<h1>Lisaqua Lands €9 Million to Grow Tropical Shrimp in France, Disrupting Seafood Supply Chains – Urgent Breaking News</h1>

<p>Seine et Marne, France – In a move poised to reshape the European shrimp market, French aquaculture startup Lisaqua has secured €9 million in funding. This isn’t just about shrimp; it’s about reimagining how we get our seafood, shortening supply chains, and prioritizing sustainability. This is <strong>breaking news</strong> for anyone interested in the future of food and the power of innovative <strong>SEO</strong> strategies to highlight impactful companies.</p>

<h2>From Nantes to Monthyon: A New Era for Shrimp Farming</h2>

<p>Founded by Charlotte Schoelinck and Gabriel Boneu, Lisaqua has been quietly perfecting its land-based aquaculture system. Following successful trials at a pilot farm in Saint-Herblain, the company is now ready to scale up with a new industrial facility in Monthyon (77). This first unit will boast an impressive capacity of 100 tonnes of shrimp annually, all raised without antibiotics and with a significantly reduced environmental footprint.</p>

<p>The core idea? Bring shrimp production closer to where people actually *eat* shrimp. Currently, a vast majority of shrimp consumed in Europe is imported from distant locations, racking up carbon emissions and raising concerns about traceability. Lisaqua’s approach tackles both of these issues head-on.</p>

<h2>Why Land-Based Aquaculture? The Benefits Beyond Freshness</h2>

<p>Land-based aquaculture, while not entirely new, is gaining momentum as a more sustainable alternative to traditional shrimp farming. Unlike open-water farms, land ponds allow for greater control over water quality, reducing the need for chemicals and minimizing the risk of disease outbreaks. This translates to healthier shrimp and a more environmentally responsible process. It also allows for year-round production, regardless of climate.</p>

<p>“The environmental impact of transporting seafood across the globe is substantial,” explains Dr. Emily Carter, a marine biologist specializing in sustainable aquaculture (though not directly affiliated with Lisaqua). “Companies like Lisaqua are demonstrating that it’s possible to produce high-quality seafood locally, reducing that impact and ensuring greater transparency for consumers.”</p>

<h2>Who’s Backing This Revolution?</h2>

<p>The €9 million funding round is a testament to the growing investor interest in sustainable food technologies. Key investors include the environmental and solidarity revolution fund of Crédit Mutuel Alliance Fédéral, the Belgian fund Noshaq, and established players like Le Gouessant and the Mer Invest Fund. This diverse group signals confidence in Lisaqua’s business model and its potential for long-term growth.</p>

<h2>Beyond France: A European Expansion on the Horizon</h2>

<p>Lisaqua isn’t stopping at one farm in France. The company has ambitious plans to expand its operations across Europe, bringing its sustainable shrimp production model to new markets. This expansion will not only increase the availability of locally-sourced shrimp but also create new jobs and stimulate economic growth in the regions where the farms are located.</p>

<p>The success of Lisaqua highlights a broader trend: consumers are increasingly demanding sustainable and ethically sourced food. Companies that can meet this demand – and effectively communicate their value proposition through smart <strong>SEO</strong> and <strong>Google News</strong> optimization – are poised to thrive. This is a story to watch, not just for seafood lovers, but for anyone interested in the future of food production.</p>

<!-- Image Placeholder -->

<img src="placeholder-image.jpg" alt="Lisaqua Shrimp Farm" style="width:100%; max-width:800px;">commando

Trump’s Customs Policy: Evaluating the Impact on Trade Dynamics

“`html

– A recently enacted agreement between the United States and the European Union, alongside separate tariffs levied on Switzerland, is sending shockwaves through international commerce. The new policies, finalized in late July, are poised to reshape trade dynamics and impact key industries on both sides of the Atlantic.

