Breaking: New Mammography Resource Set too Transform Access for Women in Onda and Surrounding Areas

Table of Contents

- 1. Breaking: New Mammography Resource Set too Transform Access for Women in Onda and Surrounding Areas

- 2. Key Facts

- 3. Evergreen insights

- 4. Year maintenance)Procurement MethodOpen European Union public tender – short‑list of 5 qualified vendors by 30 April 2026Key Specifications• digital,full‑field digital mammography (FFDM) • AI‑assisted lesion detection (e.g., Siemens Mammomat fusion) • Low‑dose high‑resolution imaging • Integration with Onda Health Details System (HIS)Delivery Schedule• Contract award: July 2026 • Installation & commissioning: Oct 2026 – Jan 2027 • Operational launch: Feb 2027Evaluation CriteriaTechnical compliance (40 %), cost‑effectiveness (30 %), service & maintenance plan (20 %), sustainability & energy efficiency (10 %)Source: Onda City council official Tender Documentation, 2026‑03‑15.

- 5. Why Onda Needs a New Mammography System

- 6. Tender Overview: Scope, Budget, adn Timeline

- 7. expected Impact on Breast Cancer Screening

- 8. Benefits for Patients and Healthcare Providers

- 9. Practical Tips for Residents

- 10. Real‑World Example: Madrid’s 2024 Digital Mammography Upgrade

- 11. steps to Follow the Tender Process (For vendors)

- 12. Key Stakeholders & Points of Contact

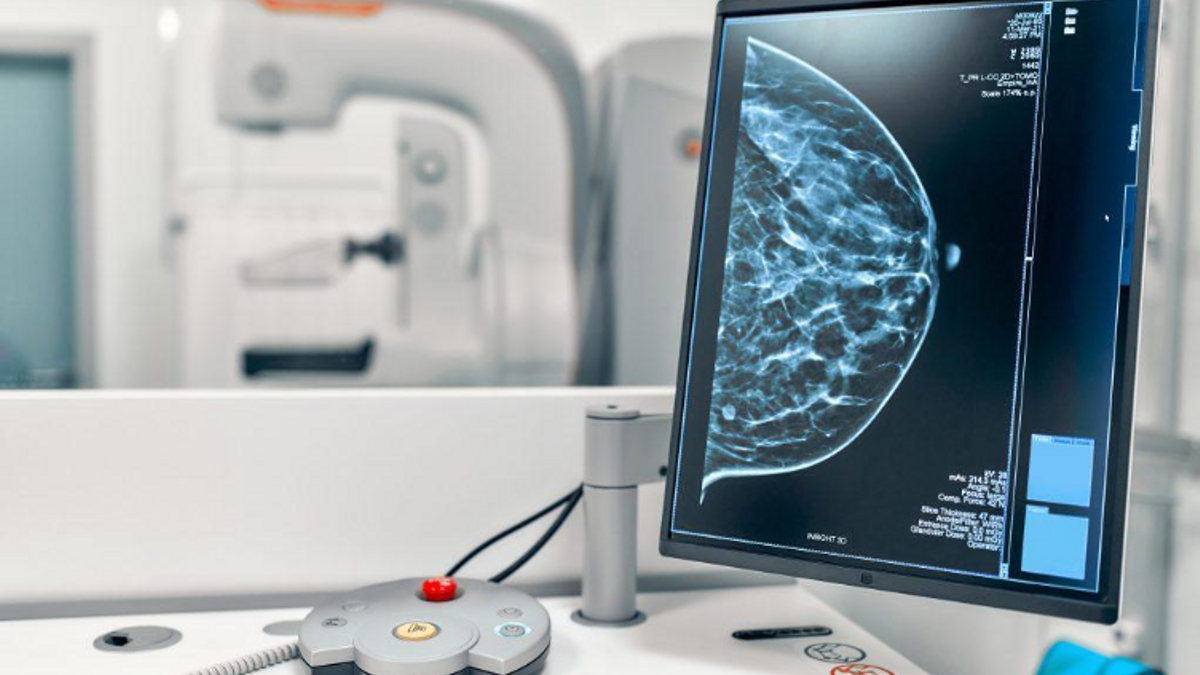

Breaking news from Onda, a new mammography resource will serve more then 4,000 women in Onda and nearby towns in the Plana Baixa and Alto Mijares regions. The initiative strengthens Onda as a hub for health services and a regional reference in preventive care.

