ACA Marketplace Braces for Disruption: Premiums Set to Soar as Key Subsidies Expire

A perfect storm is brewing for millions of Americans relying on the Affordable Care Act (ACA) Marketplace. Open Enrollment for 2026 begins November 1, 2025, but it won’t be business as usual. With enhanced premium tax credits poised to vanish at year’s end, and a wave of new eligibility rules taking effect, many enrollees are facing a potential price shock – and a more complex enrollment process. The changes, stemming from both budget reconciliation legislation and the Trump Administration’s “Marketplace Integrity and Affordability” regulation, could reshape the landscape of health insurance access for years to come.

The Looming Tax Credit Cliff

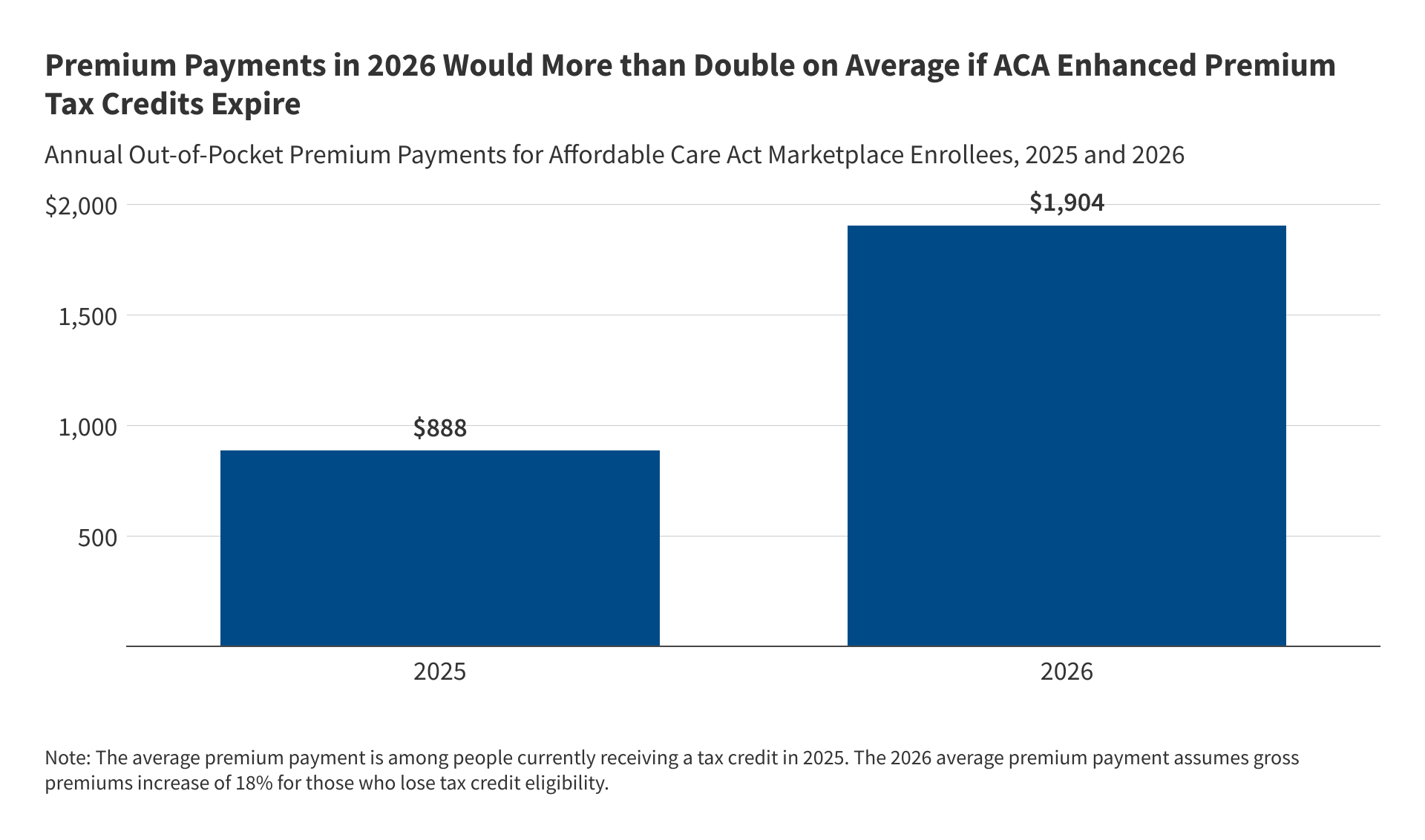

The biggest immediate threat is the expiration of enhanced premium tax credits. These credits, introduced to make coverage more affordable, particularly for middle-income individuals and families, are set to disappear unless Congress intervenes. The Kaiser Family Foundation (KFF) estimates that without these credits, out-of-pocket premiums for subsidized enrollees will jump a staggering 114% on average. That’s not a small increase; it’s a potential barrier to coverage for many.

