Venezuela Begins October ‘Economic War’ Bonus Payments to Pensioners

Table of Contents

- 1. Venezuela Begins October ‘Economic War’ Bonus Payments to Pensioners

- 2. Important Increase in Bolivar Value

- 3. Pension and Bonus Payments Combined

- 4. Understanding Venezuela’s economic Challenges

- 5. Frequently Asked Questions About the Bonus

- 6. What are the primary reasons governments are implementing pensioner bonus payments?

- 7. Starting Bonus Payments for Pensioners Amid Economic Challenges: A Guide

- 8. Understanding the Recent Pensioner Bonus Initiatives

- 9. Why the Bonus Payments? Addressing Economic Hardship

- 10. Eligibility Criteria & Payment Amounts: A Global Snapshot

- 11. Navigating the Application Process: A Step-by-Step Guide

- 12. Opportunities for Content Writers: Filling the Information Gap

- 13. Real-World Example: The UK Cost of Living Payments (2022-2024)

Caracas, Venezuela – Payments of the October “Bonus Against the Economic War” commenced this Wednesday, targeting pensioners across the nation. This supplemental payment aims to provide economic relief amidst ongoing financial challenges.

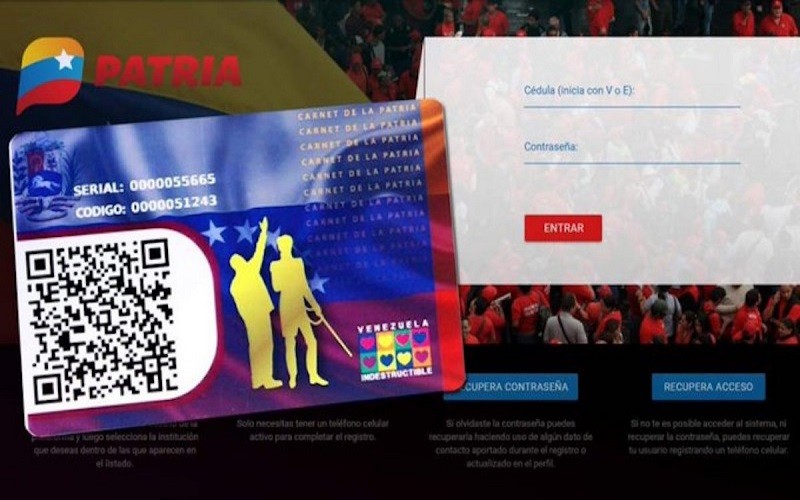

Beneficiaries will receive 9,950 bolivars,wich translates to approximately 47.31 United States dollars, based on the current exchange rate established by the Central Bank of Venezuela.The distribution is being facilitated through the carnet de la Patria identification system, a national program designed to deliver social assistance.

Important Increase in Bolivar Value

The October bonus represents a substantial 27.56 percent increase in bolivar terms compared to the 7,800 bolivars disbursed in September. However, when viewed in dollar terms, the increase is more modest, at 1.04 percent, reflecting recent depreciation of the Bolivar.

This adjustment underscores the persistent devaluation pressures within the Venezuelan economy. According to data from the International Monetary Fund (IMF), Venezuela’s inflation rate remains among the highest globally, significantly eroding purchasing power.

Pension and Bonus Payments Combined

Along wiht the bonus, the Venezuelan Institute of Social Security (IVSS) has completed the distribution of october pensions, amounting to 130 bolivars – roughly 0.62 US cents. Furthermore, a first-month bonus of 130 bolivars was also paid, bringing the total combined payment to 260 bolivars, equivalent to approximately $1.24 at the official exchange rate.

The IVSS is actively promoting the use of electronic banking platforms to streamline payments and enhance security for its beneficiaries. Despite thes supplemental payments, advocacy groups maintain that the current amounts remain inadequate to address the basic necessities of pensioners, particularly concerning food and healthcare.

Did You Know? Venezuela’s Carnet de la Patria, introduced in 2017, is a controversial system, criticized by some for potential political control and data privacy concerns, while supporters argue it’s essential for efficient social program delivery.

Pro Tip: Always verify exchange rates from multiple sources to understand the real value of any financial transaction, especially when dealing with currencies subject to volatile fluctuations.

| Payment Type | October Amount (Bolivars) | October Amount (USD) | September Amount (Bolivars) |

|---|---|---|---|

| Bonus Against Economic War | 9,950 | $47.31 | 7,800 |

| Monthly Pension | 130 | $0.62 | N/A |

| First-Month Bonus | 130 | $0.62 | N/A |

Understanding Venezuela’s economic Challenges

venezuela has been grappling with a severe economic crisis for several years, characterized by hyperinflation, shortages of essential goods, and a decline in oil production – the country’s primary source of revenue. These factors have led to widespread poverty and emigration.The “Bonus Against the economic War,” initiated several years ago, is a recurring attempt by the government to mitigate the impact of these challenges on vulnerable populations.

The effectiveness of these bonuses is frequently debated, with critics arguing they are a short-term fix that doesn’t address the root causes of the economic problems. Others contend that even modest assistance can provide a lifeline for those struggling to survive.

You can explore more details about the Venezuelan economic Crisis here.

What impact do you think supplemental bonuses have on long-term economic stability? How can governments best support their citizens during times of economic hardship?

