UnitedHealth’s Doctor Strategy Shift: A Preview of Healthcare Consolidation’s Next Phase

The healthcare landscape is bracing for a significant realignment. UnitedHealth Group, already possessing the nation’s largest network of physicians – a staggering 90,000 strong – is pivoting from a model of affiliated doctors to one dominated by healthcare consolidation and directly employed physicians. This isn’t simply a financial maneuver; it’s a signal of a broader trend towards integrated care and, crucially, increased control over costs and patient pathways.

The Rise of Employed Physicians: Why Now?

For years, UnitedHealth, through its Optum Health division, has built its network by affiliating with independent practices. This offered scale but limited direct influence. The shift towards employing physicians directly allows UnitedHealth to exert greater control over clinical decision-making, negotiate more favorable contracts with insurers (including its own), and streamline care delivery. New CEO Stephen Hemsley explicitly stated on the company’s recent earnings call that trimming the network and exiting certain markets are also part of this strategy.

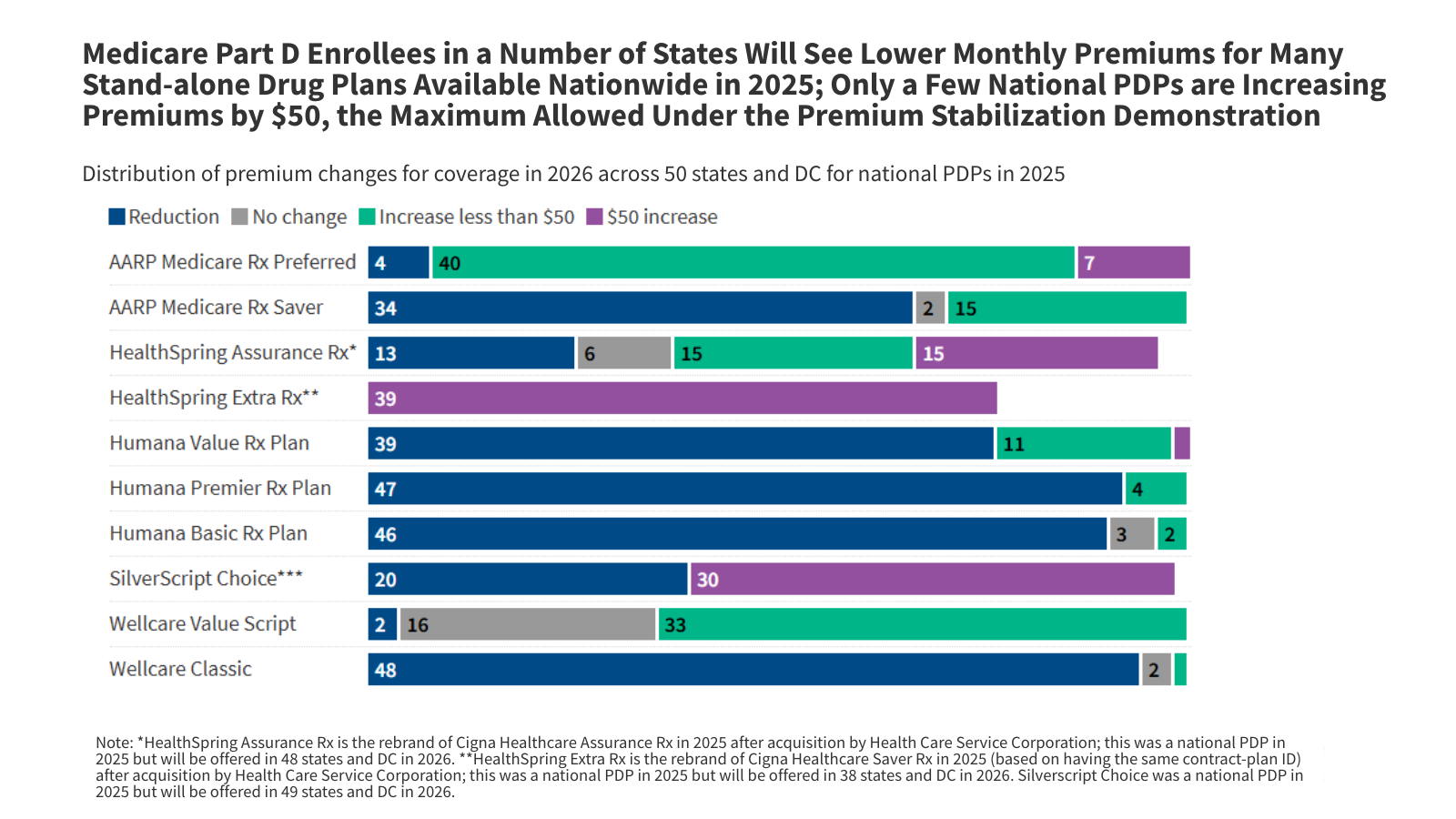

Experts suggest this move is a direct response to mounting financial pressures. While UnitedHealth remains a behemoth, rising medical costs and increasing scrutiny of healthcare spending are forcing a re-evaluation of its business model. Employing doctors allows for a more predictable cost structure and the potential to implement value-based care initiatives more effectively. This is a departure from the previous emphasis on sheer network size.

What Does This Mean for Patients?

