Read the latest economy news, market trends, and financial analysis on Archyde. Stay informed with global economic updates and expert insights.

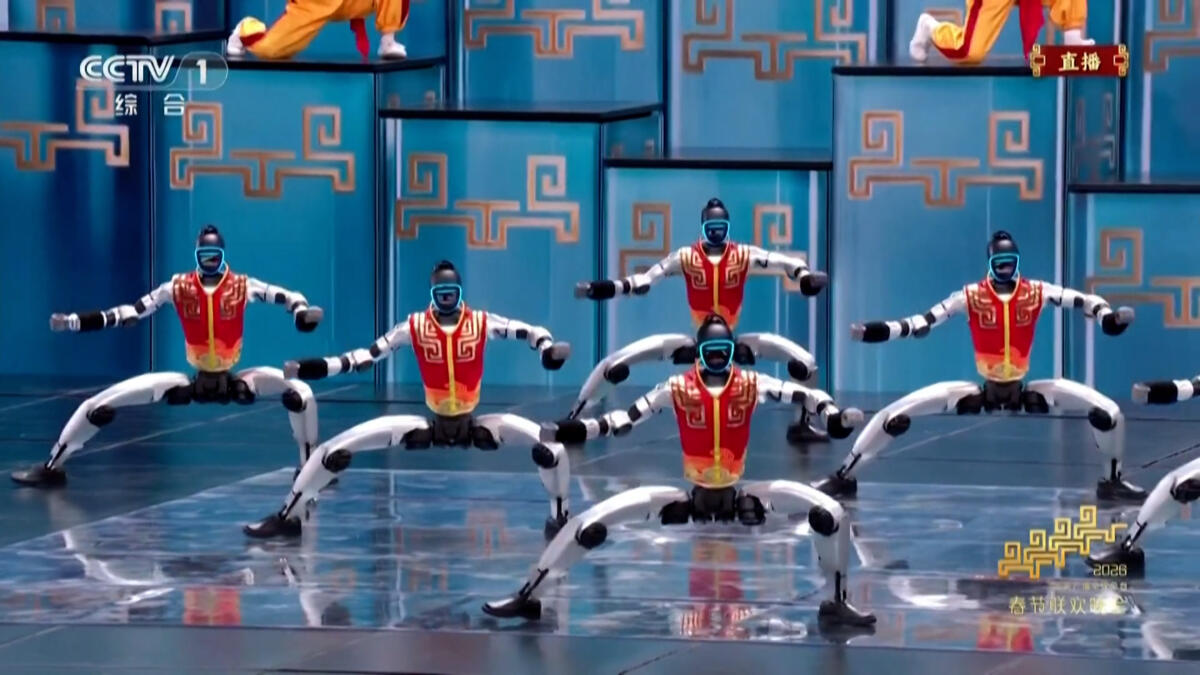

Robots performing martial arts sequences were a featured element of China’s annual Spring Festival Gala, broadcast Tuesday evening by state television network CCTV. The display, which included robots wielding swords and nunchucks alongside human performers, underscores China’s growing investment in humanoid robotics and its ambition to lead in the field.

Four Chinese startups – Unitree Robotics, Galbot, Noetix, and MagicLab – showcased their robots during the gala, a nationally televised event comparable in cultural significance to the Super Bowl in the United States. The program reached an audience of 79% of televisions turned on in the country in 2025, according to reports.

Unitree Robotics’ humanoids performed an extended martial arts demonstration, imitating the “drunken boxing” style with movements that included controlled falls and self-righting capabilities. Robots from Noetix appeared in a comedic sketch with human actors, while MagicLab robots danced in synchronization with performers during a rendition of “We Are Made in China.”

The inclusion of robotics in the Spring Festival Gala is viewed as a demonstration of China’s industrial policy and its focus on advanced manufacturing. The country accounted for 90% of the approximately 13,000 humanoid robots sold globally in 2024, according to data cited in reports following the broadcast.

Beyond the choreographed performances, the gala also featured Doubao, an artificial intelligence chatbot developed by ByteDance, the parent company of TikTok. The chatbot’s appearance highlights the integration of AI technologies alongside robotics in China’s technological development strategy.

Analysts suggest the prominent display of robotics is part of a broader effort to showcase China’s technological advancements on the international stage. The market for humanoid robots is projected to more than double in China this year, reaching an estimated 28,000 units.