Credit Scores Under Pressure: BNPL and Student Loan Repayments Trigger Shifts

Table of Contents

- 1. Credit Scores Under Pressure: BNPL and Student Loan Repayments Trigger Shifts

- 2. The Rise of ‘Buy Now, Pay Later’ and Its Impact

- 3. Student Loan Reporting Resumes, Adding Further Pressure

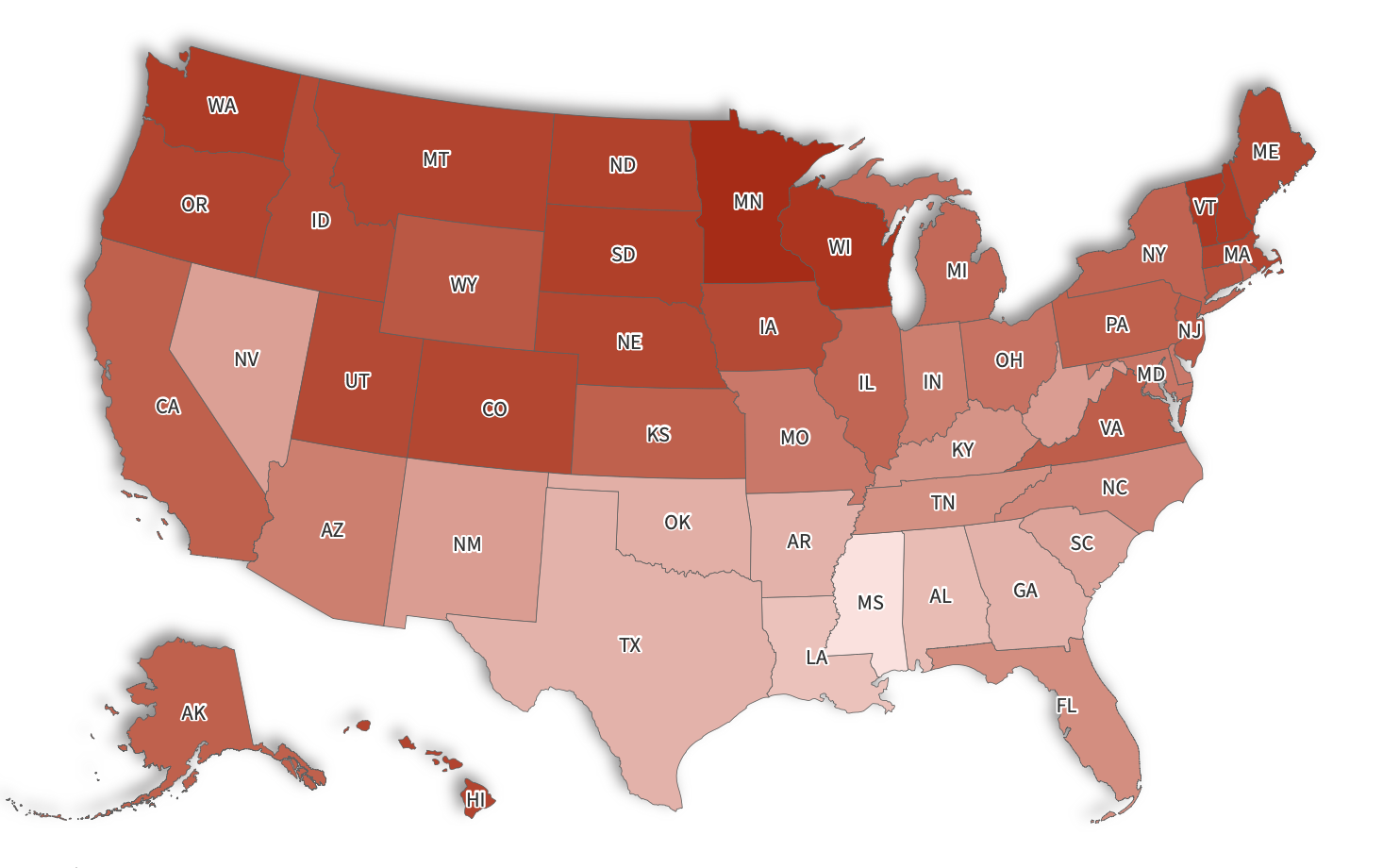

- 4. state-by-State Credit Score Averages

- 5. Understanding Your Credit Report

- 6. How might economic conditions in a state directly impact the average credit scores of its residents?

