Spain’s Shifting Rainfall Patterns: Preparing for a Wetter, Wilder Future

Imagine a coastal city bracing for not just a rainy day, but a deluge – 80 liters of water per square meter in a matter of hours. This isn’t a hypothetical scenario; it’s the reality facing parts of Spain this Tuesday, with orange alerts issued across Valencia, Alicante, Murcia, and the Balearic Islands. But this isn’t simply about a single weather event. It’s a stark signal of a broader, accelerating trend: increasingly erratic and intense rainfall patterns driven by a changing climate, demanding a fundamental shift in how we prepare and adapt.

The Immediate Threat: Current Rainfall and Regional Impacts

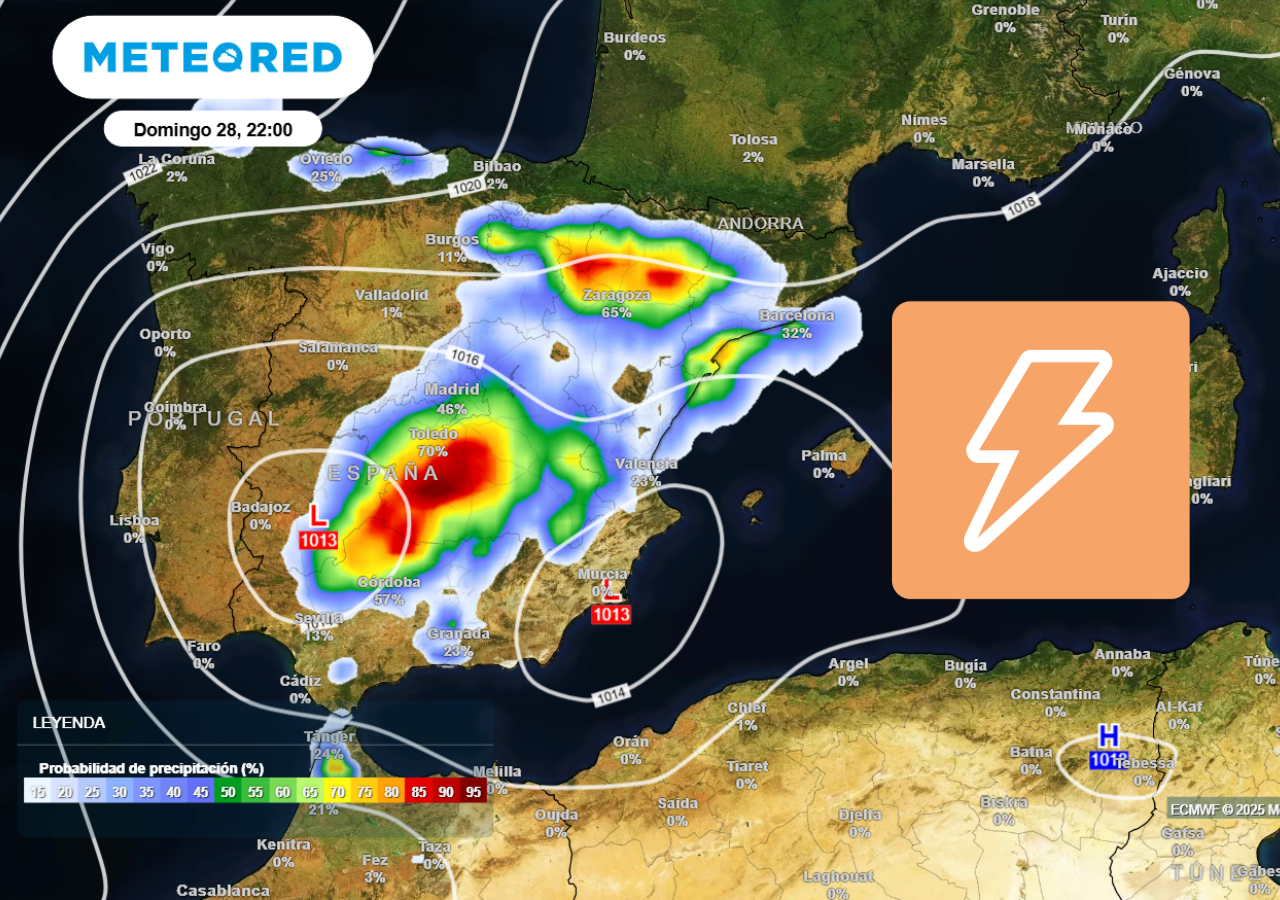

