Breaking stories and in‑depth analysis: up‑to‑the‑minute global news on politics, business, technology, culture, and more—24/7, all in one place.

The Future of the 28 Days Later Franchise: What to Expect After the Third Instalment

Did you know that the horror genre has seen a 50% increase in audience engagement over the last five years? This trend underscores why Sony Pictures’ decision to greenlight a third instalment of the 28 Days Later franchise has electrified fans and industry insiders alike. With the franchise’s return to its roots and the creative prowess of legendary filmmakers, the future looks ominous yet exhilarating for horror enthusiasts.

A Rapidly Growing Franchise

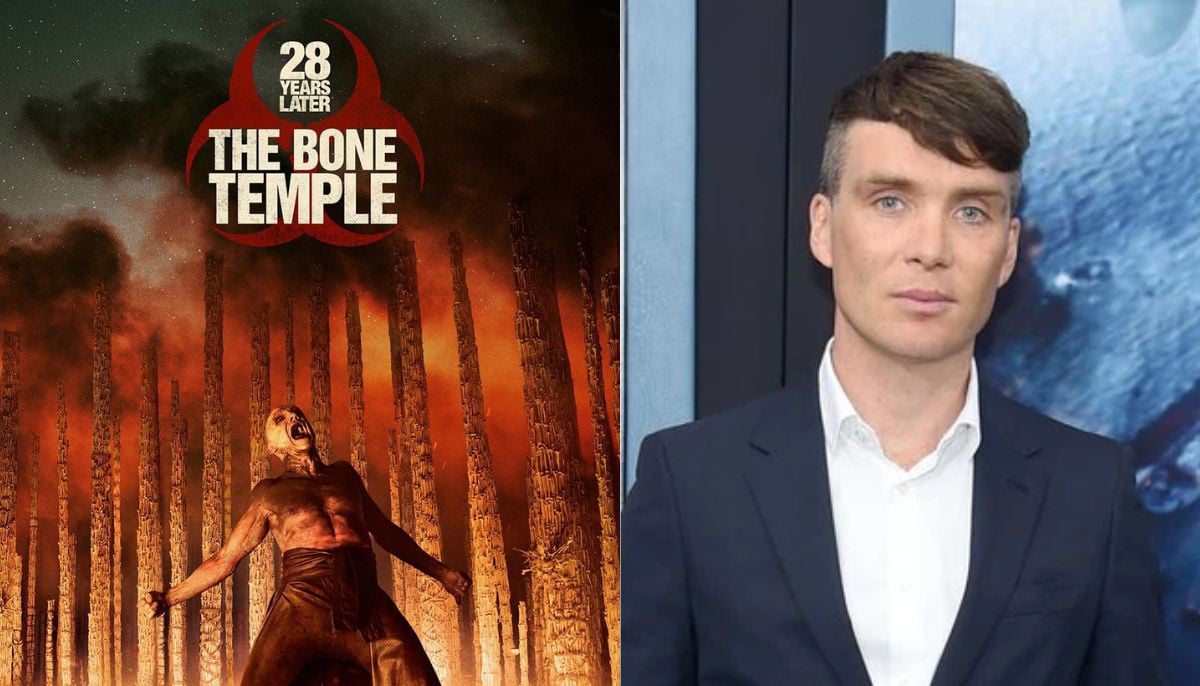

The announcement of a third film comes hot on the heels of the upcoming The Bone Temple, slated for release on January 16, 2026. The initial film in the franchise, directed by Danny Boyle in 2002, redefined the zombie genre. It mixed existential dread with visceral horror, making it a perennial favorite. The warm reception to The Bone Temple during test screenings was so overwhelming that Sony accelerated plans for the next chapter.

The Creative Team Behind the Horror

Fans are thrilled that Alex Garland, the writer-producer of the previous entries, is back to handle the screenplay. Meanwhile, Boyle is set to return as director, promising continuity in vision and style. Their combined efforts ensure that the new instalment in the 28 Days Later saga will not just continue the storyline but also redefine what horror can achieve.

Cillian Murphy’s Starring Comeback

Among the many exciting developments is the return of Cillian Murphy as Jim, the lead character from the original film. His surprise cameo in The Bone Temple hints at an expanded role in the third instalment, offering a clever narrative twist that fans have eagerly anticipated. Boyle’s assurance that Murphy’s integration into the story is both “clever” and “significant” promises that old fans and newcomers alike will be captivated.

The Implications for Modern Horror

The decision to greenlight a third film before The Bone Temple even hits theaters is a strong statement from Sony regarding their confidence in the creative team and the franchise’s commercial viability. As the industry shifts towards more serialized storytelling, franchises like 28 Days Later are at the forefront of innovation in horror, blending deep character arcs with gripping narratives.

What Lies Ahead

Looking ahead, fans can expect more casting announcements, production timelines, and plot details in the coming months. But what will this mean for the horror genre as a whole? In an age where nostalgia sells, the blending of old and new elements could set a precedent for how horror franchises evolve.

Impacts on Audience Engagement

As the horror landscape begins to embrace this renaissance, the implications for audience engagement are significant. Will emotional storylines and complex characters lead to a more engaged viewer? The increasing integration of technology in storytelling, like immersive marketing campaigns and interactive media, could enhance user experience, making it more tailored and captivating than ever before.

As we wait for further announcements from Sony, the excitement surrounding the 28 Days Later franchise is palpable. With both seasoned filmmakers at the helm and beloved characters returning, this chapter could redefine horror for both fans and newcomers alike.

What do you think will happen in the upcoming instalments of the 28 Days Later franchise? Share your theories and predictions in the comments below!