Gold stocks Rally Nears Target: What Investors Need to Know Now

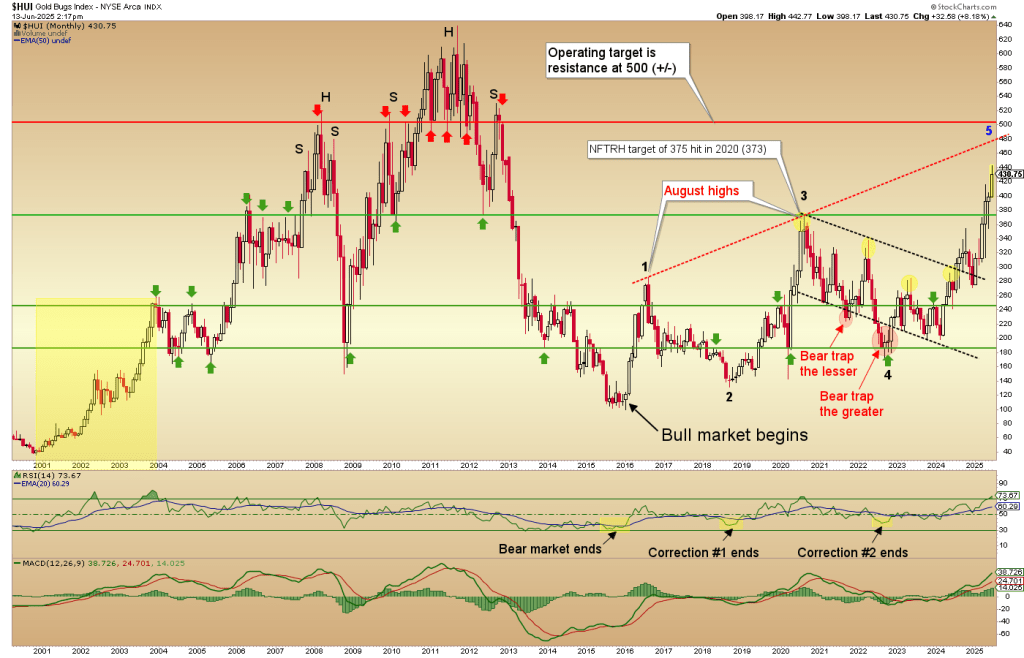

The Rally In Gold Stocks Is Approaching A Long-Anticipated Upside Target, Signaling A Critical Juncture For Investors. After A Significant Climb, The HUI Gold Bugs Index Is Drawing Close to the 500 mark, Prompting An Evaluation Of Potential Risks And rewards.

