New York, NY – Shares of Contract electronics manufacturer Jabil Inc. (NYSE: JBL) encountered a setback following the release of its fiscal 2025 fourth-quarter earnings on September 25th, yet analysts suggest the market reaction might potentially be overblown. Despite exceeding expectations in both results and forward guidance, the stock price declined, prompting questions about the underlying fundamentals and future prospects of the company.

Jabil’s Ascent in a Booming AI Market

Table of Contents

- 1. Jabil’s Ascent in a Booming AI Market

- 2. Capacity Expansion and Future Growth potential

- 3. Financial Performance and Valuation

- 4. Understanding the AI Revolution’s Impact on manufacturing

- 5. Frequently Asked Questions About Jabil and AI

- 6. How can I diversify my portfolio to manage risk within the AI sector?

- 7. AI stock Takes a Dive: Positioned to Soar Again in the Skies of High Tech Growth

- 8. The Recent AI Stock Correction: Understanding the dip

- 9. Identifying the Leading AI Sectors & Companies

- 10. Navigating the Volatility: Investment strategies for AI Stocks

- 11. The Gemini Effect & Future AI Developments

Jabil has demonstrated a strong performance throughout 2025, achieving a 51% increase in its stock value prior to the recent dip. This growth is substantially attributed to the extraordinary expansion of the company’s artificial intelligence (AI) business. Jabil is capitalizing on the increasing demand for robust computing infrastructure required for AI applications.

The company specializes in providing end-to-end rack-scale computing solutions, integrating advanced hardware to support the unique demands of AI servers. Jabil’s servers are designed to accommodate chips from industry leaders such as AMD,Intel,and Nvidia. This strategic positioning has resulted in an extraordinary 80% surge in AI-related revenue over the past fiscal year, reaching $9 billion-a rate significantly outpacing the company’s overall revenue growth of 3% to $29.8 billion.

Currently, AI revenue contributes 30% to Jabil’s total topline, a figure projected to increase as the company anticipates a 25% jump in AI revenue for the current fiscal year, compared to an overall revenue increase of just 5%. This disparity highlights the growing importance of the AI segment to Jabil’s overall financial performance.

Capacity Expansion and Future Growth potential

Despite positive forecasts, Jabil’s growth is presently constrained by production capacity.To address this, the company recently announced a $500 million investment in a new North carolina facility dedicated to manufacturing cloud and AI data center components. This proactive measure aims to increase production capabilities and meet the escalating demand within the AI server market.

Industry reports indicate substantial growth potential in the AI server market, with Grand view Research projecting an annual growth rate of nearly 39% through 2030. This suggests continued momentum for Jabil’s AI business and a potential for accelerated revenue growth in the coming years.

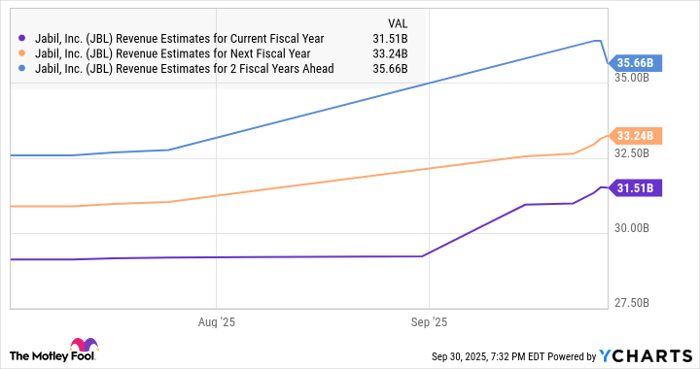

Data by YCharts.

Financial Performance and Valuation

Jabil reported a 15% increase in non-GAAP earnings in the previous fiscal year, reaching $9.75 per share. Management projects a further 13% increase to $11.00 per share in the current fiscal year.Analysts estimate earnings per share will reach $14.66 by fiscal 2028.

The current forward earnings multiple for Jabil stock stands at 20, which is lower then the 27 multiple observed in the Nasdaq-100 index. Based on this valuation, and assuming Jabil’s forecasted earnings, analysts project substantial upside potential for the stock.

| Metric | Value |

|---|---|

| Current Forward P/E Ratio | 20 |

| Nasdaq-100 Forward P/E Ratio | 27 |

| Projected EPS (Fiscal 2028) | $14.66 |

| Potential Stock Price (Based on Nasdaq-100 Multiple) | $396 |

Did You Know? The AI market is predicted to reach $1.84 trillion by 2030, driven by advancements in machine learning and deep learning technologies.

Pro Tip: When evaluating tech stocks, always consider their involvement in emerging technologies like AI, as these areas frequently enough present substantial growth opportunities.

Given these factors, investors may find the recent dip in Jabil stock to be an opportune time to invest, as the company appears well-positioned for long-term growth.

