Metaplanet‘s Market Value Now Trails Bitcoin Reserves

Table of Contents

- 1. Metaplanet’s Market Value Now Trails Bitcoin Reserves

- 2. From Premium to Discount: A Rapid Reversal

- 3. The Rise and Fall of Digital Asset Treasury firms

- 4. Understanding Digital Asset Treasury Strategies

- 5. Frequently Asked Questions about Bitcoin and Corporate Investments

- 6. What are the key risks associated with Metaplanet’s leveraged investment strategy involving Data Availability Tokens (DATs)?

- 7. Metaplanet Value Declines Amidst DAT Market Turmoil,Lagging Behind Bitcoin Holdings

- 8. The Recent Downturn in Metaplanet’s Performance

- 9. Understanding the Metaplanet Strategy: DATs and Bitcoin Exposure

- 10. DAT Market Instability: A Key Driver of Metaplanet’s Decline

- 11. Comparing Performance: Metaplanet vs. Direct Bitcoin Holdings

- 12. The Impact of Leverage and Debt Financing

- 13. Investor Sentiment and Future outlook

- 14. Potential Scenarios for Metaplanet

- 15. The Broader Implications for the DAT Market

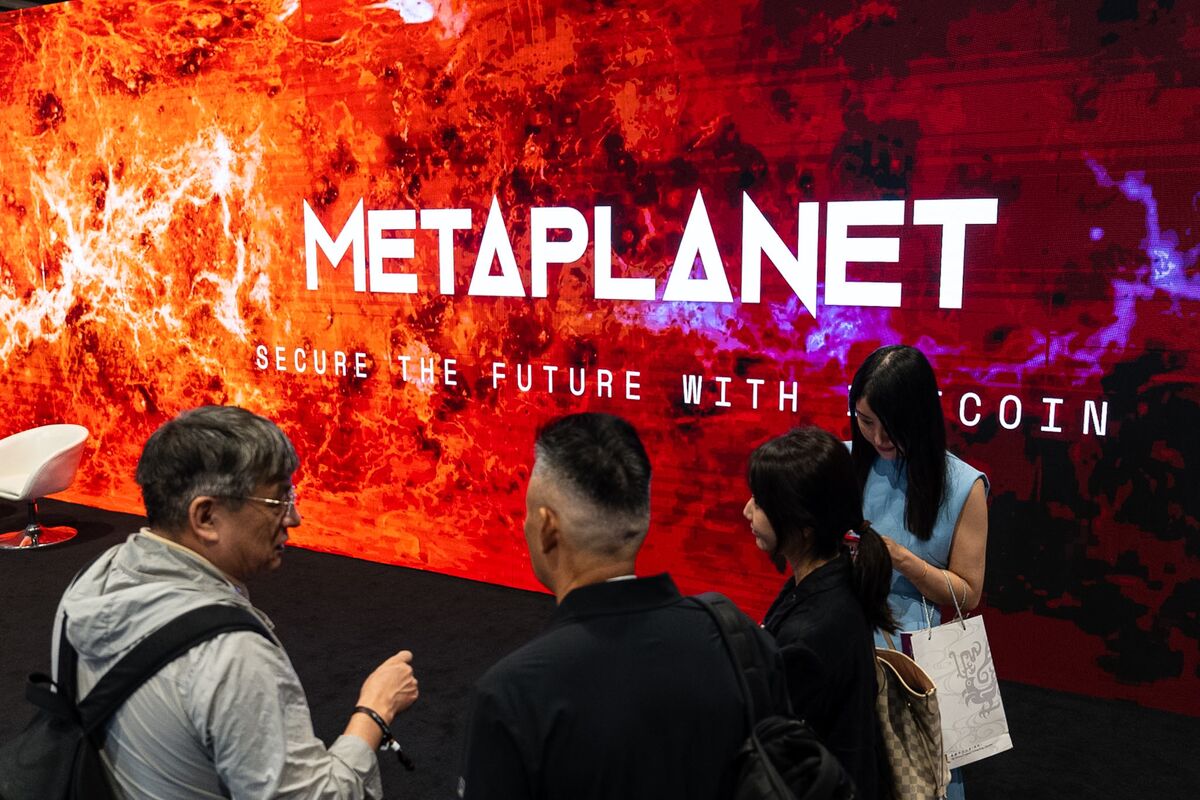

Tokyo, Japan – A significant growth has unfolded in the world of corporate Bitcoin strategies as Metaplanet Inc. recently experienced a decline in its enterprise value, falling below the total value of its Bitcoin reserves. This shift underscores a growing sense of caution among investors regarding companies that prioritize holding cryptocurrency as a core asset.

