The passage of the 2025 reconciliation law, often referred to as the “One Big, Beautiful Bill,” and its inclusion of new work requirements for some Medicaid enrollees has brought renewed attention to the employment status of those relying on the program and their access to health insurance through their jobs. A key finding is that the majority of adults subject to these new requirements are already employed, yet still depend on Medicaid because their jobs often don’t offer health coverage or the coverage offered isn’t accessible to them. Although employer-sponsored insurance remains the primary source of coverage for working-age adults in the United States, access to these plans is significantly limited for low-wage workers, those in specific industries, part-time employees, and those working at smaller companies.

These new work requirements are unlikely to dramatically increase employment rates, given that most Medicaid-eligible adults are already working or face significant barriers to employment. Similarly, due to limited access and eligibility for job-based coverage among low-wage workers, these requirements aren’t expected to substantially reduce reliance on Medicaid. However, they are projected to decrease overall Medicaid enrollment, as some working enrollees may struggle to verify their employment status.

An analysis of data from the 2025 Current Population Survey Annual Social and Economic Supplement (CPS ASEC) examined the availability of job-based insurance for adult Medicaid workers aged 19 to 64 in 2024. The study explored the reasons why these workers aren’t eligible for employer-sponsored coverage, and, if eligible, why they don’t enroll. The analysis focused on states that have adopted the Medicaid expansion and Wisconsin, which has a partial expansion, excluding self-employed individuals, those enrolled in Medicare, and those receiving disability benefits from Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI). Georgia was excluded due to limited enrollment in its Pathways to Coverage Program.

