DAX Resilience: Navigating Geopolitical Shifts and Economic Data

Despite a relentless stream of economic data and ongoing geopolitical tensions, the DAX is demonstrating surprising resilience. The German benchmark index’s positive start to the week isn’t simply a fleeting moment of optimism; it signals a potential shift in investor sentiment, one increasingly focused on navigating a complex landscape rather than fearing it. This article explores the factors driving this performance, the emerging trends shaping the DAX’s future, and what investors should be watching closely.

Decoding the Current Rally: Beyond the Numbers

Recent gains in the DAX are fueled by a confluence of factors. The initial boost came from easing concerns surrounding a full-blown trade war escalation between the US and China, particularly regarding rare earth elements. While the dispute isn’t resolved, signals of willingness to negotiate have calmed immediate anxieties. However, attributing the rally solely to this would be a simplification. Investors are also processing a flood of economic data – inflation figures, manufacturing reports, and employment numbers – attempting to discern the trajectory of the Eurozone economy.

Crucially, the market is keenly awaiting guidance from the European Central Bank (ECB). The timing and extent of potential interest rate cuts remain a central question, influencing investment decisions across the board. The Federal Reserve’s stance also plays a role, creating a complex interplay of monetary policies that impact global markets, and particularly the export-heavy DAX.

The Rare Earths Factor: A Strategic Re-evaluation

The easing of tensions regarding rare earths is more than just a temporary reprieve. It highlights a broader strategic re-evaluation of supply chains. Companies are increasingly recognizing the vulnerability of relying on single-source suppliers, particularly for critical materials. This is driving investment in diversification and domestic production, potentially benefiting German companies involved in materials science and engineering. This shift towards supply chain security is a long-term trend, and one that will continue to shape investment strategies. For further insights into global supply chain dynamics, see the report by the World Economic Forum.

Looking Ahead: Key Trends Shaping the DAX

Several key trends are poised to significantly impact the DAX in the coming months. These extend beyond immediate economic data and geopolitical events.

The Green Transition and German Industry

Germany’s commitment to the green transition presents both challenges and opportunities for DAX-listed companies. While some traditional industries face disruption, others are poised to benefit from the surge in demand for renewable energy technologies, electric vehicles, and sustainable materials. Companies investing heavily in research and development in these areas are likely to outperform in the long run. The pace of this transition, however, will be crucial, and potential bottlenecks in infrastructure and resource availability remain a concern.

Digitalization and the Future of Manufacturing

The ongoing digitalization of German industry, often referred to as “Industry 4.0,” is another critical trend. Companies embracing automation, artificial intelligence, and data analytics are gaining a competitive edge. This requires significant investment in new technologies and workforce training, but the potential rewards – increased efficiency, improved product quality, and enhanced innovation – are substantial. The DAX’s performance will increasingly be tied to the ability of its constituent companies to successfully navigate this digital transformation.

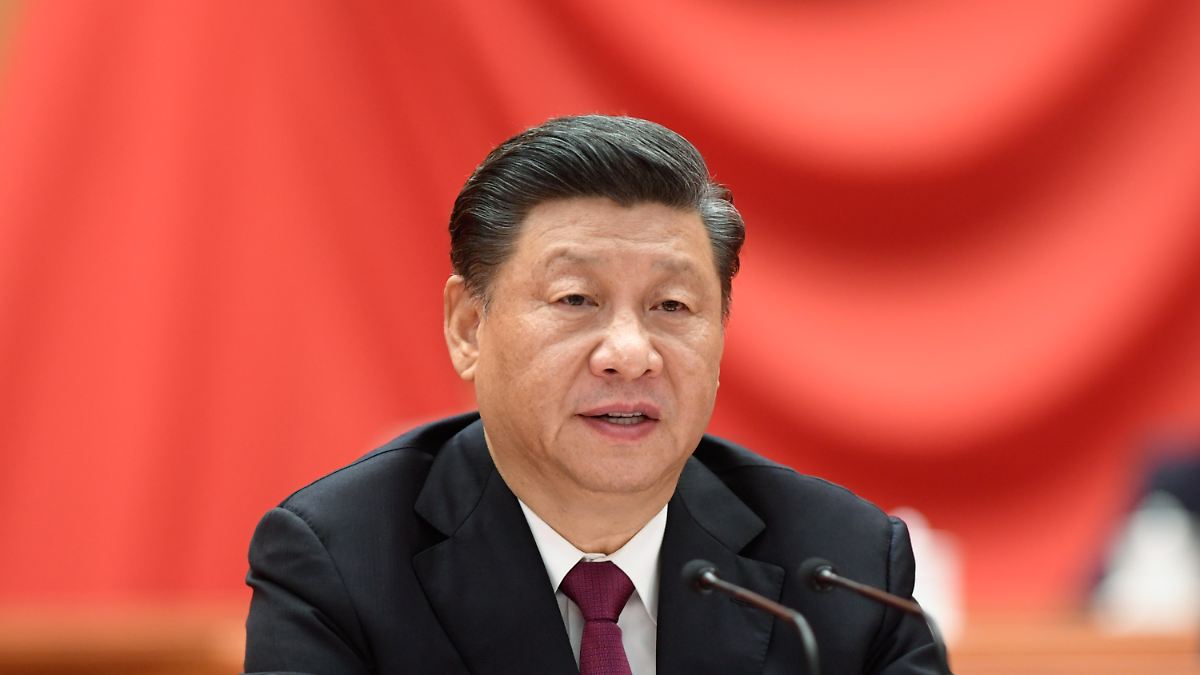

Geopolitical Risk and Diversification

Despite the recent easing of tensions, geopolitical risk remains a persistent factor. The ongoing conflict in Ukraine, tensions in the South China Sea, and potential disruptions to global trade routes all pose threats to the DAX. Companies with diversified revenue streams and a global footprint are better positioned to weather these storms. Investors should prioritize companies that demonstrate a proactive approach to risk management and a willingness to adapt to changing geopolitical realities.

Implications for Investors: A Cautiously Optimistic Outlook

The DAX’s current resilience suggests that investors are becoming more adept at navigating a volatile environment. However, caution is still warranted. The ECB’s monetary policy decisions, the trajectory of the Eurozone economy, and the evolution of geopolitical risks will all play a crucial role in determining the DAX’s future performance. A selective approach, focusing on companies with strong fundamentals, innovative business models, and a commitment to sustainability, is likely to yield the best results.

What are your predictions for the DAX in the face of these evolving challenges? Share your thoughts in the comments below!