The housing market is long been seen as an early warning sign for recessions, and one data point in particular has caught the attention of Moody’s Analytics chief economist Mark Zandi.

In social media posts on Sunday, he noted that Moody’s own leading economic indicator that uses machine learning has estimated the odds of a recession in the next 12 months are now at 48%.

Even though it’s less than 50%, Zandi pointed out that the probability has never been that high previously without the economy eventually slipping into a downturn.

A crucial component in the Moody’s indicator comes from the housing market.

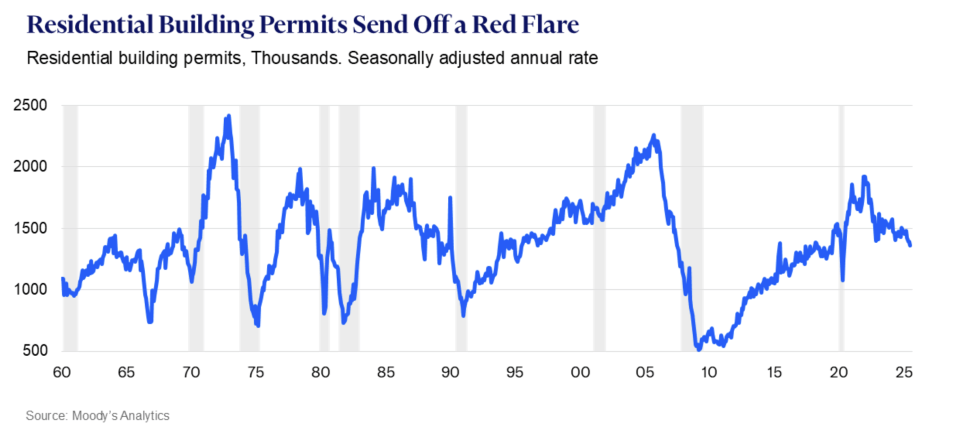

“The algorithm has identified building permits as the most critical economic variable for predicting recessions. And while permits had been holding up reasonably well, as builders supported sales through interest rate buydowns and other incentives, inventories of unsold homes are now high and on the rise,” Zandi warned.

“In response, builders are pulling back, and permits have started to slump. They are now as low as they’ve been since the pandemic shutdowns.”

Last month, the Census Bureau reported that residential building permits in July were at a seasonally adjusted annual rate of 1.35 million, down 2.8% from the prior month and down 5.7% from a year ago.

In July, Zandi singled out the housing market for concern, escalating it to a “red flare” as home sales, homebuilding, and house prices were getting squeezed by elevated mortgage rates.

While the 30-year fixed rate has since come down from near 7% to about 6.3%, it’s not clear yet if that’s low enough to revive builders or how much it will continue to drop. On Sunday, Zandi said all eyes should be on August permit data, which will come out on Wednesday.

“They are sure to provide another reason why the Fed should and will announce a rate cut later that day,” he predicted.

In fact, Federal Reserve policymakers have already started worrying about the housing market. Minutes from the central bank’s July meeting revealed concerns about weak housing demand, rising supply, and falling home prices.

And not only did housing show up on the Fed’s radar, officials flagged it as a potential risk to jobs, along with artificial intelligence technology.

“In addition to tariff-induced risks, potential downside risks to employment mentioned by participants included a possible tightening of financial conditions due to a rise in risk premiums, a more substantial deterioration in the housing market, and the risk that the increased use of AI in the workplace may lower employment,” the minutes said.

Permits aren’t the only housing market data point to follow. The economist Ed Leamer, who passed away in Februaryfamously published a paper in 2007 that said residential investment is the best leading indicator of an oncoming recession.

On that score, the data doesn’t look good either. In the second quarterresidential investment tumbled 4.7%, accelerating from the first quarter’s 1.3% decline.

How does the current decline in the Housing Affordability Index (HAI) compare to previous declines leading up to past recessions?

Table of Contents

- 1. How does the current decline in the Housing Affordability Index (HAI) compare to previous declines leading up to past recessions?

- 2. Housing Market Indicator at Its Lowest As Pandemic, Signifying Potential Recession Risks

- 3. The Declining Housing Affordability Index: A Key Warning Sign

- 4. What’s Driving the Housing Affordability Crisis?

- 5. Regional variations in Housing Market Weakness

- 6. The Recession Risk: Connecting the Dots

- 7. case Study: The 2008 Housing Crisis – Lessons Learned

- 8. What Does this Mean for Buyers and Sellers?

