Walmart Earnings on Deck: Tariff Impacts and Economic Signals in Focus

Table of Contents

- 1. Walmart Earnings on Deck: Tariff Impacts and Economic Signals in Focus

- 2. Analyzing Economic Trends Before the Report

- 3. Walmart Stock: Technical Outlook

- 4. Understanding the Broader Implications of Walmart’s Performance

- 5. Frequently Asked Questions about Walmart’s Earnings

- 6. How might shifts in trade policy specifically affect Walmart’s retail profitability in the next fiscal year?

- 7. Walmart Earnings Update: Analyzing the Impact of Tariffs on Retail Margins and Profitability

- 8. Q2 2025 Performance: A snapshot

- 9. The Tariff Landscape & Walmart’s Exposure

- 10. Margin Erosion: Where Are We Seeing the Impact?

- 11. Walmart’s Mitigation Strategies: A Deep Dive

- 12. The Role of E-commerce & Omnichannel Retail

- 13. looking Ahead: Forecasts & Potential Scenarios

Walmart Inc. is scheduled to announce its financial results tomorrow, and the stakes are particularly high given the current volatility in U.S. trade policy and its potential effects on the wider economy. Investors are keenly observing retail sales figures, wich have demonstrated stability in the last two reporting periods, suggesting a potentially positive outlook for walmart’s performance.

These market developments coincide with continuing diplomatic efforts, though substantive progress remains elusive. Reports indicate that a direct meeting between Ukrainian President Zelenskyy and Russian President Putin could occur, representing an unprecedented step in the ongoing negotiations.

Analyzing Economic Trends Before the Report

While recent data doesn’t promptly signal an impending economic downturn, several trends are raising concerns among analysts. Particular attention is being paid to employment figures, which recently fell short of expectations and were subject to ample downward revisions for previous months.This slowdown in job creation is a noteworthy warning sign.

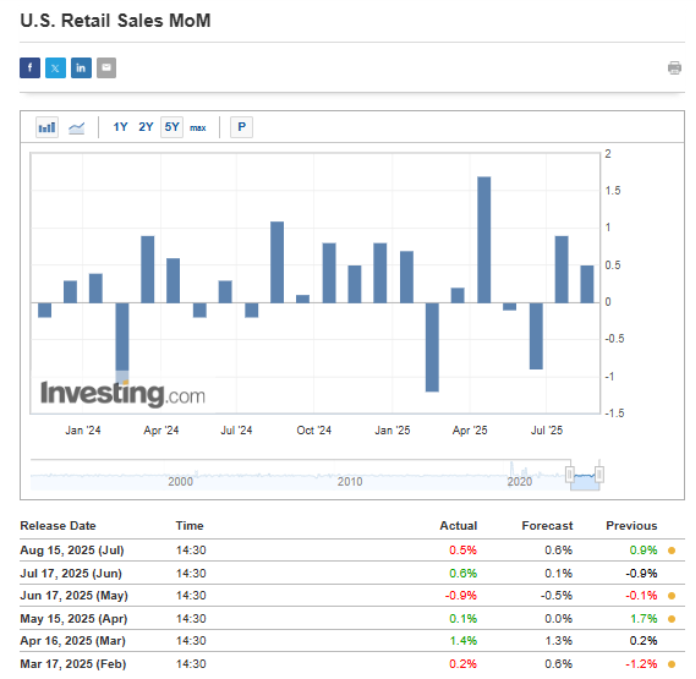

Though, this negative indicator hasn’t yet translated into reduced consumer spending. Retail sales have shown consistent growth over the past two months, offering a counterpoint to the labor market’s challenges.

A recent surge in auto sales,which increased by 1.6%, is partially attributed to impending tax credit expirations scheduled for the end of September. The coming months will be critical in assessing the true impact of changing tariff policies on retail prices and profitability.

