Bank Of England Expected To Hold Interest Rates Amid Inflation, Economic Slowdown

Table of Contents

- 1. Bank Of England Expected To Hold Interest Rates Amid Inflation, Economic Slowdown

- 2. Balancing Act: Economy Versus Inflation

- 3. Global Tensions Add Complexity

- 4. How The Interest Rate Decision Impacts You

- 5. Mortgage Rate Snapshot

- 6. Understanding Interest Rates: A Long-Term Perspective

- 7. Strategies for Navigating Interest Rate Fluctuations

- 8. Frequently Asked Questions About Interest Rates

- 9. What are the key economic indicators the Bank of England (BoE) considers when deciding to hold interest rates steady?

- 10. BoE Holds Interest Rates: Understanding the Decision and Its Impact

- 11. The Expected No-Change Scenario: Factors at Play

- 12. Inflation’s Role in Interest Rate decisions

- 13. What a Rate Hold Means for the UK Economy

- 14. Impact on Borrowers and Savers

- 15. market Reactions and Investor Sentiment

- 16. Forex Market Analysis

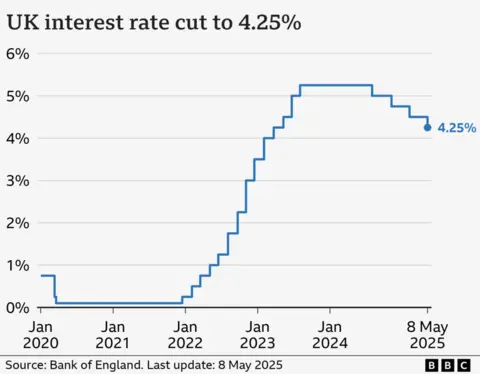

London, Uk – The Bank Of England (Boe) Is Widely anticipated To Maintain Current Interest Rates Today, As Policymakers Grapple With Persistent Inflation And A Hesitant Economy. The Decision, Expected At 12:00 Bst, Follows A previous Rate Cut In Early May, bringing The Bank Rate To 4.25%.

Despite Hints At Further Reductions, analysts Suggest That The Boe Is Likely To Adopt A Wait-And-See Approach Until Later In The Year, As Inflation Remains Above The Targeted 2% Threshold. The Current Bank Rate Serves As A Critical Benchmark For Lenders, Influencing Borrowing Costs For Consumers And Returns For Savers Alike.

Balancing Act: Economy Versus Inflation

The Uk Economy’s Performance Remains A Key Factor In Shaping Monetary Policy. Recent Data Reveals A Contraction Of 0.3% In April, driven By Increased Business Taxes, Higher Household bills, and A Decline In Exports To The Us.

However, Countering This Is The Stubborn Inflation Rate, Which Remained Elevated at 3.4% In May, The Highest level in Over A Year. This Is Largely Fueled By Rising Food Prices, Which Considerably Strain Household Budgets.

Global Tensions Add Complexity

The Boe Is Also Monitoring Geopolitical Risks. The Ongoing Conflict Between israel And Iran Could Possibly Increase oil Prices, Impacting Inflationary Pressures. Furthermore, The Us’s Trade Policies And Tariffs Add Another layer Of Uncertainty To The Economic outlook.

Expert Opinions Are Divided On The Boe’s Future Actions; While Many Economists Anticipate Two More Rate Cuts This Year, Some Predict Only One. Monica George Michail From The National Institute Of Economic And Social Research Suggests That “Inflation Is Likely To Remain above 3% Due To Persistent Wage Growth And Government Spending. Thus, We Expect Just One Further Cut This Year.”

How The Interest Rate Decision Impacts You

The Bank’s Base Rate Heavily Influences Banks’ Lending And Savings Rates. Recent High Interest rates Have Increased Borrowing Costs For Mortgages And Loans, While Providing Better Returns For Savers.

Fixed Mortgage Rates Have Shown Relative Stability In Recent Weeks. According To Money Facts, The Average Rate For A two-Year Fixed Mortgage Is 5.12%, And For A Five-Year Deal, It’s 5.10%.

Approximately 600,000 Homeowners With Mortgages That Track The Bank’s Rate Would See Immediate Changes In Their Monthly payments Following Any Rate Cut.

Mortgage Rate Snapshot

| Mortgage Type | Average Rate (June 2024) |

|---|---|

| Two-Year Fixed | 5.12% |

| Five-Year Fixed | 5.10% |

Pro Tip: Consider reviewing your mortgage options regularly to ensure you’re getting the best possible deal, especially in a changing interest rate surroundings.