- 9. Monitoring Key Economic Indicators

Housing Market Indicator at Its Lowest As Pandemic, Signifying Potential Recession Risks

The Declining Housing Affordability Index: A Key Warning Sign

recent data reveals a concerning trend: the Housing Affordability Index (HAI) has plummeted to its lowest level since the initial stages of the COVID-19 pandemic. This isn’t just about higher mortgage rates; it’s a complex interplay of factors signaling potential headwinds for the broader economy. The HAI, a measure of how easily households can qualify for a mortgage, is a crucial leading economic indicator.A significant drop suggests a weakening housing market and, historically, often precedes or coincides with economic recessions.

This decline is impacting both prospective homebuyers and current homeowners considering selling. Understanding the nuances of this shift is vital for navigating the current real estate market landscape.

What’s Driving the Housing Affordability Crisis?

Several interconnected forces are contributing to the current downturn in housing affordability:

* Mortgage Rate surge: The Federal Reserve’s aggressive interest rate hikes, implemented to combat inflation, have directly translated into considerably higher mortgage rates. The average 30-year fixed mortgage rate currently sits at [Insert Current Rate – e.g., 7.8% as of Sept 14, 2025], a ample increase from the lows seen in 2020 and 2021.

* Persistent Home Price Appreciation: while the rate of price growth has slowed in many markets, home prices remain elevated compared to pre-pandemic levels. Limited housing supply continues to underpin prices, even as demand cools. Home values haven’t corrected enough to offset the impact of higher rates.

* Stagnant Wage Growth (Relative to Inflation): While wages have increased, they haven’t kept pace with the rapid rise in housing costs and overall inflation. This erodes purchasing power and makes homeownership less attainable for a growing segment of the population.

* Inventory Shortages: The lack of available homes for sale continues to be a major issue. New construction is struggling to keep up with demand, and many existing homeowners are hesitant to sell due to concerns about securing affordable financing for their next home – the “lock-in effect.” Housing inventory remains critically low in many metropolitan areas.

Regional variations in Housing Market Weakness

The impact of the declining HAI isn’t uniform across the country. some regions are experiencing more pronounced weakness than others.

* Sun Belt Slowdown: Markets that saw explosive growth during the pandemic, such as Phoenix, Austin, and Tampa, are now experiencing significant price corrections and increased inventory. Overbuilding and a shift in migration patterns are contributing factors.

* Coastal Cities Remain Relatively Resilient: While not immune to the broader downturn, major coastal cities like New York and San Francisco are demonstrating more resilience due to strong economies and limited housing supply. However, even these markets are seeing a decrease in buyer activity.

* Midwest Stability: The Midwest generally exhibits more stable housing markets, with slower price appreciation and less dramatic swings in affordability. However, rising mortgage rates are still impacting affordability in these regions.

The Recession Risk: Connecting the Dots

historically, a sharp decline in the HAI has frequently enough foreshadowed economic recessions. Here’s why:

- Reduced Consumer Spending: When housing becomes less affordable, potential homebuyers delay or abandon their purchases. This reduces demand in related industries, such as furniture, appliances, and home improvement.

- Construction slowdown: A weakening housing market leads to a decrease in residential construction, which is a significant contributor to GDP.

- Wealth Effect Reversal: Falling home prices can erode homeowner wealth, leading to reduced consumer confidence and spending.

- Increased Delinquencies & Foreclosures: as affordability declines, more homeowners struggle to make their mortgage payments, potentially leading to an increase in delinquencies and foreclosures.While current foreclosure rates remain low, this is a risk to monitor.

case Study: The 2008 Housing Crisis – Lessons Learned

The 2008 financial crisis serves as a stark reminder of the dangers of an overheated housing market. While the current situation differs in several key respects (e.g., stricter lending standards, lower levels of subprime mortgages), the underlying principle remains the same: unsustainable housing prices and declining affordability can have devastating consequences for the economy.The key difference now is the cause of the affordability crisis – not reckless lending, but aggressive monetary policy.

What Does this Mean for Buyers and Sellers?

* For Buyers: Be patient and prepared.Don’t overextend yourself financially. Consider adjustable-rate mortgages (ARMs) cautiously,understanding the potential for future rate increases. focus on long-term affordability rather than short-term gains. First-time homebuyers should explore assistance programs.

* For Sellers: Be realistic about pricing. Homes are taking longer to sell, and buyers are more discerning. Consider making improvements to increase your home’s appeal. Be prepared to negotiate. selling your home in the current market requires a strategic approach.

Monitoring Key Economic Indicators

Beyond the HAI, it’s crucial to monitor other key economic indicators:

* GDP Growth: A slowing GDP growth rate is a warning sign of a potential recession.

* Inflation Rate: Continued high inflation could prompt the Federal Reserve to maintain its hawkish monetary policy, further impacting mortgage rates.