A widespread sell-off gripped the Cryptocurrency market on September 25, triggering a wave of liquidations totaling $407.81 million. The downturn coincided with a notable decline in the value of Bitcoin,currently trading around $111,909.50, and impacting a range of Altcoins as well.

Significant Liquidations Across the Board

Table of Contents

- 1. Significant Liquidations Across the Board

- 2. Market Sentiment and Potential Recovery

- 3. Maxi Doge Gains Traction Amidst Volatility

- 4. Understanding Cryptocurrency Liquidations

- 5. Frequently Asked Questions about Cryptocurrency Liquidations

- 6. What impact could the increasing integration of cryptocurrency settlements have on traditional financial institutions?

- 7. Bitcoin Tests $111k as Crypto Settlements Exceed $400 Million

- 8. Surging Bitcoin Price: A New All-Time high?

- 9. Understanding the $400 Million Settlement Milestone

- 10. Factors driving the Bitcoin Rally

- 11. Institutional investment & ETF impact

- 12. The Halving Event & Supply Dynamics

- 13. macroeconomic Conditions & Inflation Concerns

- 14. Implications of Increased Crypto Settlements

- 15. Enhanced efficiency & Reduced Costs

- 16. Greater Financial Inclusion

- 17. Innovation in Financial Products & Services

- 18. Navigating the Volatility: Risks and Considerations

- 19. Price volatility

- 20. Regulatory Uncertainty

- 21. Security Risks

- 22. Polish Bitcoin Community Insights (From forum.bitcoin.pl)

- 23. Practical Tips for Investors

Data reveals that 129,655 traders where liquidated within the past 24 hours. The largest single liquidation order, valued at approximately $29.12 million, occurred on the Hyperliquid exchange. Ethereum accounted for the most significant portion of these liquidations,totaling $159.92 million.

Long positions were overwhelmingly affected, experiencing losses of $152.63 million compared to just $7.29 million for short positions within the Ethereum market.Bitcoin liquidations reached $41.36 million, with long operators losing $39.88 million and short operators $1.49 million. Other affected cryptocurrencies include Solana, Pump.fun, Avalanche, and XRP.

| Cryptocurrency | Liquidation Amount (USD) | Long Position Losses (USD) | Short Position Losses (USD) |

|---|---|---|---|

| Ethereum | $159.92 million | $152.63 million | $7.29 million |

| Bitcoin | $41.36 million | $39.88 million | $1.49 million |

Market Sentiment and Potential Recovery

These liquidations suggest that investors had anticipated further price increases, a prediction that ultimately failed to materialize. Bitcoin’s price has fallen from its recent all-time high exceeding $123,000. Despite the current dip, some analysts remain optimistic about its future.

Brian Armstrong, Chief Executive Officer of Coinbase Global Inc., recently forecasted that Bitcoin could reach $1 million within the next five years. He attributed this potential growth to factors like evolving regulations and increasing institutional investment.

Did you know that market corrections, while often unsettling, can present opportunities for long-term investors?

Pro Tip: Diversification is key in the volatile cryptocurrency market. Don’t put all your eggs in one basket.