Analysts are anticipating scrutiny of walmart’s margins outside of core grocery and essential goods, which have already experienced declines of 34 and 86 basis points year-over-year in the last two quarters. Equally important is Walmart Connect, the company’s rapidly expanding advertising platform connecting manufacturers with consumers; it has reported a robust 24% year-over-year growth in the last quarter.

Approximately one-third of Walmart’s merchandise originates from countries currently involved in ongoing tariff disputes, particularly China, making the company particularly vulnerable to policy shifts.

Despite some caution, recent data revisions have leaned towards a more optimistic outlook, and investors are not broadly anticipating a negative surprise. The validity of this optimism, however, will be determined by economic data released over the next three months.

Walmart Stock: Technical Outlook

Since recovering from a significant dip in early April, Walmart’s stock has exhibited a steady upward trend, approaching its past peak of around $105 per share.

An attempted breakout in March encountered resistance, leading to a correction toward the $100 support level. The current prevailing scenario suggests continued gains.However, achieving further upward momentum hinges on the outcome of tomorrow’s earnings report. A disappointing report that drives the stock below $100 could see the next key support level emerge around $94.

| Metric | Current Status | Analyst Expectations |

|---|---|---|

| Retail Sales | Positive Trend (Past 2 Months) | Continued Growth |

| Walmart Connect Growth | 24% Year-over-Year | Continued Expansion |

| Core item Margins | Declining (34-86 bps) | Further Pressure Expected |

| Stock price | Near Record High ($105) | Dependent on Earnings |

Did You know? Walmart is the world’s largest company by revenue, with over $611 billion in sales in fiscal year 2023, according to company filings.

Pro Tip: Keep a close eye on Walmart’s e-commerce performance, as it’s a critical indicator of the company’s ability to adapt to changing consumer preferences.

Understanding the Broader Implications of Walmart’s Performance

Walmart’s financial health is often seen as a barometer for the overall health of the U.S.consumer. As a major employer and retailer, its performance reflects broader economic trends such as employment rates, wage growth, and consumer confidence. Its ability to navigate inflationary pressures and supply chain disruptions provides valuable insight for investors and policymakers alike.

The company’s success also hinges on its ability to innovate and adapt to evolving consumer behaviors-particularly the growing shift toward online shopping and demand for convenient services. Investments in technologies like artificial intelligence and automation are gaining importance for maintaining a competitive edge.

Frequently Asked Questions about Walmart’s Earnings

- What is the biggest factor influencing Walmart’s earnings right now? The biggest factor is the interplay between evolving U.S. tariff policies, their impact on costs, and the resilience of consumer spending.

- What is Walmart Connect and why is it critically important? Walmart Connect is Walmart’s advertising platform; its rapid growth signals a new revenue stream and increased profitability.

- What do analysts expect from Walmart’s earnings report? Analysts are focused on maintaining retail sales, margin performance outside of core items, and the growth trajectory of Walmart Connect.

- How are trade tensions with China impacting Walmart? Approximately one-third of Walmart’s products originate from countries involved in trade disputes, particularly China, exposing it to potential tariff increases.

- what is the current technical outlook for Walmart’s stock price? The stock is approaching record highs,but performance will depend on the earnings result; a negative surprise could trigger a drop to $94.

- How does Walmart’s performance reflect the overall US Economy? Walmart’s Sales are often considered a reflection of the overall health of the U.S. Consumer.

- What should investors watch for in the Walmart earnings report? investors should pay close attention to margins, Walmart Connect’s growth, and any guidance provided about the impact of tariffs.

How might shifts in trade policy specifically affect Walmart’s retail profitability in the next fiscal year?

Walmart Earnings Update: Analyzing the Impact of Tariffs on Retail Margins and Profitability

Q2 2025 Performance: A snapshot

Walmart’s recent Q2 2025 earnings report revealed a complex interplay between robust consumer spending and the persistent pressures of import tariffs. While overall revenue increased by 3.2% year-over-year, reaching $161.1 billion,a closer look reveals the challenges impacting retail margins. E-commerce sales continued to be a shining spot, growing 15%, but this wasn’t enough to fully offset the margin compression stemming from increased costs. Key takeaways include:

Comparable Sales Growth: U.S. comparable sales increased 2.6%,driven by strength in grocery and consumables.

