Headline: EU-US Trade Deal Sparks fury: Critics Decry “Slap in the Face” as Tariffs Loom

Breaking news: A newly struck trade agreement between the European Union and the United States is igniting fierce backlash across the continent, with critics labeling it a significant blow to European consumers and businesses. Reports indicate that a 15% tariff, intended to facilitate trade in certain key sectors, is being met with strong condemnation from political and industrial circles.

Evergreen Insight: Trade negotiations are often complex balancing acts, with agreements rarely satisfying all parties. The reaction to this EU-US deal underscores the persistent challenge of aligning national economic interests with broader international trade objectives. Historically, such pacts have been tested by domestic concerns over job security, industrial competitiveness, and consumer prices. Understanding the underlying economic forces and political pressures at play during these negotiations can provide valuable context for future trade discussions.

In Germany, right-wing extremist voices have vehemently opposed the deal. Alice Weidel, co-president of the Alternative for Germany (AfD) party, has been a vocal critic, stating, “It is not an agreement, but a slap for European consumers and companies.” Her sentiments echo broader concerns about the economic impact of the tariffs.

The Federation of German Industries (BDI) has warned of “considerable negative repercussions.” Wolfgang Groe Entrup,president of the German Chemical Industry Association (VCI),expressed similar anxieties,noting that the agreement avoids a “greater climbing” but comes at a “high price for both parties.” He specifically highlighted the risk of European exports losing competitiveness, stating, “US clients are paying tariffs.” The VCI is advocating for further negotiations to reduce tariffs, which they deem “too high” for the European chemical industry.Evergreen Insight: The concept of trade competitiveness is central to the global economy. When one bloc imposes tariffs, it can affect the pricing and market access of goods from another. This can trigger retaliatory measures or lead to shifts in global supply chains. Analyzing the long-term impact of such tariffs requires looking beyond immediate price fluctuations to consider how they influence investment decisions, innovation, and the overall comparative advantage of industries.

The potential impact on specific sectors, such as the Spanish wine industry, is also a major concern. José Luis Benítez, director of the Spanish Federation of Wine, expressed hope for carve-outs for agricultural products, including wine. He warned that a 15% tariff could disadvantage european wines against other export regions and stressed the importance of the European Commission considering wine as an exception. Lamberto Frescobaldi, president of the Italian wine institution UIV, projected a potential loss of 317 million euros (approximately $372.63 million) for the Italian wine sector in the next 12 months,pending the final agreement text.

Evergreen Insight: The agricultural and food sectors are notably sensitive to trade policy due to their direct impact on livelihoods, food security, and cultural heritage. the complexities of agricultural subsidies, quality standards, and consumer preferences frequently enough make these sectors a focal point in trade negotiations. Examining past precedents in agricultural trade agreements can reveal patterns of negotiation, compromise, and the long-term consequences for producers and consumers alike.

What are the specific adjustments to tariffs on steel and aluminum outlined in the US-EU trade deal?

Table of Contents

- 1. What are the specific adjustments to tariffs on steel and aluminum outlined in the US-EU trade deal?

- 2. US-EU Trade Deal Sparks Political and Business Concerns Across Europe

- 3. The Recent Agreement & Its Immediate Impact

- 4. Key Areas of Political Opposition

- 5. Business Concerns: Sector-by-Sector Analysis

- 6. The Role of Retaliatory Tariffs & Future Disputes

- 7. Impact on EU Trade Policy & Global Trade Landscape

- 8. Practical Tips for Businesses Navigating the Changes

US-EU Trade Deal Sparks Political and Business Concerns Across Europe

The Recent Agreement & Its Immediate Impact

The recently announced agreement between the US and EU to de-escalate their long-running trade dispute – as reported by ZDFHeute [https://www.zdfheute.de/politik/ausland/zoelle-einigung-usa-eu-faq-100.html] – isn’t being met with universal applause. While hailed by negotiators as a step towards strengthened transatlantic relations, the deal is already generating significant political and business anxieties throughout Europe. the core of the agreement centers around adjustments to tariffs, particularly concerning steel and aluminum, but the ripple effects are far-reaching. Concerns revolve around potential impacts on specific industries, national sovereignty, and the broader future of EU trade policy.

Key Areas of Political Opposition

Several European nations are voicing concerns,stemming from different political ideologies and economic priorities.

France: French officials have expressed reservations about the speed of the agreement, arguing that it was reached without sufficient consultation with all EU member states. Concerns center on protecting French agricultural interests and maintaining the EU’s ability to impose retaliatory tariffs in future disputes.

Germany: While generally supportive of closer US-EU ties, German industry leaders are wary of potential disruptions to established supply chains. The German economy, heavily reliant on exports, is particularly sensitive to changes in international trade agreements.

Italy: Italian politicians have criticized the deal as possibly favoring larger EU economies like Germany, and fear it could disadvantage Italian manufacturers in key sectors like automotive and food production.

Eastern European Nations: Several Eastern European countries, who have seen increased investment from both the US and EU, are worried about the potential for the deal to undermine their growing economic influence within the bloc.

These political disagreements highlight the inherent challenges in forging a unified EU trade strategy when faced with diverse national interests. The debate also touches on broader questions of European integration and the balance of power within the EU.

Business Concerns: Sector-by-Sector Analysis

The impact of the US-EU trade deal isn’t uniform across all sectors. Here’s a breakdown of key industries and their respective concerns:

Steel & Aluminum: While the agreement aims to resolve the initial dispute over tariffs on these materials, European steel producers remain cautious. They fear a potential influx of cheaper US steel, even with the revised tariff structure.The long-term effects on steel industry jobs are a major worry.

