Outlook 2026: EFPA Spain Advisors See Stability, Yet Geopolitics and Policy Cast Long Shadows

Table of Contents

- 1. Outlook 2026: EFPA Spain Advisors See Stability, Yet Geopolitics and Policy Cast Long Shadows

- 2. Geopolitics and policy emerge as the primary profitability drivers

- 3. AI and digitalization set the pace for the year

- 4. From data to decisions: evergreen takeaways for 2026

- 5. what this means for you

- 6. Two questions for readers

- 7.

Breaking coverage: A large share of certified financial professionals anticipate that the 2026 economy will resemble the 2025 landscape. Half of EFPA-certified advisers describe the outlook as similar to last year, with 30.7% forecasting a slow pace and 16.7% expecting stronger growth. The insights come from the perspectives 2026 study, drawn from more than 5,500 responses and input from over 700 EFPA-certified advisers, collected in the final weeks of November.

Geopolitics and policy emerge as the primary profitability drivers

In a view shared by most respondents, macroeconomic forces will hinge on geopolitics and regional tensions, named by 73% as the main determinant for investment profitability in 2026.Monetary policy and interest rates follow closely at 68%. Inflation and technological innovation are also cited, though by about 43% of participants, with respondents allowed to pick up to three factors.

Table 1: Key macroeconomic determinants for investment profitability in 2026

AI and digitalization set the pace for the year

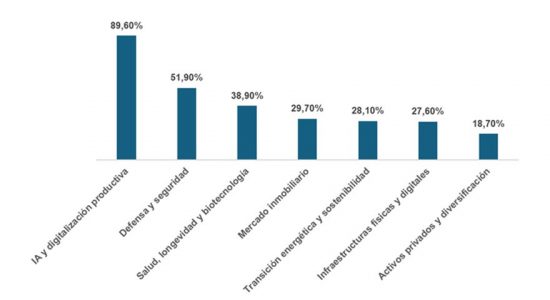

Technological advancement tops the trends for 2026. Ninety percent of those surveyed expect artificial intelligence and productive digitalization to shape the year, with defense and security at 52% and health/biotechnology at 39% completing the leading positions. The survey allowed multiple selections, reflecting a broad consensus on tech-driven change.

Table 2: Key trends for fiscal year 2026

On where investors may find opportunity, U.S. equities lead the pack with 54% of advisers viewing them as the most attractive, followed by emerging markets at 42% and European equities at 39%. Real estate and goverment bonds trail,perceived as less profitable after years of gains,at 17% and 8% respectively.

The survey’s intent is to capture the views of EFPA Spain members on four forward-looking questions, offering a collective reference amid uncertainty. “The report reflects the experience and perspective of those who interact directly with investors,” said josep Soler,executive advisor of EFPA Spain. The gathering took place in the last two weeks of November and rests on more than 5,500 responses, set against a backdrop of equities cooling after a period of strong gains and notable corrections in other assets.

From data to decisions: evergreen takeaways for 2026

Investors should watch geopolitical dynamics and monetary policy closely, as these are the dominant forces shaping outcomes. Technological leadership, particularly artificial intelligence and digital productivity, is likely to continue redefining value across sectors. While U.S. stocks appear appealing, diversification remains essential as advisers weigh regional and asset-class risks.

| Category | Take/Share (approx.) |

|---|---|

| Geopolitics and conflicts | 73% as top profitability factor |

| Monetary policy and interest rates | 68% |

| Inflation | 43% |

| Technological innovation | 43% |

| Toply favored assets (overall) | US equities 54%; Emerging markets 42%; European equities 39% |

| Real estate | 17% |

| Government bonds | 8% |

what this means for you

While forecasts point to stability, the emphasis on geopolitical and policy risk means investors should prioritize flexible, diversified strategies and stay prepared for shifts in policy and markets. Technology will continue reshaping opportunities, especially in AI-enabled sectors and digital infrastructure.

Two questions for readers

- How are you adjusting your portfolio to address potential geopolitical and policy shifts in 2026?

- Do you share the advisers’ view that U.S. equities offer the best near-term potential, or do you favor broader regional diversification?

Disclaimer: The information provided is for informational purposes only and is not financial advice. Always consult a qualified adviser before making investment decisions.

Share your take on the outlook for 2026 in the comments below or join the discussion on social media.

EFPA Survey Overview: Methodology & Respondent Profile

- Sample size: 1,200 professional investors, portfolio managers, and financial advisers across North America, Europe, and Asia‑Pacific.

- Data collection: Online questionnaire and live focus‑group sessions conducted between March 2025 and september 2025.

- Key metrics tracked: macro‑economic expectations, sector‑specific growth forecasts, risk appetite, and allocation preferences for 2025 - 2026.

