“`html

Gold Bull Market: Experts Predict Surge amid Debt Concerns

Table of Contents

- 1. Gold Bull Market: Experts Predict Surge amid Debt Concerns

- 2. Us Debt And Interest Rates: A Ticking Time Bomb?

- 3. Gold’s Ascending Trajectory

- 4. The Eastern Influence: China And India’s Golden Touch

- 5. Here are 1 PAA related questions for the provided article title and content, each on a new line:

- 6. Gold & Mining Stocks: The 2025 Safe Haven? A Deep Dive

- 7. Understanding Gold’s Role in a Portfolio

- 8. Gold’s Performance in Recent Economic Downturns

- 9. Investing in Gold vs. Gold Mining Stocks

- 10. Key Considerations for Mining Stocks

- 11. Top Gold Stocks to Watch in 2025 (Based on Recent Performance and Market Analysis)

- 12. Practical Tips for Investors in Gold and Mining Stocks

New York,July 2,2025 – A Significant Gold Bull Market is on the horizon,fueled by escalating government debt and heightened interest from both Eastern and Western investors. Experts are closely monitoring key economic indicators, suggesting that the precious metal could see ample gains in the coming months.

Us Debt And Interest Rates: A Ticking Time Bomb?

The United States Government’s mounting debt is drawing increased scrutiny. Parallels are being drawn to addiction, with some analysts warning of a painful “cold turkey” withdrawal as interest rates potentially surge. The recent debt bill is seen by many as a possible catalyst for this surge.

Long-term projections indicate that US interest rates could climb towards 20% in the coming years, signaling a major cycle shift that could last approximately four decades.This situation contrasts sharply with the Reagan era, when lower debt levels and declining interest rates facilitated economic growth despite tax cuts.

Gold’s Ascending Trajectory

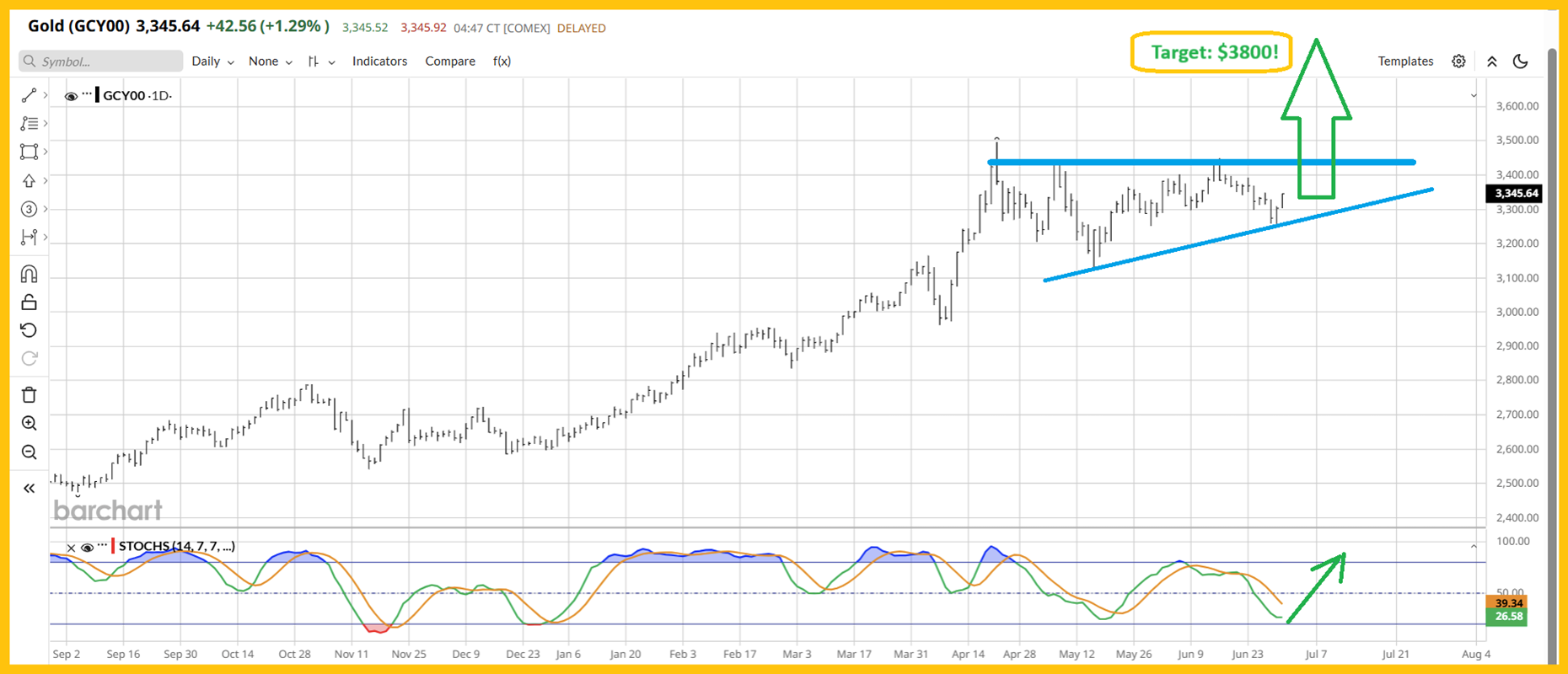

Against this backdrop, gold is poised to benefit. Technical analysis reveals an ascending triangle pattern, projecting a potential upside target of $3800. Stochastic indicators further reinforce this bullish outlook, signaling a strong buying opportunity.

