Health Insurance Costs: Individual Plans Close the Gap with Employer Coverage

Table of Contents

- 1. Health Insurance Costs: Individual Plans Close the Gap with Employer Coverage

- 2. The Trend Towards Parity

- 3. Data Deep Dive: A Market Comparison

- 4. Implications for Consumers

- 5. Looking Ahead: The Future of Health Insurance Costs

- 6. Understanding Health Insurance Options

- 7. Frequently Asked Questions About Health Insurance costs

- 8. What factors beyond monthly premiums should individuals consider when comparing ACA Marketplace plans and employer-sponsored health plans?

- 9. Comparing ACA Marketplace Insurance Costs to Employer-Sponsored Health Plans: A Comprehensive Analysis

- 10. Understanding Your Health Insurance options

- 11. The Cost Breakdown: Premiums

- 12. Beyond Premiums: Out-of-Pocket Costs

- 13. Plan Types: HMOs, PPOs, and EPOs

- 14. Income and Subsidies: A Game Changer

- 15. Special Enrollment Periods & Qualifying Life Events

- 16. Health Savings Accounts (HSAs) and Flexible Spending accounts (FSAs)

Washington D.C.- Recent analyses indicate that the price difference between health insurance plans purchased on the individual market and those provided by employers is shrinking. A extensive review of insurance data shows that in 2024, monthly premiums for individual plans averaged $540 per member, only slightly lower than the $587 average for fully-insured employer-sponsored coverage.

The Trend Towards Parity

This shift represents a notable change since 2017, when the disparity in costs was considerably wider. The current data suggests increased competition and evolving market dynamics are contributing to the convergence of pricing structures. Experts attribute this to factors such as the Affordable Care Act (ACA) Marketplace stabilizing and increased participation.

Data Deep Dive: A Market Comparison

The findings are based on a detailed assessment of insurer filings submitted to the National Association of Insurance Commissioners (NAIC) through the mark Farrah Associates Health Coverage Portal. The analysis focuses on average premiums and claims costs per member each month,providing a clear picture of the financial landscape of health insurance in the United States.

Here’s a quick breakdown of the average monthly premium costs:

