Coinbase CEO’s Bold Vision: Tokenized Equity and the Future of Startup Funding – Breaking News

In a move that could fundamentally reshape the startup landscape, Coinbase CEO Brian Armstrong has detailed a comprehensive plan to move the entire lifecycle of a company – from initial formation to public trading – onto the blockchain. This ambitious vision, centered around tokenized equity and stablecoins like USDC, promises increased efficiency but also raises critical questions about regulation and investor safety. This is breaking news for anyone involved in venture capital, startup investing, or the future of finance. We’re diving deep into what this means for you, and why it matters *now*.

From Articles of Association to IPO: A Fully Onchain Startup

Armstrong’s proposal isn’t just about using blockchain for a single aspect of a company’s operations; it’s about rebuilding the entire system. Imagine a world where a company’s foundational documents – its articles of association and cap table – are represented as tokenized units on a blockchain. Seed and Series A funding rounds would be conducted through secure, whitelisted issuance modules, automatically verifying investors through KYC (Know Your Customer) and sanctions checks. Vesting schedules and employee stock options would be programmed directly into the blockchain, ensuring transparency and automated execution.

The vision extends to day-to-day operations, with payments to suppliers and employees handled via USDC, and treasury management governed by onchain rules. But the most radical element is the proposed transition to public trading through tokenized equity, traded on regulated exchanges. This would mean real-time processing, immutable audit trails, and streamlined corporate actions like dividend distributions.

The Power of Tokenization: Why This Matters for Investors

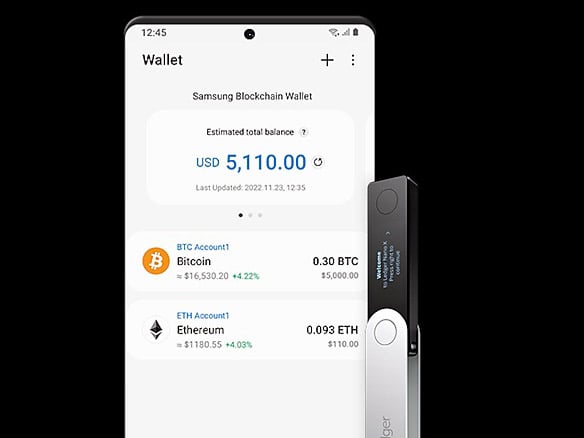

Tokenization, at its core, is about converting rights to an asset into a digital token on a blockchain. For equity, this means fractional ownership, increased liquidity, and potentially lower barriers to entry for investors. Traditionally, investing in startups is reserved for accredited investors and venture capital firms. Tokenized equity could democratize access, allowing a wider range of individuals to participate in the growth of promising companies. However, this increased accessibility also necessitates robust investor protection mechanisms.

Evergreen Insight: The concept of fractional ownership isn’t new. Real estate investment trusts (REITs) have long offered a way to invest in property without directly owning it. Tokenization takes this concept to the next level, offering potentially greater liquidity and transparency than traditional REITs.

Compliance and the Regulatory Hurdles Ahead

Armstrong acknowledges the significant regulatory challenges. Maintaining clear issuer identities, ensuring subscriptions are limited to approved investors, and safeguarding customer assets are paramount. The existing legal framework for securities offerings, reporting requirements, and market abuse prevention must be adapted to accommodate tokenized equity. Simply building the technology isn’t enough; the legal foundation needs to be solid.

“The technical layer reflects these requirements, but does not replace the legal assignment of claims, rankings and liabilities,” Armstrong emphasized. This highlights the need for a collaborative approach between regulators, technology developers, and legal experts.

Beyond the Technology: Market Structure and Operational Resilience

A successful onchain equity market requires more than just a secure blockchain. Best execution, accurate price references, and efficient primary market processes are crucial. Consolidated indices, robust order books, and redundant price feeds are needed to ensure fair and transparent trading. Furthermore, operational resilience is paramount. Clear emergency plans, rollback strategies, and fallback mechanisms are essential to mitigate risks associated with smart contract vulnerabilities or network disruptions.

SEO Tip: Understanding the nuances of blockchain technology and its potential impact on financial markets is key for investors. Search terms like “tokenized equity,” “onchain finance,” and “DeFi regulation” are gaining traction on Google News.

Armstrong also stresses the importance of a positive developer experience, providing SDKs, sandbox environments, and testnet pipelines to lower the barrier to entry for founders looking to build on this new infrastructure.

The vision outlined by Armstrong isn’t just a technological proposition; it’s a call for a fundamental rethinking of how companies are formed, funded, and traded. While significant hurdles remain, the potential benefits – increased efficiency, greater accessibility, and enhanced transparency – are too significant to ignore. This is a space to watch closely, as it promises to redefine the future of the startup economy. Stay tuned to archyde.com for ongoing coverage and expert analysis as this story develops.