Agriculture: European farmers are anxious about increased competition from US agricultural products, particularly in areas like poultry and pork. the EU’s strict regulations on food safety and environmental standards are seen as potential disadvantages in a more open market. Agricultural trade is a sensitive topic.

Automotive: the automotive industry, a cornerstone of the European economy, is bracing for potential changes in tariffs and regulations. Concerns include the impact on automotive exports to the US and the potential for increased competition from US automakers.

Chemicals: The European chemical industry, known for its innovation and sustainability, is concerned about aligning with US regulations that may be less stringent. Maintaining chemical industry standards is a priority.

Digital Services: The deal doesn’t directly address ongoing disputes over digital services taxes and data privacy. This leaves European tech companies facing continued uncertainty regarding digital trade with the US.

The Role of Retaliatory Tariffs & Future Disputes

A key element of the agreement involves the suspension of retaliatory tariffs imposed by both sides during the trade dispute. However, the potential for future disputes remains high. The agreement doesn’t fundamentally address the underlying issues that led to the initial conflict, such as differing regulatory approaches and concerns about unfair trade practices.

Safeguard Mechanisms: The deal includes provisions for safeguard mechanisms, allowing either side to reimpose tariffs if they believe their industries are being unfairly harmed.

Dispute Resolution: The effectiveness of the agreement will depend on the establishment of a robust dispute resolution mechanism to address future conflicts.

WTO Compliance: Ensuring the agreement is fully compliant with World Trade Association (WTO) rules is crucial to avoid further legal challenges.

Impact on EU Trade Policy & Global Trade Landscape

This US-EU trade deal has broader implications for the EU’s overall trade policy. It signals a potential shift towards a more pragmatic approach to transatlantic relations, but also raises questions about the EU’s commitment to multilateralism and its independent trade agenda.

CPTPP & Other Trade Agreements: The deal could influence the EU’s approach to negotiating trade agreements with other countries, such as the Complete and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

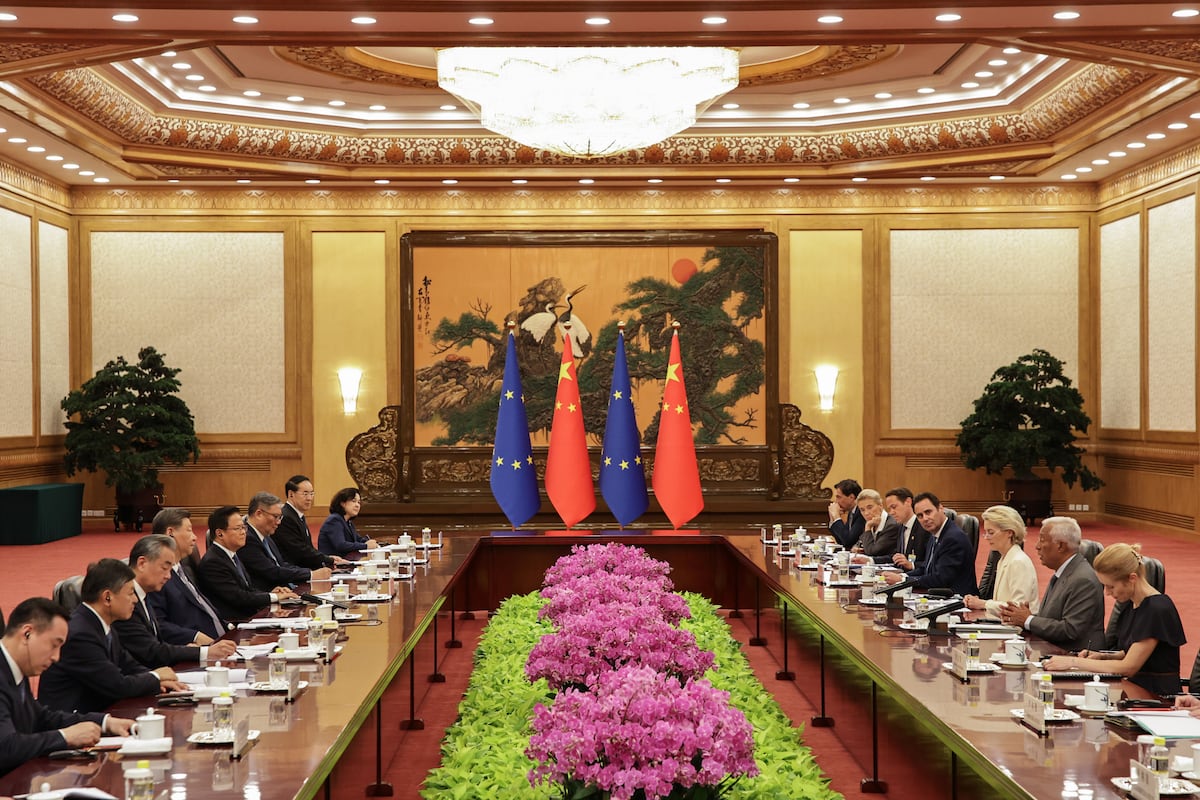

China Relations: The agreement may also impact the EU’s relationship with China, as the US seeks to strengthen its alliances in the face of growing Chinese economic influence.

* Supply Chain Resilience: The focus on resolving trade disputes highlights the importance of building more resilient global supply chains to mitigate future disruptions.

For businesses operating within the EU and engaged in trade with