Gold’s Favorable Macro-Fundamental Alignment

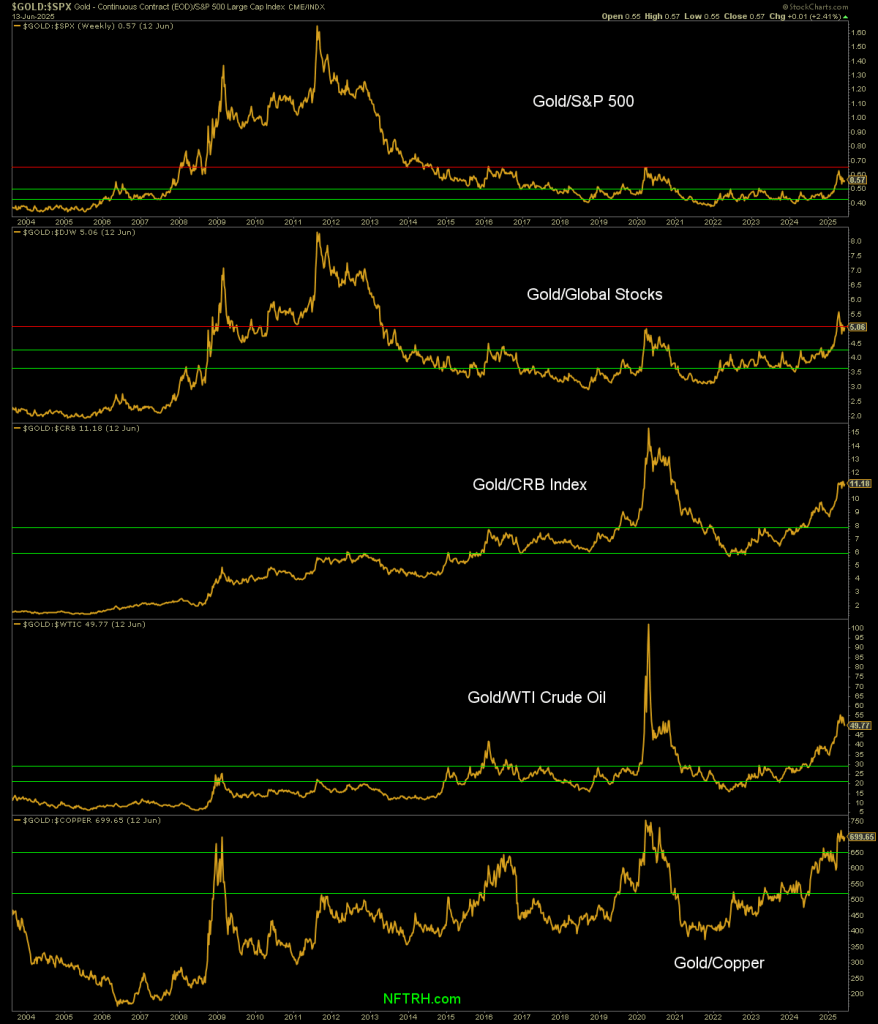

Earlier this Year, Market analysts Highlighted The Positive Macro-Fundamental Factors Aligning Favorably For The Gold mining Industry.While Many Investors Focused On High-Flying Tech Stocks, A Contrarian View pointed To gold’s Potential based On Its Relationship With Cyclical Markets.

Specifically, The Ratio Of Gold To Commodities Showed A Constructive Uptrend, Indicating Disinflationary Signals And Counter-Cyclical Dynamics. unlike A “Deflation Scare” Crisis,This Trend Was Interpreted As A “Goldilocks” Scenario,Where Conditions Were Just Right For Gold To Thrive.

When The S&P 500 Eventually Experienced A Downturn, The Gold Stock Sector Benefited significantly, validating The Earlier Bullish Outlook.

key Milestones In The Gold Stock Surge

Gold’s Breakout From Its Symmetrical Triangle Pattern Signaled A Target Of 3000+, While Silver’s Movement Above Key Resistance Levels Aimed for 42. The VanEck Gold Miners ETF (GDX) Successfully Cleared 38.72, Confirming The End Of Its Correction Phase. Later, The HUI Surpassed 375, Briefly Retraced To Shake Out weaker Positions, And Then Continued Its Upward Trajectory.

This Series Of Breakthroughs Has Propelled Gold Stocks Toward The Current Big Picture Target Of 500 (+/-). With The HUI Now Around 430, it is indeed Approximately 16% Away From This Target Zone, Having Surpassed Its 2024 Lows By 115% And Its 2022 Bear Market Low By 145%.

Fundamentals Driving The Gold Rally

The Positive Fundamentals Underpinning The Gold Rally Have Been Gradually Building As 2022, Showing Neutral Performance Against Stock Markets. Pro Tip: Wise Investors Focus On Gold’s Relationship With Cyclical And Inflation-Sensitive Markets Rather Than Being Distracted by Short-Term Noise From War, Politics, or Inflation Data.

While some argue That Technicals Lead Fundamentals, The Reverse Has Been True For Gold Miners. The Stock Market’s Correction Served As The Catalyst For The Sector’s Strong Performance.

Even though The Recent Stock Market Relief Rally Has Slightly Altered The Fundamentals, It Has Not Fundamentally broken The Bullish Trend For Gold.

Weighing Risks And Rewards As Target Nears

Despite The Overall Positive Outlook, There Are Signs Of Internal Excess Within The Precious Metals Complex. Did You Know? Reaching A long-Term Target Should Prompt Investors To Carefully Evaluate The Risk-Reward Dynamics,Even If It Doesn’t Necessarily Signal An Immediate Sell-Off.

