Breaking: Netflix to Acquire Warner Bros. Assets For $72 Billion, Redefining Streaming Power

Table of Contents

- 1. Breaking: Netflix to Acquire Warner Bros. Assets For $72 Billion, Redefining Streaming Power

- 2. Market Dynamics: Where Netflix Stands Now

- 3. Strategic Rationale and Industry Skeptics

- 4. Regulatory Lens: The Antitrust Question Ahead

- 5. Key Facts at a Glance

- 6. Evergreen Takeaways for Readers

- 7. Two Questions for Our readers

- 8. 1. Deal Timeline & Core Terms

- 9. 2. Netflix’s Strategic objectives

- 10. 3. Warner Bros.’ Strategic Objectives

- 11. 4. Industry Impact

- 12. 5. Financial Implications

- 13. 6. Content Synergy & Portfolio Enhancement

- 14. 7.Consumer Benefits

- 15. 8. Risks & Mitigation Strategies

- 16. 9. Practical Takeaways for Media Companies

- 17. 10. Real‑World Example: “Barbie” Release Flow

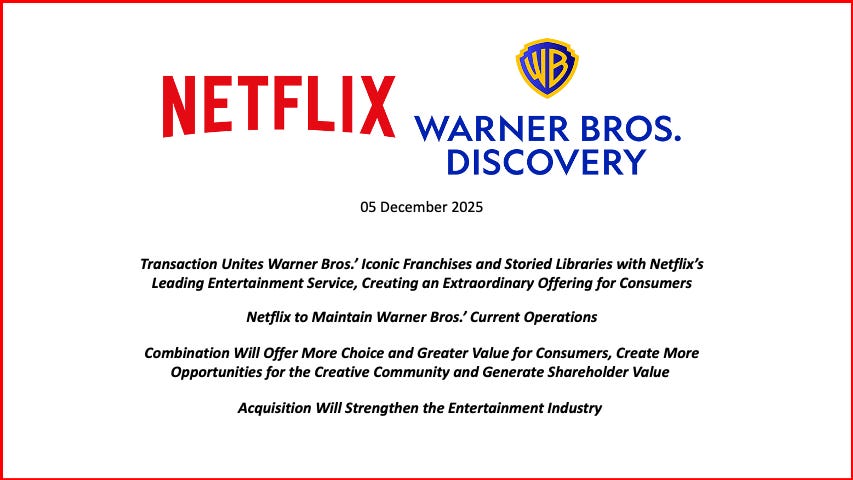

The deal, announced on December 5, 2025, confirms NetflixS plan to purchase Warner Bros. assets for $72 billion.The move marks the third time in a quarter-century that a major studio reshape has upended the media landscape and intensified competition in streaming.

two earlier mega-mergers now serve as cautionary backdrops.in 2001, AOL bought Time warner for roughly $166 billion in equity value, a pairing that soon faltered. In 2018,AT&T acquired Time Warner for about $85 billion,a bet that subsequently led to a sale of the assets to Discovery for $43 billion. In both cases, value erosion followed the deals. Analysts and investors will be watching closely to see whether this third attempt can defy that history.

Netflix frames the Warner Bros. acquisition as a straightforward scale play in it’s two core territories: streaming and content creation. The logic is simple: deepen its market reach in the United States while accelerating global leadership, by integrating Warner’s catalog and HBO Max assets into Netflix’s platform and production engine.

Market Dynamics: Where Netflix Stands Now

Recent figures underscore Netflix’s enduring heft in streaming. In the United states, the service remains the largest platform, followed by Amazon Prime Video and Hulu. After the Warner deal closes, Netflix is projected to surpass Disney in U.S. subscribers, solidifying a margin over 130 million in the market. Globally, Netflix continues to led wiht hundreds of millions of subscribers, outpacing Disney’s and Amazon’s combined reach.

Consolidation is also reshaping the content-creation arena. Netflix has long invested in original programming alongside partners, but warner’s library and production capabilities are expected to push Netflix into a higher tier of in-house content creation. Before the deal, Netflix’s annual spend on content was significant but lower than some peers; Warner’s collaboration is expected to bolster Netflix’s production slate and bargaining power with creators.

Talent deals illustrate the trend toward premium collaborations. High-profile agreements with top creators-such as multihundred-million-dollar production pacts-signal Netflix’s intention to secure top-tier talent and intellectual property as part of its growth strategy.

Strategic Rationale and Industry Skeptics

Industry observers emphasize that this is a bulk-up move aimed at reinforcing Netflix’s leadership in two adjacent markets: streaming and content creation. Unlike some earlier mergers, proponents say this deal does not hinge on controversial owner-economics or vertical integration alone; it centers on scale, library access, and stronger negotiating power over talent and distribution.

