SpaceX to Acquire AI Firm xAI in Landmark Merger

Table of Contents

- 1. SpaceX to Acquire AI Firm xAI in Landmark Merger

- 2. The Strategic Union: Synergies and Goals

- 3. Financial Implications and IPO Plans

- 4. Musk’s Vision: Beyond Earthly Boundaries

- 5. A History of Integration

- 6. The Expanding AI landscape: A Speedy Overview

- 7. What are the main advantages that spacex gains by acquiring xAI for developing space-based data centers?

- 8. SpaceX Acquires xAI, Merging Rocketry and AI for Space‑Based Data Centers

- 9. Why Space-Based Data Centers? Addressing Terrestrial Limitations

- 10. The SpaceX-xAI Synergy: A Deep Dive

- 11. The Technical Hurdles and Proposed Solutions

- 12. Potential Applications: Beyond Simple Data Storage

- 13. Early Developments and Case Studies (2024-2026)

- 14. The Future of Data: A New orbital Frontier

Hawthorne, California – In a move signaling a significant escalation in the convergence of space exploration and Artificial Intelligence, Elon Musk’s SpaceX is set to acquire xAI, his AI startup. the proclamation, made by SpaceX on Monday, details a plan to integrate resources and expertise to accelerate advancements in Artificial Intelligence and pursue ambitious long-term projects.

The Strategic Union: Synergies and Goals

The merger aims to combine SpaceX’s considerable computing power, vast data reserves, and robust engineering capabilities with xAI’s advancement of advanced AI technologies, including the Grok chatbot. This strategic alignment is intended to bolster AI innovation and lay the groundwork for ventures like space-based data centers, a concept previously championed by Musk.

Financial Implications and IPO Plans

Sources familiar with the agreement indicate that the combined entity is projected to be valued at approximately $1.25 trillion. the anticipated share price is around $527, according to recent reports from Bloomberg. This acquisition precedes a major initial public offering planned for later this year, positioning the combined company for considerable growth and market influence. Discussions surrounding the merger were initially reported by Reuters last Thursday.

Musk’s Vision: Beyond Earthly Boundaries

Elon musk articulated his ambitions for the merged entity with characteristic grand vision. “This marks not just the next chapter, but the next book in SpaceX and xAI’s mission: to scale to create a sentient sun, to understand the universe, and to extend the light of consciousness to the stars!” he stated.

A History of Integration

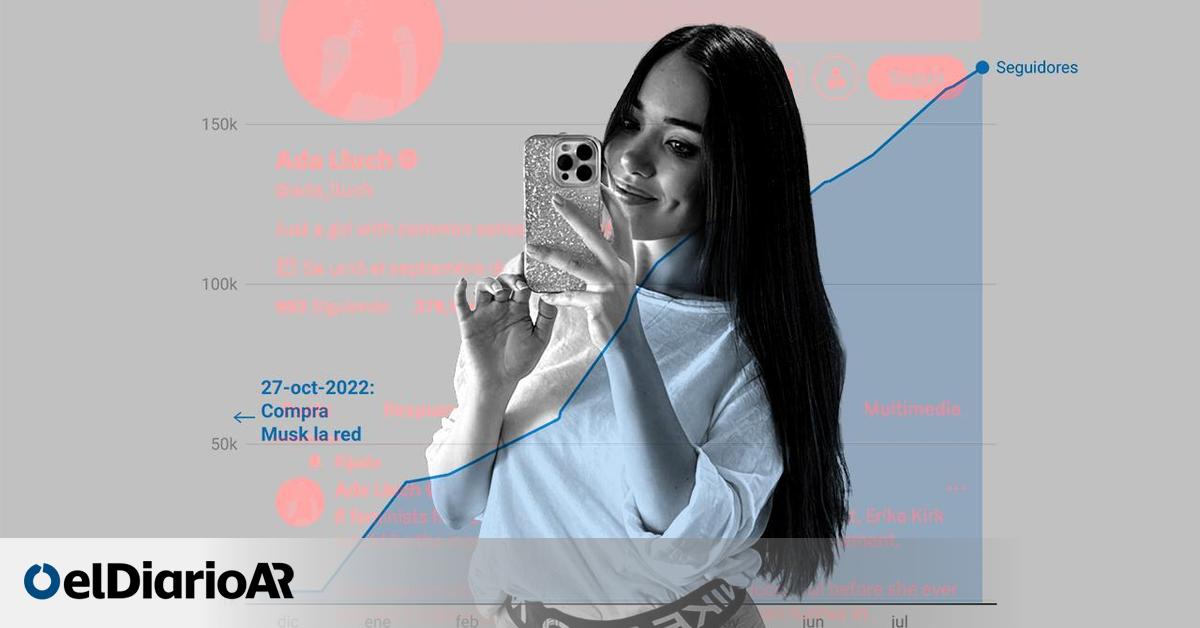

This is not the first instance of Musk consolidating his companies. In 2025, he integrated Platform X, formerly known as Twitter, into xAI. Moreover, Tesla, Musk’s electric vehicle enterprise, has committed a $2 billion investment into xAI, demonstrating a broader commitment to AI development across his portfolio.

The Expanding AI landscape: A Speedy Overview

| Company | Primary Focus | Key Investment/Development |

|---|---|---|

| SpaceX | Space Exploration & Technology | Acquisition of xAI, Computing Power |

| xAI | Artificial intelligence | Grok Chatbot, AI Algorithm Development |

| tesla | Electric Vehicles & AI | $2 Billion Investment in xAI |

The convergence of AI and space technology reflects a growing trend in the tech industry, with companies increasingly recognizing the potential for synergistic growth. According to a recent report by gartner, the global AI market is expected to reach $79.2 billion in 2024, highlighting the rapid expansion within this sector.

