Nvidia Faces China Export licence Hurdle As Memory Shortage Strains AI Chip Supply

Table of Contents

- 1. Nvidia Faces China Export licence Hurdle As Memory Shortage Strains AI Chip Supply

- 2. Key facts at a glance

- 3. Why this matters in the AI hardware race

- 4. Engage with us

- 5. Loss, raising unit costs to $1,800 per stack (TSMC internal briefing, Q4 2024).Nvidia’s bill‑of‑materials (BOM) for each GH200 GPU now exceeds $10,000, squeezing price competitiveness.Domestic memory roadmapChangXin and YMTC focus on DDR5/LPDDR5; HBM development slated for 2027, still years behind current demand.No viable short‑term alternative to replace HBM in data‑center GPUs.3. How the Shortage Disrupts Nvidia’s China Roadmap

- 6. 1. Nvidia’s China AI‑Chip Playbook

- 7. 2. The HBM Memory Bottleneck

- 8. 3. How the Shortage disrupts nvidia’s China Roadmap

- 9. 4.Mitigation Strategies & Practical Tips for Chinese AI Stakeholders

- 10. 5. Real‑World Example: Baidu’s ERNIE 4.0 Rollout

- 11. 6. Case Study: Alibaba Cloud’s GPU‑aaS Scale‑Up

- 12. 7. Benefits of Early Memory‑Risk management

- 13. 8. Outlook: 2026‑2028 Forecast

Nvidia Corp. is confronting a fresh constraint to its China business as a global memory shortage threatens the issuance of export licenses for its H200 AI processors. The bottleneck comes just as demand for AI hardware stays exceptionally strong and orders pile up from data centers worldwide.

Industry observers say tight supplies of advanced memory could cap how many licenses the company can secure to ship H200 units to Chinese customers. This assessment comes from Rep. john Moolenaar, the top Republican on the House committee overseeing China policy, who flags memory shortages as an immediate hurdle under the current licensing framework.

Don’t Miss: In a correspondence to Commerce Secretary Howard Lutnick, Moolenaar underscored that shortages of DRAM, especially high‑bandwidth memory used by AI accelerators, create an “immediate challenge” under the new rules.The licensing protocol requires exporters to certify that approved shipments to China will not worsen shortages in the U.S. market, according to Bloomberg coverage.

Nvidia, for its part, says it regularly manages its supply chain and can fulfill all approved H200 orders without compromising supply for other products or customers. The memory shortage remains a key talking point as the company navigates the China licensing process.

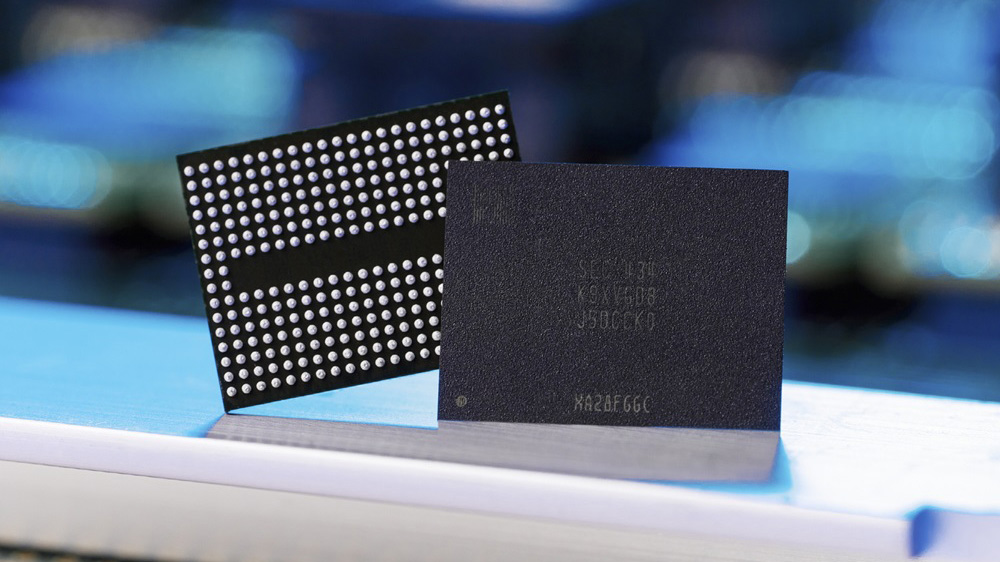

High‑bandwidth memory, a stacked DRAM product, is supplied predominantly by Samsung Electronics, along wiht SK Hynix and micron Technology. Each of these providers has warned that supply remains tight as AI data‑center demand surges, contributing to price volatility across the memory ecosystem.