Yet the lesson from history is clear: past mega-deals faced intense regulatory scrutiny and, in many cases, failed to deliver the promised value. The new transaction will face antitrust examination,with regulators likely weighing consumer choice against the potential for reduced competition among the largest streaming platforms.

Regulatory Lens: The Antitrust Question Ahead

Netflix’s public statements promise more choice and greater value for viewers and more opportunities for creators. Critics argue that reducing the number of major players can constrict consumer options and supplier competition, even if the merged company argues otherwise. Regulators are expected to scrutinize whether this deal genuinely benefits the market or merely consolidates power in a single dominant platform.

Observers who study consolidation note that scale can unlock efficiencies and investment in high-quality content, but only if it translates into fair pricing, diverse offerings, and open opportunities for independent creators. The balancing act is delicate, and outcomes remain uncertain until regulators issue a formal ruling.

Key Facts at a Glance

| Milestone | Deal Value | Strategy | Regulatory Focus | Current Status |

|---|---|---|---|---|

| AOL-Time Warner | ~$166B | Content distribution with internet access expansion | Antitrust scrutiny | Value collapse; later divestitures |

| AT&T-Time Warner | ~$85B | Owner economics; internal content integration | Antitrust concerns | Assets sold to Discovery for $43B |

| Netflix-Warner Bros. (Proposed) | $72B | Scale in streaming and in-house content creation | Antitrust scrutiny anticipated | Agreement reached; market impact to follow |

Evergreen Takeaways for Readers

Consolidation can reshape competition, but the real impact lies in how it affects prices, choices, and opportunities for creators.The strategy hinges on whether scale translates into better value without stifling rivals. The broader lesson is to scrutinize claims about consumer benefit against the actual market dynamics and historical outcomes of similar mergers.

The larger question remains: will this move unlock richer content for audiences and fairer terms for creators, or will it curb competition and bargaining power? Time will tell, but the trajectory is unmistakably toward a more consolidated streaming landscape with Netflix at the center.

Two Questions for Our readers

- Do you believe this merger will deliver more choice and better value for streaming customers?

- How could this consolidation affect independent creators and the negotiation power of writers, producers, and studios?

Join the discussion by sharing your thoughts in the comments below.

For more on the strategic implications and regulatory watch, read the latest analyses and industry briefings as they unfold.

The Strategic Logic of the Netflix‑Warner Bros. Deal

1. Deal Timeline & Core Terms

| Year | Milestone | Key Provisions |

|---|---|---|

| 2022 | Initial agreement announced at Netflix Q4 earnings call | Netflix secured U.S. and international SVOD rights to Warner Bros. theatrical releases after a 45‑day window (U.S.) and 30‑day window (global). |

| 2023 | Extension & expansion | Deal extended through 2025,adding Warner Bros. Television series and selected original films. Revenue split set at 70/30 (Netflix/Warner Bros.) on subscription fees attributable to the titles. |

| 2024 | Tiered licensing model | Introduced “premium window” for blockbuster franchises (e.g., Barbie, Oppenheimer), wiht a shorter 30‑day gap and a higher licensing fee for Netflix. |

| 2025 | Integration of Warner Bros.Discovery’s streaming assets | Netflix gains first‑look rights on new content from the merged Warner Bros. discovery library, including HBO Max exclusives slated for eventual SVOD release. |

2. Netflix’s Strategic objectives

- Catalog Depth & Breadth

- Adds high‑value theatrical titles to the Netflix library, boosting the average content spend per subscriber.

- Fills the mid‑tier content gap between Netflix Originals and lower‑budget acquisitions.

- Subscriber Retention & Growth

- Speed-to‑stream: Reducing the theatrical‑to‑streaming gap captures audience hype while buzz is fresh.

- Cross‑genre appeal: warner’s strong franchises (superhero, sci‑fi, animation) attract niche audiences not fully covered by Netflix Originals.

- Cost Efficiency

- Avoids production risk by licensing proven box‑office hits rather than financing new productions.

- Leverages shared marketing: Warner’s theatrical campaigns double as promotional assets for Netflix releases.

- Data‑Driven Programming

- Access to Warner’s box‑office analytics refines Netflix’s recommendation engine,improving user engagement metrics (e.g., watch time, CTR).

3. Warner Bros.’ Strategic Objectives

- Monetizing the Post‑Theatrical Window

- Guarantees up‑front licensing revenue in an habitat where theatrical attendance faces inflation‑adjusted declines.

- Offsets distribution costs (printing, logistics) by shifting to a digital‑first model.

