Singapore Stock Market Revival: Beyond the Initial Surge – What’s Next for Investors?

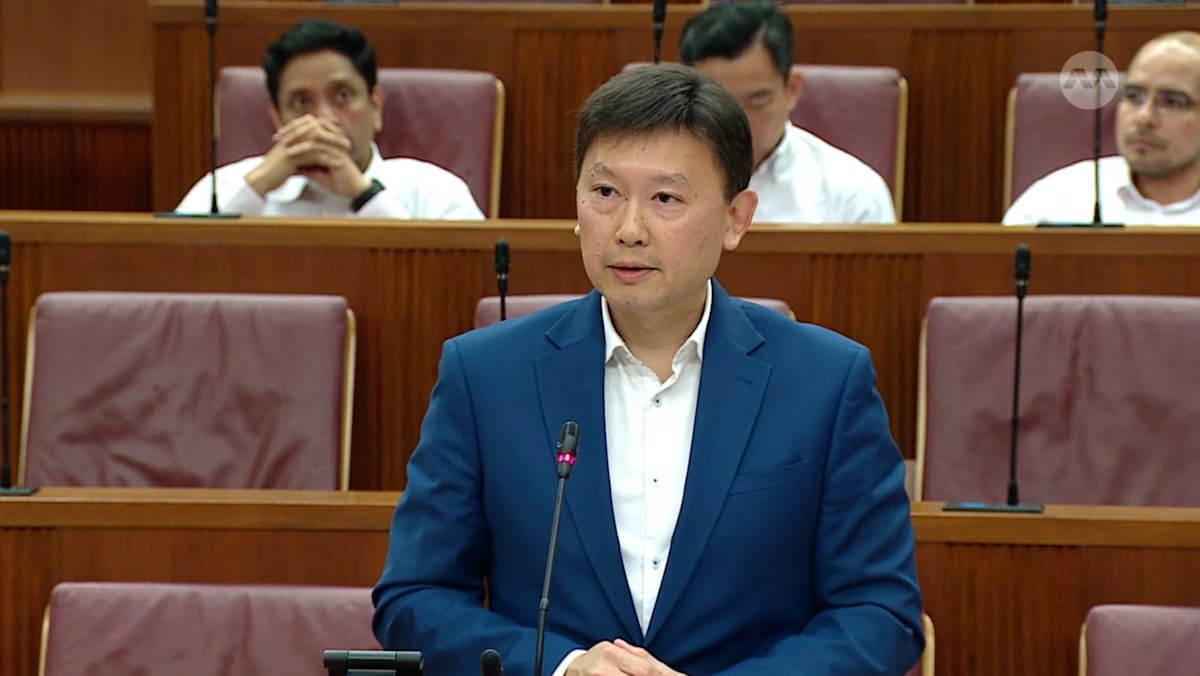

A 20% year-on-year jump in trading value and a surge in IPO funding – Singapore’s stock market is showing signs of life. But can this momentum be sustained? While recent figures, highlighted by Minister Chee Hong Tat, are encouraging, a deeper look reveals a need for more fundamental shifts to truly “make Singapore equities great again,” as opposition MPs Louis Chua and Jamus Lim put it. The question isn’t just about boosting trading volume; it’s about fostering a market that attracts long-term investment and delivers consistent shareholder value.

The Current Landscape: A Positive, Yet Fragile, Recovery

The numbers speak for themselves. November 2024 saw average daily traded value climb to almost S$1.8 billion, the highest since 2010. More than S$2.4 billion was raised through IPOs in 2025, a significant rebound from previous years. This growth, benefiting both large-cap and smaller companies, is a welcome change. However, this initial success is largely fueled by external factors and strategic initiatives like the Equity Market Development Programme, which aims to deploy over S$5 billion in capital. The core issue, as pointed out by MP Chua, is a lack of compulsion for listed companies to prioritize and demonstrate improved shareholder returns.

