As the Lunar New Year is approaching, Octopus Cards Limited has announced the launch of a new Lunar New Year promotion “One-Touch Instant”. Starting from February 14, 2026, citizens who use their Octopus or LeYo Card to spend a designated amount at designated merchants will have the opportunity to receive cash rewards, up to $28. Octopus stated at the press conference that in order to stimulate public consumption, there is no upper limit on the reward amount.

Send money to buy new year goods with Octopus mobile phone during the New Year and enjoy 12% off

Table of Contents

- 1. Send money to buy new year goods with Octopus mobile phone during the New Year and enjoy 12% off

- 2. Linkage 29 merchants promote discounts covering restaurants and supermarkets

- 3. The e-Laisee function adds interactivity to stimulate the economy in the Year of the Horse

- 4. how can I use Octopus Mobile to send Lai See and earn a 12% discount during the New Year promotion?

- 5. Send Money with Octopus Mobile & Score New Year Savings | archyde.com

- 6. How to Send Lai See & Enjoy Discounts with Octopus mobile

- 7. Participating Merchants & Exclusive Discounts

- 8. Win Cash Prizes – It’s a Lucky New Year!

- 9. Benefits of using Octopus Mobile for New Year Spending

- 10. Octopus vs. Squid vs. Cuttlefish: A Quick Note

- 11. Practical Tips for Maximizing Your Savings

According to the official announcement, the next “One-Tap” Lunar New Year Reward Promotion period is February 14 to 19 (Lunar New Year). Mobile Octopus users and Lek You card holders simply need to participate in the draw with a single spend of $100 via the new Octopus machine in Hong Kong. The event focuses on “Instant Rewards” experience. When the user pays “Congratulations on winning value (Reward Value) Mosquito Octopus Reward”, which represents winning. The reward amount will automatically offset the amount of the transaction in real time, the process is completely automated and the user does not require pre-registering or additional waiting.

Linkage 29 merchants promote discounts covering restaurants and supermarkets

In addition to the lucky draw, Octopus has also collaborated with 29 retail and catering merchants across Hong Kong to launch Lunar New Year limited offers from February 3 to 28, covering New Year goods, reunion dinners and New Year gatherings. Key discounts include: $8 off for a purchase of $60 or more at Maxim’s MX lunch or dinner; $10 off for a takeaway purchase of $150 or more at restaurants under the Tai Hing Group, such as Tai Hing, Man Wah Bing Restaurant, and Reliance; and a 12% discount on a $100 or more seafood series product at Tai Sang Lifestyle Supermarket (excluding bird’s nest).

The e-Laisee function adds interactivity to stimulate the economy in the Year of the Horse

With the popularity of electronic payment, the Octopus App will continue to open the “e-Laisee” function this year. In addition to distributing red packets to relatives and friends remotely, users can also set “e-Laise packets” of different amounts and quantities, allowing relatives and friends to participate in the lucky draw game by scanning the QR Code, adding to the interactive fun of New Year greetings.

immediately【Click here]use the app to watch more product unboxing videos

【Hot reports】

Source: Octopus

For Apple fans who often have no money or are planning to travel, Apple AirTag is definitely an indispensable item. Recently, Wilson, a local electronics chain store in Japan, suddenly launched a limited-time discount, slashing the price of the first-generation AirTag. A single package has been reduced from the original price of $239 to only $149. The discount rate is as high as 33% off. Each tablet can be purchased for less than 150 yuan on average. It can be called the most affordable “Apple price” in recent times.