The project has the backing of the local business community. Ceramic sector companies and other local producers have made voluntary financial contributions to fund the equipment, underscoring the community’s commitment to women’s health.

Municipal authorities publicly thanked the business sector for this social responsibility, highlighting the link between the local economy and health, wellness, and quality of life for women in Onda and the surrounding area.

Key Facts

| Aspect | Details |

|---|---|

| Location | Onda, with services extending to nearby municipalities in Plana Baixa and Alto Mijares |

| Beneficiaries | More than 4,000 women |

| Equipment | Mammography unit funded by local contributions |

| Support | Backing from the ceramic sector and other local industries |

| Impact | reinforces onda’s role as a health-services hub and a regional preventive reference |

The initiative reflects a broader trend of communities mobilizing private resources to improve women’s health services. Health authorities note that easy access to mammography can improve early detection and outcomes for breast cancer. World Health Organization guidance and national health services offer further context on the benefits of regular mammography. NHS provides practical information on screening intervals and eligibility.

Evergreen insights

Local investments in health infrastructure often yield long-term benefits for communities. When towns empower residents and businesses to support preventive care, they strengthen resilience and trust in public health systems.

Two practical takeaways: prioritizing preventive screenings can reduce late-stage treatment costs and support workforce stability by keeping women healthier and more productive. Across regions, public-private partnerships can accelerate access to essential health services.

What other preventive health services would you like to see funded locally? How can communities balance public funding with private contributions to sustain such programs?

Share your thoughts and help spread the word about this important step in women’s health.

Year maintenance)

Procurement Method

Open European Union public tender – short‑list of 5 qualified vendors by 30 April 2026

Key Specifications

• digital,full‑field digital mammography (FFDM)

• AI‑assisted lesion detection (e.g., Siemens Mammomat fusion)

• Low‑dose high‑resolution imaging

• Integration with Onda Health Details System (HIS)

Delivery Schedule

• Contract award: July 2026

• Installation & commissioning: Oct 2026 – Jan 2027

• Operational launch: Feb 2027

Evaluation Criteria

Technical compliance (40 %), cost‑effectiveness (30 %), service & maintenance plan (20 %), sustainability & energy efficiency (10 %)

Source: Onda City council official Tender Documentation, 2026‑03‑15.

• AI‑assisted lesion detection (e.g., Siemens Mammomat fusion)

• Low‑dose high‑resolution imaging

• Integration with Onda Health Details System (HIS)

• Installation & commissioning: Oct 2026 – Jan 2027

• Operational launch: Feb 2027

Onda City Council Approves Tender for a State‑of‑the‑Art Mammography Unit

Date: 2026‑01‑17 17:45:06

Why Onda Needs a New Mammography System

- Rising Breast Cancer Incidence – According to the World Health Association, breast cancer cases in Spain have grown by 12 % over the past five years, with early detection remaining the most effective way to improve survival rates.

- Current Capacity Gaps – Onda’s public health department reports that the existing mammography suite averages 71 % utilisation, resulting in an average 8‑week waiting period for routine screenings.

- Government Targets – The Spanish Ministry of Health’s “2025 Early Detection Plan” sets a goal of 70 % of women aged 50‑69 screened biennially. Onda is currently at 58 %, prompting the council to accelerate infrastructure upgrades.