Frequently Asked Questions About the Bonus

- What is the “Bonus Against the Economic War”? It is a supplemental payment made by the Venezuelan government to pensioners and other vulnerable groups to help offset the impact of economic hardship.

- How is the bonus distributed? Payments are made through the Carnet de la Patria system directly to beneficiaries’ accounts.

- What is the current value of the October bonus in US dollars? The October bonus is worth approximately $47.31 USD, based on the central Bank of Venezuela’s exchange rate.

- Has the bonus amount changed recently? Yes, the bonus has increased by 27.56% in bolivar terms compared to September’s payment.

- Is the bonus enough to cover basic expenses? Advocacy groups suggest the bonus amount is insufficient to fully cover essential needs like food and healthcare.

- Where can I find more information about the Carnet de la Patria? Learn more from Reuters.

What are the primary reasons governments are implementing pensioner bonus payments?

Starting Bonus Payments for Pensioners Amid Economic Challenges: A Guide

Understanding the Recent Pensioner Bonus Initiatives

Recent economic headwinds – including persistent inflation and rising energy costs – have prompted governments and financial institutions globally to explore avenues for supporting pensioners. A key response has been the introduction of one-off or recurring pensioner bonus payments. These payments aim to alleviate financial strain and maintain the purchasing power of retirees. Understanding the specifics of these initiatives is crucial, both for pensioners themselves and for content writers seeking to provide helpful guidance.

Why the Bonus Payments? Addressing Economic Hardship

The core driver behind these pension top-ups is the erosion of living standards due to inflation. Fixed incomes, like pensions, are especially vulnerable when the cost of essential goods and services increases.

* Inflation Protection: Bonuses act as a temporary buffer against rising prices.

* Energy Bill Support: Manny schemes specifically target assistance with escalating energy costs.

* Economic Stimulus: Increased spending by pensioners can provide a small boost to local economies.

* Social Equity: Recognizing the contributions of retirees and ensuring a dignified standard of living.

These payments aren’t simply handouts; they’re increasingly viewed as a necessary component of retirement income security in a volatile economic climate. Related search terms include “cost of living crisis pensioners,” “pensioner financial assistance,” and “inflation impact on retirement.”

Eligibility Criteria & Payment Amounts: A Global Snapshot

Eligibility for pensioner bonuses varies considerably by country and even by region within countries. Here’s a brief overview (as of late 2025 – information is subject to change, so always verify with official sources):

* united Kingdom: The UK government has implemented several cost of living payments, including specific amounts for pensioners receiving Pension Credit. Amounts have ranged from £300 to £600 per eligible individual.

* United States: While a nationwide bonus isn’t currently in place, some states and cities are offering property tax relief or utility assistance programs targeted at seniors.

* Canada: Provinces like British Columbia and Alberta have offered one-time payments to low-income seniors to help with affordability.

* australia: The Australian government provides regular energy assistance payments to eligible pensioners.

* European Union: Several EU member states have introduced similar measures, often linked to energy prices and inflation rates.

Key eligibility Factors:

- Age (typically 65 or older)

- Income level (frequently enough means-tested)

- Pension type (state pension, private pension, etc.)

- Residency status

content focusing on “pensioner bonus eligibility” and “how to claim pensioner benefits” will be highly sought after.

Applying for these bonuses isn’t always straightforward.Many pensioners, particularly those less familiar with online systems, require assistance.Here’s a general guide:

- Identify Applicable Schemes: Research which programs are available in your specific location. Official government websites are the most reliable source.

- Check Eligibility: Carefully review the eligibility criteria to ensure you qualify.

- Gather Required Documents: This may include proof of age,income statements,bank details,and pension statements.

- Submit Application: Applications are frequently enough submitted online, by mail, or in person at designated service centers.

- Follow Up: Keep a record of your application and follow up if you haven’t received a response within a reasonable timeframe.

Resources for Assistance:

* Citizens Advice Bureau (UK): Provides free, independent advice on a range of issues, including benefits.

* Senior Centers: Often offer assistance with completing forms and navigating government programs.

* Financial Advisors: Can provide personalized guidance on managing retirement finances.

Opportunities for Content Writers: Filling the Information Gap

the rollout of these bonus payments has created a significant demand for clear, concise, and accessible information. Here are some content opportunities:

* “ultimate Guide to Pensioner Bonuses [Year]”: A complete resource covering all available schemes.

* “How to Claim Your Pensioner Bonus: A Step-by-Step Guide”: Focus on the application process.

* “pensioner Bonus Payment Calculator”: An interactive tool to estimate potential eligibility and payment amounts.

* “Protecting your Pension from Inflation: Strategies for retirees”: Broader financial planning advice.

* “Scams targeting Pensioners: How to Stay Safe”: Addressing the risk of fraud.

Keywords to Target: “pensioner cost of living payment“, “senior benefits“, “retirement financial planning“, “pensioner grants“, “elderly financial assistance“.

Real-World Example: The UK Cost of Living Payments (2022-2024)

The UK’s response to the cost of living crisis provides a valuable case study. The government implemented a series of payments targeted at vulnerable households, including pensioners. While the scheme faced some criticism regarding complexity and eligibility criteria, it demonstrably provided financial relief to millions of retirees. This example highlights the importance of clear interaction and accessible application processes.