The Japanese hotel operator,Metaplanet,made a strategic pivot in April 2024,committing to accumulating Bitcoin.Initially, the market rewarded this decision, with the company’s stock trading at a considerable premium compared to the net asset value of its Bitcoin holdings.However, that dynamic has swiftly reversed.

This change in valuation reflects broader trends impacting the digital asset landscape. Increased market volatility, coupled with regulatory uncertainties, have contributed to a decrease in investor confidence in Bitcoin-focused firms. The recent dip suggests that the speculative fervor that drove valuations higher earlier in the year is now cooling down.

The Rise and Fall of Digital Asset Treasury firms

metaplanet’s story is emblematic of a larger trend: the fluctuating fortunes of companies adopting a “digital asset treasury” strategy. These firms, which hold cryptocurrencies on their balance sheets, were once seen as pioneers, possibly offering investors exposure to the burgeoning digital economy. Though, the inherent volatility of cryptocurrencies poses a significant risk, as demonstrated by Metaplanet’s current situation.

According to a recent report by CoinGecko,the total market capitalization of cryptocurrencies experienced a 15% correction in the third quarter of 2024,impacting the performance of treasury-focused firms. CoinGecko Data.

| Company | Original Strategy | Current Status |

|---|---|---|

| Metaplanet Inc. | Bitcoin Accumulation (April 2024) | Enterprise Value Below Bitcoin Reserves |

| MicroStrategy | Long-Term Bitcoin Holding | Share Price Correlated with Bitcoin Price |

did You No? MicroStrategy, another prominent corporate Bitcoin holder, has seen its stock price closely mirror the price fluctuations of Bitcoin, highlighting the interconnectedness of these assets.

Pro Tip: Investors considering companies with significant cryptocurrency holdings should carefully assess their risk tolerance and understand the potential for substantial price swings.

The situation raises crucial questions about the long-term viability of this investment approach. Will other companies follow suit and adjust their strategies, or will Metaplanet’s experience serve as a cautionary tale?

What impact will increasing regulatory scrutiny of cryptocurrencies have on these firms? And, could a renewed surge in Bitcoin’s price reverse this trend and restore investor confidence?

Understanding Digital Asset Treasury Strategies

A digital asset treasury strategy involves a company allocating a portion of its capital to cryptocurrencies like Bitcoin. The rationale behind this approach often centers on the belief that these assets will appreciate in value over time, providing a hedge against inflation, or offering diversification benefits.However, it’s crucial to acknowledge the inherent risks, including price volatility, regulatory uncertainties, and security concerns.A well-defined risk management framework is vital for any company considering such a strategy.

Frequently Asked Questions about Bitcoin and Corporate Investments

- What is a Bitcoin treasury strategy? A strategy where a company holds Bitcoin as a significant part of its assets.

- Is investing in Bitcoin risky for companies? Yes, Bitcoin’s price volatility presents a substantial risk to corporate balance sheets.

- What factors influence the value of Bitcoin? Market demand,regulatory developments,and macroeconomic conditions all impact Bitcoin’s price.

- How does Metaplanet’s situation affect other companies? It serves as a warning about the potential downsides of heavily investing in digital assets.

- Will digital asset treasury strategies become more common? It depends on evolving market conditions and regulatory clarity.

Share your thoughts in the comments below. Do you think corporate Bitcoin holdings are a smart investment or a risky gamble?

What are the key risks associated with Metaplanet’s leveraged investment strategy involving Data Availability Tokens (DATs)?

