Bitcoin’s $1 Million Price Tag: A Warning Sign or Bullish prediction?

Table of Contents

- 1. Bitcoin’s $1 Million Price Tag: A Warning Sign or Bullish prediction?

- 2. Economic Concerns Overshadow Bitcoin Optimism

- 3. Rising National Debt Fuels Uncertainty

- 4. Corporate Adoption and Potential for a Bubble

- 5. Understanding Bitcoin and Macroeconomic Factors

- 6. Frequently Asked Questions about Bitcoin and Economic Stability

- 7. What economic conditions might historically foreshadow a Bitcoin surge to $1 million, and how do current conditions align with those precedents?

- 8. Is Bitcoin’s Surge to $1 Million an Omen for the U.S.economy?

- 9. The Million-Dollar Question: Bitcoin & Economic Indicators

- 10. Historical parallels: Gold, Tech Bubbles, and Bitcoin

- 11. Decoding the Current Bitcoin Rally: Key Drivers

- 12. Potential Economic Impacts: A Two-Sided Coin

- 13. Negative Impacts:

- 14. Positive Impacts:

- 15. the Role of Stablecoins and DeFi

- 16. Real-World Examples & Case Studies

New york, NY – August 17, 2025 – Recent gains in the price of Bitcoin have fueled speculation about its future value, with some predicting a considerable increase to $1 million per coin by 2026. However, Galaxy Digital CEO Mike Novogratz is urging caution, suggesting that such a dramatic rise may not be a cause for celebration, but rather an indicator of meaningful economic problems within the United States.

Economic Concerns Overshadow Bitcoin Optimism

Novogratz articulated his concerns, stating that a more stable U.S. economy would likely result in a more moderate Bitcoin price.The investor emphasized that rapid currency devaluation frequently enough has detrimental consequences for society, and a Bitcoin reaching $1 million could be a symptom of larger, systemic issues. He acknowledged the enthusiasm of some investors but expressed skepticism about extraordinarily optimistic forecasts.

Rising National Debt Fuels Uncertainty

The seasoned investor also directed attention to the escalating national debt in the United States. Novogratz questioned the effectiveness of current fiscal policies designed to reduce the debt-to-GDP ratio, predicting that the deficit will likely continue to expand. This situation, he believes, contributes to the broader economic fragility that could drive up the price of Bitcoin.

Corporate Adoption and Potential for a Bubble

Novogratz raised a red flag regarding the growing trend of companies adding Bitcoin to their balance sheets. He warned that this influx of corporate investment could be indicative of a speculative bubble in the making.Galaxy Digital is reportedly receiving approximately five inquiries per week from companies interested in acquiring Bitcoin, signaling a rapidly increasing level of institutional interest.

in essence, Novogratz views a $1 million Bitcoin not as a testament to its success but as a potential warning signal of underlying economic distress. He advocates for prioritizing economic stability, even if it means a more conservative price trajectory for the cryptocurrency.

| Metric | Current Status (Aug 17, 2025) | Novogratz’s Concern |

|---|---|---|

| U.S. National Debt | Over $34 Trillion | Unsustainable and increasing |

| Bitcoin Price prediction (2026) | Varies widely | $1 million as a sign of economic problems |

| Corporate Bitcoin Adoption | Increasing rapidly | Potential bubble formation |

Did You Know? According to data from the U.S.Treasury Department, the national debt has increased by over $15 trillion in the past decade.

Pro Tip: Diversify your investment portfolio and conduct thorough research before investing in any cryptocurrency.

Understanding Bitcoin and Macroeconomic Factors

Bitcoin, launched in 2009, operates as a decentralized digital currency, meaning it is not controlled by a central bank or government. Its value is steadfast by market forces – supply and demand. Macroeconomic factors, such as inflation, interest rates, and government debt, can significantly impact Bitcoin’s price. When conventional financial systems face instability,investors often turn to choice assets like Bitcoin,potentially driving up its value. Though, this correlation also suggests that a soaring Bitcoin price could be a symptom of broader economic problems.