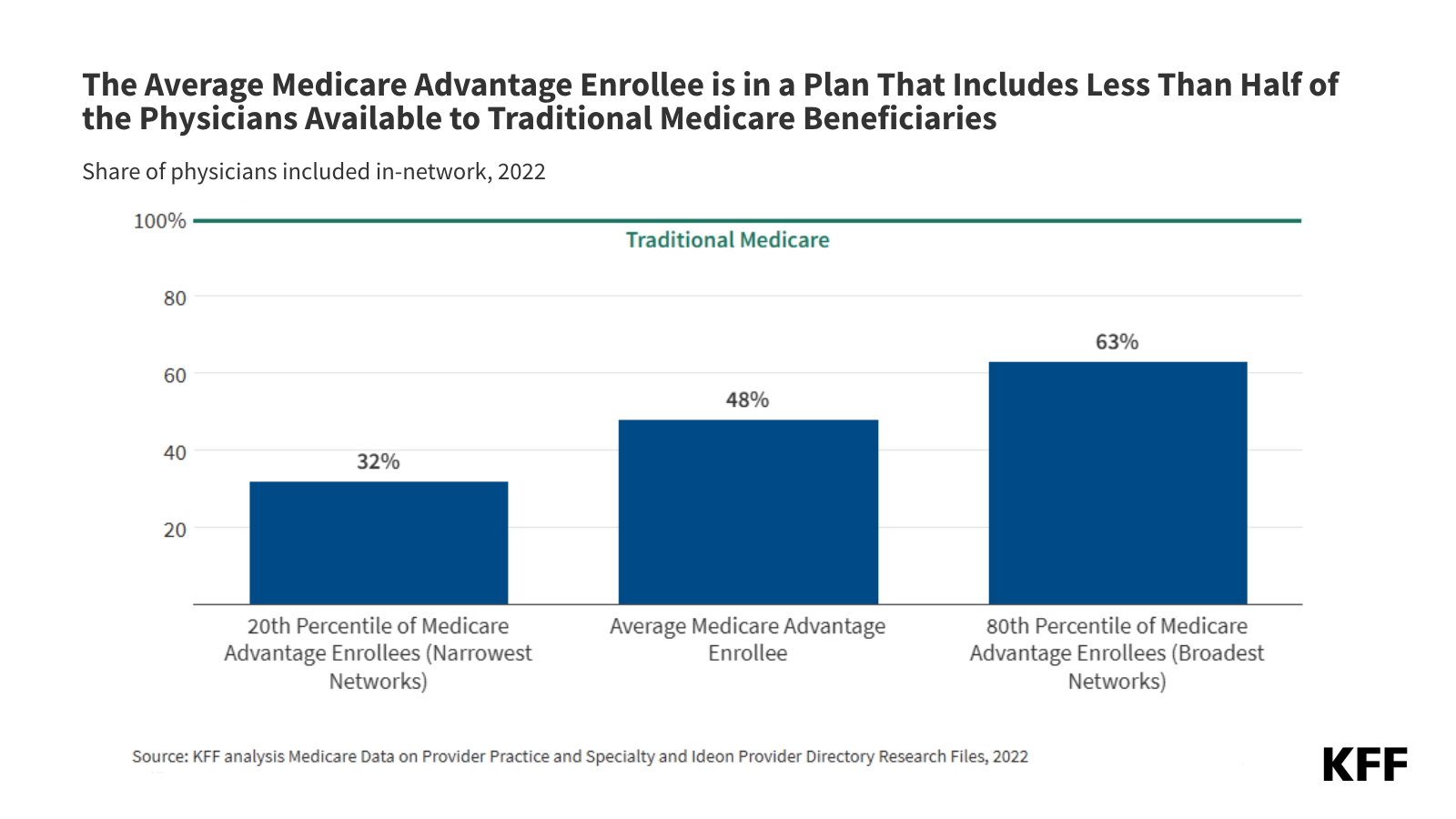

The immediate impact on patients is uncertain, but potential consequences are significant. Increased consolidation can lead to reduced choice of providers, particularly in markets where UnitedHealth decides to reduce its footprint. However, proponents argue that integrated systems can improve care coordination and quality, especially for patients with chronic conditions. The key will be whether these benefits outweigh the potential drawbacks of reduced competition. A study by the American Medical Association highlights the complex relationship between consolidation and healthcare costs, noting that while it can lead to efficiencies, it also often results in higher prices.

