New Delhi,India – Nayara Energy,a significant player in India’s refining sector,is navigating a substantial disruption to its crude oil supply chain. This progress follows the imposition of sanctions by the European Union in July targeting the Russian-backed refiner. Key oil suppliers, Saudi Aramco and iraq’s state oil company SOMO, have ceased crude oil sales to Nayara Energy, according to multiple sources.

Shift in Supply Dynamics

Table of Contents

- 1. Shift in Supply Dynamics

- 2. Payment Challenges and Operational Impact

- 3. Leadership Transition and Russian Support

- 4. Understanding the Implications of Energy Sanctions

- 5. Frequently asked Questions about Nayara Energy

- 6. what are the potential implications of Saudi Aramco and Iraq’s SOMO suspending crude oil deliveries to Nayara Energy for India’s energy security?

- 7. Saudi aramco and Iraq’s SOMO Suspend Crude Oil Deliveries to Indian Refiner Nayara,Reports Indicate

- 8. Supply Chain Disruption: A closer Look at the Nayara Situation

- 9. Key Players and Their Roles

- 10. Reasons Behind the Suspension: Ownership and Transparency

- 11. Impact on India’s Oil Supply and Refining Sector

- 12. Nayara Energy’s Response and Future Outlook

- 13. Broader Implications for Global Oil Trade

- 14. Related Search Terms:

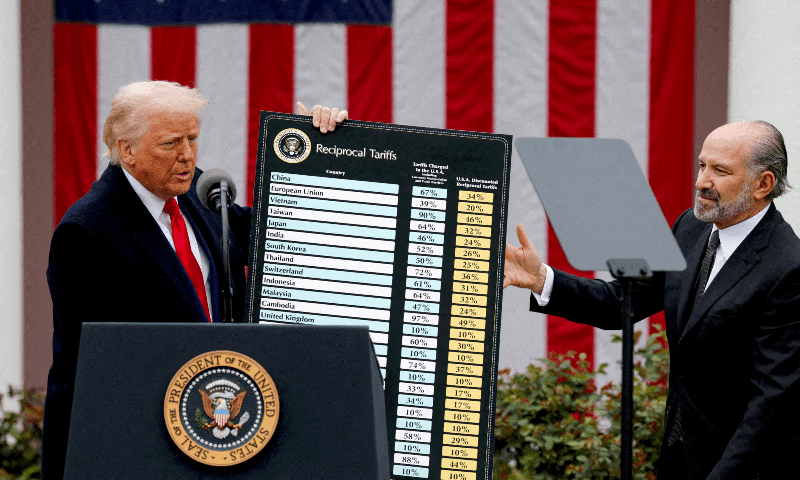

The suspension of shipments from both Saudi Arabia and Iraq has forced Nayara Energy to depend entirely on crude oil imports from Russia throughout August. Data from sources and industry analytics firms, including Kpler and LSEG, corroborate this shift.Previously, Nayara Energy typically procured approximately two million barrels of Iraqi crude and one million barrels of Saudi crude each month.

Shipping data reveals that the last delivery from SOMO, a consignment of Basra crude, was discharged at the Vadinar port on July 29th via the VLCC Kalliopi. Similarly, the final Saudi Arabian delivery, consisting of one million barrels of Arab Light and a comparable volume of Basrah heavy, arrived on July 18th aboard the VLCC Georgios.

Payment Challenges and Operational Impact

Sources indicate that the sanctions have triggered payment-related challenges for Nayara Energy’s purchases from SOMO, though specific details remain undisclosed. the 400,000 barrel-per-day refinery located in Vadinar, western India, is currently operating at a reduced capacity of 70-80 percent. This decrease is linked to difficulties in distributing its refined products due to the ongoing sanctions.

Nayara Energy controls roughly 8 percent of India’s total refining capacity of 5.2 million barrels per day. The company is currently utilizing a “dark fleet”-vessels operating outside standard tracking systems-to transport fuel, as other shipping companies are hesitant to engage due to the sanctions.