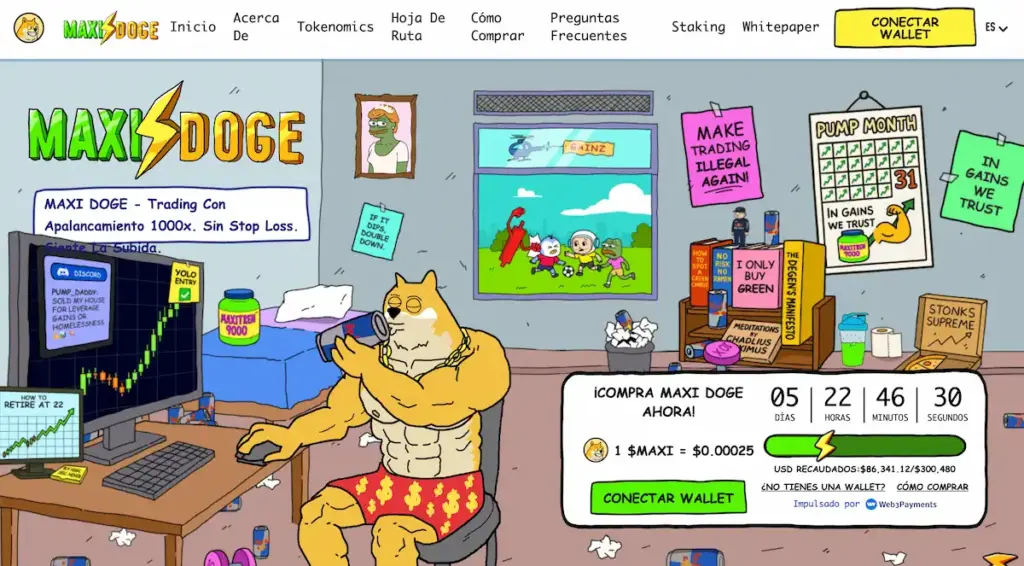

Maxi Doge Gains Traction Amidst Volatility

Amidst the broader market downturn, Maxi Doge (Maxi) has garnered considerable attention from risk-tolerant investors. The project’s presale has successfully raised $2,483,634.14 in a short period, signaling investor confidence in its long-term prospects. This momentum positions Maxi Doge among the leading cryptocurrency presales of 2025.

What impact do you think increasing institutional adoption will have on Bitcoin’s long-term price trajectory?

Do you believe newer, smaller cryptocurrencies like Maxi Doge can thrive even during periods of significant market volatility?

Understanding Cryptocurrency Liquidations

Cryptocurrency liquidations occur when a trader’s position is forcibly closed by an exchange to prevent further losses. This typically happens when the trader doesn’t have sufficient funds to cover their margin requirements. Liquidations are more prevalent in leveraged trading, where traders amplify their potential gains (and losses) by borrowing funds.

The primary driver of liquidations is rapid price movement. A sudden drop in price can trigger liquidations for long positions,while a sudden increase can trigger liquidations for short positions. Understanding liquidation risk is crucial for anyone participating in leveraged Cryptocurrency trading.

Frequently Asked Questions about Cryptocurrency Liquidations

- What is a Cryptocurrency liquidation? A forced closure of a trader’s position due to insufficient funds to cover margin requirements.

- Why do Cryptocurrency liquidations happen? They’re triggered by significant price movements that move against a trader’s position.

- What is the role of leverage in liquidations? Leverage amplifies both potential profits and potential losses, increasing the risk of liquidation.

- How can traders mitigate liquidation risk? Using stop-loss orders and managing leverage carefully can help reduce the risk of liquidation.

- What impact do large liquidations have on the market? Large-scale liquidations can exacerbate market volatility and contribute to further price declines.

Share your thoughts on this developing story and join the conversation below!

What impact could the increasing integration of cryptocurrency settlements have on traditional financial institutions?

Bitcoin Tests $111k as Crypto Settlements Exceed $400 Million

Surging Bitcoin Price: A New All-Time high?

Bitcoin (BTC) is once again capturing headlines, currently testing the $111,000 mark as of September 26, 2025. This renewed price surge coincides with a significant milestone in the broader cryptocurrency market: crypto settlements exceeding $400 million.This isn’t just about Bitcoin’s price; it’s a signal of increasing institutional adoption and real-world utility for digital assets. The current Bitcoin price is fueled by a combination of factors, including dwindling supply due to the upcoming halving event, increased demand from institutional investors, and growing acceptance as a store of value.

Understanding the $400 Million Settlement Milestone

The $400 million in crypto settlements represents the total value of transactions finalized on blockchain networks used for settling financial obligations. This figure encompasses a range of activities, including:

* Decentralized Finance (DeFi): Transactions within lending, borrowing, and trading platforms.

