Healthcare Costs Are About to Hit a Breaking Point – And the Election Will Decide What Happens Next

Nearly one in three Americans now report struggling to afford healthcare, even with insurance. This isn’t a future threat; it’s the current reality, and the upcoming election will determine whether that number climbs even higher as crucial Affordable Care Act (ACA) subsidies are set to expire. The debate isn’t just about policy; it’s about access to care, financial stability, and the fundamental health of the nation.

The ACA Subsidies: A Ticking Clock

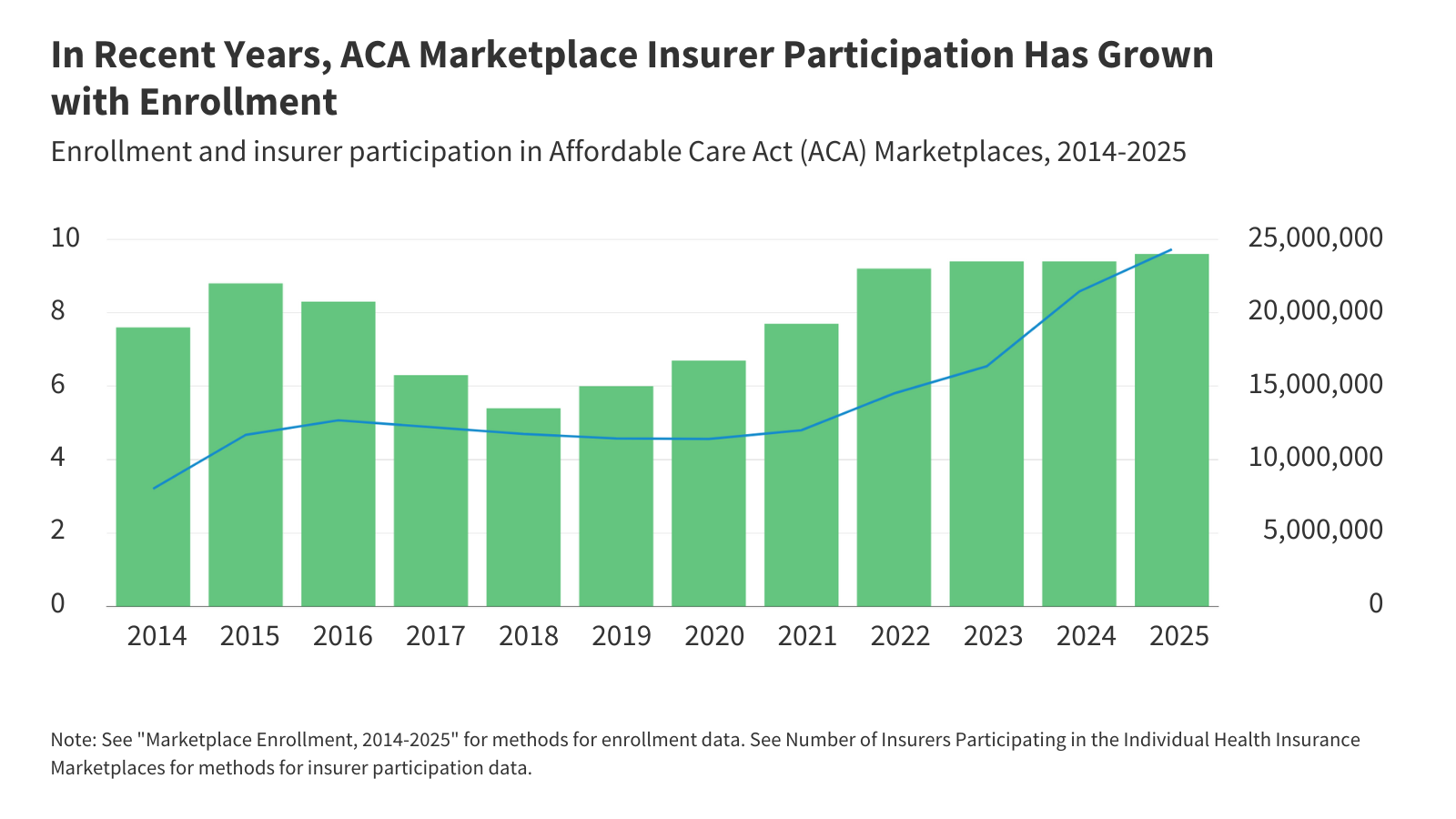

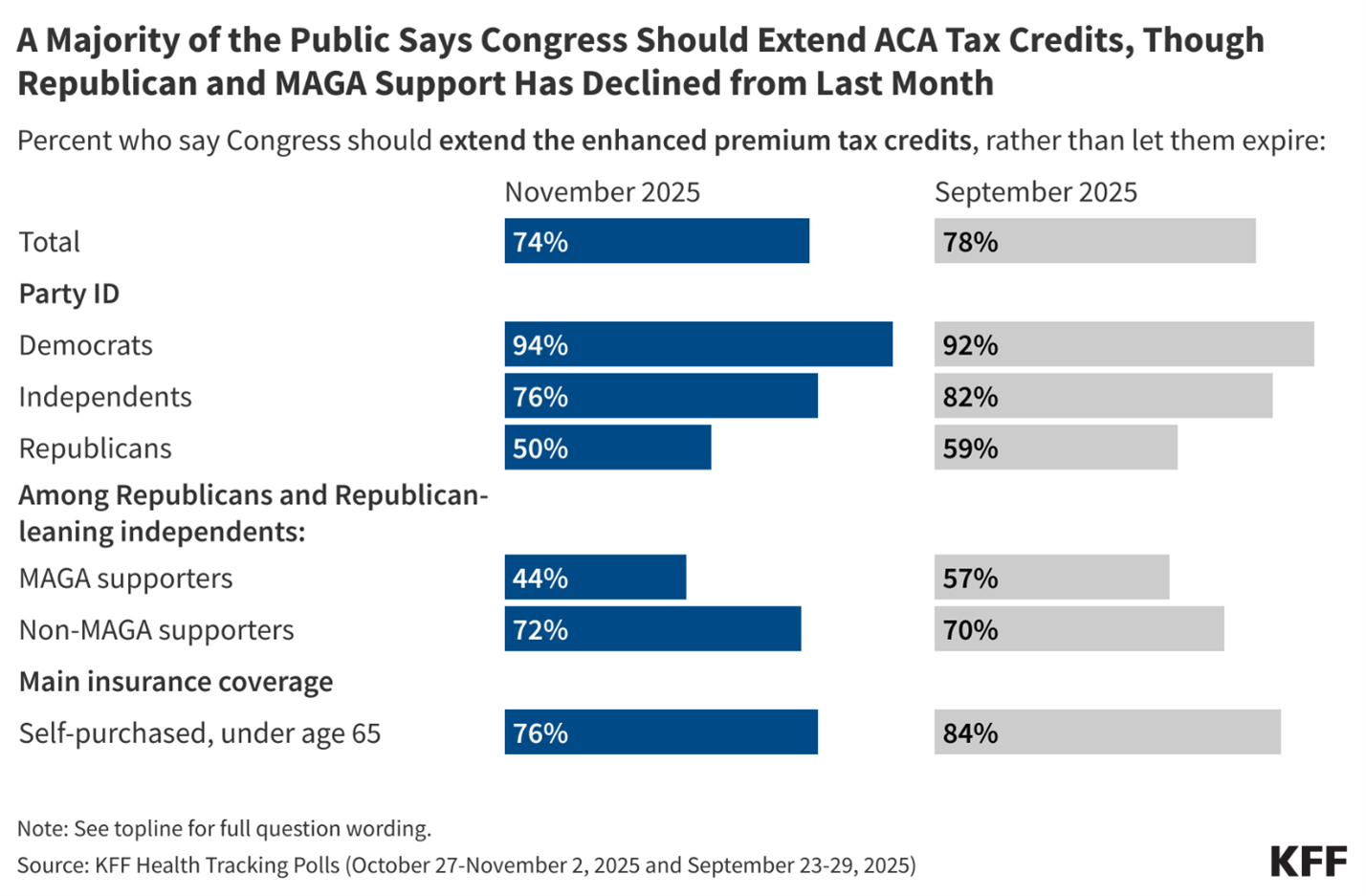

Enhanced premium tax credits, expanded under the American Rescue Plan, have been instrumental in keeping health insurance affordable for millions. These subsidies, which capped the cost of premiums at a percentage of income, are currently scheduled to expire at the end of 2025. Without an extension, experts predict a significant increase in premiums, potentially pricing millions out of the market. KFF’s Larry Levitt recently highlighted this looming crisis, emphasizing the political stakes as the election nears.

Who’s Most at Risk?

The impact won’t be felt equally. Individuals and families who don’t qualify for employer-sponsored insurance and earn slightly above the poverty line – often referred to as the “coverage gap” – are particularly vulnerable. These are the working poor, small business owners, and those in precarious employment situations. A study by the Urban Institute estimates that over 15 million people could lose coverage or face substantially higher premiums if the subsidies lapse. This disproportionately affects communities of color and those living in states that haven’t expanded Medicaid.

