Seoul, South Korea – Nestled in a quiet alley of Sillim-dong, Gwanak-gu, stands ‘Gangwon Bachelor’s,’ a residential hall with a rich and impactful history. For half a century,this institution has provided crucial support for students from Gangwon Province as they navigate the challenges of university life in the nation’s capital.

Founded in 1975, Gangwon Bachelor’s was established through the vision of the late Governor Park Jong-sung, who recognized the need to support students from Gangwon Province pursuing higher education. The hall serves as a home away from home, fostering a strong sense of community and shared identity among its residents.

A Debt of Gratitude and a Legacy of Support

Table of Contents

- 1. A Debt of Gratitude and a Legacy of Support

- 2. Generational Connections and Enduring Values

- 3. Life at Gangwon Bachelor’s: A Shared Experience

- 4. The Importance of Regional Support in Higher Education

- 5. Frequently Asked Questions about Gangwon Bachelor’s

- 6. How can tracking expenses wiht apps like Mint or YNAB specifically help a freelancer refine their debt repayment plan?

- 7. Repayment Journey: Settling a Lifetime Debt as a Content Writer

- 8. Understanding the Debt Landscape for Freelancers

- 9. the initial Assessment: Knowing Your Numbers

- 10. Debt Repayment strategies: Choosing the right Path

- 11. The Debt Snowball Method

- 12. The Debt Avalanche Method

- 13. Debt Consolidation

- 14. Maximizing Income as a Content Writer for Faster Repayment

- 15. Budgeting for Irregular Income: A Freelancer’s Guide

- 16. Leveraging Tools & Resources for Debt Management

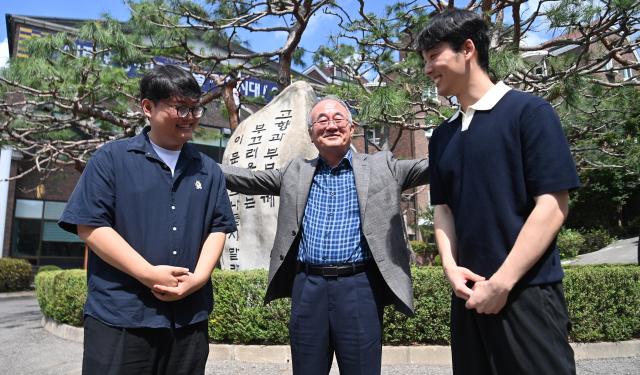

Hwang Dong-ju, CEO of ETLEK Co.,Ltd. and a former chairman of the Gangwon Bachelor’s student association,eloquently described the experience as a “lifelong debt.” He emphasized that his access to higher education was directly enabled by the support provided through the hall, funded by the taxes of Gangwon residents.

This sentiment of gratitude is deeply ingrained in the culture of Gangwon Bachelor’s, with generations of alumni returning to contribute to its continued success.The value of the hall is more than just affordable housing; it’s a network of support and a shared heritage.

Generational Connections and Enduring Values

Current Chairman of Gwanak Haksa, along with Yong Ye-hoon, Chairman of Dobong Bachelor’s, recently gathered to reflect on the institution’s history and future.The discussion highlighted the enduring bonds formed within the hall and the importance of preserving its unique spirit.

A historical inscription at the entrance of the hall, penned by Governor park Jong-sung, serves as a constant reminder of the hall’s core values. It reads: “If you are ashamed of your hometown and your parents, do not go through this door.” This quote encapsulates the hall’s commitment to fostering pride in one’s roots and giving back to the community.

Residents frequently recall the initial sense of community upon arriving. Cho Soo-hyun, a current resident, remembered a welcoming message displayed upon entering the hall: “Don’t let it be said that there are no people from Gangwon-do.” This immediate sense of belonging created a supportive environment for students adjusting to life in Seoul.

Beyond academics, Gangwon Bachelor’s fosters a vibrant social life. Residents participate in joint cultural events, creating lasting friendships and broadening their perspectives. As one resident noted, the hall provides a unique opportunity to connect with individuals from diverse backgrounds and disciplines.

| Key Feature | Details |

|---|---|

| Founded | 1975 |

| Location | Sillim-dong, Gwanak-gu, Seoul |

| Purpose | Support students from Gangwon Province |

| Key value | Community, Gratitude, Regional Pride |

Did You Know? Governor Park Jong-sung envisioned the creation of Gangwon Bachelor’s as a critical investment in the province’s human capital.

Pro Tip: Gangwon Bachelor’s residents often forge lifelong connections that extend far beyond their university years.

As Gangwon Bachelor’s celebrates its 50th anniversary, its legacy as a beacon of support and a symbol of regional pride continues to shine. The enduring spirit of the hall promises to benefit generations of students to come.

The Importance of Regional Support in Higher Education

The story of Gangwon Bachelor’s highlights a broader trend: the crucial role of regional support in expanding access to higher education.Many provinces and states offer similar programs to help students overcome financial and logistical barriers to attending university. According to a 2023 report by the National Student Aid policy Analysis System, state-level grant programs significantly increase college enrollment rates among low-income students. National Student Aid Policy Analysis System

These initiatives not only benefit individual students but also contribute to the economic and social progress of their home regions.By investing in education, communities can cultivate a skilled workforce and foster innovation.

