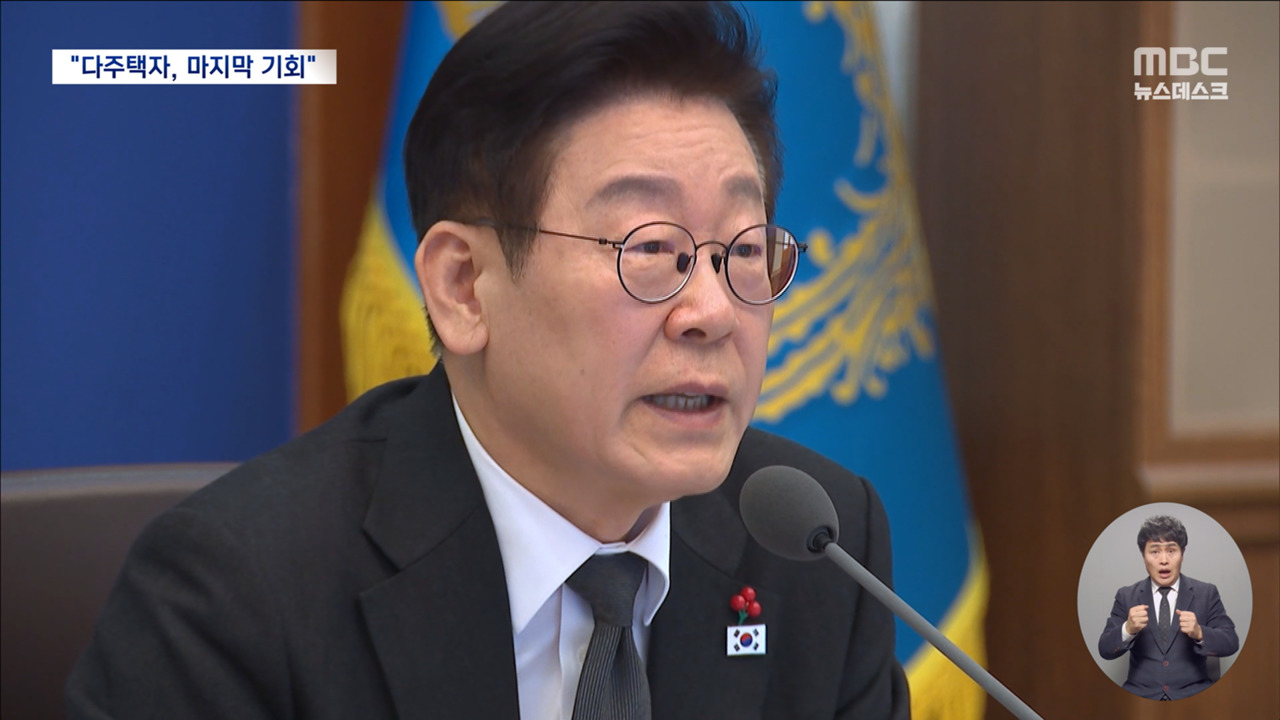

President Lee Jae-myung Vows ‘Any Means Necessary’ to Stabilize South Korea’s Housing Market – Urgent Breaking News

Seoul, South Korea – In a dramatic escalation of rhetoric, South Korean President Lee Jae-myung has reaffirmed his commitment to tackling the country’s persistent housing crisis, promising to utilize “any means necessary” to stabilize prices. The President’s forceful statements, delivered via a series of social media posts over the past 24 hours, signal a renewed push to address a deeply sensitive issue for Korean citizens and a key factor in the nation’s economic outlook. This is a developing story with significant implications for investors, homeowners, and the broader Korean economy – a crucial update for Google News followers and those tracking SEO trends in international markets.

Pressure Mounts on Multiple Homeowners, Tax Reform Looms

President Lee’s online campaign began yesterday and has continued into today, with repeated emphasis on his determination to succeed where previous administrations have struggled. He directly addressed those owning multiple properties, implicitly urging them to sell, and warned that tax reforms are on the table if necessary, despite potential public opposition. His comments came after last month’s announcement to end the heavy and deferred transfer tax for multiple homeowners on May 9th, a move intended to encourage sales.

In a particularly striking analogy, President Lee compared stabilizing housing prices to “improving the valley or achieving a stock price of 5,000,” suggesting he views the challenge as achievable with the right approach. He defended this comparison against criticism, stating, “There are people who do not understand properly like kindergarten students.” This direct response highlights the President’s willingness to engage directly with critics and defend his policies.

Political Backlash and Opposition Response

The President’s strong stance has drawn immediate fire from the opposition People Power Party, who questioned the ease with which he believes the market can be “normalized.” They pointed to past anxieties created by President Lee’s earlier statements suggesting a lack of solutions to the housing crisis, sarcastically asking if he has “come up with a trick?”

Choi Bo-yoon, a spokesperson for the People Power Party, criticized the President’s approach as “extremely inappropriate,” arguing that a president should offer calm policy explanations rather than “provocative slogans.” She further accused him of attempting to rebrand the failures of the previous Moon Jae-in administration as solutions.

Democratic Party Weighs Options, Market Impact Anticipated

The ruling Democratic Party has offered a more measured response, stating the need to assess the market’s reaction to the end of the transfer tax before considering further action. However, they also indicated that real estate tax system reform remains a possibility. This cautious approach reflects the complex political landscape and the potential for unintended consequences from drastic policy changes.

Evergreen Context: South Korea’s housing market has been characterized by decades of volatility, driven by rapid urbanization, limited land availability, and speculative investment. Historically, government interventions – including price controls, loan restrictions, and tax policies – have often had limited long-term success. The current situation is further complicated by demographic shifts, including an aging population and declining birth rate, which are impacting housing demand. Understanding these underlying factors is crucial for interpreting the President’s latest moves.

SEO Tip: For those following Korean real estate SEO, monitoring keywords related to ‘부동산 정책’ (real estate policy) and ‘집값 안정화’ (housing price stabilization) will be critical in the coming weeks. Staying informed through reliable Google News sources is essential for investors and market analysts.

President Lee’s unwavering commitment, coupled with the potential for significant policy shifts, sets the stage for a pivotal period in South Korea’s real estate landscape. The coming months will reveal whether his bold approach can deliver on its promise of stabilization and affordability, or if it will further complicate an already challenging situation. Archyde.com will continue to provide in-depth coverage and analysis of this crucial story, offering readers the latest updates and expert insights to navigate this evolving market.