BBVA’s €10 Billion Profit Masks a Looming Consolidation Wave in European Banking

A staggering €10.054 billion net profit for 2024 – a 25.4% jump from the previous year – might seem like a resounding victory for BBVA. But beneath the surface of record earnings and a flurry of dividend payouts lies a critical signal: the era of mega-mergers in European banking isn’t over, it’s merely evolving. BBVA’s failed bid for Banco Sabadell wasn’t just a setback; it’s a harbinger of increased scrutiny, shareholder activism, and a recalibration of growth strategies across the sector.

The Sabadell Bid: A Case Study in Shifting Power Dynamics

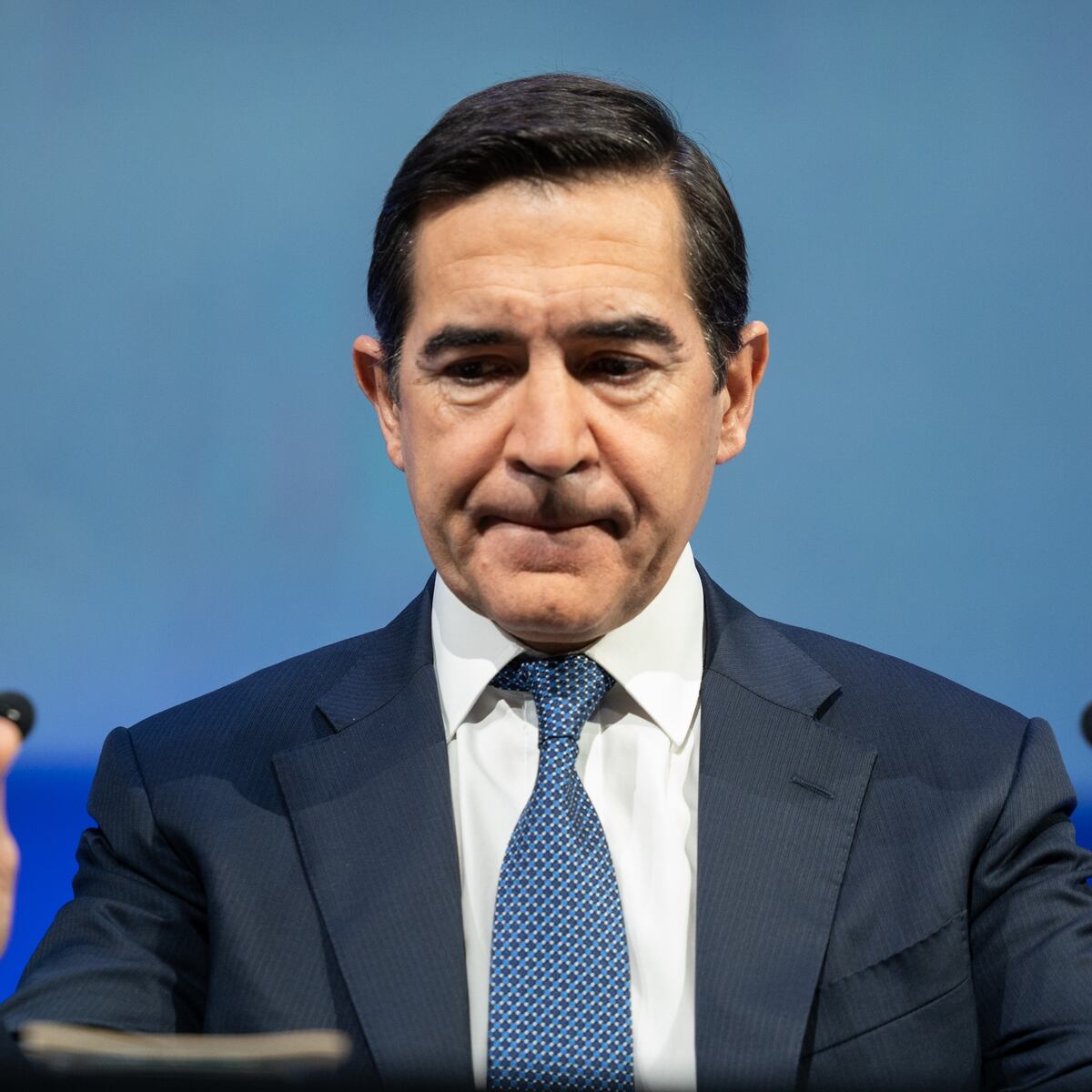

The swift rejection of BBVA’s offer – garnering support from only 25% of Sabadell shareholders – underscores a growing reluctance among investors to automatically embrace consolidation. While the promise of synergies and scale remains attractive, shareholders are now demanding more than just theoretical benefits. The role of index funds and minority shareholders, as highlighted by BBVA President Carlos Torres Vila, is becoming increasingly pivotal. These institutional investors are prioritizing independent performance and strategic alignment over the potential, but often unrealized, gains of mergers. This shift in power necessitates a new approach to M&A, one focused on demonstrable value creation and a clear articulation of long-term benefits.

Interest Margins and the Profitability Puzzle

BBVA’s impressive financial results – a 9.4% increase in interest margin to €25.267 billion and a 23.5% rise in net margin to €21.288 billion – are largely attributable to the higher interest rate environment. However, this tailwind won’t last forever. As central banks begin to signal potential rate cuts, maintaining these levels of profitability will require banks to focus on efficiency, innovation, and diversifying revenue streams. The pressure to consolidate, therefore, isn’t diminishing; it’s simply shifting from a quest for market share to a necessity for cost optimization and enhanced competitiveness. The focus will be on achieving economies of scale to absorb the impact of lower net interest income.

Sabadell’s Stand and the Rise of Independent Strength