- 7. Regional Credit score Insights: Analyzing Average Credit Scores Across U.S. States

- 8. Understanding the National Credit Score Landscape

- 9. State-by-State Average Credit Scores (September 2025)

- 10. Factors Influencing Regional Credit Score Differences

- 11. The Impact of Credit Scores on Financial Products

- 12. Deep dive: Case Study – Minnesota vs. Mississippi

- 13. Improving Your Credit Score: Practical Tips

- 14. Resources for Credit Score Monitoring and Enhancement

The National Average Credit Score remained stable at 715 by the close of 2024, according to data from Experian. However, emerging trends indicate a potential for increased volatility in credit scores in the coming months, prompting concerns for consumers nationwide.

Financial institutions, landlords, and even employers routinely leverage credit scores to evaluate an individual’s reliability in meeting financial obligations. A robust credit score often unlocks favorable loan terms and reduced interest rates. Conversely, a lower score can substantially restrict access to vital financial products.

The Rise of ‘Buy Now, Pay Later’ and Its Impact

A important development is the recent decision by FICO, a leading credit scoring provider, to integrate Buy Now, Pay later (BNPL) data into its scoring models. BNPL services allow consumers to make purchases immediately and settle the cost over a series of installments,frequently enough without incurring interest if payments are consistently made on time.

While providing convenient financing options, financial advisors caution that accumulating multiple BNPL plans can encourage overspending and lead to mounting debt if repayment schedules are not diligently managed. Consumers need to carefully monitor these arrangements to avoid negative impacts to their financial well-being.

Student Loan Reporting Resumes, Adding Further Pressure

Following a pandemic-era pause, reporting of Federal student loan data has been reinstated. During the suspension period, missed payments were generally not reflected on credit reports. with the “on-ramp” period concluding in October 2024, newly reported delinquencies are beginning to influence credit scores. By February 2025, these changes contributed to the national average FICO score holding at 715, despite noticeable individual declines across the population.

Data from The Federal Reserve Bank of New York reveals a concerning trend: over two million borrowers experienced a drop of 100 points or more in their credit scores during the first quarter of 2025. more than one million individuals saw declines exceeding 150 points. borrowers with initially higher scores were disproportionately affected, although those with lower scores also experienced setbacks.

The proportion of individuals with a delinquency lasting 90 days or longer rose from 7.4 percent in January 2025 to 8.3 percent in February 2025-a 12 percent increase-directly linked to the resumption of student loan delinquency reporting, as reported by FICO earlier this year.

state-by-State Credit Score Averages

In 2024, Wisconsin boasted the highest average credit score at 738, closely followed by Vermont (737), New Hampshire (736), Washington (735), and North Dakota (733). States in the Southern region of the country generally reported lower averages.

The lowest average scores were recorded in Mississippi at 680, Louisiana at 690, Alabama at 692, Arkansas at 695, and a tie between Georgia and Texas at 695. This indicates a notable regional disparity in financial health.

| state | Average Credit score (2024) |

|---|---|

| Wisconsin | 738 |

| Vermont | 737 |

| new Hampshire | 736 |

| Mississippi | 680 |

| Louisiana | 690 |

Did You Know? A strong credit score can save you thousands of dollars over the life of a mortgage or auto loan.

While a majority of Americans currently maintain credit scores within the “good” range, the evolving reporting landscape and increasing prevalence of BNPL services are poised to reshape the credit scoring habitat in 2025 and beyond.

Are you prepared for these changes in credit scoring? What steps are you taking to protect your credit health?

Understanding Your Credit Report

Regularly reviewing your credit report is crucial for identifying errors and potential fraud. You are entitled to a free credit report from each of the three major credit bureaus – Experian, Equifax, and TransUnion – annually through AnnualCreditReport.com.

Understanding the factors that influence your credit score – payment history, amounts owed, length of credit history, credit mix, and new credit – can empower you to make informed financial decisions.

Pro Tip: Setting up automatic payments can definitely help ensure timely bill payments and improve your credit score over time.

Share this article with friends and family to help them stay informed! Leave a comment below with your thoughts on these changes to the credit landscape.