Limited Access to Employer-Sponsored Insurance

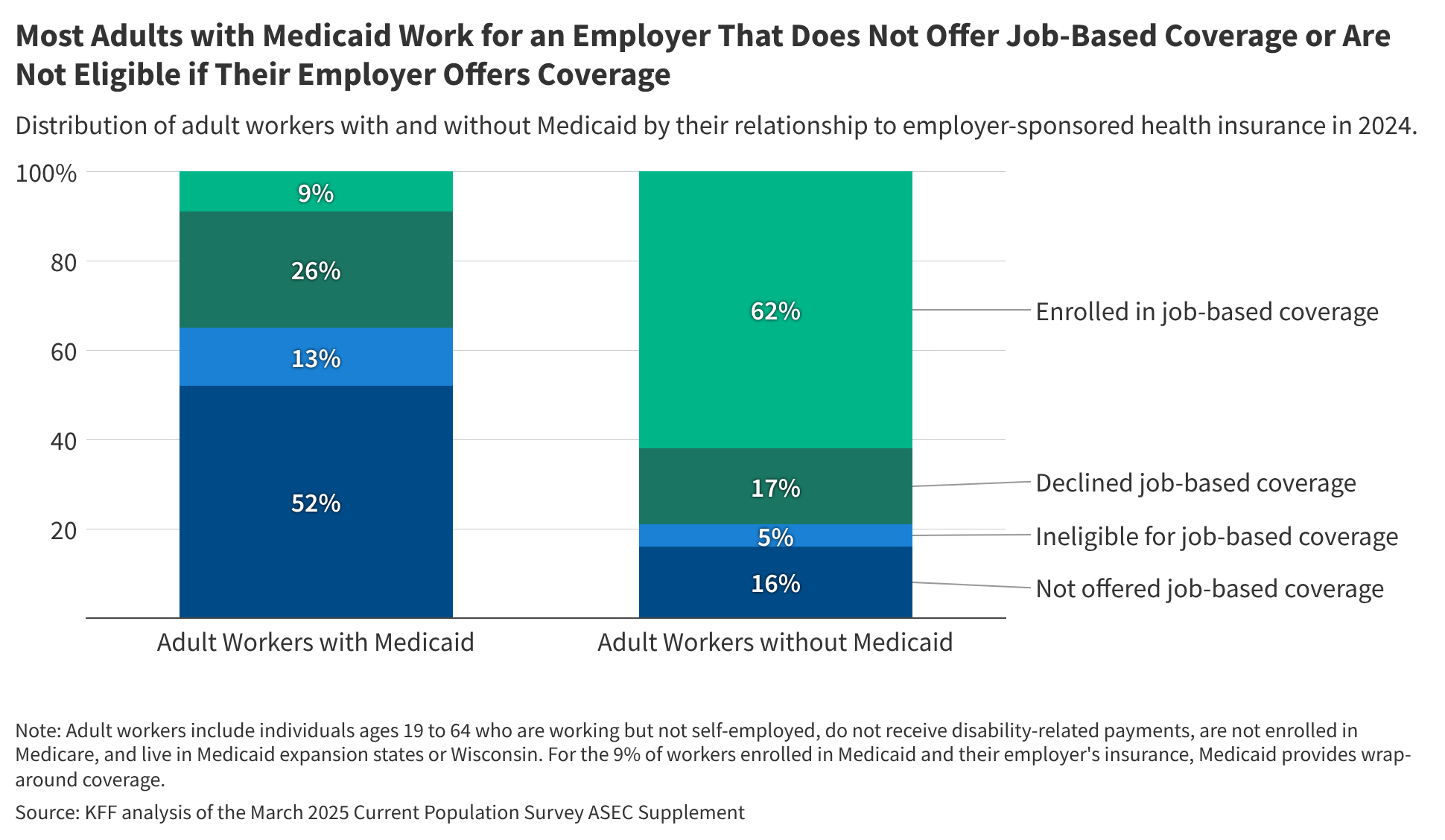

The data reveals that a significant portion of Medicaid adult workers either work for employers who don’t offer health insurance or are ineligible for the coverage offered. To enroll in job-based insurance, workers must be employed by a company that provides it and meet the eligibility criteria. According to the analysis, nearly two-thirds (65%) of Medicaid adult workers in expansion states and Wisconsin fall into one of these categories: working for an employer that doesn’t offer coverage (52%) or being ineligible for the coverage offered (13%). In contrast, only about one in five (21%) non-Medicaid covered adult workers in the same states face similar barriers – either not being offered coverage (16%) or not qualifying (5%).

Affordability as a Major Barrier

Even when offered job-based insurance, many Medicaid adult workers decline it due to cost. Approximately a quarter (26%) of Medicaid workers decline coverage when eligible, compared to 17% of those not covered by Medicaid. For those who don’t enroll, Medicaid often provides a more affordable, and sometimes more comprehensive, alternative to the insurance available through their employer. About one in ten (9%) adult Medicaid workers are covered by both Medicaid and an employer plan, with Medicaid often supplementing coverage by covering premiums, cost-sharing, and benefits not included in the employer’s plan.

The cost burden is particularly acute for low-wage workers. Those in firms where at least 35% of employees earn $37,000 or less annually face higher premium contributions for both family and single coverage (31% vs. 26% for family coverage and 19% vs. 16% for single coverage) compared to workers at firms with fewer low-wage employees. This suggests that low-income families with job-based insurance may spend a larger proportion of their income on healthcare costs overall.

Part-Time Work and Industry Impact

Medicaid adults working part-time are less likely to be eligible for job-based insurance than their full-time counterparts. About one-third (32%) of Medicaid adult workers are part-time, and only 21% of these workers are eligible for employer coverage, compared to 42% of full-time workers. This disparity is linked to the Affordable Care Act’s shared responsibility mandate, which requires employers with 50 or more full-time equivalent employees to offer minimum essential coverage, but only to employees working an average of at least 30 hours per week. Fewer firms offer benefits to part-time workers.

Eligibility also varies significantly by industry. The share of Medicaid adult workers eligible for job-based insurance ranges from 56% in the mining industry to 20% in the agricultural and forestry industry. Those working in educational and health services (23% of Medicaid adult workers) have a relatively high eligibility rate of 41%, while those in the leisure and hospitality industry (16% of Medicaid adult workers) have a much lower rate of 22%.

Hours Worked as a Key Eligibility Factor

Among Medicaid adult workers offered insurance by their employer, the most common reason for ineligibility is insufficient work hours. Approximately 13% of Medicaid adult workers work for an employer offering insurance but don’t qualify, and nearly 70% of these workers are ineligible because they don’t meet the required weekly or annual hour thresholds. Another 13% haven’t worked for the employer long enough to qualify, and 5% are ineligible due to restrictions on contract or temporary employees.

As states continue to implement the new work requirements within Medicaid, understanding the barriers to job-based insurance for this population is crucial. The data suggests that simply requiring work is unlikely to significantly shift coverage to employer-sponsored plans, given the existing limitations in access and affordability. Further analysis will be needed to assess the long-term impact of these policies on Medicaid enrollment and access to care.

This analysis provides valuable insight into the complex relationship between Medicaid, employment, and access to health insurance. Continued monitoring of these trends will be essential as policymakers navigate the evolving healthcare landscape.

Disclaimer: This article provides informational content and should not be considered medical or financial advice. Consult with a qualified professional for personalized guidance.

What are your thoughts on the new Medicaid work requirements? Share your comments below.