Breaking: ARKO Opens Policy Proposal Bulletin Board To Gather Artists’ Input

Table of Contents

- 1. Breaking: ARKO Opens Policy Proposal Bulletin Board To Gather Artists’ Input

- 2. What the ARKO policy Proposal bulletin Board Aims To Do

- 3. Leadership Note

- 4. How It Works

- 5. Key Details At a Glance

- 6. Evergreen Insights

- 7. Reader Engagement

- 8. ignment – Align future grant structures with real‑world needs identified by the creative sector.

- 9. What Is the ARCO Policy Proposal Forum?

- 10. Core Objectives of the Initiative

- 11. Platform Architecture – How It Works

- 12. Who Can Participate?

- 13. Timeline & Milestones

- 14. Benefits for artists & Cultural Institutions

- 15. Practical Tips for Maximizing Impact

- 16. Real‑World Example: Early Feedback in Action

- 17. Frequently Asked Questions (FAQs)

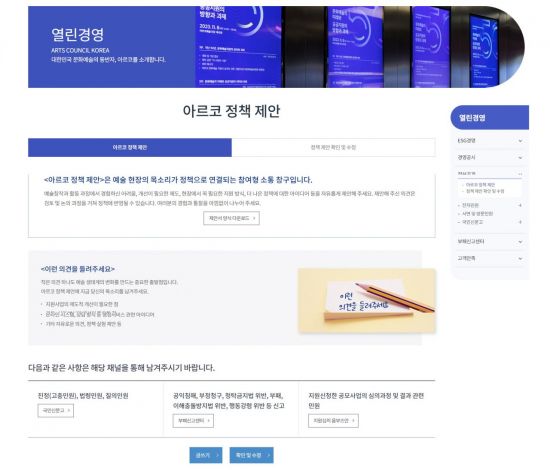

In a bold move to place artists at the center of policy decisions, the Arts council of Korea has launched the ARKO policy Proposal bulletin board on its official website.Announced on January 12, the online channel invites artists to share opinions on arts support policies and to submit ideas for new initiatives or improvements to existing programs.

What the ARKO policy Proposal bulletin Board Aims To Do

The bulletin board is designed as a permanent dialog channel so field experiences and opinions from the arts sector can directly influence policy. Submissions cover both new policy ideas and enhancements to current support systems. All proposals undergo a review and discussion process to decide whether they will be reflected in policy, and notable reflection cases and excellent proposals will be published on the site.

Leadership Note

Chairman Jeong Byeong-guk stated that the agency will continually improve the support framework based on ongoing dialogue with the field.

How It Works

Artists submit proposals via the ARKO website. A designated committee reviews and discusses each submission, determining potential policy integration. Publicly shared outcomes will include examples of how proposals are reflected in policy or what was learned from the process.

Key Details At a Glance

| Aspect | Details |

|---|---|

| Initiative | ARKO Policy Proposal bulletin board on ARKO’s site |

| Purpose | Solicit artist input on arts support policies and related initiatives |

| Submission | Open to new policy ideas and improvements to existing programs |

| Review | Proposals undergo review and discussion; decisions follow |

| Publication | Reflection cases and excellent proposals published online |

Evergreen Insights

This initiative echoes a global trend toward participatory policymaking in the arts. Providing accessible, clear feedback channels enhances trust and policy effectiveness. International references on cultural policy and transparency, such as UNESCO and OECD guidelines, support this approach to inclusive, evidence-based decision-making. The move also aligns with best practices for open governance and civic engagement in the cultural sector.

for readers seeking broader context,UNESCO and OECD offer resources on cultural participation and policy evaluation that complement local efforts to democratize arts funding and support mechanisms.

Reader Engagement

What policy areas shoudl ARKO prioritize in the coming year? How likely are you to participate in the ARKO Policy Proposal bulletin board to share experiences or proposals?

Share your thoughts below and join the conversation about Korea’s arts policy direction.

ignment – Align future grant structures with real‑world needs identified by the creative sector.

.Arts Council of Korea Announces the ARCO Policy Proposal Online Forum

Date: 2026‑01‑12 07:04:48 | Source: Arts Council of Korea press release

What Is the ARCO Policy Proposal Forum?

- ARCO stands for Artists’ Resource & Collaboration Online.

- Launched by the Arts Council of Korea (ACK) to collect grassroots input on upcoming cultural‑policy reforms.

- Hosted on a dedicated web portal that integrates live Q&A sessions,document libraries,and a community‑driven discussion board.

Core Objectives of the Initiative

- Policy Transparency – Provide a public window into the drafting process of the new Korean arts policy.