Leadership Transition and Russian Support

The situation unfolds amid a leadership change at Nayara Energy. The company’s Chief Executive Officer resigned in July, and a senior executive from azerbaijan’s SOCAR has as been appointed to the position. An official from the Russian Embassy in New Delhi has affirmed that Nayara Energy is receiving direct crude oil supplies from Rosneft, a Russian oil major.

| Supplier | Typical Monthly Volume (Barrels) | last Delivery Date |

|---|---|---|

| Saudi Aramco | 1,000,000 | July 18, 2025 |

| SOMO (iraq) | 2,000,000 | July 29, 2025 |

| Rosneft (Russia) | Ongoing | N/A |

Did You know? The “dark fleet” refers to a collection of tankers that have disabled their automatic identification systems (AIS), making their movements arduous to track, and are commonly used to circumvent sanctions.

Pro Tip: Geopolitical events and international sanctions can substantially impact energy markets,influencing both supply chains and pricing dynamics.

Understanding the Implications of Energy Sanctions

Sanctions in the energy sector are frequently employed as a tool of foreign policy, aiming to exert pressure on specific countries or entities. However, they can also have far-reaching consequences for global energy markets, potentially leading to supply disruptions and price volatility. Companies operating in this space must constantly adapt to changing regulations and geopolitical landscapes. The current situation with Nayara Energy highlights the complexities of maintaining stable energy supplies in a world increasingly shaped by political tensions.In 2024, similar disruptions where observed with venezuelan oil exports following renewed U.S. sanctions, demonstrating a recurring pattern. It’s crucial for India, a major importer of crude oil, to diversify its supply sources to mitigate risks associated with geopolitical events.

Frequently asked Questions about Nayara Energy

- what is the primary keyword? The primary keyword is “Nayara Energy”.

- What impact do the EU sanctions have on Nayara Energy? The EU sanctions have led to disruptions in Nayara Energy’s crude oil supply, resulting in reliance on Russian imports and reduced refinery capacity.

- Who are the key suppliers that have stopped selling to Nayara Energy? Saudi Aramco and Iraq’s SOMO have halted crude oil sales to Nayara Energy.

- Is Nayara Energy still receiving crude oil supplies? yes, Nayara Energy is currently receiving direct supplies from Rosneft of Russia.

- What is a “dark fleet” and why is Nayara Energy using it? A “dark fleet” consists of tankers that have disabled their tracking systems, and Nayara Energy is using them due to difficulties in securing traditional shipping services following the sanctions.

- What is the refining capacity of Nayara Energy? The company controls about 8% of India’s 5.2 million barrel-per-day refining capacity.

- What changes have occurred with Nayara Energy’s leadership? The company’s CEO resigned in July and a new CEO from Azerbaijan’s SOCAR has been appointed.

What are your thoughts on the long-term effects of these supply disruptions on india’s energy security? Share your opinions in the comments below.

what are the potential implications of Saudi Aramco and Iraq’s SOMO suspending crude oil deliveries to Nayara Energy for India’s energy security?

Saudi aramco and Iraq’s SOMO Suspend Crude Oil Deliveries to Indian Refiner Nayara,Reports Indicate

Supply Chain Disruption: A closer Look at the Nayara Situation

Recent reports confirm a important disruption in crude oil supplies to Nayara Energy,a prominent Indian oil refiner. Both Saudi Aramco, the world’s largest oil producer, and Iraq’s State Institution for Marketing of Oil (SOMO) have reportedly suspended deliveries. This growth has sent ripples thru the energy market, raising concerns about potential impacts on India’s oil security and refining capacity. The situation centers around due diligence concerns and ownership transparency.

Key Players and Their Roles

Nayara Energy: An Indian oil refining and marketing company, operating a 20 million tonne per annum (MTPA) refinery in Vadinar, Gujarat. It’s a significant player in India’s downstream oil sector.

Saudi aramco: the state-owned oil company of Saudi Arabia, a major global crude oil supplier.Aramco’s decision to halt deliveries is a critical factor in this disruption.

SOMO (State Organization for Marketing of Oil): The marketing arm of Iraq’s oil ministry, responsible for exporting Iraqi crude oil. SOMO’s suspension adds to the supply squeeze.