| Insurance Type | Average Monthly Premium (per member) |

|---|---|

| Individual Market | $540 |

| Employer-Sponsored | $587 |

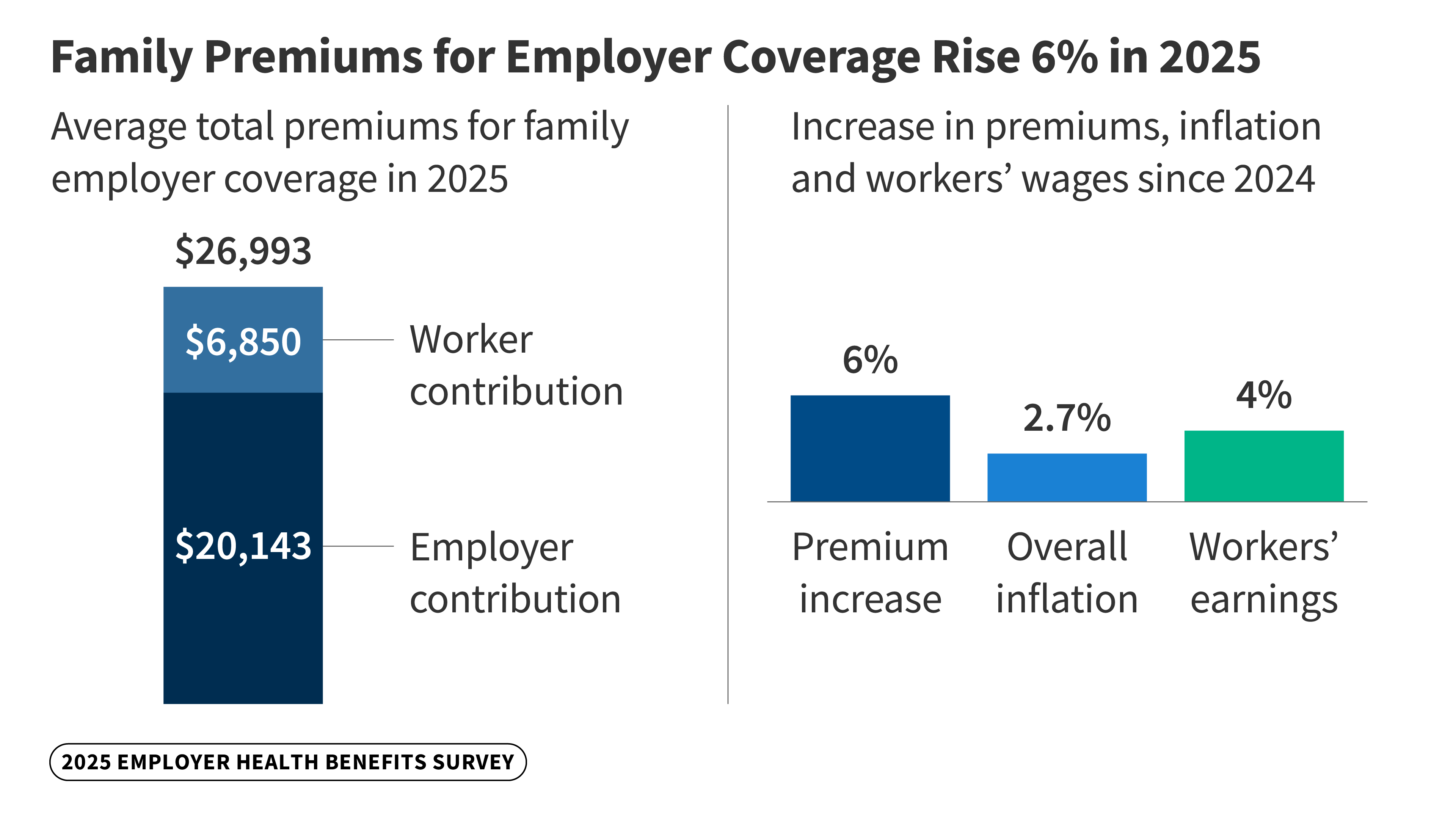

did You Know? The Kaiser Family Foundation reported in October 2024 that family premiums for employer-sponsored health insurance have risen 7% this year,highlighting the continuing strain on household budgets.

Implications for Consumers

The narrowing gap in premiums has notable implications for individuals and families seeking affordable healthcare options.It signals increased choice and potential savings for those who do not have access to employer-sponsored insurance. Moreover, it may encourage greater enrollment in the ACA Marketplaces.

Pro Tip: When comparing health insurance plans, don’t just focus on the monthly premium. Consider deductibles, copayments, and out-of-pocket maximums to get a comprehensive understanding of your potential healthcare costs.

Looking Ahead: The Future of Health Insurance Costs

Ongoing monitoring of health insurance costs remains crucial as the U.S. healthcare system continues to evolve. The Peterson-KFF Health System Tracker serves as an invaluable resource for staying informed about these vital trends. Further analyses are expected to reveal the long-term effects of policy changes and market forces on healthcare affordability.

Understanding Health Insurance Options

Navigating the world of health insurance can be complex. Beyond premiums, it’s vital to understand different plan types, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each offers varying levels of coverage, flexibility, and cost. Resources like healthcare.gov provide detailed explanations and tools to help individuals choose the best plan for their needs.

The health insurance landscape is constantly changing. factors like preventative care, prescription drug costs, and the aging population all play a role in determining premiums. Staying informed is key to making sound financial and healthcare decisions.

Frequently Asked Questions About Health Insurance costs

- What is the average cost of health insurance? The average cost varies but,as of late 2024,individual plans average around $540 per month,while employer-sponsored plans are around $587 per month.

- Is health insurance cheaper through my employer? Historically, yes, but the gap is closing, with individual market plans becoming more competitive in price.

- What factors influence health insurance premiums? Age, location, plan type, coverage level, and overall health are all key factors.

- What is the Affordable Care Act (ACA)? The ACA is a federal law that expanded health insurance coverage and introduced regulations to make insurance more affordable.

- Where can I find more facts about health insurance options? Resources like Healthcare.gov and the Peterson-KFF Health System Tracker offer valuable information.

- Does my income affect my health insurance costs? Yes, income-based subsidies are available to help eligible individuals and families afford ACA Marketplace plans.

- How can I lower my health insurance costs? Consider choosing a plan with a higher deductible, taking advantage of preventative care, and exploring cost-sharing options.

What are your biggest concerns about the cost of healthcare? Share your thoughts in the comments below!