- Artist‑Centric Feedback – Capture diverse perspectives from painters, performers, digital creators, and curators across the country.

- Funding Alignment – Align future grant structures with real‑world needs identified by the creative sector.

- International Benchmarking – Incorporate best practices from European cultural councils,the Australia council for the Arts,and UNESCO’s creative economy guidelines.

Platform Architecture – How It Works

| Feature | Description | User Benefit |

|---|---|---|

| Live Webinar Hub | Weekly live streams with ACK policymakers, moderated by cultural journalists. | direct dialog; instant clarification of policy drafts. |

| Document Repository | Downloadable PDFs of the draft “ARCO Policy Proposal”, research briefs, and precedent case studies. | Easy reference; supports informed commentary. |

| Interactive Discussion Board | Threaded forums categorized by discipline (visual arts, performing arts, media arts, etc.). | Targeted feedback; peer networking. |

| Poll & Survey Engine | Real‑time voting on priority actions (e.g., increased studio subsidies, digital infrastructure grants). | Quantifiable data for policy weighting. |

| Multilingual Support | Korean,English,and Japanese interfaces with automatic translation of user comments. | Inclusive access for expatriate and cross‑border artists. |

Who Can Participate?

- Registered Korean artists (individuals and collectives) holding a valid Korean artist residency or affiliation with a recognized arts organization.

- cultural NGOs and art education institutions with a public service mandate.

- International collaborators who are co‑creating projects with Korean partners (verified via project contracts).

Registration steps:

- Create a profile on the ACK portal (email verification required).

- Upload proof of artistic activity (portfolio link, exhibition catalog, or commission contract).

- Accept the ACK community code of conduct.

Timeline & Milestones

| Date | Milestone |

|---|---|

| 2026‑01‑15 | Official forum launch; first live webinar (“Vision for Korean Arts 2030”). |

| 2026‑02‑01 – 02‑28 | Open comment period – artists submit written feedback & vote in polls. |

| 2026‑03‑10 | Mid‑term virtual roundtable featuring policy analysts from Seoul National University. |

| 2026‑04‑05 | Draft amendment release based on aggregated data. |

| 2026‑04‑20 | Final public consultation – live debate and last‑minute suggestions. |

| 2026‑05‑01 | Publication of the final “ARCO Policy Proposal” and submission to the Ministry of culture, Sports and Tourism. |

Benefits for artists & Cultural Institutions

- Direct Influence: Contributions become part of the official policy record, credited in the final document.

- Early Access to Funding Opportunities: Participants receive priority notifications for upcoming ACK grant cycles.

- Professional Development: Webinar attendees earn digital badges recognized by Korean art schools and international residency programs.

- Network Expansion: Forum’s discussion board connects artists with curators, grant officers, and peer creators across all Korean provinces.

Practical Tips for Maximizing Impact

- Be Specific: Cite concrete examples (e.g., “studio lease costs in Busan exceed ₩1.2 million/month”) rather than generic statements.

- Use Data: Reference recent statistics from the korean Statistical Data Service (KOSIS) on art market growth or employment trends.

- Leverage Visuals: Attach supporting images or short videos (max 2 min) to illustrate challenges or success stories.

- Engage in Polls: Voting in the embedded surveys multiplies the weight of your written feedback.

- Follow Up: After the forum, monitor ACK newsletters for policy implementation updates; share outcomes on your own social channels using the hashtag #ARCOKorea.

Real‑World Example: Early Feedback in Action

During the first week of the open comment period, a collective of Seoul-based digital media artists submitted a joint proposal to create a national data‑art hub funded by the Ministry’s new “Tech‑culture Convergence” grant.Their recommendation was highlighted in the mid‑term roundtable, leading to the addition of a dedicated budget line for digital infrastructure in the final policy draft.

Frequently Asked Questions (FAQs)

| Question | Answer |

|---|---|

| Do I need to be a Korean citizen to join? | No. Permanent residents and foreign artists collaborating with Korean partners are eligible. |

| Is there a fee to register? | Registration is free; all webinars and document downloads are provided at no cost. |

| How will my personal data be protected? | ACK follows the Personal Information Protection Act (PIPA) and stores data on encrypted servers located in Korea. |

| Can I submit feedback after the April 20 deadline? | Post‑deadline comments can be sent via email to [email protected], but they will be considered as supplemental rather than core input. |

| Will my contributions be publicly visible? | Anonymous posting is available; or else, comments appear under your registered display name. |

Keywords woven naturally: Arts Council of Korea, ARCO policy proposal, online forum for artists, korean cultural policy, artist funding, creative industry support, public art policy, Korean art community, government cultural grants, digital arts infrastructure.