ABIDJAN, Ivory Coast, June 12, 2024 -/African Media Company(AMA)/-The African Growth Financial institution Group has launched highlights of its findings on buying energy parities (PPP) for Africa, following the publication by the Worldwide Comparability Program (ICP) of its revised 2021 and 2017 outcomes on Could 30.

The Worldwide Comparability Program is a worldwide statistical partnership that produces buying energy parities and comparative worth ranges for taking part economies to check the dimensions of their gross home product (GDP) and its essential parts to the internationally, making an allowance for variations in worth ranges.

The African Growth Financial institution was the regional implementing company for Africa and funded the 2021 Worldwide Comparability Program actions on the continent via its Multinational Statistical Capability Constructing (SCB) Program with sources mobilized from the African Growth Fund, the concessional lending window of the Financial institution Group. That is the fourth time that the Financial institution has financed the manufacturing of PPPs in regional member international locations, the coordination of which is completely ensured in Africa.

Highlights:

- Africa represents 5.4% of the world’s gross home product (GDP) in buying energy parity phrases and 18.5% of the overall world inhabitants.

- Egypt retains first place within the rating of the biggest African economies by way of buying energy parities (PPP) for the 2021 cycle, nonetheless forward of Nigeria.

- The 2021 PCI outcomes present, in PPP phrases, that the African economic system grew by 28.51% in comparison with the 2017 baseline and that the continent’s share of worldwide investments reached 3.27%, up from 2 .4% in 2017.

- The world’s largest economic system in 2021 was China, with a GDP-PPP of $28.8 trillion, accounting for 18.9% of worldwide GDP. America was in second place with 15.5% of worldwide GDP and India was in third place with 7.2%.

As of 2021, 52 African international locations have joined this system and successfully carried out all actions. Whereas solely 50 international locations totally participated within the 2017 spherical, Somalia and South Sudan had been added to the 2021 spherical. With 52 international locations, Africa has the biggest share of taking part international locations (29.5%) over a complete of 176 international locations around the globe.

Regional and international economies

As in 2017, Egypt as soon as once more overtook Nigeria within the rating of Africa’s largest economies, with a GDP of $1.9 trillion in buying energy parity (PPP) phrases, in response to the most recent knowledge benchmark of the 2021 Worldwide Comparability Program for Africa (ICP-Africa).

Nigeria, probably the most populous nation in Africa, comes second with a GDP-PPP degree of $1.2 trillion, adopted by South Africa with $844.7 billion, in response to the 2021 PCI outcomes generated by the African Growth Financial institution. Additionally among the many continent’s 5 largest economies are Algeria ($569.6 billion) and Ethiopia ($382.3 billion).

In the case of market change charges, Egypt with its GDP of $462.9 billion stays the biggest continental economic system, adopted by Nigeria ($438.9 billion). Additionally among the many prime 5 African economies are South Africa ($421.6 billion), Algeria ($163.5 billion) and Morocco ($141.8 billion).

