AADE has digitized the process of disputing the minimum presumptive income from business activity, making it easier and more accessible for citizens.

Her decision AADE provides, among other things, the deadline for submitting the application to challenge the presumption for objective reasons (par. 3, no. 28A, KFE), the case-by-case supporting documents, the procedure, the conditions and the deadline for submitting an application for the audit (no. 23 KFD), and finally the time of control (par. 4, no. 28A KFE).

In particular, taxpayers disputing the annual imputed income from business activity must, through the new application on the myAADE digital portal, submit a dispute request.

Depending on the reason for the dispute, the following are specifically provided for:

A. Request for an audit

In this case, the process takes place in two steps:

1st Step: The taxpayer must state in his timely declaration that he wishes to dispute the minimum income, requesting a tax audit (codes 443-444 of E1 of the income tax return).

2nd Step: If he has already filled in the relevant code in E1 of the income tax return, the taxpayer must, at the latest within 60 days from the deadline for submitting the return, fill in a questionnaire with his financial situation and living conditions of himself, his/her spouse/MSS and the protected members, which will be evaluated during the tax audit.

The questionnaire will be completed in a special digital application of AADE, which will be available in the first fortnight of May.

The audit is carried out within 12 months of notification of the audit order.

B. Request to dispute on objective grounds

In these cases, the request is submitted directly to the new digital application, which will be available in the first fortnight of May.

In particular, the request can be submitted following the submission of the income tax return and the issuance of the settlement statement (deed of tax assessment) and until notification by the Tax Administration

income tax control order or until the statute of limitations of the Tax Administration’s right to issue a tax assessment act.

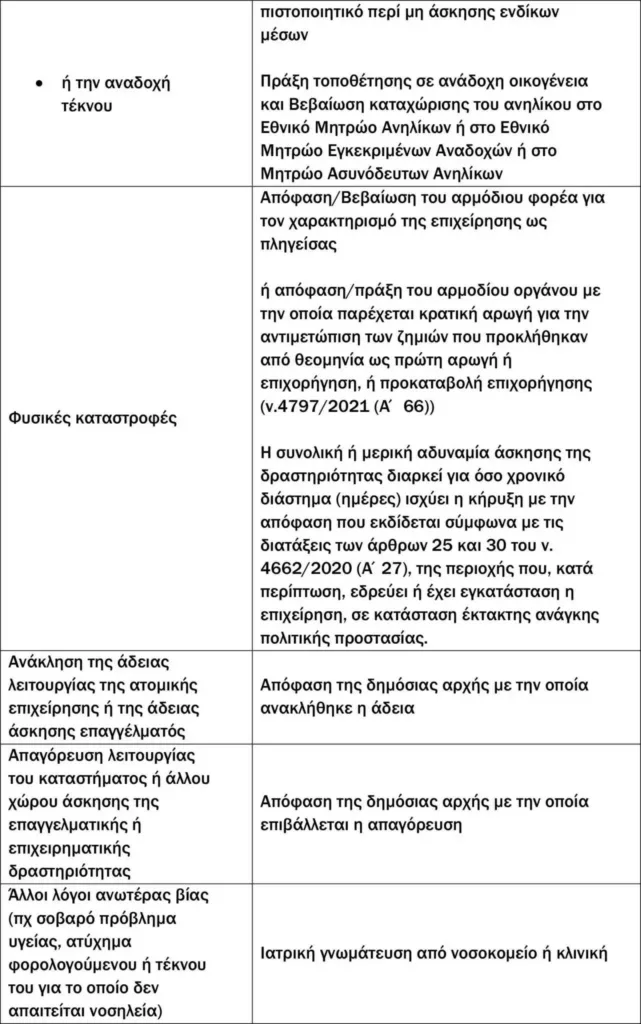

In particular, according to newsit, the objective reasons and the accompanying supporting documents proving the impossibility of carrying out business activity are the following:

For more clarification, those interested can contact the Taxpayer Service Center of AADE, and on the phone 213 162 1000, on working days and hours 07:30 – 17:00.

Read also:

Patras: The 30-year-old baby killer returns to prison – Her lawyer in “P”

Patras – GSEE Strike: Gathering in progress at the Labor Center – PHOTO

Shock in sports: “Doped Greek international footballer – Participated in the National team’s mission in Tbilisi”

Weather: ‘Polar Stream’ Brings Heavy Rains and Storms, Even Snow – Forecast Chatraphyllia

Ministry of Development: 20 Greek influencers are screened

Instant update with all the news now and via WhatsApp – See here

#professionals #challenge #minimum #annual #income #business #activity