Analysts suggest a robust bull market is in play, potentially extending well into 2026 before any significant price correction occurs.

The Eastern Influence: China And India’s Golden Touch

Looking ahead, **

Gold & Mining Stocks: The 2025 Safe Haven? A Deep Dive

The question of whether “Gold & Mining Stocks” represent a “2025 Safe Haven” is one of intense debate among investors. As we approach the tail end of 2025, economic uncertainty, geopolitical risks, and concerns about inflation continue to dominate market discussions. This article delves into the potential of gold as a safe-haven asset, exploring the role of gold mining stocks, and providing actionable insights for investors looking to navigate the complexities of this sector.

Understanding Gold’s Role in a Portfolio

Gold has historically been considered a safe haven asset, frequently enough sought during times of economic turmoil, political instability, and inflation. Its perceived value as a store of wealth stems from several factors.

- Inflation Hedge: Gold often maintains or increases its value during inflationary periods.

- Geopolitical Risk Mitigation: During times of international conflict or uncertainty, investors frequently enough flee to the relative security of gold.

- Portfolio Diversification: Gold typically has a low correlation with other asset classes, making it a valuable tool for diversification.

Gold’s Performance in Recent Economic Downturns

Examining gold’s performance during previous economic downturns provides valuable context. Historical data shows that during the 2008 financial crisis and periods of high inflation, gold prices generally increased, validating its safe-haven status.However, it’s crucial to remember that past performance is not indicative of future results. Various economic factors,global gold prices and political climates can greatly affect gold prices in the financial markets.

| Event | Gold Price Movement | Factors Influencing |

|---|---|---|

| 2008 Financial crisis | Increased Significantly | Market Fear, Quantitative Easing, Weakening dollar |

| Early 2020 (COVID-19 Pandemic) | Increased Initially, Then Fluctuated | Economic Uncertainty, Supply Chain Disruptions, Stimulus Measures |

| Current Economic Uncertainty (2025) | Under observation: dependent on several macro economic factors | Inflation rates, interest rate decisions, geopolitical events |

Investing in Gold vs. Gold Mining Stocks

Investors looking to capitalize on these trends have two primary avenues: investing directly in physical gold or investing in gold mining stocks. Each option presents unique advantages and risks.

- Owning Physical Gold: This involves purchasing gold bars, coins, or jewellery. The primary advantage is direct ownership and security. Though, storage costs and the lack of potential dividend income should be noted.

- Investing in Gold Mining Stocks: These stocks represent companies that mine gold. Their value is linked to the price of gold, but also to company-specific factors like production costs, exploration success, and management decisions. Investing in gold mining stocks offers the potential for higher returns as the price of gold increases, but with increased risk.

Key Considerations for Mining Stocks

Investing in gold mining stocks requires thorough due diligence.Investors should consider:

- Production Costs: Lower-cost producers tend to be more profitable.

- Reserves and Resources: The size and quality of a mining company’s gold reserves are crucial.

- Management Quality: Experienced management can significantly impact a company’s success.

- Geopolitical Risk: Mining operations in politically unstable regions carry inherent risks.

Top Gold Stocks to Watch in 2025 (Based on Recent Performance and Market Analysis)

Disclaimer: This is not financial advice. Always conduct your own research and consult with a financial advisor before making any investment decisions. The data is based on facts publicly available at the time of writing and is subject to change.

Here is an overview of some gold stocks based on recent Yahoo Finance data,but please check the recent prices,the website (finance.yahoo.com), and performance before making any choice.

| Company | Ticker Symbol | Sector | potential Considerations |

|---|---|---|---|

| Barrick Gold | GOLD | Gold Mining | Large, established player with global operations. |

| Newmont Corporation | NEM | Gold Mining | Major gold producer. Check their current reports and any latest news. |

| Agnico Eagle Mines | AEM | Gold Mining | Operations Focused on the americas. |

Note: Check Yahoo Finance for the most up-to-date information on top gold stocks, as market conditions can change frequently.

Practical Tips for Investors in Gold and Mining Stocks

To successfully invest in the “Gold & Mining Stocks” sector, consider these points:

- Diversify Your Portfolio: Treat gold as part of a diversified portfolio. Don’t put all your eggs in one basket.

- Perform Thorough Research: Analyze company fundamentals before investing in gold mining stocks.

- Consider Dollar-Cost Averaging: Invest a fixed amount regularly to mitigate market volatility.

- Stay Informed: Monitor news about gold prices,inflation,and global economic trends.