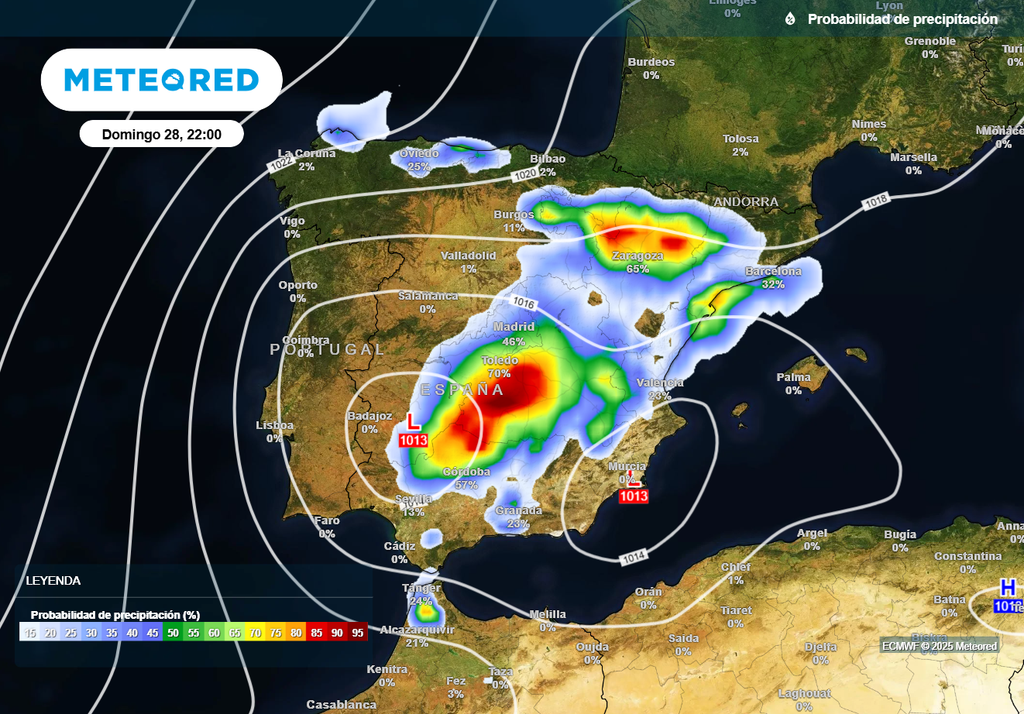

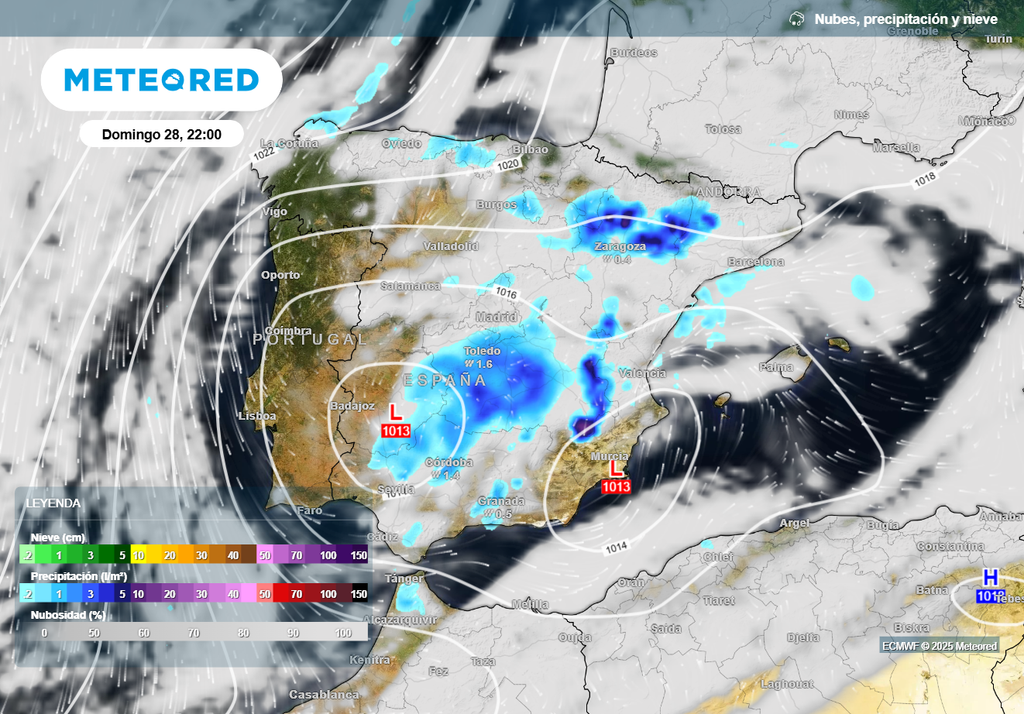

The Spanish Meteorology Agency (Aemet) has issued orange warnings – signifying a high risk – for several areas. Specifically, the northern and southern coastlines of Valencia and Alicante, La Vega del Segura, the Campo de Cartagena, Mazarrón, the Guadalentín Valley, Lorca, and Águilas in Murcia are under alert. The Balearic Islands, particularly Ibiza, Formentera, and parts of Mallorca, are also bracing for significant rainfall, with potential for up to 120 liters per 12 hours in some areas. These aren’t isolated incidents; they follow recent heavy rains that impacted Valencia, Castellón, Tarragona, and Murcia, highlighting a sustained period of heightened precipitation.