Understanding the AI Revolution’s Impact on manufacturing

The rise of Artificial Intelligence is fundamentally reshaping the manufacturing landscape. Companies like Jabil,which provide crucial manufacturing services to the tech sector,are uniquely positioned to benefit from this transformation. AI is used to optimize production processes, enhance quality control, and accelerate product advancement cycles. The demand for specialized hardware to power AI applications creates a notable growth opportunity for firms capable of designing and manufacturing these advanced components. This trend is expected to continue in the coming years, driving further innovation and investment in the manufacturing sector.

Frequently Asked Questions About Jabil and AI

- What is Jabil’s primary role in the AI ecosystem? Jabil designs, engineers, and manufactures hardware solutions for AI applications, including servers and data center components.

- How significantly has Jabil’s AI revenue grown? Jabil’s AI revenue increased by 80% in the previous fiscal year, significantly outpacing its overall revenue growth.

- what is driving the demand for Jabil’s AI solutions? The increasing demand for computing power to support the expansion of artificial intelligence.

- What are Jabil’s plans for expanding AI production capacity? Jabil is investing $500 million in a new North Carolina facility to meet growing demand.

- what is the potential upside for Jabil stock? Based on current projections and market comparisons, Jabil stock could potentially increase by around 82% from current levels.

What are your thoughts on Jabil’s growth strategy? Do you think AI will continue to drive similar growth in the coming years? Share your insights in the comments below!

How can I diversify my portfolio to manage risk within the AI sector?

AI stock Takes a Dive: Positioned to Soar Again in the Skies of High Tech Growth

The Recent AI Stock Correction: Understanding the dip

The past few weeks have seen a noticeable correction in AI stocks, leaving investors questioning the future of this once-unstoppable sector. Leading companies like Nvidia, Alphabet (Google), and Microsoft experienced pullbacks, triggering broader market concerns. But is this a sign of a bursting bubble, or a healthy recalibration? Understanding the factors driving this downturn is crucial for informed investing in artificial intelligence.

Several key elements contributed to the recent decline:

* Profit Taking: after a period of explosive growth, some investors began cashing in on gains, leading to increased selling pressure.

* Rising Interest Rates: The Federal Reserve’s continued efforts to combat inflation through interest rate hikes have impacted growth stocks, including those in the tech industry and specifically AI companies. Higher rates make borrowing more expensive, potentially slowing down innovation and expansion.

* Geopolitical Uncertainty: Global events and escalating geopolitical tensions often lead to market volatility, impacting investor sentiment towards riskier assets like AI investments.

* Realistic Expectations: Initial hype surrounding AI may have led to overinflated valuations. The market is now adjusting to more realistic expectations regarding the speed of AI adoption and its immediate impact on revenue.

Identifying the Leading AI Sectors & Companies

Despite the recent dip, the long-term outlook for artificial intelligence remains exceptionally strong. several sectors are poised for meaningful growth, offering compelling investment opportunities.

* Semiconductors: Companies like Nvidia, AMD, and TSMC are essential for powering AI applications. Demand for GPUs and specialized AI chips continues to rise.

* Cloud Computing: Amazon web Services (AWS), Microsoft Azure, and Google Cloud Platform provide the infrastructure needed to train and deploy AI models. Cloud AI is a rapidly expanding market.

* Software & Applications: Companies developing AI-powered software solutions for various industries – from healthcare and finance to manufacturing and retail – are experiencing strong growth.Examples include Salesforce, Adobe, and UiPath.

* Autonomous Vehicles: the growth of self-driving cars relies heavily on AI. Companies like Tesla, Waymo, and Cruise are at the forefront of this revolution.

* AI-Driven Cybersecurity: As AI becomes more prevalent, so does the need for AI-powered cybersecurity solutions to protect against evolving threats.

The current market conditions present both challenges and opportunities for investors. Here’s how to navigate the volatility and position yourself for long-term success:

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, irrespective of the stock price. This strategy helps mitigate risk and capitalize on potential dips.

- Focus on Fundamentals: Prioritize companies with strong financials, solid growth potential, and a clear competitive advantage in the AI market.

- diversification: Don’t put all your eggs in one basket. Diversify your portfolio across different AI sectors and companies. Consider AI ETFs (Exchange Traded Funds) for broader exposure.

- Long-Term Perspective: AI is a long-term investment. Don’t panic sell during short-term market fluctuations.

- Stay Informed: Keep abreast of the latest developments in AI technology, market trends, and regulatory changes.

The Gemini Effect & Future AI Developments

Recent advancements in large language models (LLMs) like Google’s Gemini demonstrate the rapid pace of innovation in the AI landscape. While initial rollout issues (as reported by Zhihu https://www.zhihu.com/question/1916203992091964465) highlighted the challenges of scaling these technologies, the underlying potential remains immense.

Key areas to watch include:

* Generative AI: The continued development of AI models capable of creating text, images, and other content.

* Edge AI: Bringing AI processing closer to the data source, enabling faster response times and reduced latency.

* AI-Powered Automation: Automating tasks