Source:ezone.hk

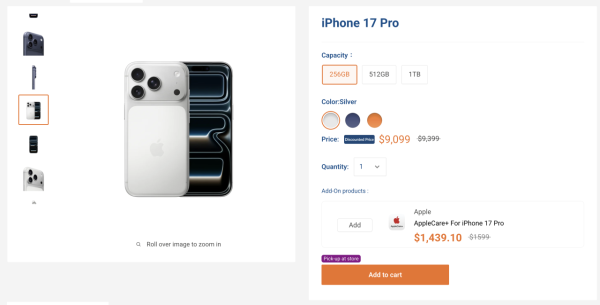

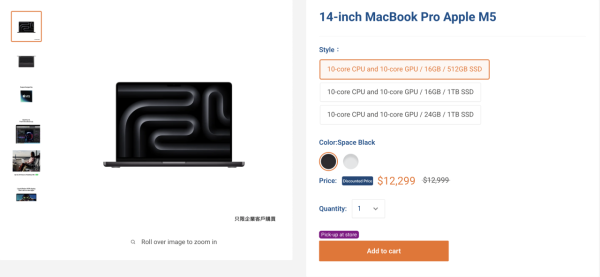

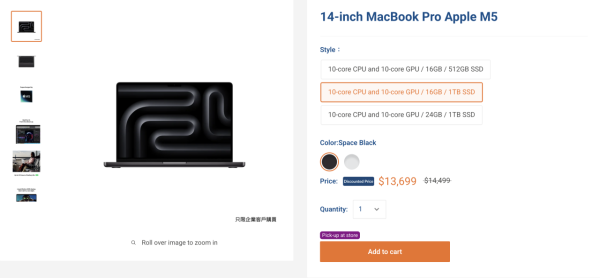

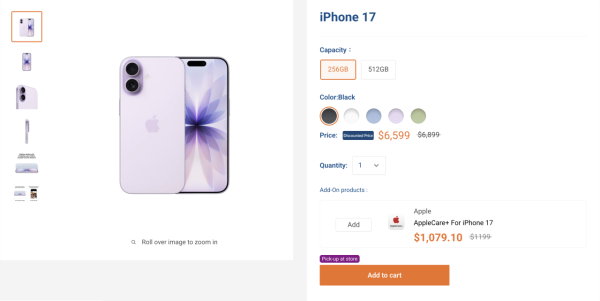

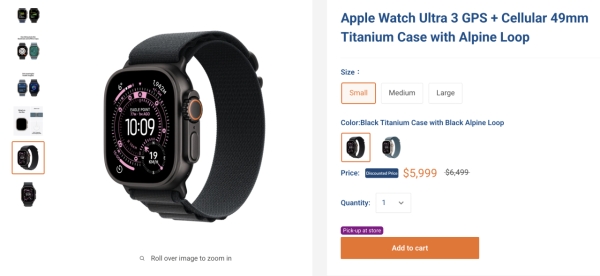

Hong Kong Broadband’s latest Valentine’s Day offer includes rare price cuts on the entire iPhone 17 series, MacBook and Apple Watch, with the MacBook Pro M4 version discounted by up to HK$1,400.

Source:ezone.hk

how can I use Octopus Mobile to send Lai See and earn a 12% discount during the New Year promotion?

Send Money with Octopus Mobile & Score New Year Savings | archyde.com

The Lunar New Year is fast approaching, and with it comes the tradition of lai see (red envelopes) and stocking up on festive goodies. This year, Octopus mobile is making it easier – and more rewarding – than ever to send money and prepare for the celebrations. From now untill [date – specify end date of promotion], enjoy a fantastic 12% discount on your purchases when you pay with Octopus mobile, plus the chance to win cash prizes!

How to Send Lai See & Enjoy Discounts with Octopus mobile

Forget queuing at the bank or scrambling for cash. Octopus mobile allows you to digitally send lai see to friends and family with just a few taps.Here’s how:

- Download & Register: ensure you have the latest version of the Octopus mobile app downloaded on your smartphone. If you’re a new user, register for an account.

- Add Value: top up your Octopus mobile wallet via various convenient methods – credit card, debit card, bank transfer, or even at Octopus service points.

- Send Lai See: Select the “Send Lai See” option within the app,choose your recipient (by phone number or Octopus number),enter the amount,and personalize your message.

- Pay with Octopus Mobile: When shopping for New Year goods at participating merchants, simply select Octopus as your payment method at checkout. Scan the QR code or tap your phone on the Octopus reader.

Participating Merchants & Exclusive Discounts

A wide range of merchants are participating in this exciting promotion, offering you savings on everything you need for a prosperous New Year.Here’s a glimpse of what’s on offer:

* Supermarkets: Stock up on festive snacks, ingredients for reunion dinners, and New Year treats at major supermarket chains.

* Department Stores: Find the perfect gifts for loved ones, from clothing and accessories to electronics and home goods.

* Grocery Stores: Grab essential ingredients for your new Year dishes and enjoy special offers on seasonal produce.

* Health & Beauty Stores: Pamper yourself and your family with skincare, cosmetics, and health supplements.

* Convenience Stores: Quick and easy access to last-minute New Year essentials.

[[Note: A detailed list of participating merchants and their specific discounts will be provided separately – link to the merchant discount list here.]

Win Cash Prizes – It’s a Lucky New Year!

Beyond the 12% discount, Octopus mobile is adding an extra layer of excitement with a lucky draw! Every transaction made with octopus mobile during the promotional period automatically enters you into a chance to win cash prizes. The more you spend, the higher your chances of winning.

* How to Participate: No seperate registration is required. Every Octopus mobile payment automatically qualifies for the lucky draw.

* Prize Details: [Specify prize amounts and number of winners – e.g., grand Prize: HKD 8,888 x 3, Second Prize: HKD 2,888 x 10, etc.]

* Draw Date: [Specify draw date – e.g., Winners will be announced on February 28, 2026.]

Benefits of using Octopus Mobile for New Year Spending

Choosing Octopus mobile for your New Year spending offers numerous advantages:

* Convenience: Skip the cash and enjoy seamless, contactless payments.

* Savings: The 12% discount substantially reduces your shopping expenses.

* Security: Octopus mobile employs robust security measures to protect your financial details.

* Rewards: the lucky draw provides an opportunity to win extra cash.

* Environmental Friendliness: Reduce your carbon footprint by opting for digital transactions.

Octopus vs. Squid vs. Cuttlefish: A Quick Note

While preparing for your New Year feast, you might encounter these terms. It’s worth knowing the difference! According to Baidu Zhidao, octopus refers to the eight-armed cephalopod, squid is a longer, more streamlined relative, and cuttlefish has an internal shell. Knowing your seafood is helpful when selecting ingredients for your reunion dinner!

Practical Tips for Maximizing Your Savings

* Plan Your Shopping: Create a list of New Year goods you need to avoid impulse purchases.

* Check Merchant Discounts: Before heading to