Frequently Asked Questions about Bitcoin and Economic Stability

- What is Bitcoin? Bitcoin is a digital currency that enables peer-to-peer transactions without the need for intermediaries like banks.

- Why is Mike Novogratz concerned about a $1 million bitcoin? he believes it could indicate significant economic problems in the U.S.,rather than a positive progress.

- What is the current U.S. national debt? As of August 17, 2025, the U.S. national debt exceeds $34 trillion.

- Is corporate Bitcoin adoption a positive sign? Novogratz warns it might very well be a sign of a speculative bubble.

- What are macroeconomic factors? These are broad economic conditions like inflation, interest rates, and government debt that influence financial markets.

What are your thoughts on Mike Novogratz’s warning? do you believe Bitcoin’s price is an accurate reflection of economic health?

Share your insights in the comments below and join the conversation!

What economic conditions might historically foreshadow a Bitcoin surge to $1 million, and how do current conditions align with those precedents?

Is Bitcoin’s Surge to $1 Million an Omen for the U.S.economy?

The Million-Dollar Question: Bitcoin & Economic Indicators

The recent breach of the $1 million mark for Bitcoin (BTC) has sent ripples through financial markets and sparked intense debate. Is this a sign of a robust,evolving financial landscape,or a flashing red warning signal for the U.S. economy? Understanding the potential implications requires a nuanced look at historical precedents, current economic conditions, and the underlying technology driving cryptocurrency adoption. This surge in Bitcoin price isn’t happening in a vacuum; it’s coinciding with persistent inflation, geopolitical instability, and growing concerns about the traditional financial system.

Historical parallels: Gold, Tech Bubbles, and Bitcoin

Throughout history, critically important asset price increases have frequently enough correlated with periods of economic uncertainty or transition.

Gold as a Safe Haven: During times of crisis,investors traditionally flock to gold as a store of value. Bitcoin is increasingly being positioned as “digital gold,” offering a similar hedge against inflation and currency devaluation.

The Dot-Com Bubble: The late 1990s saw a massive surge in tech stock valuations, fueled by speculation and the promise of a new digital era. While many companies failed, the underlying technological advancements laid the foundation for today’s internet economy. Could Bitcoin be experiencing a similar, albeit more volatile, phenomenon?

Early Bitcoin Adoption (2010-2013): The initial price surges of Bitcoin were largely driven by early adopters recognizing its potential as a decentralized, censorship-resistant form of money.This period saw limited mainstream awareness and a relatively small market capitalization.

Decoding the Current Bitcoin Rally: Key Drivers

Several factors are contributing to Bitcoin’s current price surge:

Institutional investment: Major corporations and investment firms are increasingly allocating capital to Bitcoin, viewing it as a legitimate asset class. This influx of institutional money provides significant buying pressure.

