Breaking: Trump‘s Sweeping Budget Bill Sparks Division After Narrow Congressional Approval

Table of Contents

- 1. Breaking: Trump’s Sweeping Budget Bill Sparks Division After Narrow Congressional Approval

- 2. Congressional Showdown and Presidential Party

- 3. Economic Promises Vs. Fiscal Concerns

- 4. Winners and Losers: Analyzing the Impact on Americans

- 5. Public Opinion and Awareness

- 6. Key Provisions of the Trump Budget Bill

- 7. The Road Ahead

- 8. Frequently Asked Questions About the Trump Budget Bill

- 9. Here are 1 PAA related questions for the provided text:

- 10. Trump Tax Bill Signed: What’s in the New Law?

- 11. Major Provisions of the Trump tax Bill 2025

- 12. Individual Income Tax Brackets

- 13. Corporate tax Rate

- 14. Changes to tax Deductions and Credits

- 15. Analyzing the Impact: Businesses and Individuals

- 16. Impact on Businesses

- 17. Impact on Individuals

- 18. Practical Tips for taxpayers

- 19. future Outlook and Potential Changes

Washington D.C. – In a closely watched vote, President Donald Trump’s landmark budget bill has narrowly passed both houses of Congress, triggering immediate debate over its potential impacts on the economy, national debt, and social welfare programs. The bill, celebrated by Republicans as a catalyst for economic growth, faces strong opposition from Democrats and skepticism from some within the President’s own party due to concerns about its long-term fiscal consequences.

Congressional Showdown and Presidential Party

The House of Representatives approved the bill by a razor-thin margin of 218-214, with only two Republicans breaking ranks to join all 212 Democrats in opposition.The senate also saw a tight vote earlier in the week, requiring vice-President J.D.Vance to cast a tie-breaking vote after three Republicans initially withheld their support.

Following the House vote, president Trump addressed supporters in Iowa, framing the bill’s passage as a monumental victory and the perfect “birthday present” for the nation as it approaches its 250th anniversary.

Economic Promises Vs. Fiscal Concerns

The White house asserts that the tax cuts included in the bill will stimulate economic expansion. though,numerous economists and financial experts express concern that these measures could significantly increase the budget deficit and contribute to the already substantial national debt.

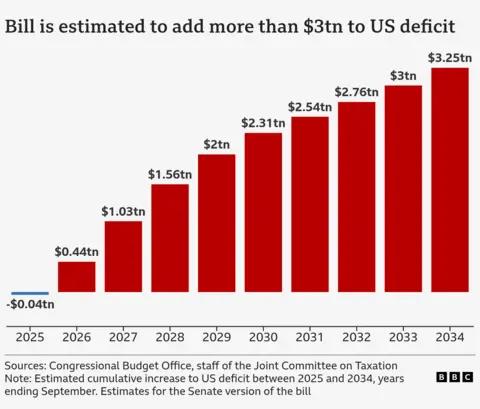

A recent analysis by the Congressional Budget office (CBO) projects that the tax cuts may initially lead to a surplus, but will afterward cause a sharp rise in the deficit.

Winners and Losers: Analyzing the Impact on Americans

The Tax Policy Center estimates that the bill’s tax provisions disproportionately favor wealthier Americans. Their analysis indicates that roughly 60% of the benefits would go to individuals earning over $217,000.

Simultaneously occurring, the bill proposes significant changes to social programs.

Cuts to SNAP (Supplemental Nutrition Assistance Programme), a program providing food assistance to millions of low-income Americans, are a major point of contention. One father of two, named Jordan, relies on SNAP benefits to feed his family and fears that reduced assistance would force him to seek additional employment.

Pro tip: Experts recommend families potentially impacted by SNAP cuts explore local food banks and community support programs to supplement their resources.

Furthermore, the CBO projects that changes to Medicaid, which provides healthcare coverage to low-income, elderly, and disabled Americans, could result in nearly 12 million people losing coverage over the next decade.

Republicans defend these changes by arguing they are necesary to curb abuse and fraud within the system through stricter work requirements.

However, critics argue that these changes will disproportionately harm vulnerable populations. According to data released in december 2024 by the Kaiser Family Foundation, nearly 85 million people were enrolled in Medicaid and CHIP (Children’s Health insurance Program), highlighting the potential scale of impact from these cuts.

Public Opinion and Awareness

Pre-passage polling indicates limited public support for the President’s budget bill. A recent Quinnipiac University survey revealed that only 29% of respondents endorsed the legislation, even though support rose to two-thirds among Republicans.

Did You Know? Awareness of specific provisions within the budget bill appears to be limited,even among President Trump’s supporters.

Reuters reported that many attendees at a recent Trump rally in Iowa expressed unfamiliarity with the details of the legislation.

