Read the latest economy news, market trends, and financial analysis on Archyde. Stay informed with global economic updates and expert insights.

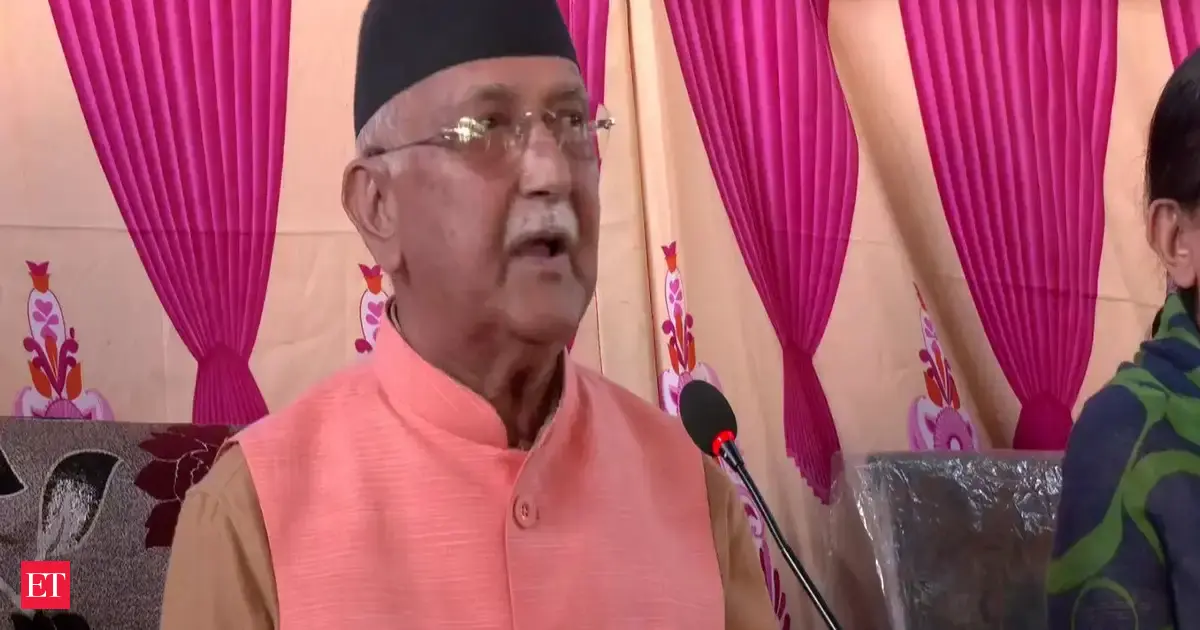

Kathmandu,Nepal – Former Prime Minister KP Sharma Oli has broken his silence regarding the nationwide demonstrations led by Gen-Z protestors that culminated in a change of leadership. In his first public appearance since the unrest, Oli squarely blamed “infiltrators” for escalating the peaceful protests into violent clashes, firmly denying any culpability for the government’s response.

The Escalation of Protests and Oli’s Response

Table of Contents

- 1. The Escalation of Protests and Oli’s Response

- 2. Claims of external Manipulation and Government Justification

- 3. Rising Death Toll and Allegations of Excessive Force

- 4. Political Aftermath and Security Concerns

- 5. Nepal’s Political Landscape: A Brief Overview

- 6. Frequently Asked Questions About the Nepal Protests

- 7. How might Prime Minister Oli’s claim of “infiltrators” influencing teh protests affect public trust in the government and the legitimacy of the protesters’ grievances?

- 8. Nepal Prime Minister Oli Blames Infiltrators for Escalation of Gen-Z Protest, Denies Involvement in Any Wrongdoing

- 9. The Allegations and Oli’s Response

- 10. Key Protest Grievances: A Deeper Dive

- 11. The Role of Social Media and Gen-Z Activism

- 12. Government Response and Crackdown Concerns

- 13. Past Context: Previous Protests in Nepal

- 14. Potential Outcomes and Future Scenarios

according to Oli’s account, delivered at a party program in Bhaktapur, the protests initially involved Gen-Z demonstrators who were joined by individuals he alleges deliberately sought to incite violence. He stated that on September 8th, while protestors gathered near the Everest Hotel, these “infiltrators” mingled with the crowd and instigated disturbances, leading to property damage and, tragically, the loss of life. An official inquiry is currently underway to determine the full extent of these claims.