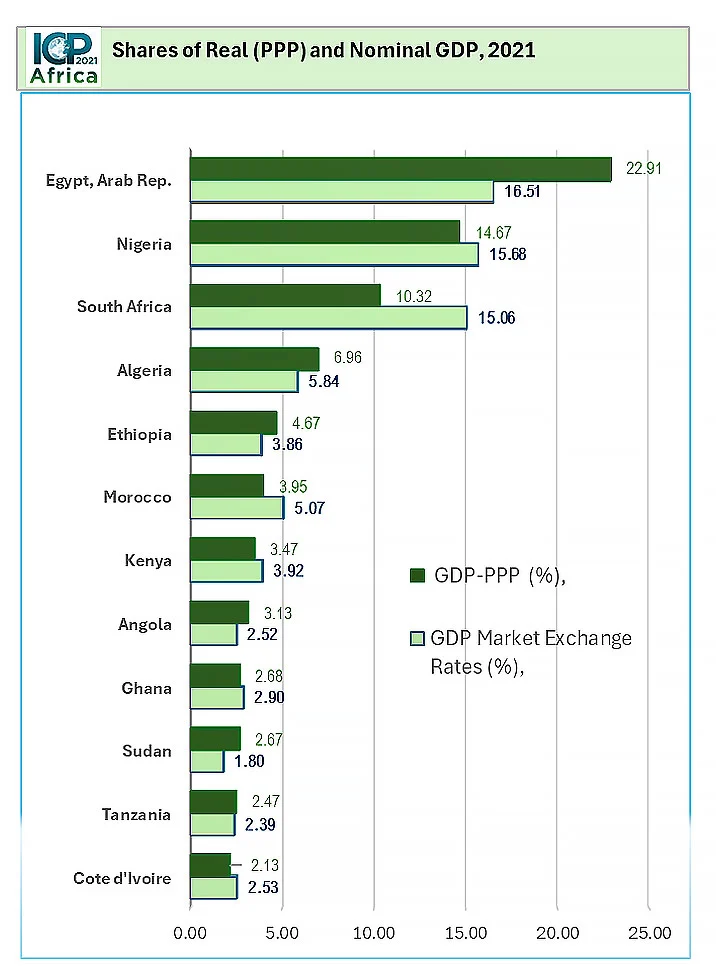

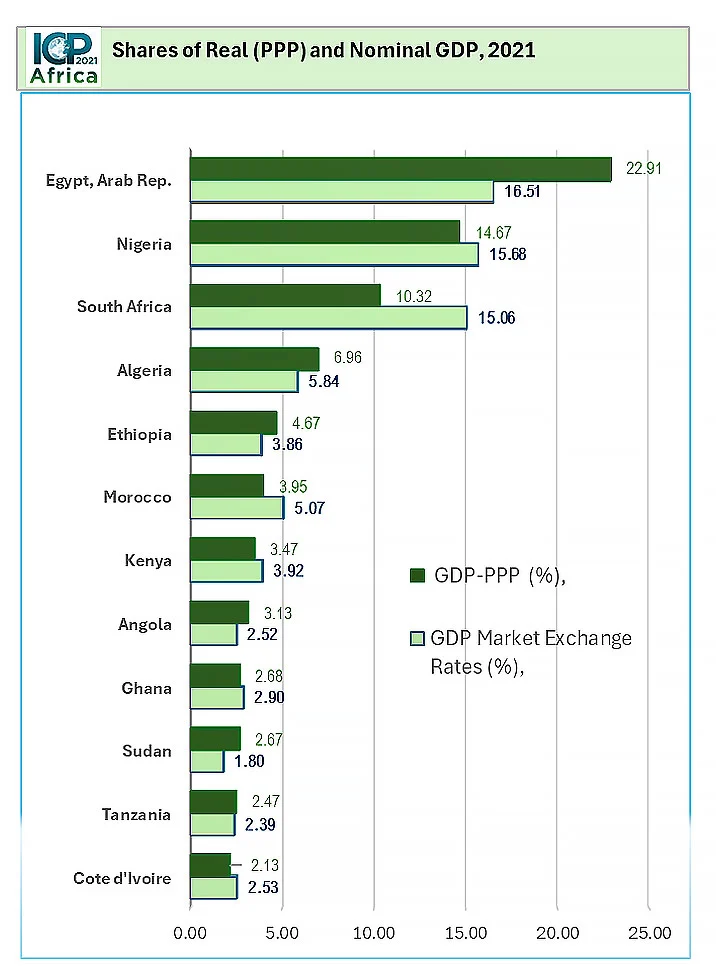

The shares of the biggest economies in Africa’s complete GDP-PPP are Egypt (22.9%), Nigeria (14.7%), South Africa (10.3%), Algeria (7.0%) and Ethiopia (4.7%).

Total, the outcomes reveal that the African economic system produced items and companies price roughly $8.2 trillion in 2021, representing solely 5.4% of worldwide manufacturing and the dimensions of the African economic system measured in PPP phrases was 28.51% greater than in 2017. Africa’s 5 largest economies (Egypt, Nigeria, South Africa, Algeria and Ethiopia) collectively account for 59.5% of the GDP of the continent. The outcomes additional present that the continent’s manufacturing was dominated by twelve international locations, Egypt, Nigeria, South Africa, Algeria, Ethiopia, Angola, Ivory Coast, Ghana , Kenya, Morocco, Sudan and Tanzania, which collectively accounted for 75% of Africa’s GDP in PPP phrases.

Thirty-six African international locations individually accounted for lower than 1% of the area’s output and, collectively, 13.04% of the area’s complete PPP GDP.

Regional GDP-PPP per capita

The report additionally presents the GDP per capita of 52 African economies.

Measured in actual GDP-PPP per capita, the 5 richest international locations in Africa are Seychelles ($29,711.9), Mauritius ($22,246.1), Gabon ($19,546.4), Guinea Equatorial ($18,180.2) and Egypt ($17,158.4). Additionally among the many prime ten international locations are Botswana ($16,651.5), South Africa ($14,222.7), Algeria ($12,893.2), Tunisia ($12,159.1) and Namibia ($10,705.2). Apart from Egypt, South Africa, Algeria and Tunisia, the opposite six international locations have small populations, ranging between 0.11 and a couple of.59 million folks, and their share in actual phrases of regional manufacturing varies from 0.06 to 0.7%.

Lower than 1 / 4 (19.2%) of African international locations had an actual GDP per capita of lower than $2,000. Burundi is the one nation whose actual GDP per capita is lower than $1,000. The 5 non-rich economies are Burundi ($981), Central African Republic ($1,085), Somalia ($1,134), Mozambique ($1,440) and Niger ($1,538).