New Tariffs and Trade Imbalance

Table of Contents

- 1. New Tariffs and Trade Imbalance

- 2. farm Europe Voices Concerns

- 3. How did the use of Section 301 tariffs under Trump’s management alter the established norms of international trade dispute resolution?

- 4. Trump’s Customs Policy: Evaluating the Impact on Trade Dynamics

- 5. The shift in US Customs Under Trump: A New Era of Protectionism

- 6. Key Components of Trump’s Customs Strategy

- 7. Impact on major Trade Partners: China, Canada, and Mexico

- 8. China

- 9. Canada & Mexico

- 10. european Union

- 11. Effects on Global Supply Chains & Trade flows

- 12. Long-Term Implications & Current Status (2025)

- 13. Case Study: The Steel and Aluminum Tariffs

A deal struck between the President of the European Commission and the U.S. President in July introduces a 15% tariff on a range of European products exported to the United States. while some European policymakers view the agreement as a necessary step to stabilize trade relations and avert escalating disputes, others express concerns about the potential for economic imbalance. The agricultural sector, in particular, is voicing strong opposition.

farm Europe Voices Concerns

Farm Europe, a leading European agricultural association, has issued a statement characterizing the agreement as overwhelmingly conceding to U.S. demands. The organization argues that Europe has accepted all concessions without securing reciprocal benefits. In 2024,the trade balance between the EU and the United States stood at €30 billion,with signific

How did the use of Section 301 tariffs under Trump’s management alter the established norms of international trade dispute resolution?

Trump’s Customs Policy: Evaluating the Impact on Trade Dynamics

The shift in US Customs Under Trump: A New Era of Protectionism

Donald Trump’s presidency (2017-2021) marked a notable departure from decades of established US trade policy. His administration prioritized a more protectionist approach,heavily utilizing customs measures – tariffs,quotas,and stricter enforcement – too reshape international trade and address perceived imbalances. This article examines the key elements of Trump’s customs policy, its effects on global trade dynamics, and the lasting implications for businesses and economies. We’ll delve into specific examples, focusing on the impact of Section 301 tariffs and the renegotiation of trade agreements.

Key Components of Trump’s Customs Strategy

The core of the strategy revolved around several interconnected policies:

* Section 301 Investigations & Tariffs: This became the administration’s primary tool. Utilizing Section 301 of the Trade Act of 1974, investigations were launched into alleged unfair trade practices by countries like China, leading to the imposition of substantial tariffs on imported goods. These tariffs targeted a wide range of products, from steel and aluminum to consumer goods.

* Bilateral Trade Negotiations: trump favored bilateral agreements over multilateral ones, believing they offered the US greater leverage. This led to the renegotiation of NAFTA (resulting in the USMCA) and attempts to secure more favorable terms with other nations.

* Increased Customs Enforcement: The administration increased funding for Customs and Border protection (CBP) and prioritized stricter enforcement of existing trade regulations, including anti-dumping and countervailing duty laws. This aimed to combat trade fraud and ensure compliance.

* “America First” Procurement Policies: Policies were implemented to prioritize US-made goods in government procurement, indirectly impacting import volumes.

Impact on major Trade Partners: China, Canada, and Mexico

The effects of Trump’s trade policy were unevenly distributed.

China

China bore the brunt of the Section 301 tariffs. The initial rounds of tariffs, imposed in 2018, targeted approximately $50 billion worth of Chinese imports.This escalated into a full-blown trade war, with retaliatory tariffs imposed by China on US goods.

* Consequences: Reduced bilateral trade, increased costs for businesses and consumers, supply chain disruptions, and a slowdown in economic growth for both countries. US agricultural exports to China, notably soybeans, were significantly impacted.

* Phase One Trade Deal (2020): While offering some temporary relief, the deal didn’t fully resolve the underlying issues and many tariffs remained in place.

Canada & Mexico

The renegotiation of NAFTA into the USMCA (United States-Mexico-Canada Agreement) aimed to address concerns about job losses and trade deficits.