Metaplanet Value Declines Amidst DAT Market Turmoil,Lagging Behind Bitcoin Holdings

The Recent Downturn in Metaplanet’s Performance

Metaplanet,a publicly traded company known for its strategy of holding Bitcoin treasury reserves via Data Availability Tokens (DATs),has experienced a significant decline in value recently. This downturn is largely attributed to volatility within the broader DAT market and a widening performance gap compared to direct Bitcoin holdings. Investors are increasingly scrutinizing the complexities of this indirect Bitcoin exposure, leading to selling pressure on Metaplanet shares. The current market conditions highlight the risks associated with leveraged and derivative bitcoin investment strategies.

Understanding the Metaplanet Strategy: DATs and Bitcoin Exposure

Metaplanet’s core investment thesis revolves around acquiring DATs issued by companies building layer-2 scaling solutions for Bitcoin. These tokens, in theory, provide exposure to the growth of the Bitcoin ecosystem without directly holding Bitcoin. The company believes this approach offers potential for higher returns, but recent events suggest otherwise.

* How DATs Work: DATs represent a share in the future revenue generated by data availability layers built on Bitcoin.

* Metaplanet’s Implementation: The company uses debt financing to purchase these DATs, aiming to generate returns that exceed borrowing costs.

* The Appeal: This strategy initially attracted investors seeking a unique and possibly high-yield way to gain Bitcoin exposure.

DAT Market Instability: A Key Driver of Metaplanet’s Decline

The DAT market has proven to be considerably more volatile than Bitcoin itself. Several factors contribute to this instability:

* Limited Liquidity: The DAT market is relatively small and illiquid, making it susceptible to large price swings.

* Project-Specific Risks: Each DAT is tied to the success of a specific layer-2 project, introducing project-specific risks.

* Regulatory Uncertainty: The regulatory landscape surrounding layer-2 solutions and DATs remains unclear, adding another layer of risk.

* Macroeconomic Factors: Broader economic conditions and shifts in investor sentiment also impact the DAT market.

Recent setbacks for several key layer-2 projects have directly impacted the value of the DATs held by Metaplanet, triggering a cascade of negative consequences. This has led to a reassessment of the risk-reward profile of Metaplanet’s investment strategy.

Comparing Performance: Metaplanet vs. Direct Bitcoin Holdings

The performance disparity between Metaplanet and direct Bitcoin holdings has become increasingly pronounced. While Bitcoin has demonstrated resilience and even gains during certain periods, Metaplanet’s share price has consistently lagged behind.

Performance Comparison (YTD 2025 – October 14th):

| Asset | Performance |

|---|---|

| Bitcoin (BTC) | +45% |

| Metaplanet (MTLP) | -20% |

This divergence highlights the inherent risks of indirect Bitcoin exposure through DATs.Direct Bitcoin ownership offers simpler, more transparent, and arguably less risky exposure to the cryptocurrency.

The Impact of Leverage and Debt Financing

Metaplanet’s reliance on debt financing amplifies both potential gains and losses. While leverage can boost returns in a bull market, it can also exacerbate losses during a downturn. The company’s high debt load has become a significant concern for investors, particularly as interest rates remain elevated.

* Debt-to-Equity Ratio: Metaplanet’s debt-to-equity ratio is currently above industry averages, indicating a higher level of financial risk.

* Interest Rate Sensitivity: The company’s profitability is highly sensitive to changes in interest rates.

* Margin Calls: A further decline in DAT values could potentially trigger margin calls, forcing Metaplanet to sell assets at unfavorable prices.

Investor Sentiment and Future outlook

Investor sentiment towards Metaplanet has soured considerably in recent weeks. Concerns about the DAT market,leverage,and the widening performance gap with Bitcoin have led to increased selling pressure.

Potential Scenarios for Metaplanet

* scenario 1: market Recovery: A broad recovery in the DAT market could alleviate some of the pressure on Metaplanet. However,this scenario relies on the success of underlying layer-2 projects.

* Scenario 2: Restructuring: Metaplanet may be forced to restructure its debt or sell assets to reduce its leverage.

* Scenario 3: Continued Decline: If the DAT market remains weak and Bitcoin continues to outperform, Metaplanet’s share price could continue to decline.

The Broader Implications for the DAT Market

Metaplanet’s struggles serve as a cautionary tale for investors considering exposure to the DAT market. The company’s experience underscores the importance of:

* due Diligence: Thoroughly researching the underlying projects