Frequently Asked Questions about Gangwon Bachelor’s

- what is the primary purpose of Gangwon bachelor’s? It’s designed to provide affordable housing and a supportive community for students from Gangwon Province attending universities in Seoul.

- Who founded Gangwon Bachelor’s? It was established in 1975 through the vision of the late Governor park Jong-sung.

- What is the significance of the inscription at the entrance? It emphasizes the importance of pride in one’s roots and giving back to the community.

- How long has Gangwon bachelor’s been operating? The institution recently celebrated its 50th anniversary in 2025.

- What kind of community does Gangwon Bachelor’s foster? It cultivates a strong sense of belonging, shared identity, and mutual support among residents.

What are your thoughts on the importance of regional support for students? Share your experiences and opinions in the comments below!

How can tracking expenses wiht apps like Mint or YNAB specifically help a freelancer refine their debt repayment plan?

Repayment Journey: Settling a Lifetime Debt as a Content Writer

Understanding the Debt Landscape for Freelancers

As a content writer, the freelance life offers freedom, but frequently enough comes with income instability. This can make managing – and escaping – long-term debt a critically important challenge. Unlike salaried employees with predictable paychecks, freelancers navigate fluctuating income, self-employment taxes, and the constant need to market for new work. Understanding these unique financial pressures is the first step towards a prosperous debt repayment plan. Common debt types for freelance writers include:

Student Loans: A significant burden for many entering the field.

Credit Card Debt: Often accumulated during lean months or for business expenses.

Business Loans: Used for equipment, software, or marketing.

Personal Loans: Taken out to cover living expenses.

the initial Assessment: Knowing Your Numbers

Before diving into repayment strategies, a thorough assessment is crucial. This isn’t just about listing debts; it’s about understanding the full financial picture.

- List All Debts: Include creditor, outstanding balance, interest rate, and minimum monthly payment.A spreadsheet is your friend hear.

- Calculate Your Net Income: Accurately determine your average monthly income after taxes and business expenses.Be realistic – don’t overestimate.

- Track Your Expenses: Use budgeting apps (Mint, YNAB) or a simple expense tracker to understand where your money is going. Identify areas for potential cuts.

- Determine debt-to-Income Ratio (DTI): Divide your total monthly debt payments by your gross monthly income. A lower DTI is better.

Debt Repayment strategies: Choosing the right Path

Several strategies can accelerate debt freedom. The best approach depends on your financial situation and personality.

The Debt Snowball Method

This method focuses on psychological wins. You list debts from smallest balance to largest, irrespective of interest rate. You pay the minimum on all debts except the smallest, where you throw every extra dollar. Once the smallest is paid off,you roll that payment into the next smallest,and so on. It’s motivating, but may not be the fastest financially.

The Debt Avalanche Method

This strategy prioritizes saving money on interest. You list debts from highest interest rate to lowest. You pay the minimum on all debts except the one with the highest interest rate, where you apply all extra funds.This method saves you the most money in the long run, but requires discipline.

Debt Consolidation

Combining multiple debts into a single loan with a lower interest rate can simplify payments and possibly save money. Options include:

Balance Transfer Credit Cards: Look for 0% introductory APR offers. Be mindful of balance transfer fees.

Personal loans: Shop around for the best rates and terms.

Debt Management Plans (DMPs): Offered by credit counseling agencies.they negotiate with creditors to lower interest rates and fees.

Maximizing Income as a Content Writer for Faster Repayment

Increasing income is just as critically important as cutting expenses. Here’s how to leverage your skills:

Diversify Your Services: Offer a range of content writing services – blog posts, articles, website copy, social media content, email marketing, etc.

Niche Down: Becoming an expert in a specific industry (e.g., finance, healthcare, technology) allows you to charge higher rates.

Increase Your Rates: Regularly evaluate your rates based on your experience, expertise, and market demand. Don’t be afraid to ask for what you’re worth.

Proactive Client Acquisition: Don’t rely solely on job boards. Network, pitch directly to businesses, and build a strong online presence.

Explore Passive Income Streams: Consider creating and selling digital products (e.g.,ebooks,templates,online courses) related to content writing.

Budgeting for Irregular Income: A Freelancer’s Guide

Freelance income isn’t consistent. A robust budget needs to account for this.

The Zero-Based Budget: Allocate every dollar of income to a specific category (expenses, debt repayment, savings).

Variable Income Allocation: When income is high, aggressively pay down debt. When income is low, focus on essential expenses.

Emergency Fund: Build a significant emergency fund (3-6 months of living expenses) to cushion against income fluctuations.

Separate Business and Personal Finances: Essential for tax purposes and clear financial tracking.

Leveraging Tools & Resources for Debt Management

Several tools can streamline the process:

Google Sheets/Excel: For creating and managing budgets and debt repayment plans.

Mint/YNAB (You Need A Budget): Budgeting and expense tracking apps.

undebt.it: A free debt snowball/avalanche calculator.

nerdwallet/Credit Karma: For comparing financial products and monitoring credit scores.

* Skillshop (Google Analytics Academy): https://support.google.com/analytics/answer/15440208?hl=en – Understanding website analytics can help you refine your marketing efforts and increase income