The provided text is an article discussing Netflix‘s financial performance and strategic changes. Here’s a breakdown of the key takeaways and an objective summary:

Key Takeaways:

Strong financial Performance: Netflix exceeded 300 million subscribers by the end of the previous year. Thay are now prioritizing customary financial metrics over subscriber growth figures. They project 17% income growth driven by membership, pricing, and advertising, with an operational margin of 31%.

Strategic Changes Driving Success: The company credits its improved results to key strategic shifts:

Cracking down on password sharing: This directly increases paying subscribers.

Introducing advertising in cheaper packages: This creates an additional revenue stream and allows for lower entry pricing while enabling higher pricing for premium tiers.

Investing in live events: Content like NFL matches and boxing fights has proven successful.

Developing a gaming service: This is currently in testing. Increased Content Investment: the improved financial results provide Netflix with more capital to invest in original content, which is crucial for competing in the streaming market.

Exciting Content Pipeline: Upcoming content includes the return of popular series like “Wednesday” and the final season of “Stranger Things.”

Revised Revenue Forecast: Netflix has raised its revenue forecast for the current year.

Broader Industry Context: The article mentions Netflix’s Emmy nominations and the long-awaited “Assassin’s Creed” series adaptation, highlighting its presence in the broader entertainment landscape.

Objective Summary:

Netflix has reported strong financial results, exceeding 300 million subscribers and projecting a 17% increase in income driven by strategic changes. The company is now focusing on traditional financial metrics instead of solely subscriber numbers. Its success is attributed to initiatives like enforcing password sharing policies, introducing advertising in lower-cost plans, broadcasting live events, and developing a gaming service. These changes have allowed for increased investment in original content, with popular series like “Wednesday” and “Stranger Things” on the horizon. Netflix has also raised its revenue forecast for the year. The article also notes the company’s Emmy nominations and the anticipation surrounding its “Assassin’s Creed” series adaptation.

How did Netflix’s crackdown on password sharing contribute to its Q2 2025 subscriber growth?

Table of Contents

- 1. How did Netflix’s crackdown on password sharing contribute to its Q2 2025 subscriber growth?

- 2. Netflix Posts Strong Q2 Earnings,Shattering Expectations

- 3. Q2 2025 Financial Highlights: A Deep Dive

- 4. Subscriber Growth: The Engine of Success

- 5. ARPU Increase: Monetizing the User Base

- 6. Content Strategy: Investing in Quality and Diversity

- 7. Impact of the Streaming Wars

- 8. Looking Ahead: Q3 2025 Outlook

Netflix Posts Strong Q2 Earnings,Shattering Expectations

Q2 2025 Financial Highlights: A Deep Dive

Netflix (NFLX) has released its Q2 2025 earnings report,and the results are nothing short of spectacular. The streaming giant substantially exceeded analyst expectations, fueled by a combination of subscriber growth, increased average revenue per user (ARPU), and a continued focus on content investment. This performance signals a robust period for the company, solidifying its position as a leader in the competitive streaming landscape. key figures include:

revenue: $9.8 billion, a 16% increase year-over-year.

Earnings Per share (EPS): $4.50, surpassing estimates by $0.75.

Global Subscribers: 279.7 million, adding 8.17 million new subscribers – a substantial jump compared to the 2.3 million predicted.

ARPU: Global ARPU reached $15.80, up 10% year-over-year.

These numbers demonstrate Netflix’s ability to navigate a challenging economic climate and maintain its growth trajectory. Investors are reacting positively,with the stock price experiencing a important boost in after-hours trading.

Subscriber Growth: The Engine of Success

The impressive subscriber growth is arguably the most significant takeaway from the Q2 report. Several factors contributed to this surge:

- Crackdown on Password Sharing: The continued rollout of paid sharing options has successfully converted a significant portion of casual viewers into paying subscribers.While initially met with some resistance, the strategy has proven effective in boosting revenue.

- Content Slate: A strong lineup of original content, including the highly anticipated second season of Bridgerton and the new sci-fi thriller Echoes of the Void, drove significant viewership and subscriber acquisition. Netflix’s investment in diverse genres continues to pay dividends.

- Ad-Supported Tier: The continued popularity of the ad-supported plan is attracting price-sensitive consumers, expanding Netflix’s reach to a broader audience. This tier now accounts for 18% of the total subscriber base.

- Geographic Expansion: Growth in emerging markets, particularly in Asia and Latin America, is contributing significantly to overall subscriber numbers. Localized content and strategic partnerships are key to success in these regions.

ARPU Increase: Monetizing the User Base

Beyond subscriber growth, Netflix has also successfully increased its ARPU. This is driven by:

Price Increases: Selective price adjustments in certain markets have contributed to the ARPU increase without significantly impacting subscriber churn.

Premium Plan Adoption: More subscribers are opting for the premium plan,which offers higher resolution and more simultaneous streams.