* Key Changes: Stricter rules of origin for automobiles, increased labor protections, and provisions related to intellectual property.

* Impact: While the USMCA avoided a complete collapse of trade relations, it introduced new complexities and costs for businesses operating in North America. The automotive sector faced particularly significant adjustments.

european Union

The US also imposed tariffs on steel and aluminum imports from the EU, citing national security concerns. This led to retaliatory tariffs from the EU on US products like Harley-Davidson motorcycles and bourbon. Negotiations eventually led to a partial resolution, but tensions remained.

Effects on Global Supply Chains & Trade flows

Trump’s customs policies triggered significant disruptions to global supply chains.

* Diversification of Sourcing: Businesses began to diversify their sourcing away from China to countries like Vietnam, Mexico, and India to avoid tariffs. This led to increased investment in these alternative manufacturing hubs.

* Reshoring & Nearshoring: The administration encouraged companies to “reshore” production back to the US or “nearshore” to countries like Mexico. While some companies responded,the scale of reshoring was limited.

* Increased Costs & Inflation: Tariffs increased the cost of imported goods, contributing to inflationary pressures in the US economy. Businesses frequently enough passed these costs on to consumers.

* Trade Diversion: Trade flows shifted as countries sought to avoid tariffs by routing goods through alternative channels.

Long-Term Implications & Current Status (2025)

while the Biden administration has not fully reversed Trump’s customs policies, it has adopted a more nuanced approach. Many of the Section 301 tariffs remain in place as of September 2025, continuing to influence trade relations with China.

* Continued Uncertainty: The ongoing trade tensions with China and the potential for future tariff actions create uncertainty for businesses.

* Supply Chain Resilience: The disruptions caused by Trump’s policies have highlighted the importance of supply chain resilience and diversification.

* Shift in Trade Landscape: The era of free trade has given way to a more fragmented and protectionist global trade landscape.

* WTO Challenges: The US actions have raised questions about the role and effectiveness of the World Trade Organization (WTO).

Case Study: The Steel and Aluminum Tariffs

The imposition of tariffs on steel and aluminum imports in 2018

The United States puts on its second SNLE of the Columbia type

USS Wisconsin Takes Shape: US Navy’s Next-Generation Nuclear Submarine Construction Underway – Breaking News & Strategic Implications

Groton, CT – August 28, 2023 – In a significant development for U.S. national security, construction of the USS Wisconsin (SSBN 827), the second Columbia-class ballistic missile submarine, officially began today at General Dynamics Electric Boat in Groton, Connecticut. This marks a crucial step in the ongoing modernization of America’s sea-based nuclear deterrent, a program designed to ensure the nation’s ability to respond to evolving global threats for decades to come. This is a breaking news story with long-term implications for global stability, and we’re bringing you the details as they unfold.

The Columbia Class: A New Era of Underwater Deterrence

The Columbia class represents the future of the U.S. Navy’s strategic fleet. These submarines, each approximately 171 meters long with a 13-meter diameter and displacing nearly 21,000 tonnes when submerged, are designed to carry 16 intercontinental ballistic missiles (ICBMs) – specifically, Trident II D5 missiles. The USS Wisconsin follows closely on the heels of the USS District of Columbia (SSBN 826), the lead ship of the class, which began construction in 2020 and is currently in the assembly phase, slated to join the fleet in 2031.

Replacing the Ohio Class: A Legacy of Service

The Columbia class is intended to replace the aging Ohio class of ballistic missile submarines, which have formed the backbone of the U.S. nuclear deterrent since the early 1980s. Eighteen Ohio-class submarines were originally commissioned, but four were converted in the 2000s into guided missile submarines (SSGNs), capable of launching Tomahawk cruise missiles and supporting special operations forces. These converted vessels traded missile silos for increased conventional strike capability. The remaining fourteen Ohio-class submarines will gradually be retired, starting with the USS Henry M. Jackson (SSBN 730) in 2027 and the USS Alabama (SSBN 731) in 2028.