This acquisition underscores Musk’s commitment to pushing the boundaries of technological innovation and solidifies his position as a key driver in both the space and AI industries. The move is highly likely to have a ripple effect, influencing investment strategies and development priorities across the tech landscape.

What are the long-term implications of merging space exploration with advanced AI capabilities? How will this acquisition impact the competitive landscape of the AI industry?

Share your thoughts in the comments below and join the conversation!

What are the main advantages that spacex gains by acquiring xAI for developing space-based data centers?

SpaceX Acquires xAI, Merging Rocketry and AI for Space‑Based Data Centers

The landscape of data storage and processing is undergoing a radical shift. SpaceX’s recent acquisition of xAI, elon Musk’s artificial intelligence company, isn’t just a business deal; it’s a foundational move towards establishing a new era of space-based infrastructure. This synergy aims to leverage the unique advantages of space – namely, vast, unobstructed cooling potential and reduced atmospheric interference – to host powerful data centers, pushing the boundaries of AI computation and data management.

Why Space-Based Data Centers? Addressing Terrestrial Limitations

Traditional data centers, while constantly evolving, face inherent limitations. These include:

* energy Consumption: Massive server farms require enormous amounts of energy, contributing substantially to carbon footprints.

* Cooling Challenges: Maintaining optimal operating temperatures for high-performance computing is expensive and resource-intensive.

* geopolitical Risks: Concentrated data centers are vulnerable to localized disruptions – natural disasters,political instability,or cyberattacks.

* Latency Issues: Distance between users and data centers introduces latency, impacting real-time applications.

Space offers solutions to all these problems. The vacuum of space provides near-perfect cooling capabilities, drastically reducing energy needs. Orbiting data centers are less susceptible to terrestrial threats, and strategically positioned satellites can minimize latency for global users.

The SpaceX-xAI Synergy: A Deep Dive

SpaceX brings to the table its proven expertise in rocketry, satellite deployment (Starlink constellation being a prime example), and orbital infrastructure. xAI contributes cutting-edge advancements in artificial intelligence, machine learning, and possibly, the development of AI specifically optimized for the space surroundings.

Hear’s how the integration is expected to unfold:

- Optimized AI Algorithms: xAI will focus on developing AI algorithms that can operate efficiently in the harsh conditions of space – radiation exposure,temperature fluctuations,and limited bandwidth.

- Automated Data Center Management: AI will be crucial for automating the management of these orbital facilities, including resource allocation, fault detection, and system optimization.

- Advanced Data Security: AI-powered security protocols will be implemented to protect sensitive data stored in space from unauthorized access.

- Rapid Deployment via Starship: SpaceX’s Starship, with its massive payload capacity, will be instrumental in deploying and maintaining these large-scale space-based data centers. this reduces the cost per kilogram to orbit,making the concept economically viable.

The Technical Hurdles and Proposed Solutions

Building and operating data centers in space isn’t without its challenges.Some key hurdles include:

* Radiation Shielding: Protecting sensitive electronic components from cosmic radiation is paramount. Solutions involve specialized shielding materials and radiation-hardened hardware.

* Power Generation: Reliable power sources are essential. Solar power is the most obvious choice, but efficient energy storage systems (advanced batteries or potentially even space-based nuclear reactors) will be needed for continuous operation.

* Thermal Management: While space offers excellent cooling potential, managing heat dissipation from densely packed servers requires innovative thermal management systems.Liquid cooling and heat pipes are likely candidates.

* Data Transmission: High-bandwidth, low-latency data transmission between space-based data centers and Earth is critical. Laser dialog technologies are being actively developed to address this need.

Potential Applications: Beyond Simple Data Storage

The implications of space-based data centers extend far beyond simply storing data. Several key applications are emerging:

* Edge Computing for IoT: Processing data closer to the source – for example, analyzing data from a network of sensors on Earth – reduces latency and improves responsiveness.

* AI-Driven Scientific Research: Providing massive computational power for complex simulations and data analysis in fields like climate modeling,drug discovery,and astrophysics.

* Real-Time Financial Modeling: Enabling faster and more accurate financial modeling and risk assessment.

* Enhanced Satellite Imagery Analysis: Processing and analyzing vast amounts of satellite imagery in real-time for applications like disaster monitoring, environmental tracking, and urban planning.

* Decentralized Cloud Services: Offering a more secure and resilient cloud infrastructure, less vulnerable to terrestrial disruptions.

Early Developments and Case Studies (2024-2026)

While still in its early stages, several key developments point towards the feasibility of this concept.

* NASA’s Research: NASA has been actively researching the feasibility of space-based computing for years, focusing on radiation hardening and thermal management techniques. Their findings are informing the development of commercial space data centers.

* Private Sector Investment: Several private companies, alongside SpaceX and xAI, are investing in technologies related to space-based infrastructure, including advanced materials, power generation, and data transmission.

* Initial Orbital Demonstrations (2025): spacex launched a small-scale orbital exhibition unit in late 2025, testing key technologies for thermal management and data transmission. Preliminary results were promising, showcasing the viability of the concept.

* Partnerships with Cloud Providers: Discussions are underway between SpaceX/xAI and major cloud providers (Amazon Web Services, Microsoft Azure, Google Cloud) to explore potential partnerships for offering space-based cloud services.

The Future of Data: A New orbital Frontier

The acquisition of xAI by SpaceX marks a pivotal moment in the evolution of data infrastructure. By combining rocketry expertise with cutting-edge AI, the company is poised to unlock the vast potential of space for data storage, processing, and innovation. While challenges remain, the benefits – increased efficiency, enhanced security, and reduced latency – are compelling. As technology continues to advance and costs decrease, space-based data centers are likely to become an increasingly critically importent part of the global digital landscape.