Which international locations are the most costly ?

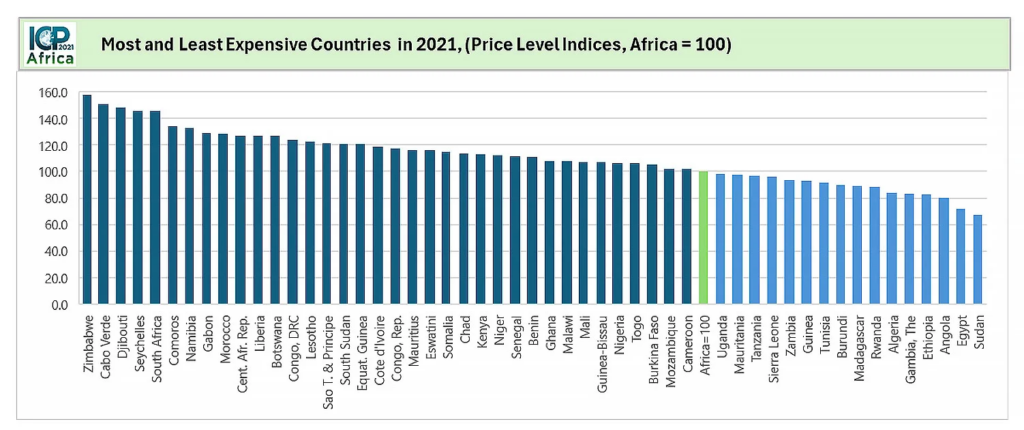

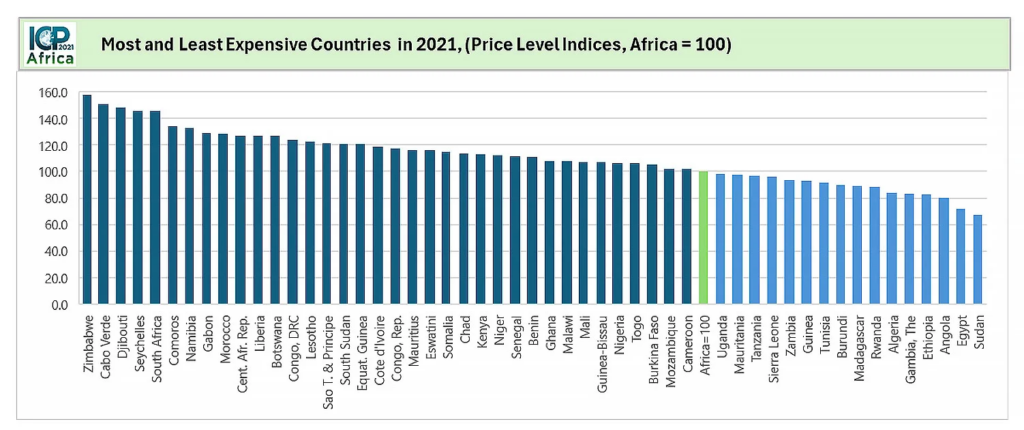

The worth degree index (PNI) is the ratio of a rustic’s PPP to the change fee of its forex in opposition to the US greenback. NPIs enable international locations’ total worth ranges to be in comparison with the African common. An INP larger than 1 implies that costs are greater than the area’s common, and an INP lower than 1 implies that costs are comparatively decrease than the area’s common.

Zimbabwe has the best worth ranges on the continent, adopted by Cabo Verde, Djibouti, Seychelles and South Africa. The bottom worth ranges are noticed in Sudan, Egypt, Angola and Ethiopia.

Capital expenditure

At 21.3%, Nigeria has the biggest share of Africa’s funding expenditure (outlined as gross fastened capital formation), adopted by Egypt (12.10%), Algeria (10.30%), South Africa (9.30%) and Morocco (6.0%). Additionally among the many prime ten international locations are Ethiopia (4.02%), Tanzania (3.9%), Kenya (3.5%), Ghana (2.49%) and Ivory Coast ( 2.46%). This group represents 75.4% of complete investments in Africa. Nigeria additionally accounts for 30.4% of investments in sub-Saharan Africa, adopted by South Africa (13.3%).

35 of the 52 international locations individually had a share of lower than 1%, collectively representing 12.5% of complete funding in Africa.

The outcomes of ICP-Africa 2021 will probably be used to check regional incidences of poverty, analyze poverty between international locations and revise worldwide poverty strains. They may also be utilized in funding and employment choices of varied financial brokers.

Distributed by African Media Company (AMA) for the African Growth Financial institution.

Supply : African Media Company (AMA)

2024-06-12 10:04:14

#African #Growth #Financial institution #publishes #highlights #report #buying #energy #parities #