With The Target Only 16% Away, it is indeed Prudent To Acknowledge This Milestone And Prepare For Potential Market Adjustments. A Thorough Analysis Of The Sector’s Internals, Momentum, Fundamentals, And Technicals is Essential For Making Informed Decisions.

Navigating Overbought Conditions

The Monthly Chart Indicates Overbought Conditions, With Significant Paper Profits Already Realized. In The Gold Community, It’s Common To Hear “Buy” Recommendations, But Less So “Sell” Signals. Approaching The Target Area, Coupled With Overbought Indicators, Calls For Heightened Vigilance.

The Gold Stocks, As Measured By The HUI, Are Nearing A Significant Target, Presenting Both Opportunities And Risks For Investors. Understanding The Underlying Fundamentals, Technical Indicators, And Market Dynamics Is Crucial For Navigating This Phase.

Understanding The Gold Market: Evergreen Insights

Investing In Gold Stocks Requires A Balanced Approach, Combining Technical Analysis With Fundamental Understanding. Here Are Some Key Considerations:

- Economic Indicators: Monitor Inflation Rates,Interest Rates,And Global economic Growth,As These Factors Can Significantly Impact Gold Prices.

- Geopolitical Events: Geopolitical Instability Frequently enough Drives Investors Towards Gold As A Safe Haven Asset.

- Currency Fluctuations: The Value Of The US Dollar,In Particular,Has An Inverse Relationship With Gold Prices.

Historical Performance And Future Outlook

Gold Has Historically Served As A hedge Against Inflation And Economic Uncertainty. While Past Performance Is Not Indicative Of Future Results, understanding Historical Trends Can Provide Valuable Insights.

| Year | Average Gold Price (USD/oz) | Key Events |

|---|---|---|

| 2020 | 1,770 | Covid-19 Pandemic, Economic Uncertainty |

| 2021 | 1,799 | Inflation concerns, Recovery Hopes |

| 2022 | 1,800 | Ukraine War, Interest Rate Hikes |

| 2023 | 1,940 | Banking Crisis, Peak Inflation |

| 2024 (YTD) | 2,300 (approx.) | Persistent Inflation, Geopolitical Tensions |

Frequently Asked Questions About Gold Stock Investing

- What Are The Main Drivers Of Gold Stock Prices? Gold Stock Prices Are Primarily Influenced By Gold Prices, Company-Specific Performance, And Overall market Sentiment.

- How Do Interest Rates Affect Gold Stocks? Higher Interest Rates Can Diminish Gold’s Appeal As An Investment, Perhaps Leading To Lower Gold Stock Prices.

- What Are The Risks Associated With Investing In Gold Stocks? Risks Include Market Volatility, Geopolitical Risks, And Company-specific Challenges Such As Mining Costs And Operational Issues.

- Is Gold A Good Hedge Against Inflation? Gold Has Historically Served As A Hedge Against Inflation, Though Its Effectiveness Can Vary Depending On The Specific Economic Environment.

- How Should I Allocate My Portfolio To Gold Stocks? The Appropriate Allocation Depends On Your Risk Tolerance, Investment Goals, And Overall Portfolio Diversification strategy. Consider consulting With A Financial Advisor.

What Are Your Thoughts On The Current Gold stock Rally? Share Your Opinions And Questions In the Comments Below!

Disclaimer: This Article Is For Informational Purposes Only And Does Not Constitute Financial Advice. Always Conduct thorough research And Consult With A Qualified Financial Advisor Before Making Any Investment Decisions.

Given the provided text, the following PAA questions are suitable for the title “Gold Ratio: Fundamentals Drive Market rallies”:

Gold Ratio: Fundamentals Drive Market Rallies

Understanding the Gold Ratio and its Significance

The Gold Ratio, often referred to as the gold-to-silver ratio, is a vital indicator used by investors and analysts to gauge market sentiment and assess the relative value of gold and silver. It represents the number of ounces of silver it takes to buy one ounce of gold. Fluctuations in the Gold Ratio often signal macroeconomic shifts and influence investment decisions, especially during periods of economic uncertainty. Understanding the dynamics of the gold market and the influence of underlying factors is crucial for navigating the complexities of market rallies.