Did You Know?: The Bank Of England’s Monetary Policy Committee (Mpc) Consists Of Nine Members Who Meet Eight Times A Year To Set The Bank Rate.

What Are Your Thoughts On The Bank Of England’s Expected Decision? How Do You Think This Will Affect Your Personal Finances?

Do You Believe the Boe Is prioritizing Inflation Over Economic Growth, Or Vice Versa?

Understanding Interest Rates: A Long-Term Perspective

interest Rates Play A Crucial Role In The Economy, Influencing Spending, Saving, And Investment. When Rates Are Low,Borrowing Becomes Cheaper,Encouraging Businesses To Invest And Consumers To Spend. Conversely,Higher Rates Make Borrowing More Expensive,Which can definitely help To Curb Inflation.

Historically, The Bank Of England Has Used Interest Rates As A Primary Tool To Manage The Economy. in Times Of Recession, rates Are Typically Lowered To Stimulate Growth. During Periods Of High Inflation, Rates Are raised To Cool Down The Economy.

For Homeowners, Understanding The Impact Of Interest Rates On Mortgage Payments Is Essential. Those With Variable-rate Mortgages Are Directly Affected By Changes In The Bank Rate, While Those With Fixed-Rate Mortgages Are Protected For The term Of Their Agreement.

Savers Can Also benefit From Higher Interest Rates, As Banks And Building Societies Typically Offer Better Returns On savings Accounts And certificates Of Deposit (Cds). It’s Important To shop Around For The Best Rates And Consider Locking In higher Rates With Longer-Term Savings Products.

Frequently Asked Questions About Interest Rates

Share Your Thoughts And Join The Conversation! How Do You Think The Bank Of England’s Decision Will impact Your Finances?

What are the key economic indicators the Bank of England (BoE) considers when deciding to hold interest rates steady?

BoE Holds Interest Rates: Understanding the Decision and Its Impact

The Bank of England (BoE) is expected to hold interest rates steady. this decision, a cornerstone of monetary policy, impacts everything from mortgages to investments. Let’s delve into what this means for the UK economy and yoru financial future. Understanding the nuances of BoE interest rate decisions is crucial for navigating the financial landscape.

The Expected No-Change Scenario: Factors at Play

When the BoE holds interest rates, it’s a carefully considered move. Several factors influence their deliberations,including:

- Inflation: The primary target of the BoE is to maintain inflation at 2%. Deviations substantially affect their policy.

- Economic Growth: A sluggish economy might prompt rate cuts. Conversely, strong growth can lead to rate hikes to curb inflation.

- Employment Data: Unemployment figures provide key insights into the health of the economy.

- Global Economic Conditions: International events and economic trends influence UK policy.

The monetary policy stance of the boe is always a balancing act. Their decisions carefully consider the interconnectedness of thes factors.

Inflation’s Role in Interest Rate decisions

Inflation is the single most meaningful driving force behind BoE decisions.If inflation exceeds the 2% target, the BoE is highly likely to consider raising rates to cool the economy and bring prices under control. Inflation data is scrutinized intensely.

Conversely, if inflation is below target, the BoE might lower rates to stimulate economic activity. Analyzing the impact of inflation on household finances is key.

What a Rate Hold Means for the UK Economy

The BoE’s interest rate decision has widespread implications for the UK economy. A holding pattern can signify:

- Stability: Maintains existing economic conditions, providing a level of predictability.

- Gradual Progression: Allows for adjustments and monitoring without drastic measures.

- Weighing Factors: Offers time to assess the impact of past policies and economic data.

Impact on Borrowers and Savers

For borrowers, no change in rates offers a continued reprieve. Mortgage rates and other borrowing costs remain stable. Savers, though, might experience less yield on savings accounts.

Here’s a concise overview:

| Area | Effect of Rate Hold |

|---|---|

| Mortgage Rates | Stable |

| Savings Accounts | Potentially Lower Yields |

| Consumer Spending | May Remain Consistent |

market Reactions and Investor Sentiment

The BoE’s decision invariably prompts market reactions. Currency markets, stock markets, and bond yields all respond. Investors and traders constantly monitor the BOE’s decisions.

Forex Market Analysis

The value of the Pound Sterling (GBP) frequently enough fluctuates based on the BoE’s announcements. A stable rate can provide a degree of predictability, however, unexpected economic data releases can quickly shift the market dynamic.

for example, if a lower interest rate is indicated by the BoE, a currency may see a decrease in trading interest and investment as a result of a loss.