Singapore Motor Show 2026: Beyond the Metal – A Glimpse into the Future of Mobility

The Singapore Motor Show 2026 isn’t just a showcase of gleaming new cars; it’s a crystal ball reflecting the rapidly evolving landscape of personal transportation. With 37 brands vying for attention, and the debut of newcomers like Hongqi and Nio, the event signals a pivotal shift – one where electric vehicles (EVs) aren’t just an alternative, but increasingly, the default. But beyond the horsepower and sleek designs, a deeper transformation is underway, driven by changing consumer preferences, technological advancements, and the unique demands of the Singaporean market.

The Electric Surge: More Than Just a Trend

The dominance of EVs at the show is undeniable. From the affordable Leapmotor C10, specifically tuned for Singapore’s Certificate of Entitlement (COE) categories, to the luxurious Mercedes-Benz CLA available in both all-electric and mild-hybrid variants, manufacturers are aggressively pushing towards electrification. BYD’s continued success, already the best-selling EV brand locally, is further cemented with the introduction of the Seal 6 DM-i, targeting those hesitant to fully commit to electric. This isn’t simply about meeting emissions targets; it’s about responding to a growing demand for sustainable and cost-effective transportation. The rise of plug-in hybrids like the Seal 6 DM-i is particularly noteworthy, bridging the gap for drivers concerned about range anxiety.

Beyond Range: The Rise of the ‘Lifestyle’ EV

However, the focus is shifting beyond simply achieving longer ranges. The Nio Firefly, with its surprisingly spacious interior and swappable battery technology (though its availability in Singapore remains to be seen), exemplifies a new trend: the ‘lifestyle’ EV. Its emphasis on practicality – a generous 335L boot expanding to 1,250L, plus hidden storage compartments – caters to the needs of urban families. Similarly, the Hyundai Ioniq 9, a large, seven-seater electric SUV, demonstrates that EVs can accommodate larger households without compromising on space or comfort. This focus on usability is crucial for wider EV adoption.

The Software-Defined Car: A New Battleground

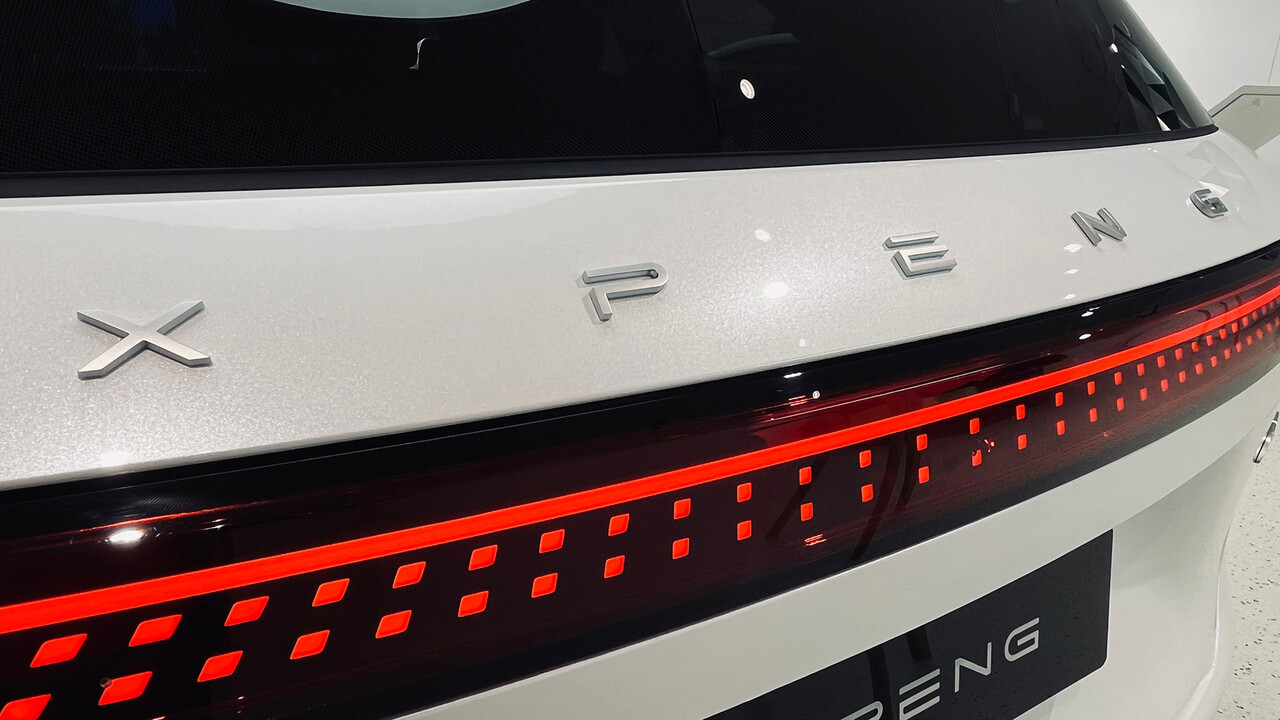

While hardware remains important, the Singapore Motor Show also highlights the growing importance of software. Honda’s Super One EV, with its simulated engine noises and gearbox feel, is a fascinating example of how manufacturers are attempting to recreate the emotional connection traditionally associated with internal combustion engines. This points to a future where the driving experience is increasingly defined by software, allowing for greater customization and personalization. The Xpeng P7, though details are still scarce, is known for its advanced driver-assistance systems and intelligent cabin features, suggesting a similar trajectory. This software-defined approach will likely become a key differentiator between brands.

The Data Advantage: Personalization and Predictive Maintenance

The increasing sophistication of in-car software also unlocks the potential for data-driven insights. Manufacturers can leverage data on driving habits, vehicle performance, and user preferences to offer personalized services, optimize vehicle maintenance, and even predict potential issues before they arise. This shift towards predictive maintenance could significantly reduce ownership costs and enhance the overall driving experience. However, it also raises important questions about data privacy and security, which will need to be addressed proactively.

Luxury Reimagined: Exclusivity and Bespoke Experiences

Even in the realm of luxury, the automotive landscape is evolving. The BMW Skytop, a limited-edition two-seater roadster, represents a return to bespoke craftsmanship and exclusivity. With only 50 units worldwide, it’s a statement piece designed for discerning collectors. This trend suggests that luxury carmakers are increasingly focusing on creating unique and highly personalized experiences, catering to a clientele that values individuality and rarity. This is a departure from the mass-market approach and signals a renewed emphasis on brand heritage and craftsmanship.

The COE Factor: Shaping Singapore’s Automotive Future

The Singaporean context – specifically the COE system – continues to exert a significant influence on vehicle choices. The Leapmotor C10’s tuning to meet Cat A COE requirements demonstrates manufacturers’ responsiveness to local regulations. As COE prices fluctuate, we can expect to see continued innovation in vehicle design and powertrain technology aimed at maximizing affordability and accessibility. The government’s policies will undoubtedly play a crucial role in shaping the future of mobility in Singapore.

The Singapore Motor Show 2026 isn’t just about the cars on display; it’s a barometer of the broader automotive industry. The accelerating shift towards electrification, the growing importance of software, and the continued influence of local regulations all point to a future where personal transportation is more sustainable, more connected, and more tailored to individual needs. What are your predictions for the future of EVs in Singapore? Share your thoughts in the comments below!