Key Provisions of the Trump Budget Bill

| Provision | Description | Potential Impact |

|---|---|---|

| Tax Cuts | Reduces individual and corporate income tax rates. | May stimulate short-term economic growth but increase the national debt. |

| Increased Defense Spending | Allocates more funds to military programs and national security. | Strengthens military capabilities but diverts funds from other sectors. |

| SNAP Cuts | Reduces funding for the Supplemental Nutrition Assistance Program. | Decreases food assistance for low-income individuals and families. |

| Medicaid Reforms | Implements stricter work requirements for Medicaid recipients. | Could result in millions losing healthcare coverage; aims to reduce fraud. |

The Road Ahead

As the Trump governance begins to implement the budget bill, its effects will be closely monitored by economists, policy analysts, and the American public. The debate over its merits and potential consequences is likely to continue in the years to come.

The implementation of this budget occurs amidst growing global economic uncertainty, adding complexity to forecasting its ultimate effects.Recent data from the International Monetary Fund (IMF), updated in April 2025, projects moderate global growth but warns of downside risks related to geopolitical tensions and trade uncertainties.

Frequently Asked Questions About the Trump Budget Bill

- What is the main goal of the Trump budget bill?

The Trump budget bill aims to stimulate economic growth through tax cuts and increased spending in certain areas. - How does the budget bill affect the national debt?

The Congressional Budget Office projects that the bill will increase the national debt over the next decade. - who benefits most from the tax cuts in the budget bill?

Higher-income individuals are expected to receive the largest share of the tax cuts under the new budget. - What changes does the budget bill make to SNAP?

The bill reduces funding for SNAP, potentially affecting millions of low-income Americans. - How could the budget bill impact Medicaid?

Changes to Medicaid under the bill could result in millions of people losing healthcare coverage.

What are your thoughts on the potential impact of this budget bill? How do you think it will affect your community? Share your comments below.

Trump Tax Bill Signed: What’s in the New Law?

The *Trump Tax Bill of 2025*, a meaningful piece of legislation, has been signed into law. This new tax law brings sweeping changes to the U.S. tax code, impacting both individuals and businesses. Understanding these changes is crucial for effective financial planning and navigating the new tax landscape.This article provides a comprehensive overview of the key provisions, potential implications, and how they could affect *taxpayers*.

Major Provisions of the Trump tax Bill 2025

The *Trump Tax Bill of 2025* encompasses several critical areas,including *individual income tax*,*corporate tax*,and *tax deductions*. Here’s a breakdown of the most significant adjustments:

Individual Income Tax Brackets

The new bill modifies the individual income tax brackets. These adjustments influence how much income is taxed at each rate. While specific brackets can vary, the overall structure aims to offer tax relief to certain income levels. Here’s a potential, illustrative exmaple (Remember, actual figures will be different):

| Taxable Income | Tax Rate |

|---|---|

| Up to $12,000 | 10% |

| $12,001 to $50,000 | 12% |

| $50,001 to $100,000 | 22% |

| Over $100,000 | 32% |

Corporate tax Rate

A central component of the *Trump Tax Bill* often involves adjustments to the corporate tax rate. Proponents argue that a reduced corporate tax rate boosts economic activity, encouraging investment and job creation. The actual percentage might potentially be affected by the ongoing debates. Changes to the *corporate tax rate* can directly affect business profits and investment decisions nationwide.

Changes to tax Deductions and Credits

Many *tax deductions and credits* receive modifications under the new law. These provisions can considerably affect how individuals and businesses minimize their tax liabilities. Common areas of change include:

- Standard Deduction: potential changes to the value of the *standard deduction*.

- Itemized Deductions: Adjustments to deductions like *mortgage interest*, *state and local taxes (SALT)*, and *charitable contributions*.

- Tax Credits: Updates to existing credits or the introduction of new tax credits. This could affect *child tax credits*, *earned income tax credits*, and *educational tax credits*.

Analyzing the Impact: Businesses and Individuals

The *Trump Tax Bill of 2025* creates significant shifts in the tax landscape. Different groups will experience varying outcomes. Consider the following:

Impact on Businesses

Businesses must analyze how the bill affects their operations. Key considerations include:

- Corporate Tax Rate Impact: lower rates may increase after-tax profits.

- Changes in Deductions: Evaluate how deductions such as those for business expenses,equipment depreciation,or research and advancement (R&D) are adjusted.

- Overall Financial Strategies: Businesses may need to revisit their long-term operational and financial planning strategies.

Impact on Individuals

For individuals, understanding the new laws’ impact is vital for tax planning. Things to evaluate include:

- Tax Bracket Changes: Determine how your income level interacts with new tax bands.

- Changes to Deductions: Review deduction options and how they may impact taxable income.

- Financial Planning: Consider the best financial strategies to optimize taxes. Tax planning tools and professional advice can offer guidance.

Practical Tips for taxpayers

To navigate the *Trump Tax Bill of 2025*, consider these practical tips:

- Consult with a Tax Professional: Seek advice from qualified tax advisors who can provide personalized guidance.

- Review Your Financial Situation: Analyze your income, deductions, and credits to prepare for adjustments.

- Stay Informed: Continuously monitor updates, guidelines, and revisions to taxation laws from official sources.

- adjust Withholding and Estimated Tax payments: Modify withholdings to more accurately align with your tax liabilities.

future Outlook and Potential Changes

Tax legislation often evolves as new situations arise. Stay informed about upcoming changes and potential updates. This includes paying attention to IRS announcements. Keep abreast of how any future reforms could further modify the landscape of U.S. taxes.