Share this article with your network to help spread awareness about the changing landscape of health insurance!

Comparing ACA Marketplace Insurance Costs to Employer-Sponsored Health Plans: A Comprehensive Analysis

Understanding Your Health Insurance options

Navigating health insurance can feel complex. Many Americans face the decision of choosing between coverage offered through their employer (employer-sponsored health plans) or purchasing a plan on the Affordable Care Act (ACA) Marketplace (also known as obamacare).Both options have pros and cons, particularly when it comes to cost. This analysis breaks down the key factors to consider when comparing ACA health insurance and employer health benefits.

Premiums are the monthly payments you make to maintain your health insurance coverage.

* Employer-Sponsored Plans: Employers typically cover a significant portion of the premium, making these plans generally more affordable upfront. The average employee contribution for single coverage in 2023 was around $646 per month, while family coverage averaged $1,334 (KFF, 2023). However, this varies greatly depending on the employer, plan type (HMO, PPO, etc.), and your location.

* ACA Marketplace Plans: Premiums on the ACA Marketplace are income-based. The Affordable Care Act subsidies (premium tax credits) can considerably lower your monthly costs if your income falls within a certain range. Without subsidies, Marketplace premiums can be higher than employer-sponsored plans, but subsidies can make them comparable or even cheaper. The Kaiser Family Foundation (KFF) provides tools to estimate potential subsidies.

* Key Consideration: Don’t just look at the premium. Factor in potential tax credits and employer contributions to get a true picture of your out-of-pocket costs.

Premiums are only one piece of the puzzle. You also need to consider out-of-pocket expenses.

* deductibles: The amount you pay for healthcare services before your insurance starts to cover costs. High-deductible health plans (hdhps) have lower premiums but higher deductibles.

* Copays: A fixed amount you pay for specific services,like a doctor’s visit or prescription.

* Coinsurance: The percentage of healthcare costs you pay after you’ve met your deductible.

* Out-of-Pocket Maximum: The most you’ll pay for covered healthcare services in a year. Once you reach this limit, your insurance covers 100% of eligible expenses.

Comparing Out-of-Pocket Costs: Employer plans and Marketplace plans vary significantly in these areas. Carefully review the Summary of Benefits and Coverage (SBC) for each plan to understand your potential costs.

Plan Types: HMOs, PPOs, and EPOs

The type of plan impacts your access to care and costs.

* HMO (Health Maintenance Organization): Typically lower premiums, but you usually need to choose a primary care physician (PCP) and get referrals to see specialists.Generally, HMOs have a limited network of providers.

* PPO (Preferred Provider Organization): More adaptability to see specialists without referrals, but premiums are usually higher. PPOs have a broader network, and you can ofen go out-of-network (at a higher cost).

* EPO (Exclusive Provider Organization): Similar to HMOs, but you generally don’t need a PCP. Though, you typically can’t go out-of-network for coverage.

* Marketplace vs. Employer: Both Marketplace and employer-sponsored plans offer various plan types. Consider your healthcare needs and preferences when choosing.

Income and Subsidies: A Game Changer

ACA subsidies are a crucial factor for many individuals and families.

* Eligibility: Subsidies are available to those with household incomes between 100% and 400% of the federal poverty level. (Income limits vary by state for enhanced subsidies).

* How They Work: Subsidies are applied as a tax credit to lower your monthly premium.

* Impact on Cost: Subsidies can make Marketplace plans significantly more affordable than employer-sponsored plans, especially for lower-income individuals. Use the healthcare.gov calculator to estimate your potential savings.

Special Enrollment Periods & Qualifying Life Events

* Employer Plans: Typically, you can only enroll during your company’s open enrollment period.

* ACA Marketplace: Open enrollment usually runs from November 1st to January 15th. However, qualifying life events (like losing job-based coverage, getting married, having a baby, or experiencing a change in income) trigger a special enrollment period, allowing you to enroll outside of the open enrollment window.

Health Savings Accounts (HSAs) and Flexible Spending accounts (FSAs)

* HSAs (Health Savings Accounts): Available with high-deductible health plans (hdhps). Contributions are tax-deductible, and the funds grow tax-free. Used for qualified medical expenses.

* FSAs (Flexible Spending Accounts): Offered through employers. Allow you to set aside pre-tax money for healthcare expenses. “Use it or lose it” rule often applies.

*