A Multi-Billion Dollar Investment in Security

The sheer scale of this modernization program is substantial. Studies for the Columbia class began in 2017, with the first two submarines ordered in 2020. The initial investment for the lead ship, the USS District of Columbia, is estimated at a staggering $15 billion. This reflects the complexity of building these technologically advanced vessels and the critical importance of maintaining a credible nuclear deterrent. This isn’t just about building submarines; it’s about safeguarding peace through strength.

Beyond the Headlines: The Strategic Context

The timing of this construction is particularly noteworthy. With increasing geopolitical tensions and the proliferation of advanced weapons systems globally, the need for a reliable and secure second-strike capability is paramount. Ballistic missile submarines, operating silently beneath the waves, provide a survivable deterrent that discourages potential adversaries. The Columbia class, with its advanced technology and enhanced capabilities, will ensure the U.S. maintains this critical advantage. Understanding the nuances of SEO and Google News indexing is vital in delivering this information quickly and efficiently to those who need it most.

What Does This Mean for the Future?

The launch of the USS Wisconsin isn’t just a shipbuilding event; it’s a signal of America’s commitment to maintaining a strong and credible defense. As the Columbia class submarines enter service, they will gradually replace the Ohio class, ensuring the continuity of the U.S. sea-based nuclear deterrent for the next several decades. This ongoing modernization program is a testament to the enduring importance of strategic stability in a complex and uncertain world. Stay tuned to archyde.com for continued coverage of this vital story and other developments in defense and national security.

For more in-depth analysis of defense strategies and emerging technologies, explore our dedicated Defense & Security section. We’re committed to bringing you the most relevant and timely information to help you stay informed.

The political declaration of the conference on the Ocean of Nice formally adopted