Singapore stock market performance is currently reliant on proactive measures, rather than organic growth driven by company fundamentals. This creates a potential vulnerability – what happens when the Programme’s capital is fully deployed? Sustained growth requires a shift in mindset among listed companies and a more robust regulatory framework.

Learning from Japan: The Power of Disclosure and Accountability

The debate surrounding shareholder returns isn’t new, but the comparison to Japan, raised by MP Chua, is particularly insightful. The Tokyo Stock Exchange’s structured disclosure framework, which publicly ranks companies based on their commitment to shareholder value, creates “constructive market pressure.” This transparency forces companies to address concerns and demonstrate a clear path to improved performance.

Expert Insight: “The Japanese model isn’t about heavy-handed regulation; it’s about creating a culture of accountability. Publicly available data on shareholder return strategies incentivizes companies to act in the best interests of their investors, fostering greater trust and attracting long-term capital.” – Dr. Emily Tan, Financial Markets Analyst, National University of Singapore.

Implementing a similar system in Singapore wouldn’t be without its challenges. Cultural differences and the composition of the Singaporean corporate landscape would need to be considered. However, the principle of increased transparency and accountability is universally applicable.

Beyond Disclosure: Catalysts for Long-Term Growth

While enhanced disclosure is crucial, it’s only one piece of the puzzle. Several other factors will shape the future of the Singapore stock market:

The Rise of ESG Investing

Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions globally. Companies that prioritize sustainability and ethical practices are attracting a growing pool of capital. Singapore-listed companies need to demonstrate a genuine commitment to ESG principles to remain competitive.

Did you know? A recent study by MSCI found that ESG-focused funds outperformed their conventional counterparts by an average of 3.3% in 2024.

Technological Innovation and Fintech

Fintech innovations, such as fractional share trading and robo-advisors, are democratizing access to the stock market. These technologies can attract a new generation of investors, particularly retail investors, who may have been previously intimidated by the complexities of traditional investing.

Pro Tip: Explore fractional share trading platforms to gain exposure to high-value stocks with a smaller initial investment.

Regional Economic Integration

Singapore’s strategic location and strong economic ties with Southeast Asia position it as a gateway to a rapidly growing region. Increased regional economic integration and the development of cross-border investment opportunities could further boost the Singapore stock market.

The Role of Retail Investors: Encouraging Local Participation

MP Jamus Lim rightly highlighted the importance of encouraging local retail investor participation. However, simply encouraging investment isn’t enough. Financial literacy programs and investor education initiatives are essential to equip retail investors with the knowledge and skills they need to make informed decisions.

Key Takeaway: A well-informed retail investor base is a more stable and resilient investor base.

Navigating the Future: Risks and Opportunities

The path forward isn’t without its risks. Global economic uncertainty, geopolitical tensions, and rising interest rates could all dampen investor sentiment. However, Singapore’s strong fundamentals – its political stability, robust regulatory framework, and skilled workforce – position it well to weather these challenges.

The real opportunity lies in transforming the Singapore stock market from a regional trading hub into a global destination for long-term investment. This requires a concerted effort from policymakers, listed companies, and investors alike.

Frequently Asked Questions

Q: What is the Equity Market Development Programme?

A: It’s a strategic initiative by the Monetary Authority of Singapore (MAS) to deploy over S$5 billion in capital to support the growth of the Singapore stock market.

Q: How does the Tokyo Stock Exchange’s disclosure framework work?

A: The TSE publishes a monthly list of companies based on their disclosure status regarding shareholder return strategies, creating public pressure for improvement.

Q: What are ESG factors?

A: Environmental, Social, and Governance factors are criteria used to assess a company’s sustainability and ethical impact.

Q: Is it safe for retail investors to invest in the stock market?

A: Investing in the stock market involves risk, but it can also offer significant returns. It’s crucial to conduct thorough research, diversify your portfolio, and invest only what you can afford to lose.

What are your predictions for the future of the Singapore stock market? Share your thoughts in the comments below!

Learn more about the growing importance of ESG Investing.

Discover the latest Fintech trends in Singapore.

For more information on ESG performance, visit MSCI ESG Research.