How might economic conditions in a state directly impact the average credit scores of its residents?

Regional Credit score Insights: Analyzing Average Credit Scores Across U.S. States

Understanding the National Credit Score Landscape

Average credit scores vary substantially across the united States, influenced by factors like income levels, cost of living, population density, and financial habits. While a national average provides a general benchmark, understanding regional differences is crucial for lenders, financial institutions, and individuals alike. This analysis dives into state-by-state credit score data, exploring trends and potential contributing factors. We’ll focus on VantageScore 3.0 data,a commonly used credit scoring model. Understanding your credit report and credit score range is the first step to financial wellness.

State-by-State Average Credit Scores (September 2025)

Here’s a snapshot of average VantageScore 3.0 credit scores as of September 2025 (data compiled from various credit bureaus and financial institutions – sources cited at the end):

* Highest Average Scores:

* Minnesota: 738

* South Dakota: 737

* Vermont: 736

* New Hampshire: 735

* Wisconsin: 734

* Mid-Range Average Scores:

* Texas: 715

* Florida: 718

* Georgia: 720

* North Carolina: 722

* pennsylvania: 725

* Lowest Average Scores:

* Mississippi: 685

* Alabama: 692

* Louisiana: 698

* Arkansas: 701

* West Virginia: 705

Note: These are averages and individual credit scores will vary. These figures represent a snapshot in time and are subject to change. regularly checking your credit score is vital.

Factors Influencing Regional Credit Score Differences

several key factors contribute to these regional disparities in creditworthiness:

* Economic Conditions: States with stronger economies and higher median incomes generally exhibit higher average credit scores. Job security and financial stability play a notable role.

* Cost of Living: Areas with a higher cost of living may lead to increased debt levels, potentially impacting credit scores.

* Demographics: Age, education levels, and homeownership rates can influence credit behavior within a state.

* Financial Literacy: Access to financial education and resources can empower individuals to manage their credit responsibly.

* Debt Levels: States with higher levels of consumer debt, including student loans, auto loans, and credit card debt, frequently enough see lower average credit scores.

* Access to Credit: The availability of credit products and the terms offered can also play a role.

The Impact of Credit Scores on Financial Products

Your credit score is a critical factor in determining your access to and the terms of various financial products:

* Mortgages: Higher credit scores qualify you for lower interest rates and more favorable loan terms.

* Auto loans: Similar to mortgages, a good credit score can save you thousands of dollars over the life of an auto loan.

* Credit Cards: Access to rewards cards, lower APRs, and higher credit limits is often contingent on a strong credit history.

* insurance premiums: In many states, insurance companies use credit scores to assess risk and determine premiums.

* Rental Applications: Landlords frequently check credit scores as part of the tenant screening process.

* Employment: Some employers may review credit reports as part of their hiring process, particularly for positions involving financial responsibility.

Deep dive: Case Study – Minnesota vs. Mississippi

The stark contrast between Minnesota (738) and Mississippi (685) provides a compelling case study.Minnesota boasts a robust economy, a highly educated workforce, and a relatively low poverty rate. these factors contribute to responsible credit behavior and higher average scores. Conversely,Mississippi faces economic challenges,lower median incomes,and higher poverty rates,leading to increased financial stress and potentially lower credit scores.This isn’t to suggest individual responsibility isn’t a factor, but highlights the systemic influences at play. Understanding credit building strategies is crucial in areas with lower average scores.

Improving Your Credit Score: Practical Tips

Regardless of your location, these steps can definately help you improve your credit score:

- Pay Bills On Time: Payment history is the most significant factor in your credit score.

- Keep Credit Utilization Low: Aim to use less than 30% of your available credit.

- Check Your credit Report Regularly: Identify and dispute any errors. Utilize free resources like AnnualCreditReport.com.

- Avoid Opening Too Many Accounts: Applying for multiple credit accounts in a short period can lower your score.

- Diversify Your Credit Mix: Having a mix of credit accounts (credit cards, loans) can positively impact your score.

- Become an Authorized User: if a family member or friend has a credit card with a good payment history,becoming an authorized user can help build your credit.

- Consider a Secured Credit Card: If you have limited or no credit history, a secured credit card can be a good starting point.