Gold Hits Record High: Surpasses $3,534 Per Ounce

Table of Contents

- 1. Gold Hits Record High: Surpasses $3,534 Per Ounce

- 2. WhatS Driving the Rally?

- 3. What specific geopolitical events are moast substantially contributing to the current surge in gold prices?

- 4. Gold Sets New Past Price Record Amidst Economic Uncertainty and Investor Demand Surge

- 5. The Rally to $3,000: What’s Driving Gold’s Ascent?

- 6. key Drivers Behind the Price Surge

- 7. Forms of Gold Investment: diversifying Your Options

- 8. Historical Context: Gold’s Performance During Past Crises

- 9. Risks and Considerations for Gold Investors

- 10. The Future Outlook: Will Gold Continue to rise?

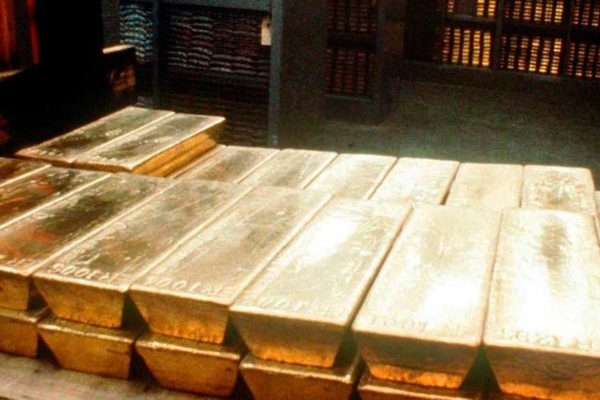

New York,NY – Gold futures soared to an unprecedented high on Friday,reaching $3,534.1 per ounce at teh Mercantil de Chicago stock market. This marks a critically important increase of 2.32% adn eclipses the previous record of $3,509.9 set on April 22nd.

The surge in gold prices follows the United States’ recent imposition of import tariffs on 1 kilogram gold bullion.Both futures and cash prices have experienced consecutive weeks of gains, fueled by the uncertainty surrounding these new tariffs.

WhatS Driving the Rally?

Analysts point to a confluence of factors, both short-term and structural, underpinning gold’s remarkable performance in 2025. The precious metal is increasingly viewed as a safe haven asset amid growing global instability.

Goldman Sachs highlights escalating geopolitical conflicts and concerns regarding U.S. fiscal policy as key drivers. Investors are actively seeking secure investments, and gold is benefiting from this flight to safety.

Beyond the Headlines: why gold Matters

Gold has long been considered a hedge against inflation and economic uncertainty. Unlike fiat currencies, its supply is limited, preserving its value over time. This inherent scarcity, coupled with its historical role as a store of wealth, makes it a compelling investment during periods of market volatility.

The recent tariff implementation adds another layer of complexity. By increasing the cost of importing gold, the U.S. may inadvertently further drive up demand and prices, as investors seek to acquire the metal before costs escalate further.

Looking Ahead

The future trajectory of gold prices remains uncertain. However, the current surroundings of geopolitical risk, economic uncertainty, and evolving trade policies suggests that gold’s appeal as a safe haven asset is likely to persist. Investors should closely monitor these developments and consider the role of gold within a diversified portfolio.

What specific geopolitical events are moast substantially contributing to the current surge in gold prices?

Gold Sets New Past Price Record Amidst Economic Uncertainty and Investor Demand Surge

The Rally to $3,000: What’s Driving Gold’s Ascent?

Gold prices have shattered previous records, surging past $3,000 per ounce in early August 2025. This unprecedented climb isn’t a sudden event; it’s the culmination of several converging factors, primarily escalating global economic uncertainty and a dramatic increase in investor demand for safe-haven assets. Understanding these dynamics is crucial for investors considering adding gold to their portfolio or re-evaluating existing holdings.The current gold market is unlike anything we’ve seen in recent history.

key Drivers Behind the Price Surge

Several interconnected forces are fueling this historic gold price increase:

Geopolitical Instability: Ongoing conflicts and rising tensions in multiple regions (Eastern Europe, the South china Sea, and the Middle East) are creating a risk-off environment. Investors flock to gold as a store of value during times of geopolitical stress.

Inflationary Pressures: While inflation has cooled from its 2022 peak, it remains stubbornly above central bank targets in manny major economies. Gold is traditionally viewed as an inflation hedge, preserving purchasing power when currency values decline.

Central Bank Policies: the Federal Reserve and other central banks are navigating a complex landscape of slowing growth and persistent inflation. Uncertainty surrounding future interest rate decisions is boosting gold’s appeal. dovish signals from central banks frequently enough correlate with rising gold prices.

Currency devaluation: concerns about the long-term stability of major fiat currencies, including the US dollar and the Euro, are prompting investors to diversify into gold. The weakening dollar specifically makes gold more attractive to international buyers.

Increased Demand from Emerging Markets: Demand for gold is notably strong in countries like China and India,driven by cultural significance,investment demand,and growing wealth. China’s central bank has been steadily accumulating gold reserves, signaling confidence in the metal.

Forms of Gold Investment: diversifying Your Options

Investors have a variety of avenues to gain exposure to gold:

- Physical Gold: This includes gold bars, gold coins (like American Eagles, Krugerrands, and Maple Leafs), and gold jewellery. While offering direct ownership, physical gold involves storage and insurance costs. Be aware of the risk of counterfeit coins, as highlighted in recent reports (see resources section).

- Gold ETFs (Exchange-Traded Funds): These funds hold physical gold or gold futures contracts, offering a convenient and liquid way to invest. Popular options include SPDR Gold Shares (GLD) and iShares Gold Trust (IAU).

- Gold Mining Stocks: Investing in companies that mine gold can provide leveraged exposure to gold prices. However,these stocks are also subject to company-specific risks.

- Gold Futures Contracts: These are agreements to buy or sell gold at a predetermined price and date. Futures trading is highly speculative and not suitable for all investors.

Historical Context: Gold’s Performance During Past Crises

Looking back at historical events provides valuable outlook:

The 1970s Inflation: Gold soared during the high inflation of the 1970s, serving as a powerful hedge against currency devaluation.

the 2008 Financial Crisis: Gold experienced a meaningful rally during the 2008 financial crisis as investors sought safe-haven assets.

The COVID-19 Pandemic: Gold prices surged in early 2020 as the pandemic triggered economic uncertainty and market volatility.

These historical patterns demonstrate gold’s tendency to perform well during periods of economic turmoil.

Risks and Considerations for Gold Investors

While gold offers potential benefits, it’s essential to be aware of the risks:

Chance Cost: Gold doesn’t generate income like stocks or bonds. Holding gold means foregoing potential returns from other investments.

Storage Costs: Physical gold requires secure storage,which can incur costs.

Price Volatility: While often considered a safe haven, gold prices can still be volatile in the short term.

counterfeit Risks: As noted in reports from organizations like Gold.de, the market for fake gold coins and bars exists. Thorough due diligence is crucial when purchasing physical gold.

The Future Outlook: Will Gold Continue to rise?

Most analysts predict that gold will continue to trade in a bullish trend in the near to medium term. Factors supporting this outlook include:

Continued Geopolitical Risks: The ongoing conflicts and tensions are unlikely to resolve quickly.

Persistent Inflation: While inflation may moderate, it’s unlikely to return to pre-pandemic levels soon.

Central Bank Uncertainty: The path of interest rate policy remains unclear.

Strong Demand from Emerging Markets: Demand from China and India is expected to remain robust.

However, a significant shift in global economic conditions or a sudden