The impact won’t be uniform. Those earning below four times the poverty level ($62,600 for an individual, $128,600 for a family of four in 2026) will still receive some tax credit, but likely a significantly reduced amount. However, those above that income threshold – who currently benefit from the enhanced credits – will be hit hardest, facing both the loss of subsidies and rising insurer premiums. You can estimate your potential 2026 premiums with and without the enhanced credits using the KFF premium calculator.

The timing is critical. If Congress doesn’t act before Open Enrollment begins, enrollees will immediately see the higher premiums when they log in to the Marketplace on November 1st. Experts predict this could lead to significant coverage losses, as younger, healthier individuals opt out, further driving up costs for those who remain.

Tax Time Troubles: Repaying Credits Could Get Painful

Beyond premium increases, a change to tax credit repayment rules is adding to the financial uncertainty. Currently, there’s a limit to how much of an excess tax credit enrollees must repay at tax time. Starting in 2026, that limit is gone. Enrollees will be responsible for repaying the full amount of any excess credit received. This is particularly concerning for those with fluctuating incomes – common among self-employed and gig workers – who may underestimate their earnings during enrollment.

The “subsidy cliff” – the abrupt loss of financial assistance as income rises above four times the poverty level – will exacerbate this issue. Individuals who initially qualify for credits but later exceed the income threshold could face a hefty tax bill.

Shifting to High-Deductible Plans and HSAs

Faced with higher premiums, many enrollees are likely to trade down to lower-cost plans, specifically bronze or catastrophic plans. These plans offer lower monthly premiums but come with significantly higher deductibles. The Trump administration is actively encouraging this shift by streamlining access to catastrophic plans for those who don’t qualify for premium tax credits or cost-sharing reductions.

Furthermore, changes to Health Savings Account (HSA) rules will now automatically qualify all Marketplace bronze and catastrophic plans as high-deductible health plans (HDHPs), making them HSA-eligible. This could incentivize more enrollees to pair their coverage with an HSA, offering a tax-advantaged way to save for healthcare expenses. Importantly, HSAs can now cover telehealth services before the deductible is met.

Eligibility Restrictions and Enrollment Changes

The ACA Marketplace is also becoming less accessible for certain populations. Starting in 2026, lawfully present immigrants with incomes below 100% of the federal poverty level who are ineligible for Medicaid will no longer qualify for subsidized coverage. This restriction expands in 2027, further limiting eligibility to lawful permanent residents and those covered under specific agreements.

Additionally, the low-income special enrollment period (SEP) – which allowed individuals with incomes up to 150% of the federal poverty level to enroll outside of Open Enrollment – is effectively being eliminated. This change, driven by concerns about adverse selection, will require more individuals to enroll during the standard Open Enrollment period.

Navigators and DACA Recipients Face Uncertainty

Access to enrollment assistance is also under threat. A drastic 90% reduction in federal Navigator funding will severely limit the resources available to organizations that help consumers navigate the Marketplace. While agents and brokers are filling some of the gap, concerns remain about potential conflicts of interest and recent allegations of fraudulent enrollment practices.

Finally, a recent rule change has stripped Deferred Action for Childhood Arrivals (DACA) recipients of their eligibility for Marketplace coverage, leaving them without access to affordable health insurance options.

The Future of the ACA Marketplace: A Wait-and-See Approach

The ACA Marketplace is at a critical juncture. The combination of expiring tax credits, changing eligibility rules, and reduced enrollment assistance creates a challenging environment for consumers. While a federal court has temporarily blocked some of the more restrictive changes proposed by the Trump Administration, the long-term impact remains uncertain. The coming months will be crucial as Congress decides whether to extend the enhanced premium tax credits and shape the future of affordable healthcare access for millions of Americans. What will be the ultimate impact of these changes? Only time will tell, but proactive planning and careful consideration of all available options will be essential for navigating this evolving landscape.

Explore more insights on health insurance options and financial assistance programs on Archyde.com.