Beyond the ACA: The Broader Affordability Crisis

Even with the ACA subsidies, healthcare affordability remains a pervasive problem. Rising deductibles, copays, and out-of-pocket costs are squeezing household budgets. The cost of prescription drugs continues to soar, forcing many to choose between medication and other essential needs. And the administrative complexity of the healthcare system adds further financial burden.

The Role of Consolidation and Market Power

Hospital and insurance company consolidation is a major driver of rising costs. When fewer players control the market, they have greater leverage to negotiate higher prices. This lack of competition stifles innovation and reduces incentives to control costs. Furthermore, the increasing prevalence of “surprise billing” – unexpected charges from out-of-network providers – adds to the financial strain on patients. Addressing these issues requires a multi-pronged approach, including antitrust enforcement and greater price transparency.

Future Trends: What to Expect in the Next 5-10 Years

The affordability crisis isn’t going away on its own. Several trends are likely to exacerbate the problem in the coming years. An aging population will increase demand for healthcare services. The rising prevalence of chronic diseases will drive up costs. And technological advancements, while promising, often come with a hefty price tag. However, there are also potential solutions on the horizon.

Telehealth and Virtual Care: A Double-Edged Sword

Telehealth has the potential to improve access to care and lower costs, but its long-term impact is uncertain. While convenient, it doesn’t address the underlying issues of high prices and administrative complexity. Furthermore, equitable access to broadband internet is crucial for telehealth to reach underserved populations.

The Rise of Value-Based Care

A shift towards value-based care – which rewards providers for quality of care rather than volume of services – could help control costs and improve outcomes. However, implementing value-based care models requires significant investment in data analytics and infrastructure.

Personalized Medicine and Gene Therapies

Advances in personalized medicine and gene therapies offer the potential to cure previously untreatable diseases, but these treatments are often incredibly expensive. The question of how to finance these innovations – and ensure equitable access – will be a major challenge in the years ahead.

The Election’s Impact: A Fork in the Road

The outcome of the upcoming election will have profound implications for the future of healthcare affordability. Extending the ACA subsidies is a critical first step, but it’s not enough. Addressing the root causes of high costs – including market consolidation, administrative complexity, and drug pricing – will require bold policy changes. The debate over healthcare will undoubtedly be a central theme of the election, and voters need to understand the stakes.

What are your predictions for the future of healthcare affordability? Share your thoughts in the comments below!