The protests, initially sparked by demands for political accountability, an end to corruption, and the repeal of a social media ban, rapidly descended into chaos when authorities employed water cannons, tear gas, and ultimately, live ammunition to disperse the crowds. The resulting death toll has reached at least 74, with the majority of victims being students under the age of 30. Oli’s administration faced widespread condemnation for it’s handling of the crisis, with critics accusing the government of ordering a brutal crackdown.

Claims of external Manipulation and Government Justification

Oli maintained that the Gen-Z movement, while originating as a localized expression of discontent, was exploited and manipulated by external forces aiming to destabilize the nation. he emphasized that the younger generation, when acting authentically, does not engage in acts of vandalism or arson. He further clarified that his resignation on September 9th was a proactive measure to de-escalate the situation, taken when he felt he no longer had control over events.

He described a situation where, despite his attempts to prevent casualties and protect property, the unrest spiraled out of control, leading to widespread looting and destruction.The former Prime Minister asserted that his actions were motivated by a desire to avoid further bloodshed and maintain order amidst the escalating chaos.

Rising Death Toll and Allegations of Excessive Force

Official reports indicate that at least 21 protestors were killed on September 8th, with another 39 fatalities recorded the following day, including 15 deaths resulting from severe burns.over the subsequent ten days, an additional 14 lives were lost, bringing the total to 74. Postmortem examinations in the Kathmandu Valley revealed that many of the deceased sustained fatal injuries from gunshot wounds to the head and chest.

Though, these findings have been contested by some, including a former cabinet member who claims Oli resisted calls for his resignation despite mounting pressure. The use of lethal force by police has also come under scrutiny, with the former Home minister, Ramesh Lekhak, stepping down from his post in the wake of the violence.

| Date | Event | Fatalities |

|---|---|---|

| September 8th | Initial Protests & Escalation | 21 |

| September 9th | Continued Unrest & Clashes | 39 |

| September 10th – 18th | Subsequent Fatalities | 14 |

| Total | 74 |

did You Know? Nepal experienced a similar period of major political upheaval in 2006, when widespread protests led to the abolishment of the monarchy and the establishment of a democratic republic.

Political Aftermath and Security Concerns

Oli’s reappearance on the political scene comes as Nepal navigates a turbulent transition period. He has also expressed concerns about his personal security, citing threats circulating on social media. He has formally requested enhanced protection from the government, questioning its ability to safeguard him.

The unrest has prompted a ban on Oli’s foreign travel, a move he decried as politically motivated and an attempt to stifle his voice. He maintains his commitment to establishing a constitutional and democratic Nepal, governed by the rule of law.

Nepal’s Political Landscape: A Brief Overview

Nepal, a landlocked nation nestled in the Himalayas, has experienced notable political instability in recent decades. Following years of civil war and the overthrow of the monarchy, the country has struggled to establish a stable democratic system. Corruption,political infighting,and economic challenges remain significant hurdles to progress. The recent protests highlight the deep-seated frustrations of Nepal’s youth and their demand for a more accountable and clear government. The country’s reliance on foreign aid, particularly from India and China, also plays a crucial role in its political and economic dynamics. According to the World Bank, Nepal’s GDP growth is projected at 2.3% for 2024, and the nation continues to grapple with poverty and unemployment.

Frequently Asked Questions About the Nepal Protests

- What were the primary causes of the Gen-Z protests in Nepal? The protests were driven by demands for political accountability, an end to corruption, and the reversal of a controversial social media ban.

- What is KP Sharma Oli’s role in the recent unrest? Oli, the former Prime Minister, has blamed “infiltrators” for escalating the protests and has defended his government’s actions.

- What were the reported circumstances surrounding the deaths of protestors? Postmortem reports indicate that many protestors died from gunshot wounds to the head and chest, sparking concerns about the use of excessive force.

- What is the current political situation in Nepal? Nepal is currently undergoing a period of political transition following Oli’s resignation, with Sushila Karki serving as interim Prime Minister and elections scheduled for the coming year.

- What security concerns has KP Sharma Oli expressed? Oli has voiced concerns about threats to his safety and has requested increased security protection from the government.

What impact do you think this unrest will have on Nepal’s future political trajectory? Do you believe external forces played a significant role in escalating the protests?

Share your thoughts in the comments below and join the conversation.

How might Prime Minister Oli’s claim of “infiltrators” influencing teh protests affect public trust in the government and the legitimacy of the protesters’ grievances?

