoughts in the comments below!

South Africa’s Market Volatility: Beyond Precious Metals, Towards a New Economic LandscapeThe JSE’s recent 3.5% plunge, triggered by fluctuations in precious metals, isn’t an isolated incident. It’s a symptom of a deeper shift in the global economic landscape, one where South Africa’s reliance on commodity cycles leaves it increasingly vulnerable. But within this volatility lies opportunity. Understanding the forces at play – and anticipating the next moves – is crucial for investors and businesses alike. This isn’t just about gold and platinum; it’s about a fundamental reassessment of risk and reward in a rapidly changing world. The Commodity Connection: A Historical PerspectiveSouth Africa’s economic history is inextricably linked to its mineral wealth. From gold in the 19th century to platinum group metals (PGMs) today, commodity prices have dictated the nation’s fortunes. However, this dependence has created a cyclical boom-and-bust pattern. Recent volatility in PGMs, driven by factors like electric vehicle (EV) demand and supply chain disruptions, has exposed this vulnerability. The decline in global demand, coupled with increased supply from some regions, has put significant downward pressure on prices, directly impacting JSE-listed mining companies and the broader market sentiment. Did you know? South Africa holds approximately 75% of the world’s PGM reserves, making it a key player in the global transition to green energy, but also highly susceptible to price swings in these metals. Beyond Commodities: Emerging Risks to the JSEWhile precious metals volatility is a significant factor, several other risks are converging to create a challenging environment for the JSE. These include:

The Rise of ESG Investing and its Impact on South African MarketsEnvironmental, Social, and Governance (ESG) investing is no longer a niche trend; it’s becoming mainstream. This shift is having a profound impact on capital flows, with investors increasingly prioritizing companies that demonstrate strong ESG credentials. South African companies, particularly in the mining sector, face increasing scrutiny regarding their environmental impact and social responsibility. Those that fail to adapt risk losing access to capital and facing reputational damage. “ESG factors are increasingly integrated into investment decisions, and South African companies need to demonstrate a commitment to sustainability to attract and retain investors,” notes a recent report by the Responsible Investment Association of Southern Africa. Future Trends: What to Expect in the Coming MonthsLooking ahead, several key trends are likely to shape the future of the JSE: Increased Diversification – A Necessity, Not a ChoiceSouth Africa needs to diversify its economy away from its reliance on commodities. This requires fostering innovation, supporting entrepreneurship, and attracting investment in sectors like technology, renewable energy, and tourism. Government policies that incentivize diversification will be crucial. The Green Transition: Opportunities and ChallengesThe global transition to a low-carbon economy presents both opportunities and challenges for South Africa. While the country is rich in the minerals needed for green technologies (PGMs, lithium, manganese), it also needs to address its own carbon emissions and develop a sustainable energy infrastructure. Investing in renewable energy and green hydrogen production could unlock significant economic potential. Digitalization and Fintech InnovationThe rapid pace of digitalization is transforming the financial landscape. Fintech companies are disrupting traditional banking and investment services, offering new opportunities for financial inclusion and efficiency. South Africa has a vibrant fintech ecosystem, but regulatory frameworks need to adapt to foster innovation while protecting consumers. Pro Tip: Investors should consider diversifying their portfolios to include exposure to sectors that are less vulnerable to commodity price fluctuations, such as technology, healthcare, and consumer staples. Actionable Insights for Investors and BusinessesNavigating this volatile environment requires a proactive and strategic approach. Here are some key takeaways:

Expert Insight: “The JSE’s future success hinges on its ability to adapt to a changing world and embrace innovation. Companies that prioritize sustainability, digitalization, and diversification will be best positioned to thrive in the long term.” – Dr. Anya Sharma, Economist at Global Insights Research. Frequently Asked QuestionsWhat is the biggest risk facing the JSE right now?The biggest risk is the continued reliance on commodity cycles, coupled with structural challenges like load shedding and infrastructure deficits. Diversification is key to mitigating this risk. How will ESG investing impact South African companies?ESG investing will force South African companies to prioritize sustainability and social responsibility. Those that fail to do so risk losing access to capital and facing reputational damage. What sectors offer the most promising growth potential in South Africa?Sectors like renewable energy, technology, fintech, and tourism offer the most promising growth potential, driven by global trends and domestic opportunities. Is now a good time to invest in the JSE?While the JSE is currently facing challenges, it also presents opportunities for long-term investors. A diversified approach and a focus on quality companies are crucial. The JSE’s current turbulence isn’t a signal to retreat, but a call to adapt. The future of South African markets lies in embracing change, fostering innovation, and building a more resilient and diversified economy. What steps will you take to navigate this evolving landscape? Explore more insights on South African Economic Outlook in our comprehensive guide. Adblock Detected |