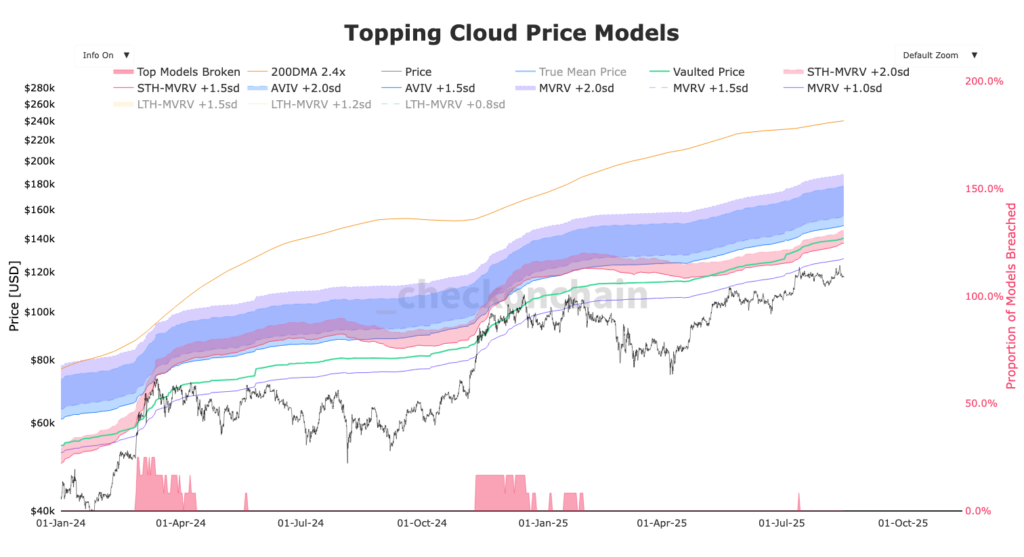

Halving Events: Bitcoin’s programmed “halving” events, which reduce the reward for mining new blocks, historically lead to price increases due to reduced supply. The most recent halving in 2024 amplified this effect.

Inflation Concerns: Persistent inflation in the U.S. and globally is eroding the purchasing power of fiat currencies, driving investors towards choice assets like Bitcoin.

Geopolitical Uncertainty: Global conflicts and political instability create a demand for safe-haven assets, and Bitcoin is increasingly fulfilling that role.

Technological Advancements: Improvements in the Bitcoin blockchain – like the Lightning Network for faster transactions – are enhancing its usability and scalability. As Finanztip.de explains, the blockchain is the core of Bitcoin’s functionality, ensuring secure and verifiable transactions.

Potential Economic Impacts: A Two-Sided Coin

A $1 million Bitcoin doesn’t automatically equate to economic doom, but it does present potential risks and opportunities.

Negative Impacts:

Wealth Inequality: A significant increase in Bitcoin’s value could exacerbate wealth inequality, as early adopters and those with substantial capital benefit disproportionately.

Capital Flight: If investors perceive the U.S. economy as unstable, a soaring Bitcoin price could encourage capital flight, weakening the dollar and possibly leading to higher interest rates.

Systemic Risk: While currently limited, increased integration of Bitcoin into the traditional financial system could create systemic risk if a major Bitcoin exchange or fund were to collapse.

regulatory Challenges: the rapid growth of the cryptocurrency market presents challenges for regulators, who are struggling to keep pace with innovation and protect investors.

Positive Impacts:

Innovation & technological Advancement: The surge in Bitcoin’s value incentivizes further innovation in blockchain technology and related fields.

Financial Inclusion: Bitcoin can provide access to financial services for the unbanked and underbanked populations,particularly in developing countries.

diversification: Bitcoin offers investors a diversification opportunity, potentially reducing overall portfolio risk.

Increased competition: The rise of Bitcoin challenges the traditional financial system, potentially leading to greater efficiency and lower fees.

the Role of Stablecoins and DeFi

The broader cryptocurrency ecosystem, including stablecoins and Decentralized Finance (DeFi), plays a crucial role. Stablecoins, pegged to the value of fiat currencies, facilitate transactions within the crypto space and provide a bridge to the traditional financial system.DeFi platforms offer lending, borrowing, and trading services without intermediaries, potentially disrupting traditional finance. The interplay between Bitcoin, stablecoins, and DeFi will significantly shape the future economic landscape.

Real-World Examples & Case Studies

El Salvador’s Bitcoin Adoption (2021): El Salvador’s decision to adopt Bitcoin as legal tender demonstrated the potential for cryptocurrencies to challenge traditional monetary systems,though it also highlighted the risks associated with volatility and implementation.

MicroStrategy’s Bitcoin Strategy: Michael Saylor’s MicroStrategy has heavily invested in bitcoin, positioning the company as a bellwether for corporate adoption. Their strategy has been both