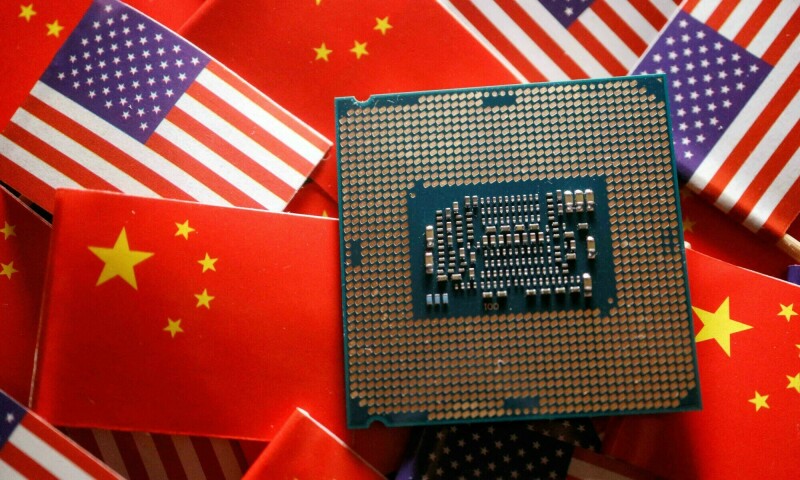

Rosneft: The Russian state-owned oil company holds a significant stake in Nayara Energy,a factor heavily scrutinized in the current situation.

Reasons Behind the Suspension: Ownership and Transparency

The primary driver behind the suspensions appears to be concerns surrounding Nayara Energy’s ownership structure. Specifically, scrutiny focuses on the influence of Russian oil major Rosneft, which holds a 49.13% stake in Nayara through its subsidiary.

sanctions Compliance: Western nations have imposed sanctions on Russia following the invasion of Ukraine. While Nayara Energy isn’t directly sanctioned, Aramco and SOMO are likely exercising caution to avoid any perceived violation of sanctions regulations by indirectly supplying a company with significant Russian ownership.

Due Diligence Requirements: Both Aramco and SOMO have reportedly requested greater transparency regarding Nayara’s ownership and control.This includes detailed data about the ultimate beneficial owners and the flow of funds.

US Pressure: Reports suggest that the United States government has been actively urging Aramco and SOMO to reassess their dealings with Nayara Energy, further intensifying the pressure for greater transparency.

Impact on India’s Oil Supply and Refining Sector

the suspension of crude oil deliveries poses several challenges for India:

- Supply Shortfall: Nayara Energy’s refinery requires approximately 18-20 million barrels of crude oil per month. The loss of supplies from Saudi Arabia and Iraq creates a significant shortfall that needs to be addressed.

- Price Volatility: Reduced supply can contribute to increased crude oil prices, impacting India’s import bill and potentially leading to higher fuel prices for consumers.

- Refining Capacity Utilization: A prolonged supply disruption could force Nayara Energy to reduce its refinery utilization rate, impacting india’s overall refining capacity.

- Search for Alternative Sources: India will need to actively seek alternative crude oil sources, potentially from countries like the united Arab Emirates, Kuwait, or the United states, to mitigate the supply shortfall. This may involve negotiating new contracts and adjusting existing supply agreements.

Nayara Energy’s Response and Future Outlook

Nayara Energy has acknowledged the supply disruptions and stated it is indeed working to secure alternative crude oil sources. The company maintains it operates within all applicable laws and regulations.

Diversification of Supply: Nayara is actively exploring options to diversify its crude oil supply portfolio,including sourcing from new suppliers and increasing imports from existing ones.

Engagement with Stakeholders: The company is reportedly engaging with Saudi Aramco, SOMO, and relevant government authorities to address their concerns and restore crude oil deliveries.

Potential Ownership Restructuring: Some analysts suggest that a potential restructuring of Nayara Energy’s ownership could be a solution to alleviate concerns and secure future supplies. This could involve Rosneft reducing its stake or divesting entirely.

Broader Implications for Global Oil Trade

this situation highlights the increasing complexities of global oil trade in the current geopolitical landscape.

Geopolitical Risk: The conflict in Ukraine and the resulting sanctions have introduced significant geopolitical risk into the oil market, forcing companies to carefully assess their supply chains and partnerships.

Energy Security Concerns: The disruption underscores the importance of energy security for importing nations like India, prompting them to diversify their energy sources and build strategic reserves.

Transparency and Compliance: The case emphasizes the growing importance of transparency and compliance with sanctions regulations in the oil industry. Companies are facing increasing pressure to conduct thorough due diligence and ensure their operations are not inadvertently supporting sanctioned entities.

india oil imports

Rosneft Nayara Energy

Saudi aramco crude oil

Iraq SOMO oil exports

Crude oil supply disruption

Oil sanctions Russia

India energy security

* Nayara Energy ownership