Banco Sabadell’s successful defense of its independence isn’t merely a local victory. It validates a strategy of focused growth and specialization. President Josep Oliu’s assertion that the two entities generate more value separately than together resonates with a growing sentiment that size isn’t everything. Smaller, agile banks with a clear niche – such as Sabadell’s focus on specific regional markets and customer segments – can outperform larger, more bureaucratic institutions. This trend could encourage other mid-sized banks to resist takeover attempts and pursue independent growth strategies, potentially leading to a more fragmented, yet dynamic, banking landscape.

Government Scrutiny and the National Interest

The Spanish government’s positive reaction to the failed bid, with Vice President Yolanda Díaz calling it “good news for the country,” highlights the increasing political sensitivity surrounding banking consolidation. Governments across Europe are becoming more cautious about approving mergers that could lead to reduced competition, job losses, or a decline in local banking services. This heightened scrutiny adds another layer of complexity to the M&A process, requiring banks to demonstrate a clear commitment to preserving jobs, maintaining branch networks, and supporting local economies.

The Future of European Banking: Organic Growth and Digital Transformation

BBVA’s pivot towards organic growth and reinforcing its image of strength is a smart move, but it’s not a panacea. The bank will need to invest heavily in digital transformation to enhance customer experience, streamline operations, and develop new revenue streams. This includes leveraging technologies like artificial intelligence and machine learning to personalize financial services, automate processes, and improve risk management. Furthermore, banks must adapt to the evolving needs of their customers, particularly in areas like sustainable finance and digital payments. The future of **European banking** isn’t about simply getting bigger; it’s about becoming smarter, more efficient, and more customer-centric. The pressure to innovate will only intensify as fintech companies continue to disrupt the traditional banking model.

The failed BBVA-Sabadell deal isn’t the end of the story, but a pivotal moment. It signals a new era where shareholder value, independent strength, and government oversight will play a far greater role in shaping the future of the European banking sector.

What are your predictions for the next major consolidation move in European banking? Share your thoughts in the comments below!