The Inflation Reduction Act (IRA) of 2022 continues to reshape healthcare access for Medicare beneficiaries, and new data reveals a significant impact on prescription drug coverage. Beyond the widely publicized negotiation of lower drug prices, the IRA is demonstrably improving access to medications for seniors, ensuring broader coverage of both newly negotiated drugs and existing treatments. This expansion of coverage is a direct result of the IRA’s requirement that all Medicare Part D plans include these selected drugs, in all available dosages and forms.

For millions of Americans relying on Medicare, the cost of prescription drugs can be a substantial financial burden. The IRA aims to alleviate this pressure through a two-pronged approach: directly negotiating prices with pharmaceutical companies and expanding coverage to ensure more beneficiaries can actually use those lower-priced medications. Initial findings indicate the law is already delivering on the latter promise, with improved coverage rates observed even before the first negotiated prices took effect on January 1, 2026.

An analysis of 2026 Medicare Part D formulary coverage shows that access to several dosages and forms of nine out of the first ten drugs selected for price negotiation has improved since 2025, prior to the IRA’s coverage requirements. So more Medicare enrollees now have access to these vital medications through their existing Part D plans. The changes are particularly notable for insulin products like Fiasp and NovoLog, and for the cancer drug Imbruvica.

Expanded Coverage for Negotiated Drugs in 2026

The IRA’s coverage requirement stipulates that all Part D plans must cover the ten drugs selected for the initial round of price negotiations, encompassing all dosage forms and strengths. This has led to tangible improvements in access. In 2025, Fiasp, a rapid-acting insulin, was covered by just 24% of Part D plans, while NovoLog was covered by 32%. Coverage for two dosages of Imbruvica, a medication used to treat certain blood cancers, was available to roughly half of Part D enrollees. With the IRA’s provisions in effect, all Part D enrollees now have access to these medications.