Beyond UnitedHealth: A Wider Trend

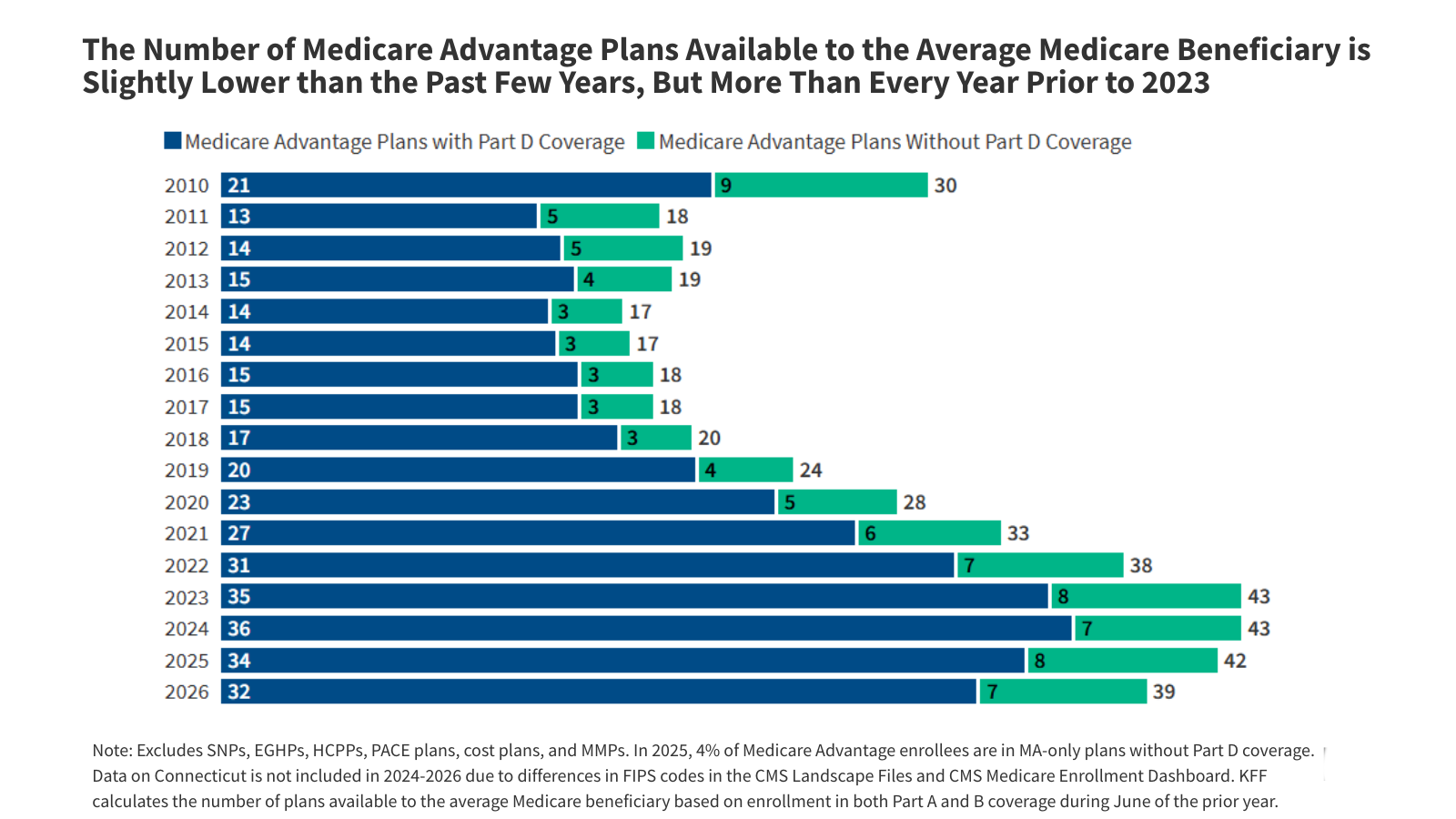

UnitedHealth’s move isn’t happening in a vacuum. Across the country, hospital systems and insurers are increasingly acquiring physician practices. This trend is driven by several factors, including the shift towards value-based care, the desire to control costs, and the need to improve care coordination. Private equity firms are also heavily investing in physician practices, further accelerating consolidation. This creates a ripple effect, impacting everything from physician autonomy to the availability of independent practices.

The Role of Technology in Consolidation

Technology is playing a crucial role in enabling this consolidation. Electronic health records (EHRs) and data analytics allow integrated systems to track patient outcomes, identify areas for improvement, and manage costs more effectively. Telehealth is also expanding access to care, particularly in rural areas, and can be integrated into consolidated systems to provide more convenient and affordable care options. However, concerns remain about data privacy and security as more patient information is shared across larger networks.

Implications for Independent Practices

The future looks increasingly challenging for independent physician practices. They face mounting administrative burdens, declining reimbursement rates, and increasing competition from larger, consolidated systems. Many are considering joining hospital systems or larger groups to gain economies of scale and improve their financial stability. This could lead to a further reduction in the number of independent practices, potentially limiting patient choice and innovation.

The shift towards employed physicians also raises questions about physician autonomy and professional satisfaction. While some physicians may welcome the stability and resources offered by larger systems, others may fear losing control over their clinical practice. Finding a balance between integration and autonomy will be crucial for attracting and retaining talented physicians.

Ultimately, UnitedHealth’s strategic shift is a harbinger of things to come. The healthcare industry is undergoing a period of rapid consolidation, driven by financial pressures, technological advancements, and the desire to improve care delivery. Navigating this changing landscape will require careful planning, strategic partnerships, and a focus on patient-centered care. What remains to be seen is whether this consolidation will truly deliver on its promise of lower costs and better outcomes, or simply create larger, more powerful entities with limited accountability.

What are your predictions for the future of physician employment models? Share your thoughts in the comments below!