* Non-Fungible Token (NFT) marketplaces: Sales and transfers of digital collectibles.

* Cross-Border Payments: Utilizing cryptocurrencies for faster and cheaper international money transfers.

* Tokenized Real-World Assets (RWAs): Settlement of trades involving tokenized stocks, bonds, and commodities.

This surge in settlements indicates a maturing ecosystem where cryptocurrency transactions are becoming increasingly commonplace and integrated into traditional financial workflows. The growth is particularly noticeable in stablecoin settlements, highlighting their role as a bridge between fiat currencies and the crypto world.

Factors driving the Bitcoin Rally

Several key factors are contributing to Bitcoin’s current bullish momentum.

Institutional investment & ETF impact

The approval of Bitcoin Exchange-Traded Funds (ETFs) earlier in 2025 played a pivotal role in attracting significant institutional capital. These ETFs provide a regulated and accessible way for investors to gain exposure to Bitcoin without directly holding the asset. Major financial institutions are now actively offering Bitcoin-related investment products,further legitimizing the asset class.

The Halving Event & Supply Dynamics

The upcoming Bitcoin halving – expected in early 2026 – is a recurring event that reduces the reward miners receive for validating transactions by 50%. Historically, halvings have been followed by substantial price increases due to the reduced supply of new Bitcoin entering the market. This scarcity principle is a core tenet of Bitcoin’s value proposition. Bitcoin halving events consistently create anticipation and drive up demand.

macroeconomic Conditions & Inflation Concerns

Global macroeconomic conditions,including persistent inflation and geopolitical uncertainty,are also driving investors towards Bitcoin as a potential hedge against traditional financial systems. The perception of Bitcoin as “digital gold” – a scarce and decentralized asset – is gaining traction. Concerns about fiat currency devaluation are pushing investors to explore alternative stores of value.

Implications of Increased Crypto Settlements

The rise in crypto settlements has far-reaching implications for the financial landscape.

Enhanced efficiency & Reduced Costs

Blockchain-based settlements offer the potential for significantly faster and cheaper transactions compared to traditional systems.Eliminating intermediaries and automating processes can streamline financial operations and reduce costs for businesses and individuals.Blockchain technology is at the heart of this efficiency.

Greater Financial Inclusion

Cryptocurrencies can provide access to financial services for the unbanked and underbanked populations around the world. Individuals without traditional bank accounts can participate in the digital economy through mobile wallets and decentralized applications.

Innovation in Financial Products & Services

The growth of crypto settlements is fostering innovation in financial products and services. DeFi platforms are offering new ways to lend, borrow, and trade assets, while tokenization is unlocking liquidity in previously illiquid markets.

While the current outlook for Bitcoin and the broader crypto market is positive, it’s crucial to acknowledge the inherent risks.

Price volatility

Bitcoin remains a volatile asset, and price swings can be significant. investors should be prepared for potential losses and only invest what they can afford to lose. Bitcoin volatility is a key factor to consider.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, and changes in regulations could impact the market. Staying informed about regulatory developments is essential.

Security Risks

While blockchain technology is generally secure, cryptocurrency exchanges and wallets are vulnerable to hacking and theft.Implementing robust security measures is crucial to protect your assets. Consider using cold storage for long-term holdings.

Polish Bitcoin Community Insights (From forum.bitcoin.pl)

Recent discussions on Polish Bitcoin forums (https://forum.bitcoin.pl/viewtopic.php?t=38429) indicate growing optimism among Polish investors regarding Bitcoin’s long-term potential. Users are actively discussing strategies for navigating the volatility and maximizing returns, with a particular focus on long-term holding (HODLing) and diversification. the Polish community is also keenly following regulatory developments in the EU and their potential impact on the local crypto market.

Practical Tips for Investors

* Diversify Your Portfolio: Don’t put all your eggs in one