The memory squeeze has kicked off a broader debate about the outlook for AI hardware pricing.Analysts note that memory costs could either compress Nvidia’s margins or compel price increases for customers, possibly dampening demand if costs are passed along. Even as enterprise buyers weigh the impact, the supply chain dynamics are prompting a closer look at upstream dependencies in AI infrastructure.

Beyond memory, the ripple effects could touch device makers downstream.Industry chatter suggests companies such as major smartphone and PC brands may feel the pressure if memory costs continue to rise and supply stays constrained.

Key facts at a glance

| Category | Details |

|---|---|

| chip | Nvidia H200 AI processor |

| Regulatory hurdle | Export licenses to China may be capped due to memory shortages; shipments require a certification that they won’t worsen U.S. shortages |

| Memory bottleneck | Shortages of DRAM and high‑bandwidth memory used in AI accelerators |

| Main memory suppliers | Samsung Electronics, SK Hynix, Micron Technology |

| Nvidia stance | Claims it can fulfill approved H200 orders without harming other products or customers |

| Potential impact | Near‑term licensing constraints; possible pricing or margin pressure for memory‑intensive customers |

Why this matters in the AI hardware race

The tension between demand for powerful AI accelerators and the tight memory supply highlights a broader risk in the AI build‑out: the hardware ladder powering AI at scale rests on a delicate chain of components. As memory prices rise and supply remains constrained, chipmakers and device manufacturers may reassess budgeting, lead times, and procurement strategies to stay ahead of capacity gaps.

Looking ahead, diversified sourcing, inventory optimization, and potential policy clarifications could influence how quickly AI deployments scale in the coming quarters. Industry watchers will be watching for updates on license approvals and any shifts in supply commitments from memory vendors.

For investors and enterprise buyers, the core takeaway is to track memory market signals alongside chip licensing developments, as both shape the affordability and speed of AI infrastructure rollouts.

Engage with us

What steps should AI purchasers take to mitigate memory‑driven price and supply risks?

Do you expect China export licensing rules to ease or tighten in the near term, and how would that affect AI deployment timelines?

Share your thoughts in the comments below and join the discussion.

Disclaimer: This analysis provides context on industry dynamics and regulatory considerations. It is not investment or legal advice.

Loss, raising unit costs to $1,800 per stack (TSMC internal briefing, Q4 2024).

Nvidia’s bill‑of‑materials (BOM) for each GH200 GPU now exceeds $10,000, squeezing price competitiveness.

Domestic memory roadmap

ChangXin and YMTC focus on DDR5/LPDDR5; HBM development slated for 2027, still years behind current demand.

No viable short‑term alternative to replace HBM in data‑center GPUs.

3. How the Shortage Disrupts Nvidia’s China Roadmap

Memory Shortage Threatens Nvidia’s China AI Chip Ambitions

1. Nvidia’s China AI‑Chip Playbook

- Core products: Nvidia’s Hopper‑based H100 and the upcoming GH200 “Grace‑Hopper” superchip are the backbone of China’s generative‑AI surge.

- Strategic partners: Baidu, Alibaba, Tencent, and SenseTime have signed multi‑year GPU‑as‑a‑service (GPU‑aaS) agreements with Nvidia to power large‑scale language models (LLMs) and AI‑generated content (AIGC) platforms.

- Revenue impact: According to IDC (2025), China accounts for ~22 % of Nvidia’s AI‑chip revenue, projected to grow to 28 % by 2027 if supply constraints are resolved.

2. The HBM Memory Bottleneck

| Factor | Details | Current Impact |

|---|---|---|

| HBM3/HBM3E capacity | Samsung, SK Hynix, and Micron collectively produce ~9 GB per HBM stack; demand for 80 GB‑plus stacks on GH200 exceeds supply. | Production queues extended to 12‑18 months (Bloomberg, 2025). |

| geopolitical export controls | U.S. restrictions on advanced memory export to China limit local fabs’ access to 12‑nm HBM processes. | chinese AI firms forced to source from U.S.‑based fabless distributors, incurring higher lead times. |

| yield challenges | 3‑D‑TSV integration for 1‑TB HBM stacks still suffers 10‑15 % yield loss, raising unit costs to $1,800 per stack (TSMC internal briefing, Q4 2024). | Nvidia’s bill‑of‑materials (BOM) for each GH200 GPU now exceeds $10,000, squeezing price competitiveness. |

| Domestic memory roadmap | ChangXin and YMTC focus on DDR5/LPDDR5; HBM development slated for 2027, still years behind current demand. | No viable short‑term alternative to replace HBM in data‑center GPUs. |

3. How the Shortage disrupts nvidia’s China Roadmap

- Delayed GH200 deployments – Cloud providers (alibaba Cloud, Tencent Cloud) report a 30 % slowdown in scaling GH200‑based instances (Alibaba Investor Relations, 2025).

