Spain’s automotive sector is bracing for a swift exhaustion of funds allocated under the newly launched Auto+ program, designed to stimulate electric vehicle (EV) sales. Industry sources suggest the €400 million ($435 million USD) program may be fully committed by the middle of the year, mirroring the shortcomings of its predecessors, the Moves schemes.

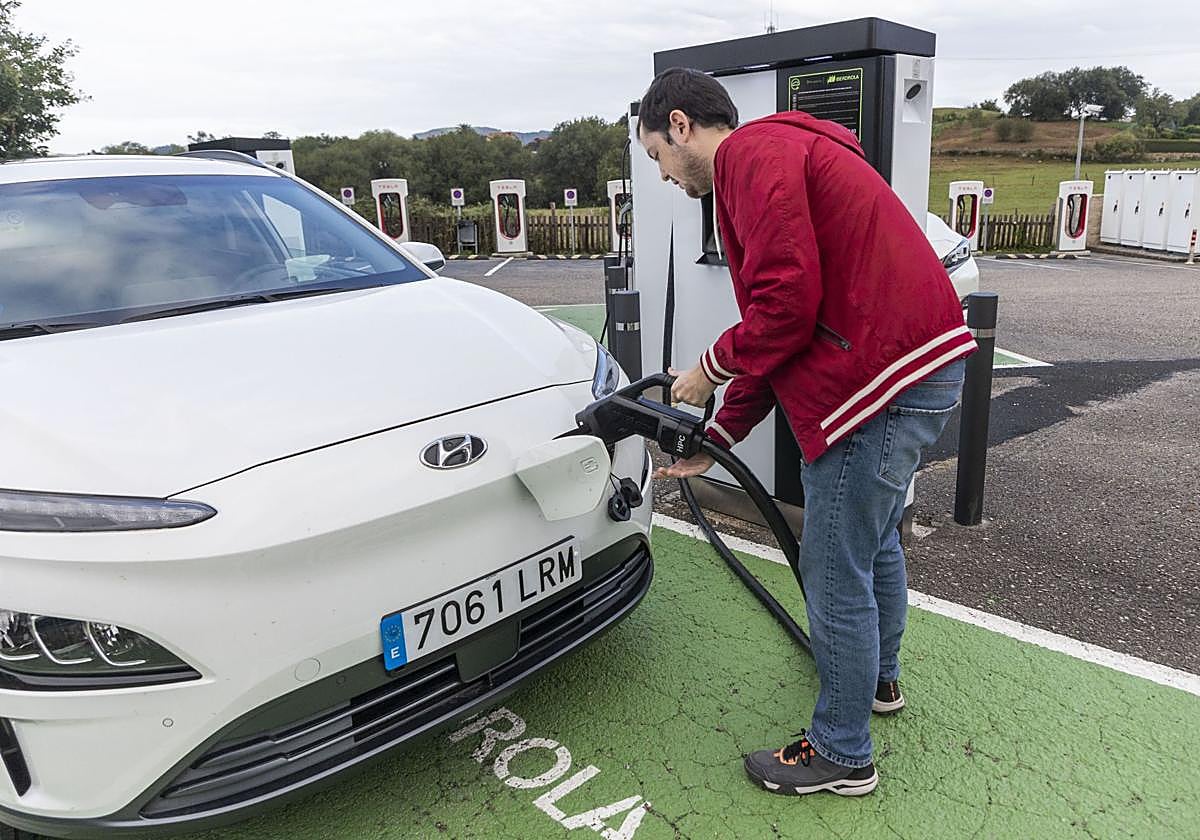

The Auto+ program, approved February 3rd and retroactively effective from January 1, 2026, aims to address lagging EV adoption rates in Spain, which, as of October 2025, saw hybrid and electric vehicles account for 65.6% of registrations, with fully electric cars representing only 19% of the market. This contrasts sharply with leading nations like Norway, where electric vehicle sales exceed 90%.

A key criticism of the previous Moves schemes, which concluded at the conclude of 2025, was the significant delay in disbursing approved funds. More than half of the aid granted – 52% – remained unpaid to beneficiaries as of February 2026, according to data accessed by a Spanish newspaper. This delay created frustration among both consumers and industry stakeholders.

The regional disparity in payment processing further exacerbated the issue. While Ceuta processed 98% of its allocated funds and Madrid 71%, several autonomous communities lagged significantly. Baleares, Melilla, and the Principality of Asturias had yet to disburse any funds at all. Nationally, autonomous communities collectively held €580.7 million ($630 million USD) in pending payments.

Auto+ introduces a direct discount at the point of sale, with state funding supplemented by a minimum contribution of €1,000 ($1,085 USD) from dealerships. This contrasts with the Moves III scheme, which required applicants to apply for reimbursement after purchase and was managed at the regional level. The centralized management of Auto+ is intended to streamline the process, but comes with a reduced overall budget.

The program prioritizes vehicles manufactured in Europe, with up to 25% of the aid contingent on the vehicle’s origin. A maximum subsidy of €4,500 ($4,880 USD) can be reduced to 75% if the vehicle does not meet European manufacturing criteria. This represents a shift from the Moves scheme, where vehicle origin did not affect aid eligibility.

Industry analysts anticipate that the current rate of EV sales growth, which already exceeds 20% of total registrations in early 2026 – up from 14.2% in January 2025 and an average of 11.4% in 2024 – will quickly deplete the Auto+ budget. Ganvam, the Spanish association of vehicle dealers and repair shops, estimates that electric vehicles could reach nearly 28% of the market in 2026, further straining available funds.

While the Moves III scheme initially had a budget of €400 million, it was progressively increased to €1.603 billion ($1.74 billion USD). The Auto+ program, despite its more stringent requirements, begins with a lower initial allocation, raising concerns about its long-term sustainability. The detailed regulations governing the Auto+ program have yet to be published.