Looking Ahead: Coverage Gains Expected with 2027 Negotiations

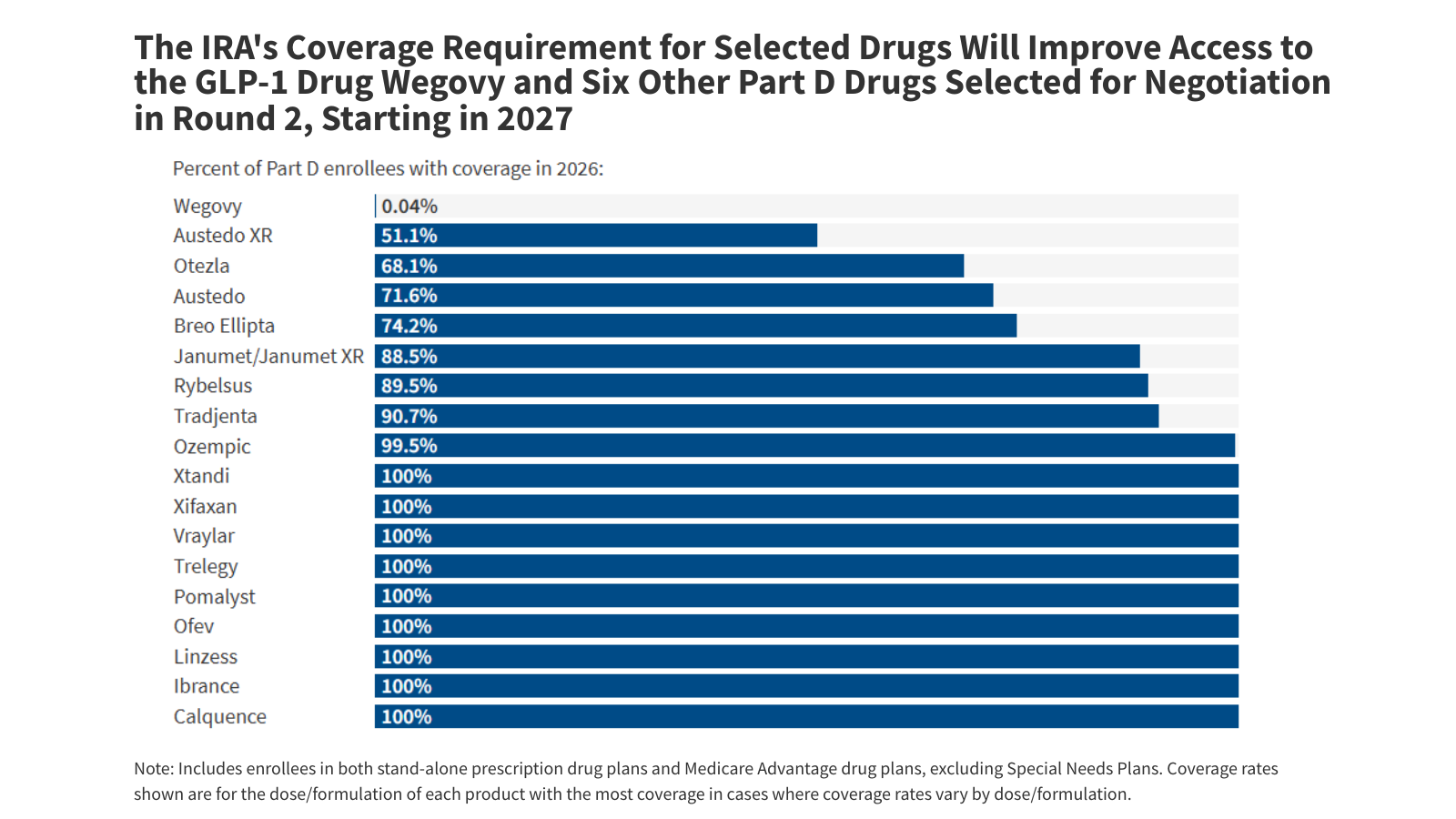

The benefits aren’t limited to the first ten drugs. The IRA also authorized Medicare to negotiate prices for an additional 15 drugs, with those negotiated prices slated to accept effect in 2027. Preliminary data suggests similar coverage improvements are on the horizon. One drug in particular, Wegovy, a GLP-1 receptor agonist approved for both obesity and cardiovascular disease risk reduction, currently faces limited coverage. As of 2026, less than 1% of Part D enrollees have access to Wegovy through their plans, largely because Medicare traditionally hasn’t covered drugs specifically for weight loss.

However, a potential shift is underway. The Trump administration is reportedly planning a voluntary model to expand Medicare coverage of GLP-1s for obesity treatment beginning in 2027. This expansion, coupled with the IRA’s coverage requirement, is expected to significantly increase access to Wegovy for eligible beneficiaries. Six other drugs selected for negotiation in 2027 – Austedo and Austedo XR, Otezla, Breo Ellipta, Xtandi, Pomalyst, Ofev, Ibrance, Calquence and Vraylar – also currently have less than universal coverage among Part D plans, and will see increased access due to the IRA’s provisions. Notably, six of these drugs already fall within protected classes that require all plans to offer coverage.

The Medicare Prescription Drug Inflation Rebate Program, established by the IRA, is a complex undertaking. CMS has issued final rulemaking for the program, with the most recent updates published on October 31, 2025. The agency continues to refine guidance and address feedback from stakeholders as the program is implemented.

As the IRA’s provisions continue to roll out, ongoing monitoring and evaluation will be crucial to assess the full impact on drug costs and access for Medicare beneficiaries. The initial data is promising, suggesting that the law is not only lowering prices but also ensuring that more seniors can benefit from these crucial medications. The coming years will reveal the long-term effects of this landmark legislation on the landscape of prescription drug coverage in the United States.

Disclaimer: This article provides informational content about the Inflation Reduction Act and its impact on Medicare Part D coverage. This proves not intended to be a substitute for professional medical or financial advice. Always consult with a qualified healthcare provider or financial advisor for personalized guidance.

What are your thoughts on the IRA’s impact on drug coverage? Share your comments below.

/t:r(unknown)/filters:format(jpeg)/medias/CuRqpISqIC/image/kermesse_fetes_illustration_ia1749111082961.jpg)