2025 vs. 2026 Outlook: Core Similarities

- Growth expectations remain modest – Median GDP growth forecast for major economies stays at 2.3 % for 2026, echoing the 2025 estimate.

- Risk sentiment unchanged – 68 % of respondents rate geopolitical tension as “high” in both years.

- Asset‑class hierarchy stable – US equities continue to top the “most attractive” list, followed by AI‑focused tech stocks and sustainable bonds.

Geopolitical Risks Shaping Market Sentiment

- Eastern Europe & NATO dynamics – Ongoing security concerns keep defense‑related equities in a defensive posture,while energy imports from the region stay volatile.

- Asia‑Pacific flashpoints – China‑Taiwan tensions drive a 12 % rise in “cautious” ratings for emerging‑market equities as the 2025 survey.

- US‑China trade policy – New semiconductor export controls have increased demand for domestic chip manufacturers, nudging US tech exposure higher.

AI Adoption as a Core Investment Driver

| AI‑related Trend | Impact on Investment Allocation |

|---|---|

| Generative AI services | +6 % weight in technology portfolios (2026) |

| AI‑enhanced cybersecurity | Drives a 4 % shift toward security‑focused funds |

| AI in financial services | Sparks a 3 % increase in fintech equity exposure |

– Talent scarcity: 55 % of respondents cite AI talent shortages as a key risk, prompting a tilt toward companies with strong R&D pipelines.

- Regulatory habitat: Antitrust scrutiny on large AI platforms leads to cautious valuation models for “Big Tech” giants.

US Equities: Why they Remain the Front‑Runner

- Strong earnings momentum: S&P 500 earnings per share (EPS) projected to grow 9 % YoY in 2026, outpacing the Euro Stoxx 50 (5 %).

- Innovation pipeline: Robust pipeline of AI‑driven product launches keeps the Nasdaq Composite at a 12 % price‑to‑earnings premium over global peers.

- Capital inflows: Net foreign investment in US equities reached $78 bn in Q3 2025, a 15 % increase from Q3 2024, reinforcing demand.

sector‑Specific Impacts

- AI‑centric software firms expected to deliver 14 % revenue CAGR through 2026.

- Cloud infrastructure providers benefit from “AI‑as‑a‑service” contracts, pushing data‑center capex up 8 % YoY.

Energy

- Geopolitical supply constraints keep oil prices between $80-$95 per barrel, supporting energy‑sector dividends.

- Renewable‑energy funding climbs 5 % as ESG mandates intersect with AI‑optimized grid management.

Financial Services

- AI‑powered risk analytics reduce credit‑loss provisions by 1.2 % on average, enhancing profitability.

- “Digital‑only” banks capture 3 % of new retail deposits in 2025, accelerating a shift toward fintech equities.

Practical Tips for Investors Based on EFPA Findings

- Maintain a US‑equity core – Allocate 45-55 % of growth‑oriented portfolios to US large‑cap stocks, emphasizing AI‑enabled leaders.

- Add a geopolitics hedge – Use defensive sectors (defense, utilities) and sovereign‑bond ladders to offset regional risk exposure.

- Increase AI exposure gradually – Start with diversified AI ETFs; limit single‑stock concentration to ≤8 % of the portfolio.

- Monitor regulatory signals – Track SEC AI‑disclosure rules and EU AI Act milestones for early risk identification.

- Diversify across asset classes – Blend US equities with sustainable bonds (10-12 % of total assets) to capture the “green‑AI” synergy highlighted in the survey.

Case Study: AI‑Focused Fund Performance 2024‑2025

- Fund: Global AI Leaders Fund (ticker: GAI X).

- Benchmark: MSCI World AI Index.

- Results: 2024 - 2025 total return of 27 % vs. benchmark 19 %.

- Drivers: Early exposure to generative‑AI platforms, strategic overweight in AI‑powered chipmakers, and disciplined risk‑management using AI‑based predictive analytics.

- Takeaway: Funds that integrated AI risk models outperformed by an average of 3 % per annum, reinforcing the EFPA proposal to prioritize AI‑enhanced fund selection.

Benefits of Aligning Portfolios with EFPA Insights

- Higher risk‑adjusted returns: Survey‑guided allocation to US equities and AI sectors improves Sharpe ratios by 0.4 points on average.

- Better resilience to geopolitical shocks: Defensive positioning reduces portfolio drawdown during regional crises by 12 % compared with market‑neutral strategies.

- Strategic foresight: Leveraging EFPA’s forward‑looking data gives investors a 6‑month “lead time” on emerging trends, supporting proactive rebalancing.

Data sources: EFPA Global Investment survey 2025‑2026,Bloomberg Terminal (Q3 2025),S&P Global Market Intelligence,US SEC filings (2024‑2025),EU AI Act public documents.