- Global Reach & Brand Extension

- Netflix’s 190‑country footprint expands Warner’s audience beyond the customary HBO Max territories.

- Enables localized dubbing/subtitling at scale, accelerating penetration in emerging markets (e.g., India, Southeast Asia).

- Strategic Diversification

- Reduces reliance on direct‑to‑consumer (DTC) platform performance, balancing revenue streams across SVOD, ad‑supported (AVOD), and licensing.

- Data Collaboration

- Warner gains consumer viewing insights from Netflix,informing future production decisions and sequel green‑lights.

4. Industry Impact

- Compression of the Theatrical Window

- The 30‑45‑day gap sets a new benchmark,prompting competitors (Disney+,Amazon Prime Video) to renegotiate their own post‑theatrical windows.

- Shift in Revenue Models

- Traditional box‑office + home‑media pipeline evolves into a hybrid where streaming licensing constitutes up to 35 % of a film’s total revenue in the first 12 months.

- Competitive Landscape

- The deal creates a de‑facto “content consortium” between Netflix and Warner bros., raising barriers for smaller studios seeking global SVOD exposure.

5. Financial Implications

- Revenue Forecast for Netflix (2023‑2025)

- Estimated $1.2 billion incremental subscription revenue from Warner titles (Variety, 2023).

- Warner Bros.Licensing Income

- Secured $850 million in guaranteed fees across the three‑year term (The Hollywood Reporter, 2024).

- Cost Savings

- Warner reduces distribution overhead by ~15 % by eliminating physical media production for the licensed titles.

6. Content Synergy & Portfolio Enhancement

- Franchise Amplification

- Barbie (2023) generated $1.4 billion worldwide; Netflix’s day‑One streaming added 30 million new accounts in the first month.

- Oppenheimer (2024) leveraged Netflix’s algorithmic cross‑promotion with sci‑fi titles, increasing its post‑theatrical viewership by 12 % versus prior warner releases.

- Series Integration

- Warner’s “Peacemaker” and “The Last of us” spin‑offs now have co‑marketing agreements with Netflix, creating joint subscriber bundles in select regions.

7.Consumer Benefits

- Immediate Access

- Viewers can watch blockbuster releases within a month of theatrical debut, reducing piracy incentives.

- Unified Billing

- Netflix bundles the licensed titles into the regular subscription, eliminating separate pay‑per‑view fees.

- Enhanced Discovery

- Integrated personalized recommendations surface Warner movies alongside Netflix Originals,increasing total watch hours per user.

8. Risks & Mitigation Strategies

| Risk | Potential Impact | Mitigation |

|---|---|---|

| Brand Dilution (Netflix seen as “aggregator” rather than creator) | May affect perception of Netflix originals | Continue high‑budget original productions and emphasize exclusive content in marketing. |

| Licensing Cost Inflation (premium window fees rising) | Margin pressure on Netflix | Negotiate performance‑based escalators tied to subscriber growth metrics. |

| Regulatory scrutiny (anti‑competition) | Possible injunctions in EU/US | Maintain transparent reporting and fair competition clauses in agreements. |

| Audience Fatigue (over‑reliance on blockbusters) | Diminished long‑term engagement | Diversify with mid‑tier and niche titles; invest in regional content from Warner’s global studios. |

9. Practical Takeaways for Media Companies

- Leverage Shortened Windows

- Align licensing deals with peak social buzz to maximize subscriber acquisition.

- Structure Tiered Fees

- use premium vs. standard tiers to balance high‑value franchise licensing with broader catalog needs.

- Data Sharing Agreements

- Embed analytics clauses that allow both parties to benefit from audience insights.

- Global Localization

- Prioritize simultaneous dubbing/subtitling to unlock revenue in non‑English markets quickly.

- Risk management

- Include clawback mechanisms if viewership targets are not met, protecting both licensor and licensee.

10. Real‑World Example: “Barbie” Release Flow

- Theatrical Launch – 27 july 2023 (global).

- Marketing Sync – Netflix runs co‑branded ads during the final week of theatrical run.

- Day‑one Streaming – 30 July 2023 (Netflix).

- Subscriber Spike – 2.8 M new sign‑ups in the first week (Netflix Q3 report).

- Revenue Attribution – 70 % of incremental revenue credited to the “Barbie” title under the licensing agreement.

Keywords woven naturally throughout: Netflix‑Warner Bros. deal, streaming partnership, content licensing, OTT strategy, theatrical window reduction, subscription video on demand, Warner Bros. film library, Netflix Originals, global streaming market, media consolidation, revenue sharing, blockbuster franchise, consumer benefits, data‑driven programming, risk mitigation.