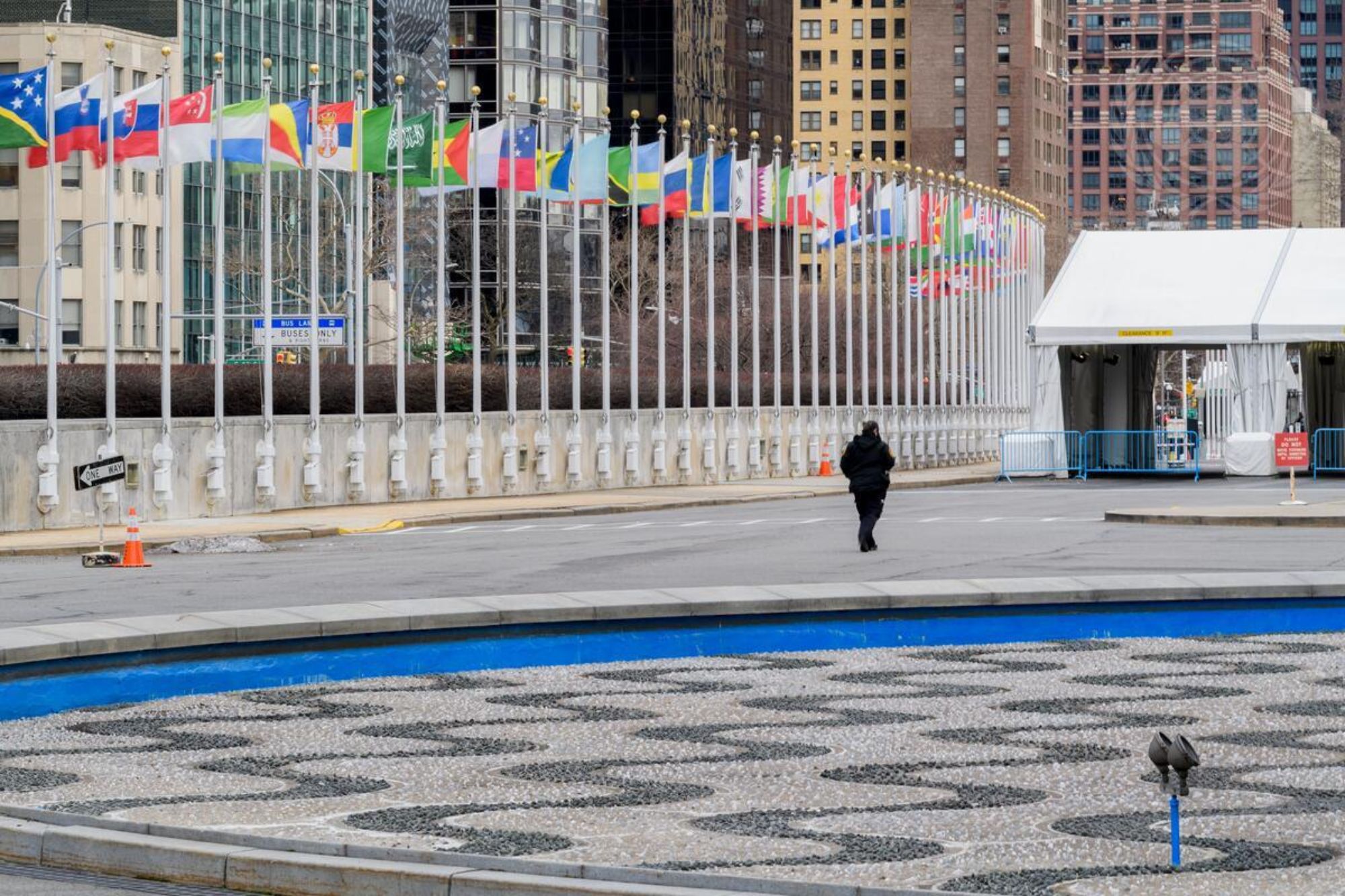

UN General Assembly Adopts Ocean Governance Declaration Amid US Opposition

to adopt a political declaration on ocean governance. The vote of 102 in favor, one against, and no abstentions signifies a significant step forward in global efforts to protect and sustainably use marine resources.

Immediate Repercussions and Support

The declaration, adopted unanimously at the end of the UN Ocean Conference (UNOC), was scheduled for a vote by the UN General Assembly at the request of the United States. Absent at the conference held in Nice, France, and Costa Rica, the US representative voted against the resolution. The political declaration is a multilateral effort to govern ocean resources under the Sustainable Development Goal (SDG) 14 of the 2030 United Nations program.

The Political Climate

The tone was set by an array of international voices. France and Costa Rica, the co-hosts of the conference, expressed disapproval, highlighting the United States’ opposition. The US defended its stance by arguing that the declaration emphasized SDG 14 too strongly, which aligns with the Trump administration’s resistance to perceived international constraints.

Historical Context and Future Implications

Historically, the 2030 United Nations program is a comprehensive blueprint for global sustainability. SDG 14 focuses on conserving and sustainably using ocean resources. The rejection by the Trump administration echoes wider discontent over internationally mandated objectives conflicting with domestic policy aims.

Expert Insights and the Road Ahead

“The United Nations’ program is a robust and necessary framework,” states Marine Conservationist Dr. Jane Brown. She emphasizes that international cooperation is essential for sustaining ocean resources given their global significance. The declaration, while instrumental, will face future challenges in implementation and compliance, especially given varying national perspectives on global governance.

Communicating with the International Community

Understanding the implications of this vote is crucial for policymakers, environmental advocates, and the general public. As the UN allies behind its declaration, it reflects multilateral efforts and a forward-looking strategy to battle climate change and ocean degradation. remained critical of this move.

“Stay tuned for more updates on the United Nations’effort towards sustainable ocean management. For in-depth analysis and expert insights, follow archyde.com for the latest news and opinions on global sustainability and environmental conservation.”