Ad Revenue: The ad-supported tier is generating substantial revenue, further boosting ARPU.

upselling: Effective marketing campaigns are encouraging subscribers to upgrade to higher-tier plans.

Content Strategy: Investing in Quality and Diversity

Netflix’s commitment to original content remains a cornerstone of its success. The company continues to invest heavily in a diverse range of programming, including:

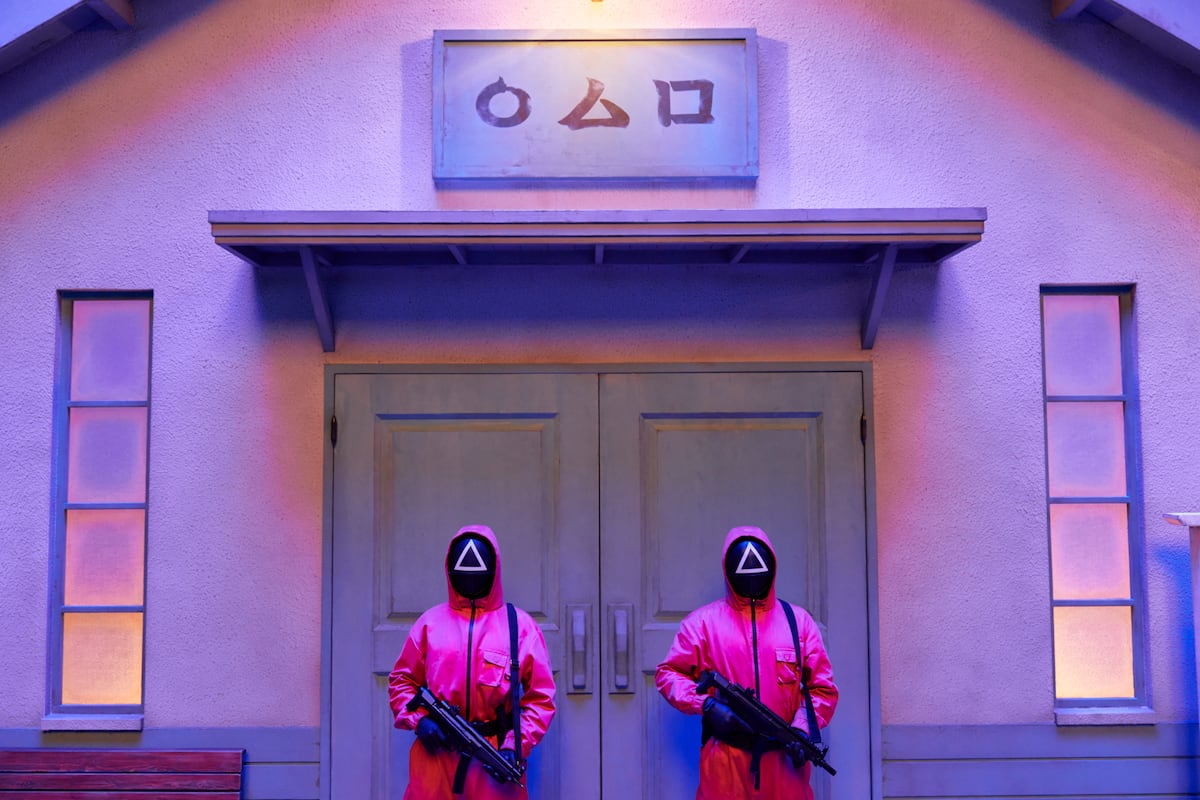

original Series: Squid Game remains a cultural phenomenon, and new series like The Serpent’s Kiss are gaining traction.

Original Films: Netflix is producing a growing number of high-quality films, competing directly with traditional Hollywood studios.

International Content: Investing in local-language content is proving to be a winning strategy, attracting viewers in specific regions and expanding the platform’s global appeal.

Anime: Netflix has become a major player in the anime market, with popular titles like Cyberpunk: Edgerunners attracting a dedicated fanbase.

Impact of the Streaming Wars

Despite the strong Q2 performance, Netflix operates in an increasingly competitive landscape.The “streaming wars” continue to intensify, with rivals like disney+, HBO Max, and Amazon Prime Video vying for market share. However,Netflix’s established brand recognition,extensive content library,and global reach give it a significant advantage. The company is also adapting to the changing surroundings by:

Focusing on Profitability: Netflix is prioritizing profitability over pure subscriber growth, streamlining operations and controlling costs.

Exploring New Revenue Streams: The company is experimenting with new revenue streams, such as gaming and live events.

Data-Driven Decision Making: Netflix leverages data analytics to understand viewer preferences and optimize its content strategy.

Looking Ahead: Q3 2025 Outlook

Netflix anticipates continued growth in Q3 2025, projecting subscriber additions of 6.5 million and revenue of $10.2 billion.The company remains optimistic about its long-term prospects, citing the growing demand for streaming entertainment and its ability to innovate and adapt to changing market conditions. The upcoming release of Stranger Things* Season 5 is expected to be a major driver of subscriber growth in the second half of the year.