2023-05-27 12:39:01

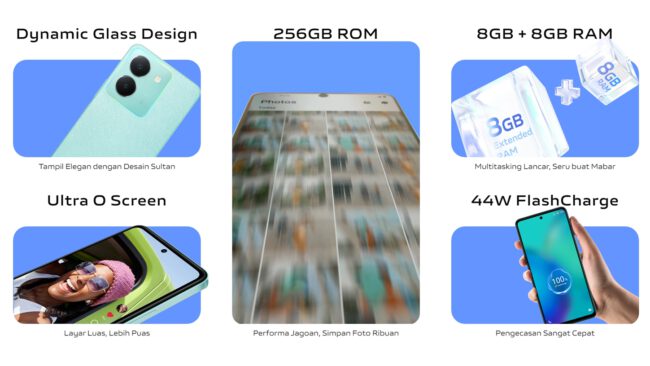

Coming to Indonesia, the first country vivo Y36 Series The mid-sequel model vivo Y35, this time looks similar to the original. Change the punch hole screen and there is also a 5G version. However, the 4G model specification is almost the same as the vivo Y35, except for the 256GB capacity, storing more photos, videos, and apps.

Specification vivo Y36 4G / 5G

- 6.64-inch IPS LCD screen (FHD +), supports Refresh Rate 90Hz

- Capacity 256GB UFS 2.2

- Snapdragon 680 (4G), Dimensity 6020 (5G) + 8GB RAM

- System Android 13 (Funtouch OS)

- Main Camera 50MP F1.8 + Macro, Front Camera 16MP

- 5000 mAh battery (44W fast charge)

Comes with an Ultra-O screen, probably the same screen as the iQOO Z7x 5G, reduced to 90Hz, available in 2 colors: Glitter Aqua, Meteor Black, looks more premium The original specification camera, the 4G model, uses the same chip, but the capacity has been upgraded to 256GB.

iQOO Z7x 5G, the best 5G mobile phone

https://shope.ee/1q69QbmKKB

https://s.lazada.co.th/l.dfZR

vivo Y36 Series Start selling in Indonesia, the 4G model first, the price is regarding 7,000 baht, the 5G model comes later, usually these models come to Thailand. Have to wait and see what comes first or following, or support iQOO Z7x 5G, I think it’s definitely worth more.

1685210806

#Summary #vivo #Y36 #Series #design #options #tight #capacity #256GB