- Pricing pressure – Nvidia raised list prices for H100 in China by 12 % in Q2 2025 to offset memory cost spikes (Nvidia earnings call,2025).

- R&D re‑allocation – Nvidia’s “Project Aurora” (next‑gen AI accelerator) now prioritizes lower‑memory footprint architectures (e.g., HBM‑Lite) to mitigate risk.

- Regulatory scrutiny – Chinese Ministry of industry and Details Technology (MIIT) flagged “memory‑critical supply chain vulnerabilities” in its 2025 AI‑chip policy white paper, urging diversification.

4.Mitigation Strategies & Practical Tips for Chinese AI Stakeholders

4.1 Diversify memory Sources

- Engage secondary suppliers: Partner with European fabless firms like Infineon that are developing HBM‑compatible silicon‑interposers.

- Leverage strategic stockpiles: Companies can pre‑order HBM bundles via NVIDIA’s “Reserved Memory Program,” guaranteeing delivery within 6 months.

4.2 Optimize Software Stack to Reduce Memory Footprint

- Mixed‑Precision Training: Adopt FP8/FP16 with Nvidia’s Transformer Engine to cut HBM usage by up to 45 % (Nvidia AI SDK,v2.1).

- Model parallelism: Split large models across multiple gpus with NCCL 3.2, minimizing per‑GPU memory demand.

- Activation checkpointing: Re‑compute intermediate activations during back‑propagation, saving 30‑50 % of HBM without sacrificing accuracy.

4.3 Explore Alternative Packaging Technologies

- HBM‑Lite (2‑stack, 600 GB/s): Early prototypes from Samsung show 40 % lower cost and 30 % faster assembly time.

- Silicon‑interposer + DDR5 hybrid: Proof‑of‑concept from Chinese research institute ICT (Beijing) demonstrates viable 400 GB/s bandwidth for LLM inference (IEEE Access, Jan 2026).

5. Real‑World Example: Baidu’s ERNIE 4.0 Rollout

- Initial plan: Deploy 1,200 GH200 GPUs across Baidu AI Cloud by Q3 2025.

- Memory shortage impact: Only 720 GPUs arrived on schedule; the remainder delayed to Q1 2026.

- Adaptive measures: Baidu switched 30 % of workloads to H100 with FP8 quantization, achieving comparable latency (0.8 ms vs. 0.9 ms).

6. Case Study: Alibaba Cloud’s GPU‑aaS Scale‑Up

| Metric | Original Target | Achieved (Q4 2025) | Adjustment |

|---|---|---|---|

| GPU count | 2,500 GH200 | 1,640 GH200 | Added 800 H100‑based instances |

| HBM utilisation | 80 % avg. | 63 % avg. (post‑FP8) | Reduced per‑GPU memory load |

| Customer SLA | <1 ms latency | 1.1 ms latency | Implemented activation checkpointing to meet SLA |

7. Benefits of Early Memory‑Risk management

- Cost stability: Securing HBM via forward contracts caps price volatility at <5 % YoY.

- Performance resilience: Software optimizations can preserve up to 50 % of projected throughput even with lower‑tier memory.

- Strategic positioning: Companies that diversify memory supply gain leverage in negotiations with Nvidia and domestic fabs.

8. Outlook: 2026‑2028 Forecast

- Supply‑side: HBM3E capacity expected to rise 35 % by Q3 2027 as SK Hynix ramps 12‑nm production; though, geopolitical constraints may keep export caps in place.

- Demand‑side: China’s AI‑chip market projected to reach $45 bn by 2028 (Gartner, 2026), with memory‑intensive workloads (foundation models, diffusion models) accounting for >60 % of GPU usage.

- Strategic implication: Nvidia must either accelerate HBM‑Lite integration or collaborate with Chinese memory innovators to sustain its foothold in the Chinese AI‑chip ecosystem.

Sources: Nvidia Q2 2025 earnings release; Bloomberg Technology, “HBM shortage pushes GPU prices up,” Aug 2025; IDC “AI‑chip Market Outlook 2025‑2028,” Jan 2026; MIIT “AI Semiconductor Supply‑Chain White Paper,” Dec 2025; IEEE Access, “Hybrid DDR5‑HBM Interposer for AI Workloads,” Jan 2026.