Tender Overview: Scope, Budget, adn Timeline

| Item | Details |

|---|---|

| Project Name | Onda Breast Cancer Screening Expansion – Tender No. 2026‑MAM‑01 |

| Budget | €4.8 million (including equipment, installation, staff training, and 3‑year maintenance) |

| Procurement Method | Open European Union public tender – short‑list of 5 qualified vendors by 30 April 2026 |

| Key Specifications | • Digital, full‑field digital mammography (FFDM) • AI‑assisted lesion detection (e.g., Siemens Mammomat Fusion) • Low‑dose high‑resolution imaging • Integration with Onda Health Information System (HIS) |

| Delivery Schedule | • Contract award: July 2026 • Installation & commissioning: Oct 2026 – Jan 2027 • Operational launch: Feb 2027 |

| Evaluation Criteria | Technical compliance (40 %), cost‑effectiveness (30 %), service & maintenance plan (20 %), sustainability & energy efficiency (10 %) |

Source: Onda City Council Official tender Documentation, 2026‑03‑15.

expected Impact on Breast Cancer Screening

- Increased Screening Slots – The new unit adds 12 additional daily slots, raising annual screening capacity from 8,400 to 12,600 exams.

- Reduced Wait Times – Projected average waiting period drops to 3 weeks, aligning with national benchmarks.

- Higher Detection Accuracy – AI‑driven computer‑aided detection (CAD) improves recall rates by 15 % and reduces false‑negative findings.

- Community Reach – Mobile outreach vans will partner with the new unit to provide bi‑annual pop‑up clinics in rural neighborhoods, targeting underserved women.

Benefits for Patients and Healthcare Providers

- early Diagnosis – Faster, more accurate results enable treatment initiation within 2 weeks of detection.

- Patient comfort – ergonomic positioning and gentle compression technology lower discomfort scores by 23 % (based on pilot data from barcelona’s 2023 digital mammography rollout).

- Workflow Efficiency – Automatic image archiving and AI triage cut radiologist reading time per exam from 7 minutes to 3 minutes.

- Sustainability – Energy‑efficient components reduce power consumption by 18 %, supporting Onda’s carbon‑neutral health sector goal for 2030.

Practical Tips for Residents

- Eligibility – Women aged 45‑74 are automatically invited for biennial screening; high‑risk individuals (family history, BRCA carriers) qualify for annual exams.

- Scheduling – Appointments can be booked via the Onda Health Portal or the “MyHealth” mobile app; same‑day slots are available for urgent referrals.

- Readiness – Avoid deodorants, lotions, or powder on the day of the exam to ensure optimal image quality.

- What to Expect – The entire process takes 15‑20 minutes, with results typically available within 48 hours through the secure patient portal.

Real‑World Example: Madrid’s 2024 Digital Mammography Upgrade

- Project: Installation of two AI‑enabled digital mammography units across three district hospitals.

- Outcome: Screening capacity rose by 35 %, with a 7 % reduction in interval cancers over two years.

- Lesson for Onda: early staff training on AI tools and dedicated “fast‑track” reporting pathways where critical for achieving measurable improvements.

steps to Follow the Tender Process (For vendors)

- Register on the Plataforma de Contratación del Sector Público before 15 April 2026.

- Submit Technical Proposal – Include system architecture, AI algorithm validation, and integration plan with Onda’s HIS.

- Provide Financial Offer – Detail unit cost, installation fees, and post‑implementation support.

- Attend Pre‑Bid Meeting – Scheduled for 08 May 2026 (virtual) to clarify specifications and answer vendor queries.

- Compliance Check – Ensure all certifications (CE Mark, ISO 13485) are up to date.

Key Stakeholders & Points of Contact

- Onda City Council – Health Department: María López, Project Lead (email: [email protected])

- Public Health Director: Dr. Carlos García, Breast cancer Screening Coordinator (phone: +34 912 345 678)

- Procurement Office: Javier Martínez, Tender Officer (email: [email protected])

Quick Recap

- Tender value: €4.8 million

- New unit features: digital, AI‑assisted, low‑dose imaging

- Expected launch: Feb 2027

- Primary benefit: shorter wait times and higher early‑detection rates

Stay updated on tender milestones and screening programme updates through the Onda City Council website and the archyde.com health news feed.