Key Takeaway: The current rainfall events are not anomalies, but rather part of a growing pattern of more frequent and intense precipitation in these regions.

Beyond the Headlines: Unpacking the Climate Connection

While attributing any single weather event solely to climate change is complex, the scientific consensus points to a clear link between rising global temperatures and altered precipitation patterns. Warmer air holds more moisture, leading to heavier rainfall when conditions are right. Furthermore, changes in atmospheric circulation patterns, influenced by climate change, are contributing to more prolonged and intense rainfall events in the Mediterranean region. A recent report by the IPCC (Intergovernmental Panel on Climate Change) emphasizes the increasing frequency of extreme weather events, including heavy precipitation, across Europe.

“Expert Insight:” “We’re seeing a clear intensification of the hydrological cycle,” explains Dr. Elena Ramirez, a climate scientist at the University of Valencia. “This means more evaporation, more atmospheric moisture, and ultimately, more extreme rainfall events. The Mediterranean basin is particularly vulnerable due to its geographical location and sensitivity to climate shifts.”

Future Trends: What Can We Expect?

The trend of increased rainfall intensity isn’t expected to reverse. Climate models predict a continued increase in extreme precipitation events across the Iberian Peninsula and the Balearic Islands. However, the changes won’t be uniform. Some areas may experience longer periods of drought interspersed with these intense rainfall events, creating a “whiplash” effect. Here’s a breakdown of potential future developments:

Increased Frequency of “DANA” Events

“DANA” (Depresión Aislada en Niveles Altos), or Isolated High-Level Depression, are atmospheric disturbances that often trigger intense rainfall in the region. Climate change is expected to increase the frequency and intensity of these events, leading to more frequent flash floods and landslides.

Shifting Rainfall Distribution

The traditional rainfall patterns may become less predictable. Areas that historically received moderate rainfall could experience more extreme events, while others might see a decrease in overall precipitation. This shift will require a reassessment of water resource management strategies.

Sea Level Rise and Coastal Flooding

Combined with increased rainfall, sea level rise will exacerbate coastal flooding risks. Storm surges, already a concern in these regions, will become more frequent and severe, threatening coastal infrastructure and communities.

Actionable Insights: Preparing for a Wetter Future

Adapting to these changing rainfall patterns requires a multi-faceted approach. Here are some key areas for action:

Infrastructure Investment

Investing in improved drainage systems, flood defenses, and resilient infrastructure is crucial. This includes upgrading existing infrastructure and incorporating climate resilience into new construction projects. Consider nature-based solutions like restoring wetlands and creating green spaces to absorb excess water.

Pro Tip: Prioritize infrastructure projects that offer multiple benefits, such as flood control and improved water quality.

Early Warning Systems

Strengthening early warning systems and improving communication to the public are essential. This includes providing timely and accurate information about impending rainfall events and potential risks. Utilizing mobile alerts and social media can help reach a wider audience.

Land Use Planning

Implementing stricter land use planning regulations to prevent construction in flood-prone areas is vital. Promoting sustainable land management practices can also help reduce runoff and erosion.

Water Resource Management

Developing integrated water resource management strategies that address both drought and flood risks is crucial. This includes investing in water storage infrastructure, promoting water conservation, and exploring alternative water sources.

“

Frequently Asked Questions

Q: What is an “orange alert”?

A: An orange alert signifies a high risk of dangerous weather conditions. It means that these conditions are not frequent and could be dangerous for people and property.

Q: How is climate change affecting rainfall in Spain?

A: Climate change is leading to warmer temperatures, which allow the atmosphere to hold more moisture, resulting in heavier rainfall events. Changes in atmospheric circulation patterns are also contributing to these shifts.

Q: What can individuals do to prepare for increased rainfall risks?

A: Individuals can stay informed about weather forecasts, ensure their homes are adequately insured, and take steps to protect their property from flooding, such as clearing gutters and elevating valuables.

Q: Where can I find more information about weather warnings in Spain?

A: You can find the latest weather warnings and information from the Spanish Meteorology Agency (Aemet) website: https://www.aemet.es/en

The increasing intensity of rainfall in Spain isn’t just a meteorological phenomenon; it’s a call to action. By understanding the underlying trends, investing in proactive measures, and fostering a culture of preparedness, we can mitigate the risks and build a more resilient future for these vulnerable regions. What steps will your community take to adapt to this changing climate?