Nepal Prime Minister Oli Blames Infiltrators for Escalation of Gen-Z Protest, Denies Involvement in Any Wrongdoing

The Allegations and Oli’s Response

Nepal’s Prime Minister K.P. sharma Oli has directly attributed the recent intensification of Gen-Z led protests against his government to the actions of “infiltrators” and “foreign elements.” These protests, largely fueled by concerns over political corruption, economic hardship, and perceived authoritarian tendencies, have seen a surge in participation from young Nepalis utilizing social media for organization and mobilization.

Oli vehemently denies any wrongdoing on the part of his administration, claiming the demonstrations are being deliberately manipulated to destabilize the nation. He has publicly stated that the genuine concerns of the youth are being exploited by individuals with ulterior motives. This statement, made during a televised address on September 26th, 2025, has further inflamed tensions.

Key Protest Grievances: A Deeper Dive

the current wave of protests isn’t a spontaneous outburst. It’s rooted in a confluence of factors impacting Nepal’s younger generation. Understanding these grievances is crucial to grasping the scale and intensity of the demonstrations.

* Economic Discontent: High unemployment rates, particularly among recent graduates, are a major driver.The promise of economic opportunities, especially following Nepal’s economic reforms and increased foreign investment, hasn’t materialized for many.

* Political Corruption: Allegations of widespread corruption in Nepal within government contracts and public projects continue to erode public trust. Transparency International’s Corruption Perception Index consistently ranks Nepal poorly.

* Erosion of Democratic values: Concerns are growing regarding restrictions on freedom of speech and assembly, and the perceived centralization of power within the executive branch. The recent amendments to media regulations have been particularly contentious.

* COVID-19 Pandemic Response: Criticism of the government’s handling of the COVID-19 pandemic, including vaccine procurement and distribution, has added to the public dissatisfaction.

This protest movement is distinctly characterized by its reliance on social media platforms like Twitter, Facebook, and tiktok. gen-Z activists are leveraging these tools to:

* Organise Demonstrations: Rapidly disseminate data about protest locations, times, and objectives.

* Bypass Traditional Media: Share choice narratives and counter government messaging.

* Mobilize Support: Reach a wider audience and garner international attention.

* Document Events: Provide real-time coverage of protests, frequently enough circumventing state-controlled media.

This digital activism represents a important shift in Nepal’s political landscape, empowering a generation previously marginalized in traditional political processes. the use of hashtags like #SaveNepal and #OliResign are trending globally, demonstrating the reach of the movement.

Government Response and Crackdown Concerns

Beyond blaming infiltrators, the government’s response has included:

* Increased security Presence: Deployment of security forces in key protest areas, leading to clashes with demonstrators.

* Internet Restrictions: Sporadic disruptions to internet access, particularly during peak protest activity, raising concerns about censorship.

* Arrests of Protest Leaders: Several prominent activists and organizers have been arrested on charges ranging from public disturbance to sedition. Human rights organizations have condemned these arrests as politically motivated.

* Counter-Narrative Campaigns: Government-backed media outlets are actively promoting a narrative that portrays the protests as disruptive and orchestrated by external forces.

These actions have drawn criticism from international observers, who fear a further escalation of the conflict and a crackdown on essential freedoms.

Past Context: Previous Protests in Nepal

Nepal has a history of significant protests that have shaped its political trajectory.

* The 1990 People’s Movement (Jana Andolan): Led to the restoration of multi-party democracy.

* The 2006 April Uprising: Forced King Gyanendra to relinquish absolute power.

* The Madhesi Movement (2007-2008): Advocated for greater rights and autonomy for the Madhesi community.

These past movements demonstrate the power of popular mobilization in Nepal and the potential for significant political change. The current Gen-Z protests, while distinct in their methods and focus, are part of this ongoing tradition of civic engagement.

Potential Outcomes and Future Scenarios

The situation remains fluid, and several potential outcomes are possible:

* Continued Escalation: If the government continues its hardline approach and fails to address the underlying grievances, the protests could intensify, possibly leading to widespread unrest.

* Negotiated Settlement: A dialog between the government and protest leaders could lead to concessions and a de-escalation of tensions.

* Political Realignment: The protests could trigger a realignment of political forces, potentially leading to a change in government.

* Increased Foreign Intervention: While unlikely, prolonged instability could invite increased foreign intervention in Nepal’s internal affairs.

The coming weeks will be critical in determining the future of Nepal’s political landscape. the ability of the government to address the legitimate concerns of its citizens, particularly the younger generation, will be paramount in preventing further escalation and fostering a more stable and democratic future.