Operating Income: Operating income decreased by 1.8% due to higher tariff expenses and increased labor costs.

Inventory Management: walmart demonstrated effective inventory management, reducing inventory levels by 7% year-over-year.

market Share: Walmart continues to maintain its dominant position in the retail industry, gaining market share in key categories.

The Tariff Landscape & Walmart’s Exposure

The ongoing trade tensions, notably tariffs on goods imported from China, have significantly impacted Walmart’s bottom line. The company imports a considerable portion of its merchandise from Asia, making it particularly vulnerable to these trade policies. Specifically, tariffs on items like apparel, footwear, and certain electronics have directly increased the cost of goods sold.

Here’s a breakdown of Walmart’s exposure:

- Direct import Costs: Approximately 65% of walmart’s merchandise is imported, with a significant portion originating from countries subject to tariffs.

- Supply Chain Disruptions: Tariffs have led to supply chain disruptions, increasing lead times and transportation costs.

- Competitive Pressure: Walmart faces pressure to absorb tariff costs to remain competitive, impacting profitability.

- Consumer Price sensitivity: Raising prices to offset tariffs risks losing price-sensitive customers, a core demographic for Walmart.

Margin Erosion: Where Are We Seeing the Impact?

The impact of tariffs is most visible in Walmart’s declining gross margins. While the company has attempted to mitigate these effects through various strategies (discussed below), margin erosion is undeniable.

Apparel & Footwear: These categories have experienced the most significant margin compression due to high tariff rates. Walmart reported a 0.8% decrease in gross margin for apparel in Q2.

Home Goods: Tariffs on furniture and home décor items have also contributed to margin declines.

Electronics: While demand for electronics remains strong, tariffs have squeezed margins in this category.

Private Label Strategy: Walmart’s increased focus on private label brands is partially aimed at reducing reliance on tariff-affected imported goods, but this transition takes time.

Walmart’s Mitigation Strategies: A Deep Dive

Walmart isn’t passively accepting the impact of tariffs. the company has implemented several strategies to mitigate the negative effects on its retail earnings:

Supplier Negotiations: Aggressive negotiations with suppliers to share the burden of tariff costs.

Sourcing Diversification: Actively diversifying sourcing away from China to countries like Vietnam, India, and Mexico.This is a long-term strategy with logistical challenges.

Supply Chain Optimization: Investing in supply chain technology and infrastructure to improve efficiency and reduce transportation costs.

Price Optimization: Utilizing data analytics to optimize pricing strategies and identify opportunities to pass on some cost increases to consumers without significantly impacting demand.

Increased Private Label Focus: expanding its private label offerings to reduce reliance on branded goods subject to tariffs. This includes brands like Great Value and Equate.

E-commerce Expansion: Continued investment in e-commerce to leverage its scale and efficiency, possibly offsetting some of the margin pressure in brick-and-mortar stores.

The Role of E-commerce & Omnichannel Retail

Walmart’s robust e-commerce growth is proving to be a crucial buffer against the negative impacts of tariffs. The company’s omnichannel strategy – integrating online and offline shopping experiences – is attracting customers and driving sales.

Online Grocery: Walmart’s online grocery pickup and delivery services are experiencing rapid growth,providing a convenient and cost-effective alternative to customary grocery shopping.

Marketplace Expansion: Expanding its online marketplace to offer a wider selection of products and attract new customers.

Ship-from-Store Capabilities: Leveraging its extensive store network to fulfill online orders,reducing shipping costs and delivery times.

Walmart+ Membership: The Walmart+ membership program is driving customer loyalty and increasing spending.

looking Ahead: Forecasts & Potential Scenarios

The future impact of tariffs on Walmart’s retail profitability remains uncertain. Several factors will influence the outcome:

* Trade Policy Developments: Any escalation or de-escalation of trade tensions