Decoding the Gold-Silver Relationship

Analyzing the historical Gold Ratio provides insights into market cycles. A rising ratio frequently enough suggests that gold is outperforming silver, perhaps driven by factors like heightened economic instability or increased inflation expectations. Conversely, a falling ratio may indicate silver is gaining ground relative to gold, perhaps due to perceived industrial demand growth, a strengthening economy, or a belief that precious metals are undervalued.

Factors Influencing Gold and Silver Prices – Key Market Drivers

Several essential forces impact the precious metals market.These fundamental factors directly influence the Gold Ratio and, consequently, the trajectory of market rallies. It’s vital to understand these drivers to make informed trading decisions and anticipate market movements. Here are some of the most impactful:

- Inflation: Gold is frequently enough perceived as a hedge against inflation. Rising inflation usually pushes gold prices higher, affecting the Gold Ratio.

- interest Rates: Higher interest rates can make gold less attractive compared to yield-bearing assets, potentially impacting the ratio.

- Geopolitical Risks: Economic and political instability often fuels demand for gold as a “safe haven”,affecting both gold and silver prices.

- Economic Growth: Robust economic growth can increase industrial demand for silver, possibly lowering the Gold Ratio.

Fundamental Analysis for Gold Price Movements and Market Rallies

Fundamental analysis involves examining the underlying economic data and news that affect the gold market. Applying this analytical framework helps investors understand the forces driving precious metal prices and forecast potential market rallies or downturns. Focusing on these elements can provide significant insight into pricing trends, offering more informed trading strategies and helping gain a competitive advantage for investors keen on gold.

Economic Indicators as Key Drivers

Certain key economic indicators provide critically important signals impacting gold prices. The direction and magnitude of these indicators can either fuel increases or decreases in the gold market.

- GDP Growth: Analyzing GDP growth shows the overall direction of the economy. Robust growth potentially weakens the appeal of safe-haven assets like gold.

- Inflation Rates: The rate of change in prices, measured by the Consumer Price Index (CPI) and Treasury Inflation-Protected Securities (TIPS) breakeven rates.Rising inflation typically supports gold prices.

- Employment Data: Changes in payrolls and the unemployment rate provide insight into economic health, affecting the perception of risk and the demand for safe-haven assets.

Case Study: Impact of Inflation on the Gold Market

In the period of high inflation during the 1970s, gold prices soared. This real-world example illustrates how inflation can significantly influence gold prices.As prices for everyday items rose, investors sought the safety of gold, pushing its price upwards.

Here’s a simplified table showing that correlation:

| Year | Average inflation rate (%) | Average Gold Price (USD/oz) |

|---|---|---|

| 1970 | 5.7 | $35.92 |

| 1975 | 9.1 | $161.40 |

| 1980 | 13.5 | $612.50 |

Source: Information based on US inflation rates and gold prices.

Strategic Trading Using the Gold Ratio

Incorporating the Gold Ratio into your trading plan can provide insights on the overall gold market, improving opportunities to maximize returns and avoid risks. This method leverages fundamental analysis and sentiment analysis to identify advantageous entry and exit points, enhancing your overall trading strategy.

Trading Strategies Based on gold Ratio Analysis

Specific trading strategies may be formulated based on variations in the Gold Ratio. They may provide valuable entry and exit indications,improving trade decisions and assisting traders in managing risks more effectively.

- Ratio Expansion: A rising gold Ratio (indicating that gold strengthens more than silver). Traders might use this event as motivation to buy silver or short gold.

- Ratio Contraction: A falling Gold Ratio (implying that silver gains more than gold). A strategy here might involve buying gold or implementing a short on silver.

Practical Tips for Traders

Employing certain strategies and tools can lead to better judgments and more effective trading in an habitat when gold is traded. Here are some suggestions to help traders be more productive.

- Track The Gold Ratio Regularly: Continuously follow the ratio to spot potential changes.

- Combine With Technical Analysis: Mix Gold Ratio analysis with methods like line charts or candlestick techniques.

- Stay Informed: Continue by closely following economic reports and geopolitical news to anticipate market rallies.